Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Technology is constantly evolving and creating new opportunities for businesses and investors. However, not all technologies are equally promising or profitable. Some may be too risky, too expensive, or too niche to generate a good return on investment (ROI). How can you identify the best new technology to invest in for the future?

This article gives you a preview of the top 10 new technologies (a data-driven selection) to invest in and why they are worth your attention in 2025. We will also introduce you to a powerful tool that provides you insights into up-and-coming industry and technology trends in a click.

This article was last updated in January 2025.

Top 10 New Technologies to Invest in (2025)

We generated this list using our Big Data and AI-powered Discovery Platform, covering over 4.7M startups and 20K+ technologies globally.

How did we do it?

Leveraging the platform’s Trend Intelligence feature, we looked at specific parameters of each technology to determine its impact in 2025. Some of these criteria include:

- Annual Growth

- Magnitude

- Maturity

- Number of organizations involved

- Manpower involved

- Funding

- Press mentions

So, let’s dive into the top new technologies to invest in 2025!

1. Artificial Intelligence (AI)

AI has already made significant strides and is set to revolutionize multiple sectors. Investing in AI presents substantial growth opportunities.

Computer vision focuses on teaching computers to interpret and analyze visual information, which has applications in autonomous vehicles, surveillance systems, and healthcare diagnostics.

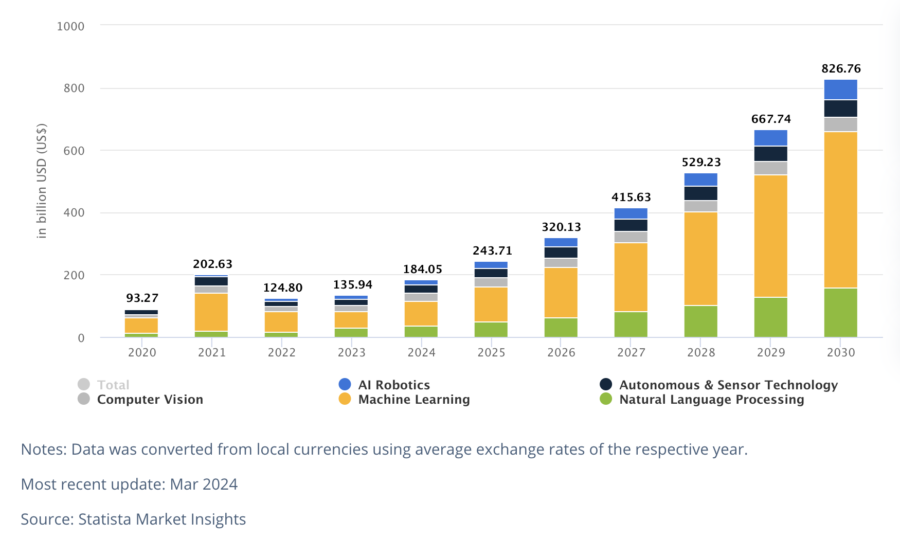

With a projected compound annual growth rate (CAGR) of 27.67% from 2025 to 2030, the Artificial Intelligence market is expected to expand to USD 826.70 billion by 2030.

Source: Statista

Natural Language Processing (NLP) enables machines to understand and respond to human language, opening doors for virtual assistants and chatbots.

OpenAI’s ChatGPT and Microsoft’s Bing are already ruling the niche! ChatGPT’s user base has surpassed 250 million users weekly in 2024, as per OpenAI’s latest report.

Don’t forget to read: AI for Business: 12 Ways it is Driving Transformation Across Sectors

2. Internet of Things (IoT)

IoT involves connecting everyday objects to the internet, enabling them to send and receive data. Thus, allowing for real-time monitoring, automation, and improved efficiency.

Internet of Things is expected to connect over 75 billion devices due to the increased adoption of 5G, edge computing, and AI integration. Further, McKinsey anticipates that IoT applications will generate an economic impact of USD 11 trillion by 2025, with immense potential across industries like healthcare, manufacturing, and smart cities.

For instance, the industrial IoT (IIoT) market is expected to reach USD 500 billion in 2025, while the IoT market in the retail industry is projected to reach USD 46.77 billion.

The IoT market is expected to reach USD 1.5 trillion by 2027.

