Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Our Innovation Analysts recently looked into emerging technologies and up-and-coming startups working on FinTech solutions. As there is a large number of startups working on a wide variety of solutions, we decided to share our insights with you. This time, we are taking a look at 6 promising microfinance startups.

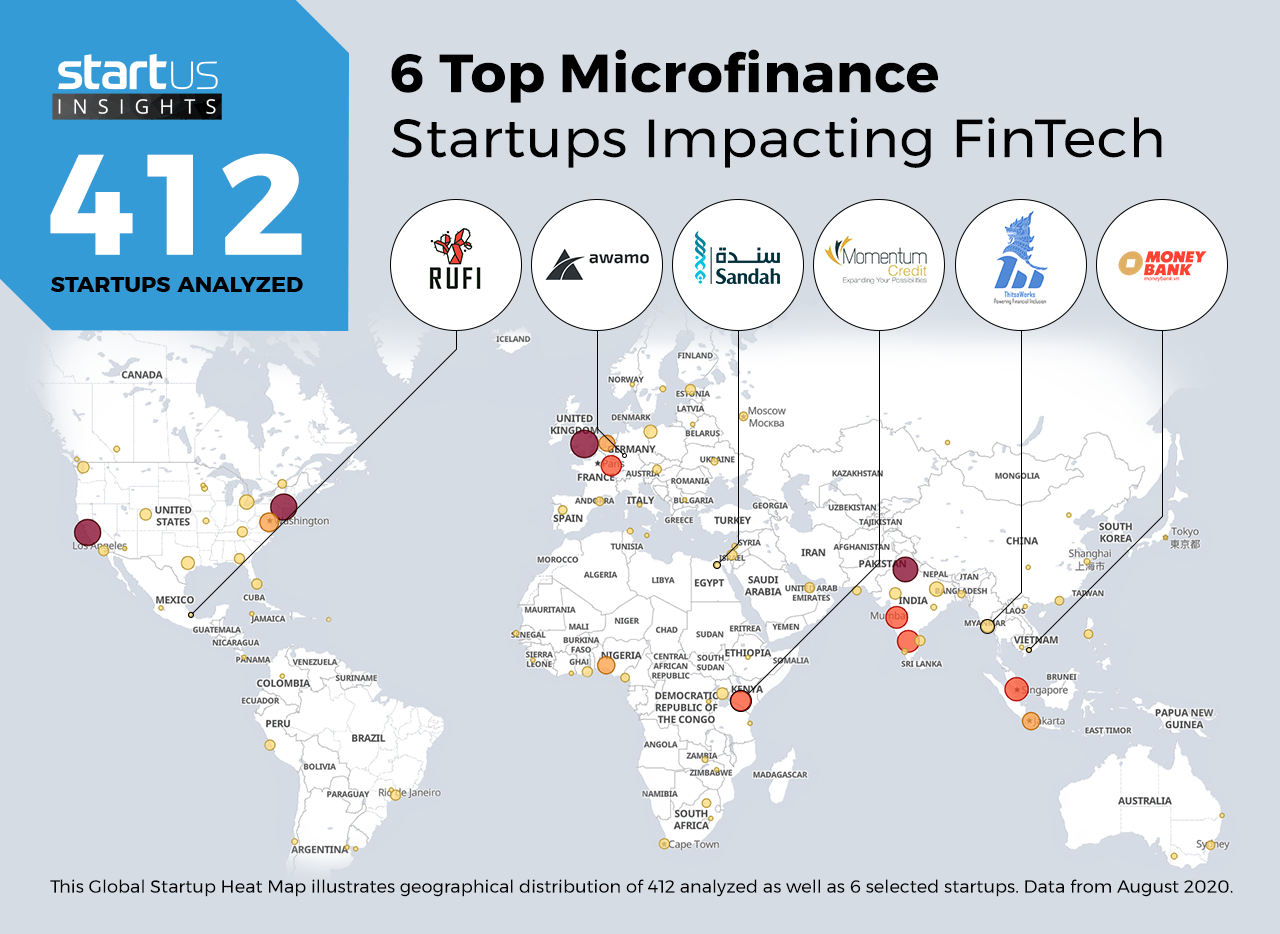

Heat Map: 6 Top Microfinance Startups

Using our StartUs Insights Platform, covering 1.116.000+ startups & emerging companies, we looked at innovation in the field of banking and finance. For this research, we identified 412 relevant solutions and picked 6 to showcase below. These companies were chosen based on a data-driven startup scouting approach, taking into account factors such as location, founding year, and technology among others. Depending on your specific criteria, the top picks might look entirely different.

