Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Despite the challenges caused by the COVID-19 pandemic and increasing economic uncertainty, 2020 still managed to major tech breakthroughs, as well as thousands of startups. We analyzed 2.554 FinTech startups founded in the last 5 years to identify top startups in the industry. In this report, you will discover 5 emerging FinTech startups to watch in 2021.

The 5 promising financial technology startups you should watch in 2021 were hand-picked based on our data-driven startup scouting approach, taking into account factors such as location, founding year, and relevance of technology, among others. The 2.554 companies that were analyzed for this report, are identified using the StartUs Insights Discovery Platform, covering 1.379.000+ startups & scaleups globally. When you are looking for up-to-date FinTech solutions for your innovation units, R&D, or product development department, the StartUs Insights Discovery Platform gives you the most exhaustive collection and ensures you continuously discover new startups, scaleups, and technologies.

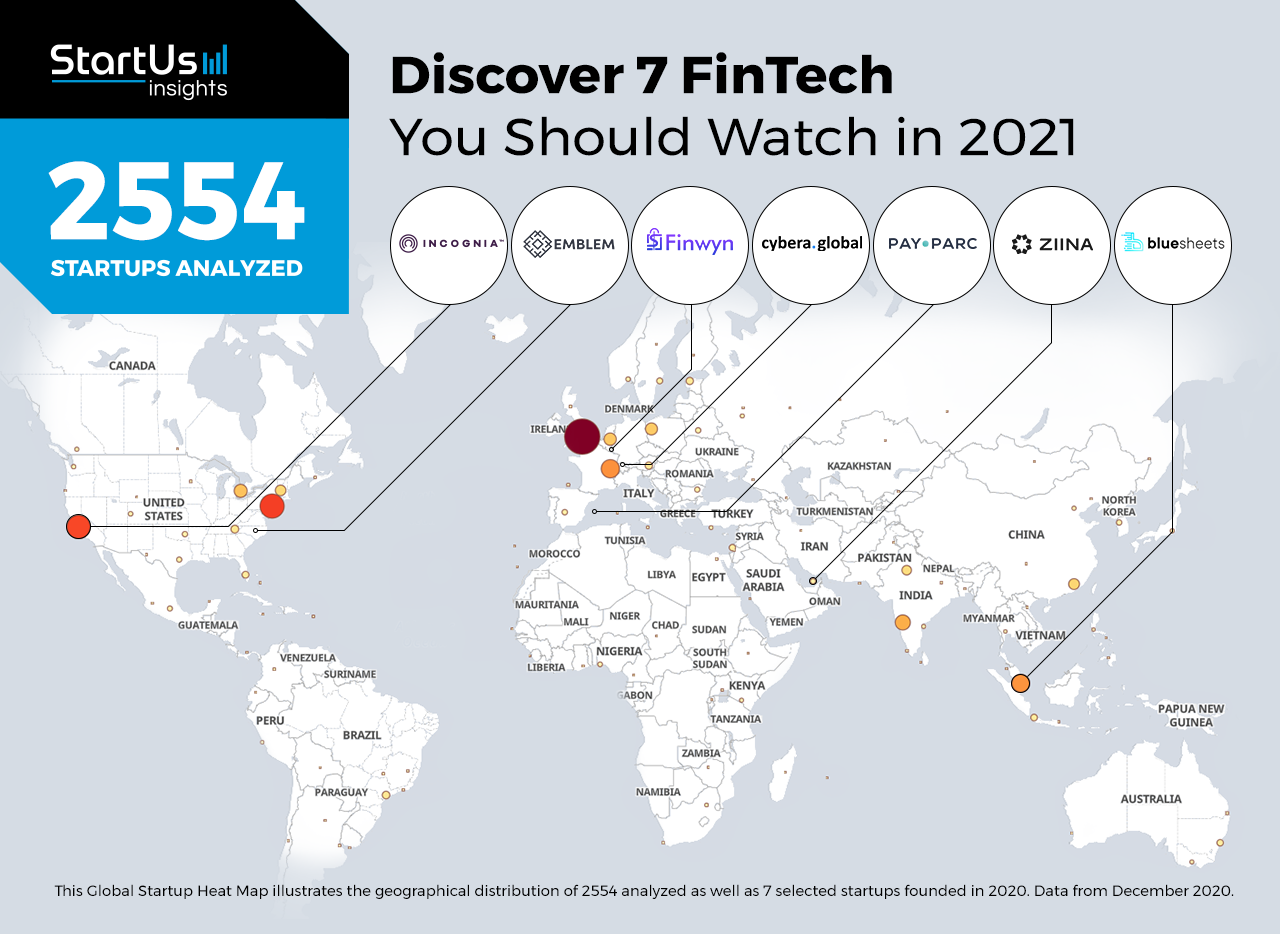

Global Startup Heat Map: 5 FinTech Startups to Watch in 2021

The Global Startup Heat Map below highlights 5 FinTech startups, established in 2020, developing technology-driven solutions for the financial sector. Moreover, you can explore global hotspots for FinTech startups and even download this graphic to include in your next presentation.