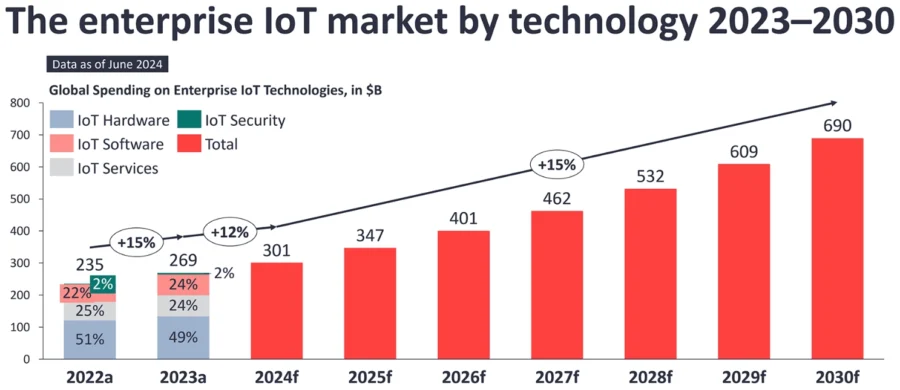

Note: a: Actuals, f: Forecast

Source: IoT Analytics

Investments in IoT include connected devices like smart home appliances, industrial sensors for predictive maintenance, and data analytics platforms to derive valuable insights from collected data.

For example, in an IoT-related funding round, Terminus Technologies raised approximately USD 276 million for smart city solutions, while Siemens acquired Altair Engineering for USD 10.6 billion to enhance its AI-powered simulation portfolio for industrial IoT applications.

3. Biotechnology

The biotechnology industry offers immense potential for investors. Areas of advancement include genomics, personalized medicine, synthetic biology, and much more. Genomics is already revolutionizing healthcare through personalized medicine and targeted therapies. Synthetic biology also finds applications in biofuels and pharmaceuticals.

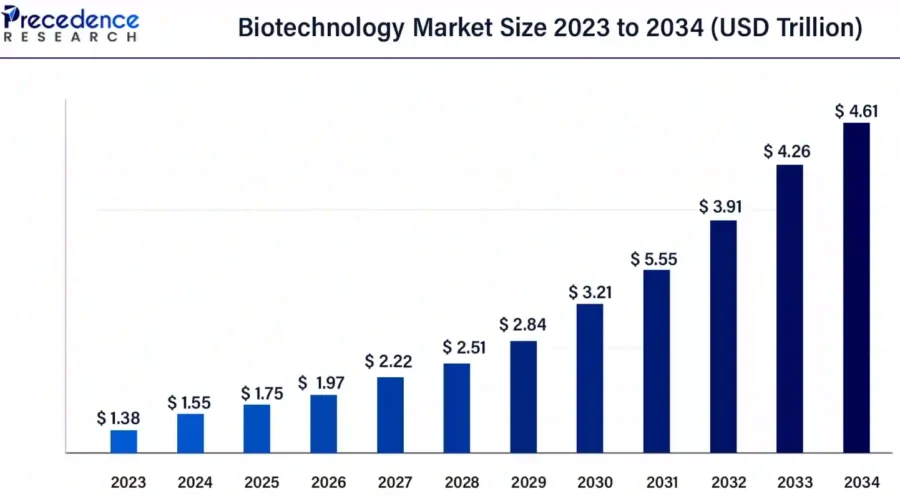

Precedence Research expects the biotech market to reach USD 1.75 trillion by 2025, while Omnicore Agency predicts a market size of USD 727.1 billion.

Source: Precedence Research

In 2024, US venture capital (VC) funding for life sciences rebounded strongly in 2024, with USD 34 billion raised, surpassing the USD 30 billion total for 2023. Mergers and acquisitions (M&A) activity is expected to surge in 2025 after a subdued year in 2024. Early signs include Johnson & Johnson’s USD 14.6 billion acquisition of Intra-Cellular Therapies.

Source: Goodwin Procter

Consider investments in companies focused on genetic testing, gene editing technologies, and biopharmaceuticals. Read this data-driven report to check out the top 5 startups advancing industrial biotechnology. Also, here’s an interesting list of startups merging IoT and biotech.

4. 5G

By the end of 2023, global 5G connections surpassed 1.5 billion, making it the fastest-growing mobile broadband technology. By 2025, 5G will cover one-third of the world’s population

As 5G networks continue to roll out globally, investing in this transformative technology becomes increasingly attractive. 5G technology offers faster data speeds, lower latency, and increased network capacity.

