Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Our Innovation Analysts recently looked into emerging technologies and up-and-coming startups working on solutions for the financial services industry. As there is a high number of startups working on various different applications, we want to share our insights with you. This time, we take a look at 5 promising blockchain startups.

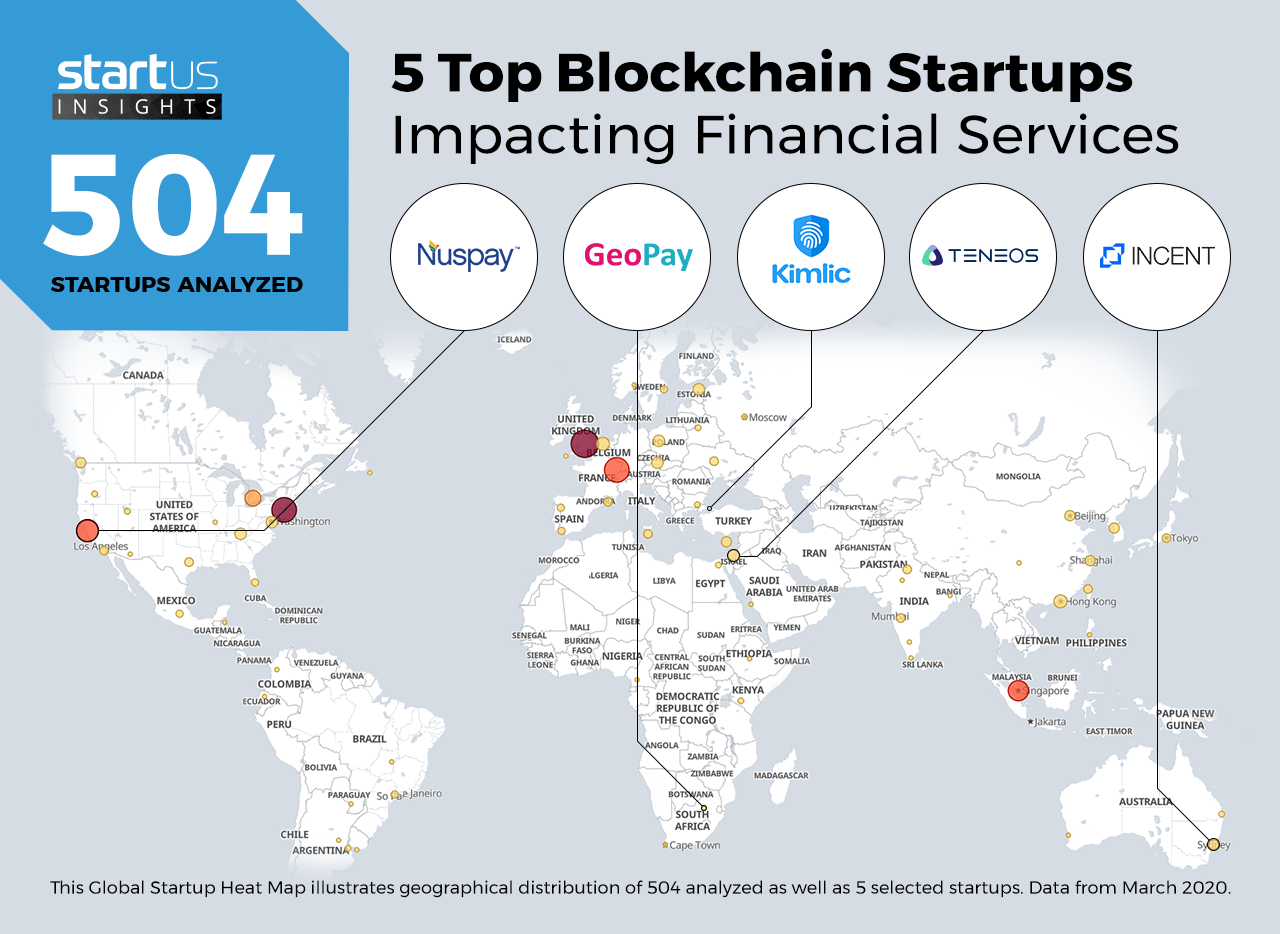

Heat Map: 5 Top Blockchain Startups

For our 5 top picks, we used a data-driven startup scouting approach to identify the most relevant solutions globally. The Global Startup Heat Map below highlights 5 interesting examples out of 504 relevant solutions. Depending on your specific needs, your top picks might look entirely different.

