Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Industries are rapidly adopting digitization, and the insurance sector is no exception. Emerging trends, including artificial intelligence (AI), the Internet of Things (IoT), and cloud computing, are replacing legacy systems and enhancing workflows. These technologies enable secure and data-driven insurance services by offering automated solutions for claims processing and fraud detection. Additionally, the industry leverages technology to improve customer experience, providing more personalized and efficient service. This report explores how these advancements are transforming the insurance landscape, driving innovation and operational efficiency while meeting the evolving market needs.

This article was last updated in August 2024.

Innovation Map outlines the Top 8 Insurance Industry Trends & 16 Promising Startups

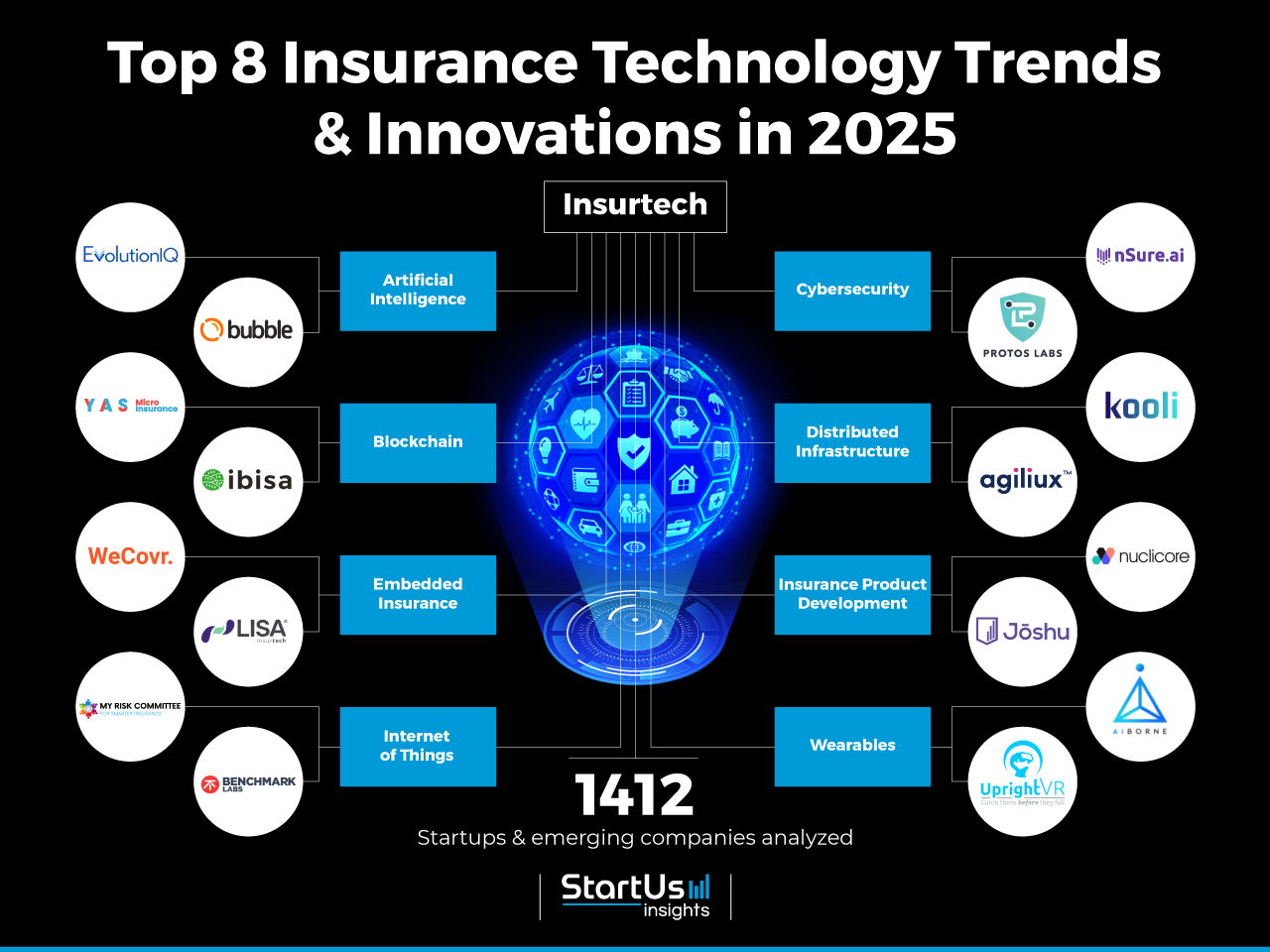

For this in-depth research on the Top Insurance Technology Trends & Startups, we analyzed a sample of 1 412 global startups and scaleups. The result of this research is data-driven innovation intelligence that improves strategic decision-making by giving you an overview of emerging technologies & startups in the insurance technology industry. These insights are derived by working with our Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 4.7M+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant startups, emerging technologies & future industry trends quickly & exhaustively.