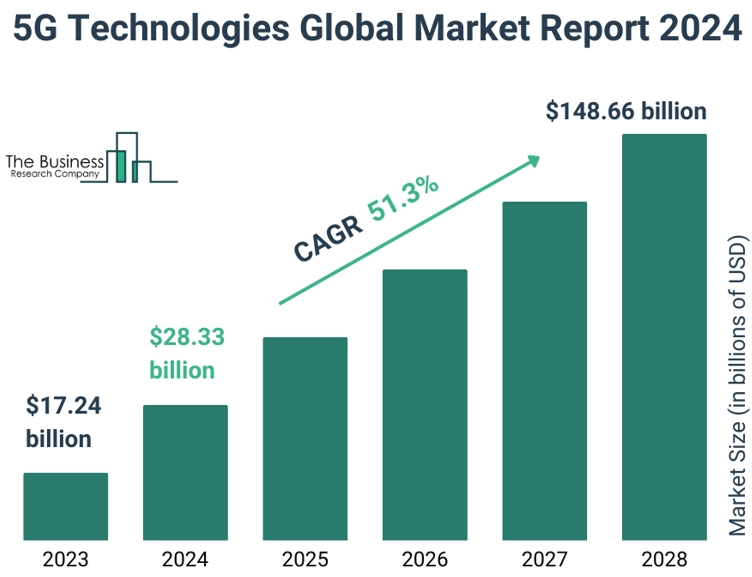

The market size of 5G is projected to reach USD 668 billion by 2026.

Source: The Business Research Company

Its major application areas include telecommunications, autonomous vehicles, and smart infrastructure. America’s one of largest telecom brands AT&T’s revenues from continuing operations in 2022 amounted to USD 120.7 billion.

China is leading global investments in 5G infrastructure, with over USD 215 billion estimated by 2025. Additionally, Ericsson announced an additional USD 50 million investment in its smart factory in Texas to accelerate local production of advanced 5G infrastructure components.

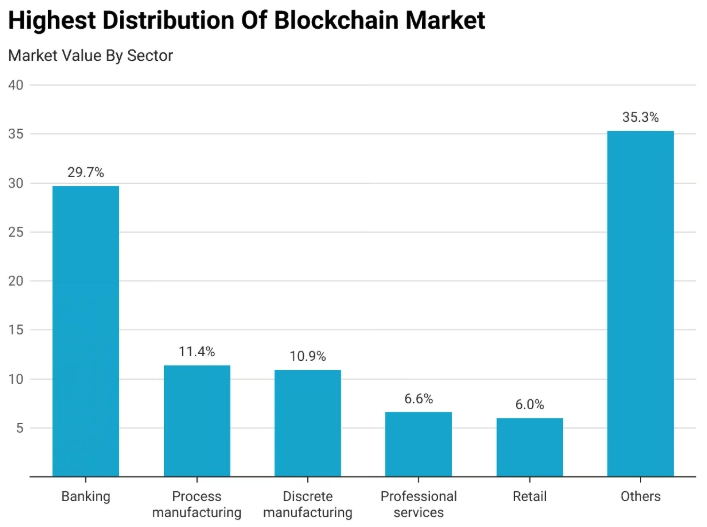

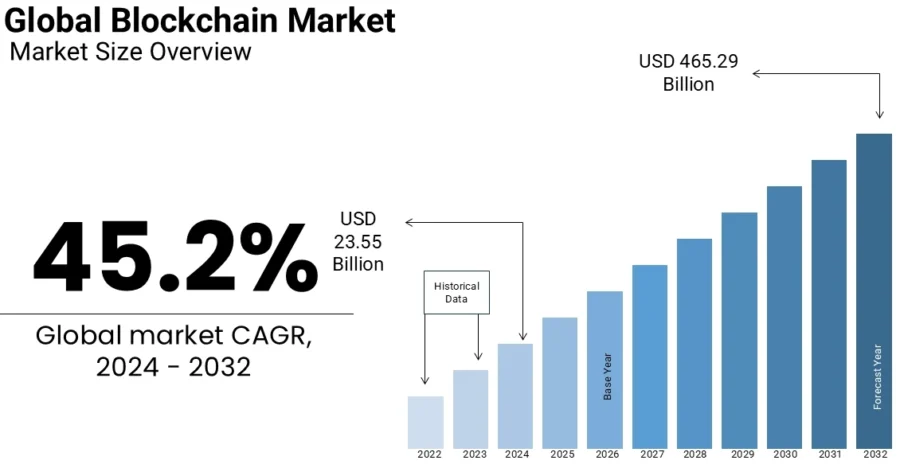

5. Blockchain

Spending on blockchain solutions was expected to surpass USD 19 billion in 2024, with further growth driven by increasing adoption across industries like finance, healthcare, and supply chain management.