GeoPay – Cross-Border Transfers

Banks and financial institutions usually face timing issues when performing international payments, since this can take from a couple of days to weeks considering all formalities. Besides, the process certainly requires intermediary banks that charge fees. Blockchain solves these issues by establishing a decentralized peer-to-peer (P2P) or bank-to-bank (B2B) ecosystem with no middlemen thereby cutting transaction costs and time.

South African startup GeoPay offers a cross-border money transfer solution covering more than 20 countries. It leverages Blockchain technology to arrange instant payments, as well as support deposit and withdrawal of funds in local currency. The solution targets the P2P market, thus, intending to provide a user-friendly and understandable interface, especially for users with no previous experience with Blockchain.

Kimlic – Know-Your-Customer (KYC)

Nowadays, FinTechs and banks alike have to comply with various government regulations in terms of Know-Your-Customer (KYC) and Anti-Money Laundering (AML) policies to prevent identity fraud. This turns into bulks of usually non-standardized and extensive paperwork. On the contrary, in the Blockchain system, a user needs to confirm their identity only once. Later, the person obtains a verification document that enables trustworthy transactions with different counterparts – with no paperwork involved.

Turkish startup Kimlic develops a GDPR-compliant Know-Your-Customer system for the finance and other industries. The solution employs Quorum Blockchain to establish a decentralized identity verification environment. Furthermore, it allows for secure KYC data transfer thanks to passwordless authentication.

Nuspay – Initial Coin Offering (ICO)

Usually, accumulating capital via Initial Public Offerings (IPOs) entangle considerable time costs and financial expenditures related to permits, disclosure, underwriting, etc. In contrast, ICOs aim at eliminating the challenges of IPOs for emerging companies. FinTechs create transparent Blockchain-based platforms that facilitate ICOs and investor engagement in return of financing with widely-traded cryptocurrencies like Bitcoin.

The US-based startup Nuspay creates the Blockchain-powered Nuspay ICO Platform. Mediated by Ethereum ICO and ERC-20 tokens, the solution facilitates cryptocurrency exchange and trading to support funding of crypto projects and accelerate the time-to-market of new FinTech ideas.

Teneos – Credit Management

Sometimes, cryptocurrency owners are forced to exchange their digital assets for real-world currency, such as dollars or euros. As a result, the crypto system starts to lose its innate potential. Instead of selling digital coins, startups across the world work to transform cryptocurrencies into collateral and enable companies to receive prompt and secure credit lines. This model assists firms in retaining ownership over their funds and obtaining the needed amount of real-world money.

Israel-based startup Teneos plans to boost the crypto economy with Blockchain-capacitated credit management solutions for individuals, businesses, and financial entities. The solution assists users in configuring their crypto assets as collateral, setting credit limits and obtaining flexible cash loans in their desired currency.

Incent – Loyalty Rewards

Traditional loyalty programs of eCommerce and financial companies involve numerous challenges, associated with customer conversion, rewards personalization, liability estimation, limited loyalty options, registration issues, etc. Blockchain technology intends to address and ease these challenges by introducing a single crypto loyalty wallet for multiple rewards programs and companies, enhanced by flexibility and transparency.

Australian startup Incent develops a digital wallet loyalty platform, backed by Blockchain and a cryptocurrency, called INCT. The platform aims at rewarding users for any vendor-incentivized activity in the digital realm. A person securely connects one’s bank account with Incent and receives loyalty points in the form of cryptocurrency for spending actions, favored by businesses.

What About The Other 499 Solutions?

While we believe data is key to creating insights it can be easy to be overwhelmed by it. Our ambition is to create a comprehensive overview and provide actionable innovation intelligence for your Proof of Concept (PoC), partnership, or investment targets. The 5 blockchain startups showcased above are promising examples out of 504 we analyzed for this article. To identify the most relevant solutions based on your specific criteria and collaboration strategy, get in touch.