In the Innovation Map below, you get an overview of the Top 8 Insurance Technology Trends & Innovations that impact 1 400+ companies worldwide. Moreover, the Insurance Technology Innovation Map reveals 16 hand-picked startups, all working on emerging technologies that advance their field.

Top 8 Insurance Industry Trends in 2025

- Artificial Intelligence

- Blockchain

- Embedded Insurance

- Internet of Things (IoT)

- Cybersecurity

- Distributed Infrastructure

- Insurance Product Development

- Immersive Technologies

Want to explore all insurance industry innovations & trends?

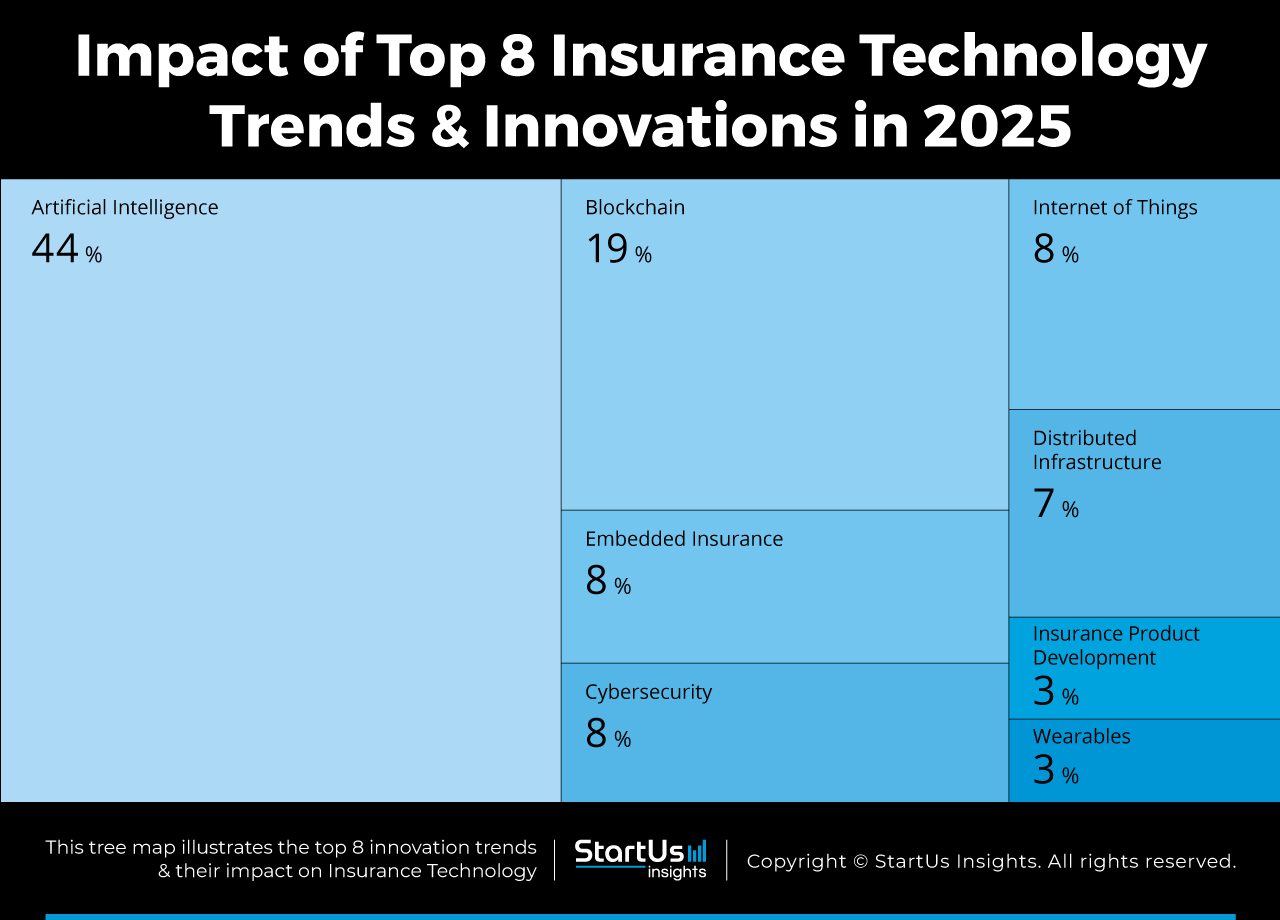

Tree Map reveals the Impact of the Top 8 Insurance Technology Trends

Based on the Insurance Technology Innovation Map, the Tree Map below illustrates the impact of the Top 8 Insurance Technology Trends. AI is automating slow, manual processes in the insurance sector as well as reducing the scope for errors. Meanwhile, the use of blockchain and a focus on cybersecurity are introducing new layers of security, further demonstrating a focus on transparency and growing customer confidence in the industry. Immersive technologies are creating opportunities for remote collaborations and improving sales. Other insurance trends such as insurance product development and embedded insurance are contributing to the wider adoption of insurance services.

Global Startup Heat Map covers 1 412 Insurance Technology Startups & Scaleups

The Global Startup Heat Map below highlights the global distribution of the 1 412 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals that Europe and the US see the most startup activity.

Below, you get to meet 16 out of these 1 412 promising startups & scaleups as well as the solutions they develop. These insurance technology startups are hand-picked based on criteria such as founding year, location, funding raised, and more. Depending on your specific needs, your top picks might look entirely different.

Top 8 Insurance Industry Trends for 2025

1. Artificial Intelligence

In the Insurtech industry, AI and related technologies are becoming increasingly popular. Startups are creating AI-based solutions to minimize manual tasks and errors. These solutions handle a variety of tasks, from processing insurance claims to predicting risks.

The insurance industry produces a vast amount of data. Startups and scaleups use AI to transform this data into insights, enhancing the efficiency of InsurTech operations. Further, AI-driven chatbots are enhancing client engagement and satisfaction by providing round-the-clock customer support. Predictive analytics in AI are also enabling proactive risk management by anticipating potential claims.

EvolutionIQ enables Claims Guidance