Source: Market.us Scoop

Blockchain technology, with its decentralized and secure nature, is gaining traction beyond cryptocurrencies. Investing in blockchain involves areas like supply chain management, financial services, and digital identities. Blockchain ensures transparency and immutability of transaction records, making it ideal for supply chain tracking and verification.

Additionally, governments worldwide are adopting blockchain for digital infrastructure projects like land registries, voting systems, and identity verification. Over 80% of central banks plan to launch digital currencies leveraging blockchain.

The global blockchain market is projected to reach USD 469.49 billion by 2030.

Source: Market Data Forecast

The Asia-Pacific region is leading blockchain adoption due to supportive regulatory frameworks and high digital infrastructure readiness. Countries like China, South Korea, and Singapore are also fostering vibrant ecosystems for startups and investors.

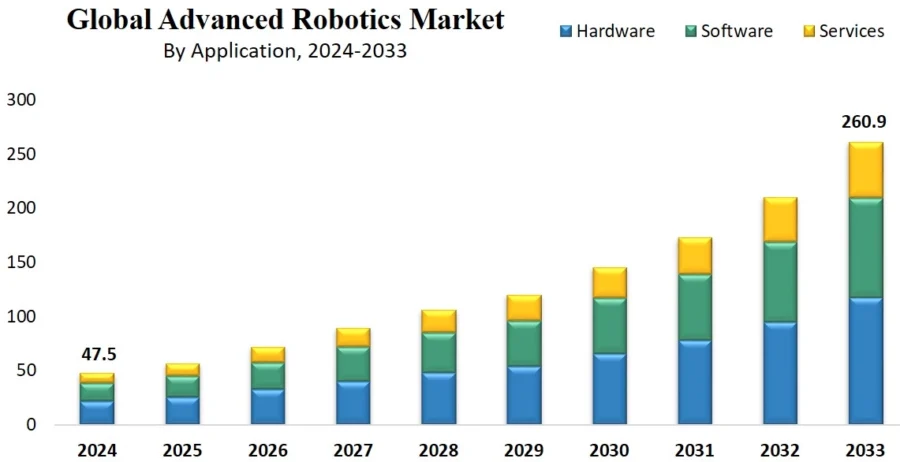

6. Robotics & Automation

Industrial automation involves using robots and intelligent systems to perform tasks previously done by humans, resulting in increased speed and precision. Cobots are designed to work safely alongside humans, enabling collaboration in manufacturing environments.

By replacing manual tasks with automated systems, businesses report significant savings. For instance, robotic process automation (RPA) saved financial services firms at least USD 100 000 annually per organization as of 2024.

The market size of robotics is expected to reach USD 260.9 billion by 2033.

Source: Dimension Market Research

Autonomous vehicles, including self-driving cars and drones, have the potential to revolutionize transportation and logistics. Here are the top 10 industries integrating advanced robotics in 2025.

Major funding rounds in 2024 included:

- Aptiv’s USD 2.2 billion for autonomous driving technologies.

- Monarch Tractor’s USD 133 million for autonomous electric tractors.

Moreover, the cost of deploying industrial robots has significantly decreased, with the average cost per robot projected at USD 10 856 in 2025, down from USD 27 000 in 2017.

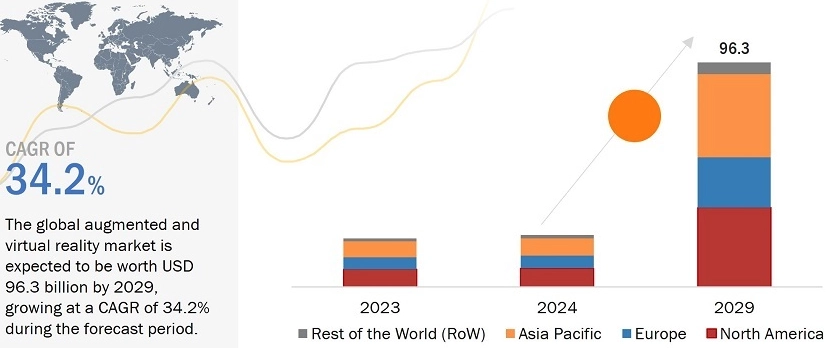

7. Immersive Technologies

Virtual Reality (VR) & Augmented Reality (AR) technologies are poised to reshape industries such as gaming, entertainment, and education. AR overlays digital information in the real world, enhancing perception, while VR creates immersive virtual environments.