Emerging Financial Technology Solutions

The financial sector is currently experiencing an upheaval in terms of employing new technologies to reach more consumers. From quantum computing for transaction monitoring and anti-money laundering (AML) to the use of blockchain ledgers for open banking and financial inclusion, FinTech startups are ushering in the next generation of banking products. Further, utilizing artificial intelligence (AI) algorithms, biometric verification, and big data analytics enables financial and banking institutions to streamline their offering and optimize their operations. Further, the ability to bank via mobile phones and without internet connectivity empowers large sections of previously unbanked populations to conduct easy financial transactions. Finally, regulatory compliance for financial institutions takes up a significant amount of resources which pushes startups to develop novel RegTech solutions.

Who benefits from FinTech solutions?

The tools and applications of FinTech affect almost every person who wants to make financial transactions. Consumers find easy-to-use peer-to-peer (P2P) and digital payment solutions to transfer money across regional and national borders. Compliance professionals spend considerably less time, and hence fewer resources, by using AI-based platforms to manage regulatory compliance. Investment bankers also employ deep neural networks to identify the most suitable opportunity for capital investment. Moreover, banks and FinTech startups are able to reach a much wider group of people by offering affordable financial products for small and medium enterprises (SMEs) and farmers. Governments and multilateral organizations also utilize FinTech solutions to advance counter-terrorism financing (CTF) efforts and digitize public finances.

Explore which of these technologies are advanced by 7 FinTech startups to watch in 2021:

Cybera Global – Platform to Prevent Cybercrime

Swiss startup Cybera Global builds a FinTech platform to help financial institutions and governments prevent financially-motivated cybercrime. The startup combines the latest technologies with subject-matter expertise to reduce online fraud and cybercrime-related losses globally. The financial information technology (IT) platform collates all government blacklist data and serves as a single point of contact for quickly reporting suspicious transactions. Moreover, the platform to fight cybercrime addresses the main challenge in identifying financial mismanagement and fraud – the speed of monitoring transactions.

Swiss startup Cybera Global builds a FinTech platform to help financial institutions and governments prevent financially-motivated cybercrime. The startup combines the latest technologies with subject-matter expertise to reduce online fraud and cybercrime-related losses globally. The financial information technology (IT) platform collates all government blacklist data and serves as a single point of contact for quickly reporting suspicious transactions. Moreover, the platform to fight cybercrime addresses the main challenge in identifying financial mismanagement and fraud – the speed of monitoring transactions.

Ziina – Peer-to-Peer Payments

Ziina is a UAE-based FinTech startup providing users an app for easy P2P payments. The mobile app features banking-grade security and end-to-end encryption to protect the users’ money and data. Further, the app does not require users to enter details such as banking codes to transfer money. The solution simplifies financial payments between friends and families while reducing the need to carry cash all the time. For example, friends are able to easily split grocery bills and payments through the mobile app.

Ziina is a UAE-based FinTech startup providing users an app for easy P2P payments. The mobile app features banking-grade security and end-to-end encryption to protect the users’ money and data. Further, the app does not require users to enter details such as banking codes to transfer money. The solution simplifies financial payments between friends and families while reducing the need to carry cash all the time. For example, friends are able to easily split grocery bills and payments through the mobile app.

Bluesheets – Automated Bookkeeping

Singaporean startup Bluesheets enables the digital transformation of finance departments with the help of real-time bookkeeping automation. The startup addresses multiple challenges in manual bookkeeping, including complex financial recording and costly software integrations. Bluesheets’ proprietary technology enables the low-cost implementation of financial automation with just a few clicks. The automation tool enables live transaction monitoring, error tracing, and easy approvals tracking for finance professionals and departments. The solution also eliminates the need for time-consuming paperwork.

Singaporean startup Bluesheets enables the digital transformation of finance departments with the help of real-time bookkeeping automation. The startup addresses multiple challenges in manual bookkeeping, including complex financial recording and costly software integrations. Bluesheets’ proprietary technology enables the low-cost implementation of financial automation with just a few clicks. The automation tool enables live transaction monitoring, error tracing, and easy approvals tracking for finance professionals and departments. The solution also eliminates the need for time-consuming paperwork.