US-based startup EvolutionIQ builds a predictive claim guidance platform. It improves claims processing, assists in tracking team productivity, and detects fraud trends. With AI-based automation, it enables insurance examiner teams to increase their capacity to process claims and lower claims duration. This assists insurance companies to improve their services and, thereby, increase, customer satisfaction.

Bubble Insurance provides Personalized Insurance

US-based startup Bubble Insurance offers personalized, digital insurance services. It combines life insurance with homeowner insurance when users buy a house or refinance their mortgage. This enables homeowners and homebuyers to protect their families from unexpected events. Using AI, it finds the right coverage for home insurance and associated plans to fit the individual needs of customers.

2. Blockchain

Security and transparency drive the adoption of blockchain technology in the insurance industry. This technology facilitates rapid data sharing while providing robust protection against fraud. Cryptographic methods enhance the reliability of blockchain for storing and transmitting insurance data.

Furthermore, smart contracts streamline claim settlements by minimizing processing time and human error. Lastly, decentralized ledgers bolster policy management transparency, thereby boosting customer trust.

YAS offers Microinsurance

Hong Kong-based startup YAS offers on-demand microinsurance. It offers multiple insurance services for different end-users such as hikers, cyclists, runners, and car riders. All of these are low-cost insurance options to provide a sense of safety and security to commuters.

All the sensitive customer data collected for insurance purposes is secured through the blockchain architecture on which YAS is built thereby further instilling a sense of confidence in customers that they and their data both are secure on the platform.

Ibisa provides Agricultural Insurance

Luxembourg-based startup Ibisa develops a global risk-sharing platform for agricultural insurance. The startup’s platform offers affordable and automated weather index micro insurance by leveraging earth observation and blockchain technology.

This enables farmers and breeders to avail of next-generation insurance and builds the price resilience of their produce. In turn, this contributes to reducing poverty among farmers and improving food security.

3. Embedded Insurance

Embedded insurance bundles insurance with the transaction of a product or service at a point of sale. This trend offers hard bundles, like warranties, or soft bundles, where customers can opt out after a small increment. The affordability and accessibility of insurance services have improved significantly due to embedded insurance.