The Global Startup Heat Map below highlights 6 startups & emerging companies developing innovative microfinance solutions. Moreover, the Heat Map reveals regions that observe a high startup activity and illustrates the geographic distribution of all 412 companies we analyzed for this specific topic.

Rufi Rural FinTech – Micro-Lending For Rural Communities

Microfinance advances small sums of credit, usually to help young or marginalized and unbanked communities. All around the world, microcredit is gaining in popularity and shows promise for lifting large sections of the world population out of poverty. Families accessing microfinance solutions are able to look beyond living with only essentials into savings and investments.

Mexican startup Rufi Rural FinTech employs big data and advanced analytics techniques to extend micro-lending services to rural communities. Rufi targets businesses by providing digitization services for rural enterprises and also builds digital communities and internet cafes targeting young rural people.

Momentum Credit – Loan Products For Small & Medium Enterprises (SMEs)

Micro, small and medium enterprises usually form the majority of businesses in many countries around the world. This, in turn, makes SME development a priority for several governments, and many have schemes to support SME growth. Microfinance is a powerful tool for SMEs as it provides timely money, no matter how nominal the amount. Systematic investing in small businesses improve economic diversity as well as stability.

Kenyan startup Momentum Credit advances structured working capital to individuals and SMEs. The startup’s range of micro-loan products includes invoice factoring, logbook loans, bid bonds, and payment guarantees. These solutions allow those with low incomes or collateral to finance their businesses with alternative security arrangements.

MoneyBank – Peer-To-Peer (P2P) Lending Platform

Increasingly, governments are looking for ways to implement financial inclusion policies, mainly to bring more people into the formal banking sector. Microfinance plays an especially useful role in catering to previously unbanked communities like women and younger people from low-income regions. Startups develop simple and easy-to-use P2P solutions to improve the livelihoods of millions of people around the world.

Vietnamese startup MoneyBank provides a 24/7 digital P2P lending platform across Vietnam. Using digital technologies, the startup extends loans without requiring any paperwork or collateral. Borrowers have several options for choosing their loan amount and repayment plans. MoneyBank also works to minimize investors’ risk by utilizing a data-driven, reliable scoring technology along with inputs from risk analysts and experts.

ThitsaWorks – Microfinance Data Sharing Platform

Microfinance is largely considered a low-risk venture, mainly because the sums of money involved are relatively small. However, it takes powerful data-driven analysis to ensure that finance is extended only to those most likely to repay the money. As an industry, microfinance also provides employment opportunities and pushes local development from the bottom up.

Myanmar-based startup ThitsaWorks is developing a range of financial and regulatory technology solutions for microfinance institutions. The startup offers a microfinance data-sharing platform along with data visualization services. In partnership with Musoni, the startup provides governments with core banking systems for financial institutions. ThitsaWorks is also creating a Facebook Messenger bot called Pite Pite to improve financial literacy for local communities in Myanmar.

Sandah – Microfinance For Financial Inclusion

One of the more surprising aspects of microfinance has to do with the high repayment rates, according to various studies conducted in existing markets. By borrowing and working to repay smaller sums of money, more people are able to access the finance that they need, in terms of both money and repayment period. Low-income workers’ earnings usually remain stagnant, making it difficult for them to access credit from larger lenders. Microfinance helps these groups of the population avoid both formal banking complexities, as well as loan sharks.

Egyptian startup Sandah extends microfinancing and home financing solutions starting from 1.000 Egyptian Pounds (EGP) up to 30.000 EGP. In addition, the startup also works to improve project opportunities, create job prospects for young professionals, and enhance the skills of industrial workers.

Awami – Biometric Microfinance Software

At the end of the day, financial pressures, in particular for low-income families, lead to increased stress and depression. Microfinance startups are working to alleviate several societal pressures by extending small sums of credit that radically improve livelihoods. Biometrics-based solutions aim to help, in particular, the poor, underbanked, and unbanked populations, and empowers them to shift from surviving to thriving.

German FinTech startup Awamo is building its eponymous software, awamo 360 – a mobile, biometric banking software tailored for microfinance institutions and savings and credit cooperative organizations (SACCOs). This software completely digitizes client businesses at affordable rates. The startup offers a range of features in the platform from biometric security, automated accounting, and reporting tools to loans, activity and location tracking, as well as client management.

What About The Other 406 Solutions?

While we believe data is key to creating insights it can be easy to be overwhelmed by it. Our ambition is to create a comprehensive overview and provide actionable innovation intelligence so you can achieve your goals faster. The 6 microfinance solutions showcased above are promising examples out of 412 we analyzed for this article. To identify the most relevant solutions based on your specific criteria, get in touch.

![Discover the Top 10 FinTech Trends & Innovations [2025-2026]](https://www.startus-insights.com/wp-content/uploads/2025/06/FinTech-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)