Our Innovation Analysts recently looked into emerging technologies and up-and-coming startups working on solutions for the financial service industry. As there is a high number of startups working on a variety of applications, we want to share our insights with you. This time, we take a look at 5 promising RegTech startups.

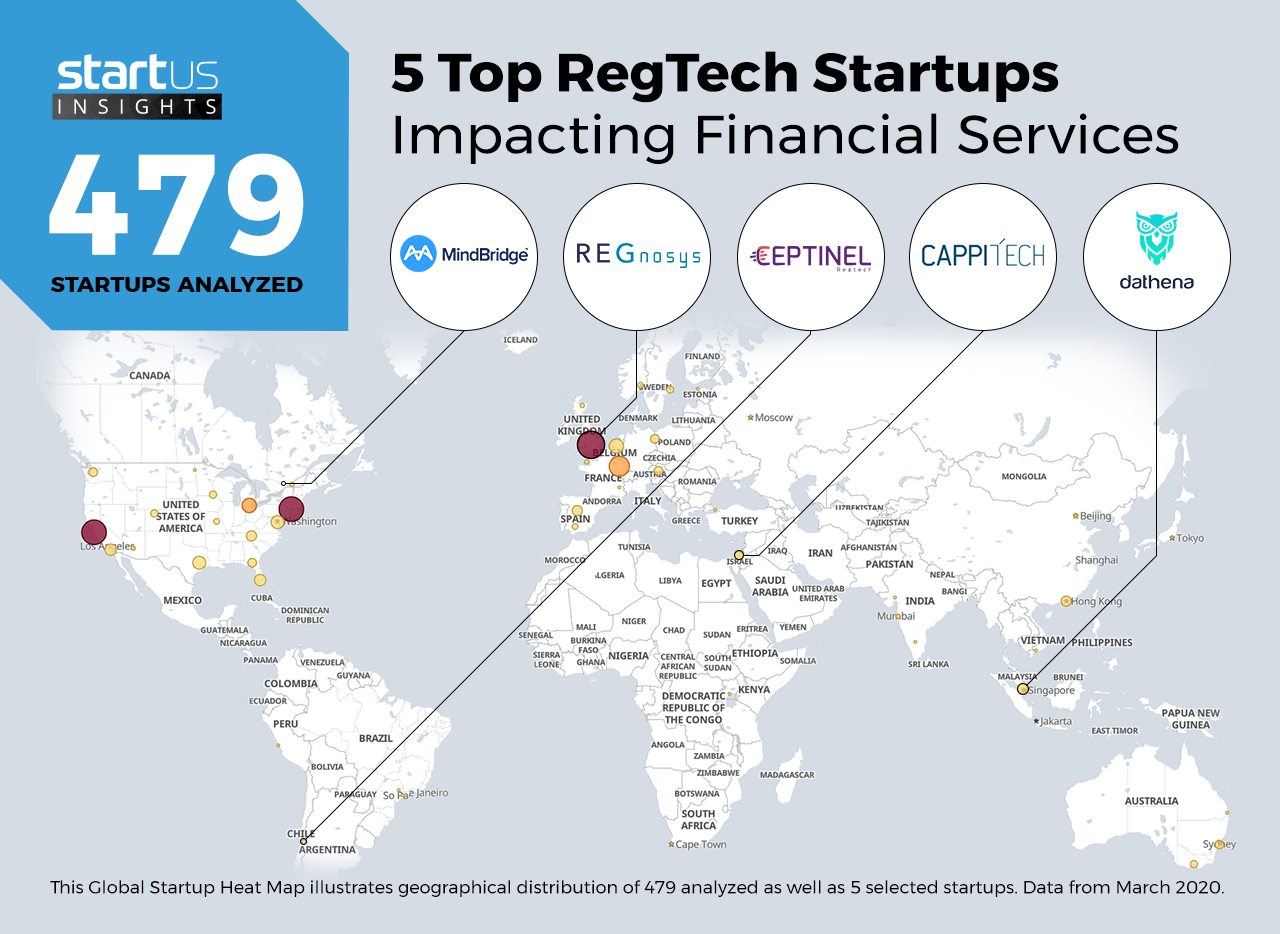

Heat Map: 5 Top RegTech Startups

For our 5 top picks, we used a data-driven startup scouting approach to identify the most relevant solutions globally. The Global Startup Heat Map below highlights 5 interesting examples out of 479 relevant solutions. Depending on your specific needs, your top picks might look entirely different.

REGnosys – Compliance Management

Banks and financial companies usually have to act in accordance with many regulatory requirements. However, conventional compliance management systems lack when it comes to efficient data organization and warehousing. Startups across the world work to build comprehensive risk assessment-based regulatory compliance management suites with data mining and analytics functionalities.

The UK-based startup REGnosys offers a regulatory technology compliance platform, called Rosetta. It aims at facilitating the implementation of the Common Domain Model (CDM) for financial sector players with programmatically enforced compliance mechanisms. The solution saves costs and risks based on a specific rule-based operational lifecycle design.

Ceptinel – Monitoring

As government laws, regulations, and procedures tend to change over time, established companies and FinTechs alike need to stay aware of any pending requirements, modifications in norms, or new state guidelines related to their business. RegTech monitoring software intends to ease the process of tracking regulatory environment changes by incorporating real-time big data analysis, risk management, and contextual search.

Chile-based startup Ceptinel develops a real-time regulatory monitoring system for financial companies. It applies machine learning and complex event processing algorithms to treat large amounts of data coming from various sources to prevent risks and stay aware of regulatory and business environment changes.

Cappitech – Reporting

Not only are banks and financial organizations obliged to cope with government norms, but also to regularly create and submit corresponding regulatory reports. RegTech aims at automating manual and routine tasks of report preparation while integrating powerful big data management and convenient visualization tools into the flow of reporting.

Israeli startup Cappitech provides a regulatory reporting platform, Capptivate, for FinTechs. The solution automates data transfer, as well as report creation and submission. Besides, it validates given information and reformats it in accordance with regulatory requirements, monitors the reporting status and grants feedback on past reports.

Mind Bridge – Auditing

One more challenge banks and financial institutions encounter during regulatory compliance procedures involves errors and inconsistencies usually occurring as a result of human inattentiveness, manual checks, and time constraints. FinTech startups build RegTech auditing tools that automate and streamline the regulatory report quality check, as well as add artificial intelligence (AI) features to enhance the process.

Canadian startup Mind Bridge creates a financial data analytics platform for auditing, based on AI and machine learning. It leverages accounting data and incorporates domain expertise to detect mistakes and anomalies, spot potential risks and investigate specific cases with built-in natural language processing (NLP) search.

Dathena – Security Management

RegTech also covers the area of data security management so as to ensure that the data related to a company, its clients, stakeholders, partners, reports, and all connected parties remains safe. Startups globally elaborate on new security mechanisms that prevent data theft and loss and make enterprises continuously immune to fraudsters’ attacks.

Singapore-based startup Dathena utilizes AI to arrange a suite of regulatory data safeguarding tools for the financial, healthcare, travel, and retail industries. This suite allows enterprises to organize their data repositories, manage secure access to files, classify data by importance and confidentiality, and automate data protection policies implementation.

What About The Other 474 Solutions?

While we believe data is key to creating insights it can be easy to be overwhelmed by it. Our ambition is to create a comprehensive overview and provide actionable innovation intelligence for your Proof of Concept (PoC), partnership, or investment targets. The 5 RegTech startups showcased above are promising examples out of 479 we analyzed for this article. To identify the most relevant solutions based on your specific criteria and collaboration strategy, get in touch.