Further, data analytics plays a crucial role in customizing offerings in embedded insurance, ensuring they meet consumer needs. As a result, insurance companies leverage this technology to penetrate various markets and reach diverse customer demographics.

WeCovr offers Insurance APIs

British startup WeCovr develops insurance APIs. These APIs support both mobile and web applications and allow online sellers to embed insurance into their product sales. This provides online stores with an additional source of revenue while making purchases secure for end-users.

Lisa Insurtech develops Insurance Gateway

US-based startup Lisa Insurtech is the developer of proprietary insurance gateway technology. Lisa Gateway is the core technology that is solving the interoperability problems between insurers, brokers, and startups.

The gateway acts as an enabler through which insurance products can be embedded with different services and products such as business intelligence software, payment gateways, and more. Through their gateway, Lisa Insurtech promotes insurance as a service ecosystem.

4. Internet of Things

Digital transformation in the insurance industry accelerates with the Internet of Things (IoT) trend. In today’s fast-paced business climate, immediate results are the expectation. Hence, businesses across sectors, including insurance, strive to enhance customer experience and loyalty digitally. IoT devices enable continuous data collection and exchange across networks. This optimizes claim processes, reduces data duplication, and curbs customer dissatisfaction.

Paperwork is no longer a time-consuming task for customers, as sensitive data collection from devices and effective insurance claim handling become the norm. Furthermore, proactive policy adjustments are facilitated, aligning coverage with evolving risk scenarios.

My Risk Committee offers Enterprise Risk Management

French startup My Risk Committee provides IoT-enabled enterprise risk management solutions. The startup offers a cloud platform, My Risk io, that integrates with connected devices in an industrial setting for risk assessment and data-driven decision-making. It also features cloud analytics and integrates with existing systems. The platform enables continuous monitoring of industrial assets and assists in preventing risks to improve insurance underwriting accuracy

Benchmark Labs offers Asset Specific Weather Forecasting

US-based startup Benchmark Labs is the developer of a weather forecasting platform used to deliver asset-specific data for the agricultural sector. The startup’s platform offers machine learning-based forecasts for specific locations using publicly available information and real-time data from IoT sensors.

The primary aim of the platform is to reduce the discrepancies between environmental data available between insurers and clients. This, in turn, assists insurers in developing parametric insurance models that trigger payouts using real-time data.

Find out how 10 emerging technologies shape your industry!

5. Cybersecurity

With the rising sophistication of cyberattacks, cybersecurity is emerging as a major trend in the insurance industry. Legacy insurance providers often lack the necessary knowledge and tools to prevent these attacks or losses. Startups are bridging this gap by offering cybersecurity solutions that protect the interests of insurance companies and consumers alike.

These solutions guard against various types of internet-based fraud and secure sensitive user data. Furthermore, training employees in cyber hygiene practices significantly reduces the risk of internal security lapses.

Nsure.ai offers Fraud Detection

Israeli startup Nsure.ai builds a fraud detection platform. The platform uses AI to accurately differentiate between real buyers and sellers from fraudulent ones. The platform features real-time anomaly detection to safeguard transactions. This way, Nsure.ai is enabling businesses to securely approve sales of higher-risk digital products.

Protos Labs enables Cyber Underwriting

Singaporean startup Protos Labs uses a threat-based approach to manage cyber risk for insurers. The startup’s risk quantification platform provides a cyber attack analysis report that indicates which threats insurance companies are most susceptible to.

It uses predictive machine learning to non-intrusively assess the cyber resiliency of its clients. Protos Labs’ cyber underwriting approach enables insurers to make informed risk assessments and accurately calculate the risk exposure.

6. Distributed Infrastructure

A significant technology adoption gap exists in the global insurance industry, with on-premise legacy technologies hindering many core processes. The maturation of cloud technology is facilitating a shift in all core systems. This shift aids insurance companies in swiftly launching new products and enhancing customer service. Furthermore, the cloud is indispensable for harnessing the computational power required to comprehend and utilize the large data sets generated by insurance companies.

As the cloud ecosystem evolves, cloud-native insurance companies are emerging as connecting hubs among customers, distributors, insurance, and healthcare providers. Importantly, distributed infrastructure bolsters business continuity and disaster recovery, ensuring operational maintenance during system failures.