Consider investments in companies developing AR/VR headsets, content creation studios, and applications for training, tourism, and marketing.

The AR and VR market size is expected to reach USD 114.5 billion by 2027, growing at a CAGR of 25.3%.

Source: MarketsandMarkets

Consumer spending on AR/VR adoption is forecasted to reach USD 7 billion in 2025, with USD 3.3 billion allocated specifically to gaming. North America leads the global AR/VR market due to advanced technological infrastructure and widespread adoption of 5G networks. The region accounted for over 40% of the market share in recent years.

For instance, Apple is working on a revolutionary mixed reality (MR) headset, Apple Vision Pro, that “seamlessly blends digital content with your physical space” to take the immersive experience to the next level. It might even replace smartphones one day!

The AR/VR industry is expected to generate revenues exceeding USD 46.6 billion globally in 2025 due to increased adoption in sectors like healthcare, retail, and construction.

Must-read: Explore the impact of VR on 10 industries and check if your industry is one of them!

8. Biometrics

The global biometrics market is projected to reach USD 73.5 billion by 2027. Not surprisingly, biometrics are now integrated into 81% of smartphones globally – applications ranging from unlocking devices to securing payments. Moreover, a Visa survey revealed that 86% of consumers prefer using biometrics for authentication due to the ease of use and enhanced security compared to passwords or PINs.

Biometrics is a rapidly evolving field that uses unique physical or behavioral characteristics for identification and authentication. Investing in biometrics involves areas like security systems, access control, and identity verification.

Fingerprint Cards AB’s partnership with IN Groupe for biometric payment cards and IDEMIA’s collaboration with Singapore’s HTX to advance biometric and forensic technologies are substantial investment activities in the biometric market in 2025.

Biometric technologies include fingerprint recognition, facial recognition, iris scanning, and voice recognition. These technologies have applications in industries such as banking, healthcare, and law enforcement.

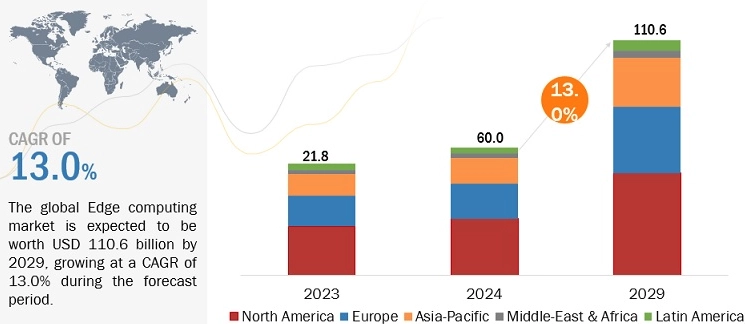

9. Edge Computing

Spending on edge computing is anticipated to reach USD 378 billion by 2028, marking a 14% increase from 2023. Further, Gartner predicts that 75% of enterprise data will be processed at the edge by 2025, compared to just 10% in 2018. This showcases the technology’s impact across industries.

Edge computing is gaining popularity as it enables faster data processing and reduced latency. Investing in edge computing includes areas like smart cities, autonomous systems, and IoT applications. Edge computing brings computing power closer to the data source, reducing the need for sending data to remote servers.

The market size of Edge Computing is projected to reach USD 43.4 billion by 2027.

Source: MarketsandMarkets

This technology is essential for real-time applications, such as autonomous vehicles, where split-second decisions are critical. Investments in edge computing consist of hardware providers, software developers, and companies developing edge-based applications for smart infrastructure and IoT devices.

Over USD 6 billion was invested globally in edge computing in 2024 – with significant funding allocated to AI-driven edge solutions and infrastructure development. Notable investments include Microsoft’s M12 venture fund leading a USD 40 million round in Armada and Axelera AI securing USD 68 million for its Metis platform.