Incognia – Know Your Customer (KYC)

Incognia is a US-based startup offering a privacy-first digital identity solution for mobile apps. It enables real-time recognition of trusted users at onboarding, login, and payments. Incognia uses location behavioral biometrics and device fingerprinting to increase conversions, reduce false positives, and stop fraud. The startup’s location technology utilizes network signals and on-device sensors to deliver precise location information without capturing any personally identifiable information (PII). Further, companies with mobile apps and connected devices use Incognia for frictionless user ID verification, authentication, risk assessment, and fraud detection.

Incognia is a US-based startup offering a privacy-first digital identity solution for mobile apps. It enables real-time recognition of trusted users at onboarding, login, and payments. Incognia uses location behavioral biometrics and device fingerprinting to increase conversions, reduce false positives, and stop fraud. The startup’s location technology utilizes network signals and on-device sensors to deliver precise location information without capturing any personally identifiable information (PII). Further, companies with mobile apps and connected devices use Incognia for frictionless user ID verification, authentication, risk assessment, and fraud detection.

Emblem – Web3 Integration Platform

The US-based startup Emblem develops CircuitBuilder, a Web3 integration platform using concepts from functional programming and workflow orchestration. In combination with its Emblem Vault solution, a crypto token that enables the transfer of entire multi-coin wallets without the need to convert native assets, the startup supports all digital assets, including blockchain assets, layer 2 assets, or P2P stored digital files. CircuitBuilder further allows web and app developers to use a drag-and-drop interface to quickly wire together a multitude of different blockchain logic and systems. By classifying blockchain APIs, common cryptography, and cryptocurrency functions, CircuitBuilder makes rapid automation experimentation easy to build upon.

The US-based startup Emblem develops CircuitBuilder, a Web3 integration platform using concepts from functional programming and workflow orchestration. In combination with its Emblem Vault solution, a crypto token that enables the transfer of entire multi-coin wallets without the need to convert native assets, the startup supports all digital assets, including blockchain assets, layer 2 assets, or P2P stored digital files. CircuitBuilder further allows web and app developers to use a drag-and-drop interface to quickly wire together a multitude of different blockchain logic and systems. By classifying blockchain APIs, common cryptography, and cryptocurrency functions, CircuitBuilder makes rapid automation experimentation easy to build upon.

PayParc – Business-to-Business (B2B) Payments

Spanish startup PayParc allows travel companies to optimize B2B payments. The PayParc Platform helps travel companies send and receive payments instantly and automatically via e-wallets while saving significant costs. PayParc’s payment flow works completely independent of credit or debit card networks. PayParc streamlines all the payments between buyers and sellers in the travel industry and helps to control the cash flow better than manual work. Each transaction is verified and matched with the booking information using smart contracts. Further, the solution eliminates other common challenges such as high virtual credit card costs, bank transfer delays, or fraud risk.

Spanish startup PayParc allows travel companies to optimize B2B payments. The PayParc Platform helps travel companies send and receive payments instantly and automatically via e-wallets while saving significant costs. PayParc’s payment flow works completely independent of credit or debit card networks. PayParc streamlines all the payments between buyers and sellers in the travel industry and helps to control the cash flow better than manual work. Each transaction is verified and matched with the booking information using smart contracts. Further, the solution eliminates other common challenges such as high virtual credit card costs, bank transfer delays, or fraud risk.

Finwyn – P2P Marketplace

Luxembourg-based startup Finwyn supports SMEs by finding investors who are willing to take on outstanding loans or other costs. The startup’s peer-to-peer investing platform and marketplace allows investors with free money to find and make the right investments. The marketplace standardizes contracts, allows users to experiment with technical features, and receive a market offer from investors. Investors seeking high rewards decide to put their money into businesses, secondary financial markets, or alternative loans. Further, the platform also automates investments to continuously rotate clients’ money to increase their returns.

Luxembourg-based startup Finwyn supports SMEs by finding investors who are willing to take on outstanding loans or other costs. The startup’s peer-to-peer investing platform and marketplace allows investors with free money to find and make the right investments. The marketplace standardizes contracts, allows users to experiment with technical features, and receive a market offer from investors. Investors seeking high rewards decide to put their money into businesses, secondary financial markets, or alternative loans. Further, the platform also automates investments to continuously rotate clients’ money to increase their returns.

What will 2021 bring for FinTech companies?

To stay ahead of the technology curve, it is important that you know which technologies and industry trends will impact your company in 2021. You can explore our curated reports on emerging FinTech industry trends & technologies or let us do the work for you. To keep you up-to-date on the latest technology and emerging solutions, we provide you with actionable innovation intelligence – quickly and exhaustively.