Kooli connects Insurance Industry Actors

Portuguese startup Kooli is a Portuguese startup that offers a cloud-based insurance platform to connect businesses and insurance companies in a personalized fashion. Kooli combines multiple technologies on its cloud platform which includes AI, predictive analytics, and IoT with legacy technologies being used by their customers.

This enables insurance companies to not be dependent on various complex systems and rather get access to a flexible platform that is able to handle all their processes. Kooli cloud also offers flexible API integrations, claims automation, fraud prevention, and data analytics features to further improve business operations and client experience for insurance companies.

Agiliux offers Insurance Digitization

Singaporean startup Agiliux provides a scalable SaaS platform for the insurance industry. Agiliux’s Cloud Insurance Software offers catered solutions for insurance providers, agents, and brokers. The platform acts as a core through which multiple tasks are performed by the users.

It assists with policy management, claims management, and insurance product development by digitizing the workflow. The startup’s platform integrates with legacy systems and is customizable to the unique needs of the startup’s clients.

7. Insurance Product Development

The rise of low-code development platforms is transforming the insurance product development landscape. These platforms enable insurance providers to create policies and applications swiftly, bypassing the complexities of coding. As a result, the launch of new products is expedited.

Given that insurance products and applications handle sensitive information, they undergo rigorous testing and quality assurance processes. The predefined architecture of low-code platforms mitigates vulnerability risks, facilitating the creation of functional products. Moreover, continuous feedback loops with policyholders ensure that products evolve to meet changing demands.

Nuclicore offers a No-code Insurance Platform

German startup Nuclicore develops a no-code insurance platform. It enables insurance providers to develop new products in a short period of time without having to code. The platform also has features that are used to easily develop APIs of existing software of insurance providers which are then integrated on different platforms thereby improving their product integration. Nuclicore is also system agnostic and is compatible with the system or third-party solutions in use by the client.

Joshu speeds up Insurance Product Development & Distribution

Joshu is a US-based startup that provides an insurance product development and distribution platform. The platform allows users to upload their product configurations via Excel, configure aspects like coverage limits and payment plans, and analyze product changes before launching them.

The platform also features no-code product setup, rapid deployment, and integrated APIs for improved digital distribution. This accelerates product time-to-market and simplifies insurance product management, providing a comprehensive solution for digital underwriting and policy management.

8. Immersive Technologies

To improve customer experience and operations, the industry is embracing modern technologies. Virtual reality and augmented reality are pivotal in this modernization effort. These technologies enable remote, cost-effective risk assessments and claims damage assessments.

Virtual reality simulations provide realistic scenarios for risk assessment and management training, enhancing preparedness. Additionally, augmented reality boosts customer engagement by allowing interactive policy explanations and demonstrations.

Airborne offers AR-based Damage Assessment

Indian startup Airborne creates an Inspections-as-a-Service (IaaS) platform. It automates traditionally human-led inspection for exhaustive damage assessment in automotive, manufacturing, and insurance. The platform uses industry-specific deep learning algorithms and AR to perform damage assessments with detailed on-screen visualizations and create reports on defect metrics. This enables insurance companies to perform real-time three-dimensional visual assessments.

UprightVR enables Fall Risk Assessment

US-based startup UprightVR develops a virtual reality-based fall prevention solution. UprightVR’s balance assessment system is a combination of their VR headset technology and platform which are used in tandem to analyze patients and assess their risk of falling.

This is done by simulating fall scenarios in the headset and then measuring 10 underlying causes of falls based on the patient’s performance. It then generates a risk report that highlights how likely they are to fall. This informs insurance claims purposes and also assists in keeping track of at-risk patients over time.

Discover all Insurance Technology Trends, Technologies & Startups

Emerging Insurtech trends are advancing a data-driven and customer-centric approach. Startups are advancing automation in the industry by removing manual processes with AI-driven solutions. The focus is also on growing the customer base with technologies that make insurance more accessible. Security is also a top concern, as insurance companies seek solutions that allow them to process documents fast while lowering the risk of fraud.

The Insurance Technology Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation and startup scouting process. Among others, cyber insurance, embedded insurance, and IoT will transform the sector as we know it today. Identifying new opportunities and emerging technologies to implement into your business goes a long way in gaining a competitive advantage. Get in touch to easily and exhaustively scout startups, technologies & trends that matter to you!