Governments are also supporting edge computing:

- The Biden-Harris Administration allocated USD 269 million to the microelectronics sector, which includes edge solutions.

- The EU announced USD 1.25 billion for cloud and edge computing projects across Europe.

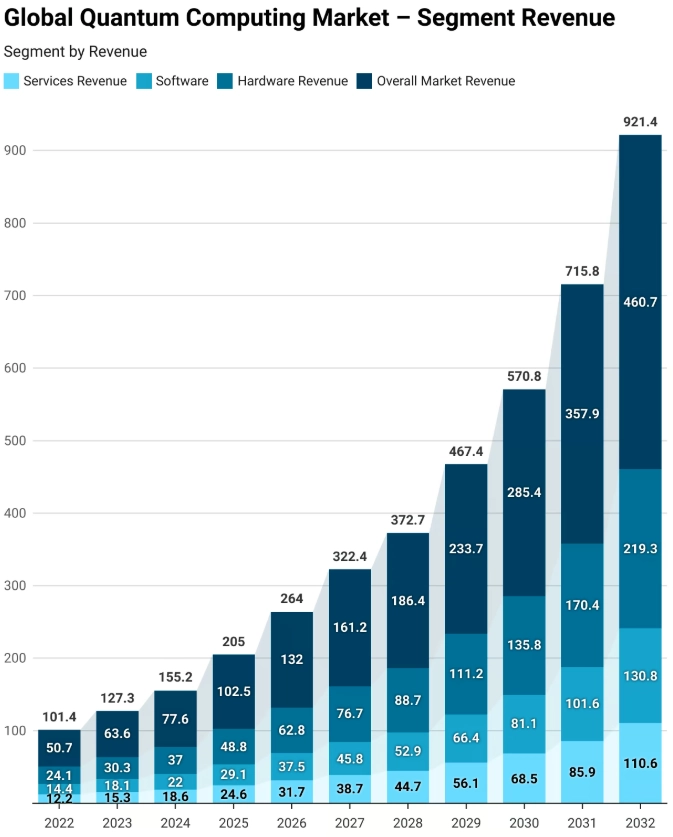

10. Quantum Computing

Quantum computing is expected to create a cumulative economic impact of USD 1 trillion by 2035 – driven by cost savings and new revenue opportunities across industries like finance, healthcare, and logistics.

This technology holds tremendous potential for solving complex problems beyond the capabilities of traditional computers. Investing in quantum computing involves areas like cryptography, drug discovery, and optimization algorithms. Quantum computers leverage quantum bits (qubits) to perform calculations at an exponential scale, enabling faster problem-solving.

The market size of Quantum Computing is projected to reach USD 8.28 trillion by 2033.

Source: Market.us Scoop

Cryptography, the science of secure communication, benefits from quantum-resistant algorithms. Drug discovery and optimization algorithms are also enhanced by the computational power of quantum computers. Consider investments in companies developing quantum hardware, software, and applications for various industries.

Notable funding events in this sector include PsiQuantum raising USD 617 million from the government to develop fault-tolerant quantum systems and Honeywell’s USD 300 million equity round for Quantinuum, valuing the company at USD 5 billion.

Ready to Identify the Next Big Tech Opportunity?

As you’ve seen, the technology landscape for 2025 is brimming with potential. To make the most of these opportunities, leverage our AI-powered Discovery Platform, designed to simplify your investment journey with actionable insights.

Here’s how you can get started:

- Access Comprehensive Data: Explore over 4.7 million startups and 20 000+ emerging technologies and trends across the globe.

- Filter & Compare: Narrow down startups by technology, location, funding, and more, and compare them based on innovation potential and market fit.

- Make Informed Decisions: Analyze detailed startup profiles, including their products, team, funding history, and market position.

- Engage Directly: Connect with startups or request introductions from our expert team.

Stay ahead of the curve by equipping yourself with the insights that matter. Book a demo today to see how our Discovery Platform empowers you to spot trends early, make confident investments, and lead in the fast-evolving tech world.

![Business Resilience Planning: 10 Strategies & Technologies to Tackle the Current Market [2025-2026]](https://www.startus-insights.com/wp-content/uploads/2025/06/Business-Resilience-Planning-SharedImg-StartUs-Insights-noresize-420x236.webp)

![10 Biggest Business Trends: What to Invest in, Build, and Watch Closely [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/06/Business-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)