Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Our Innovation Analysts recently looked into emerging technologies and up-and-coming startups working on solutions for the financial services sector. As there is a large number of startups working on a wide variety of solutions, we want to share our insights with you. This time, we are taking a look at 5 promising mobile banking startups.

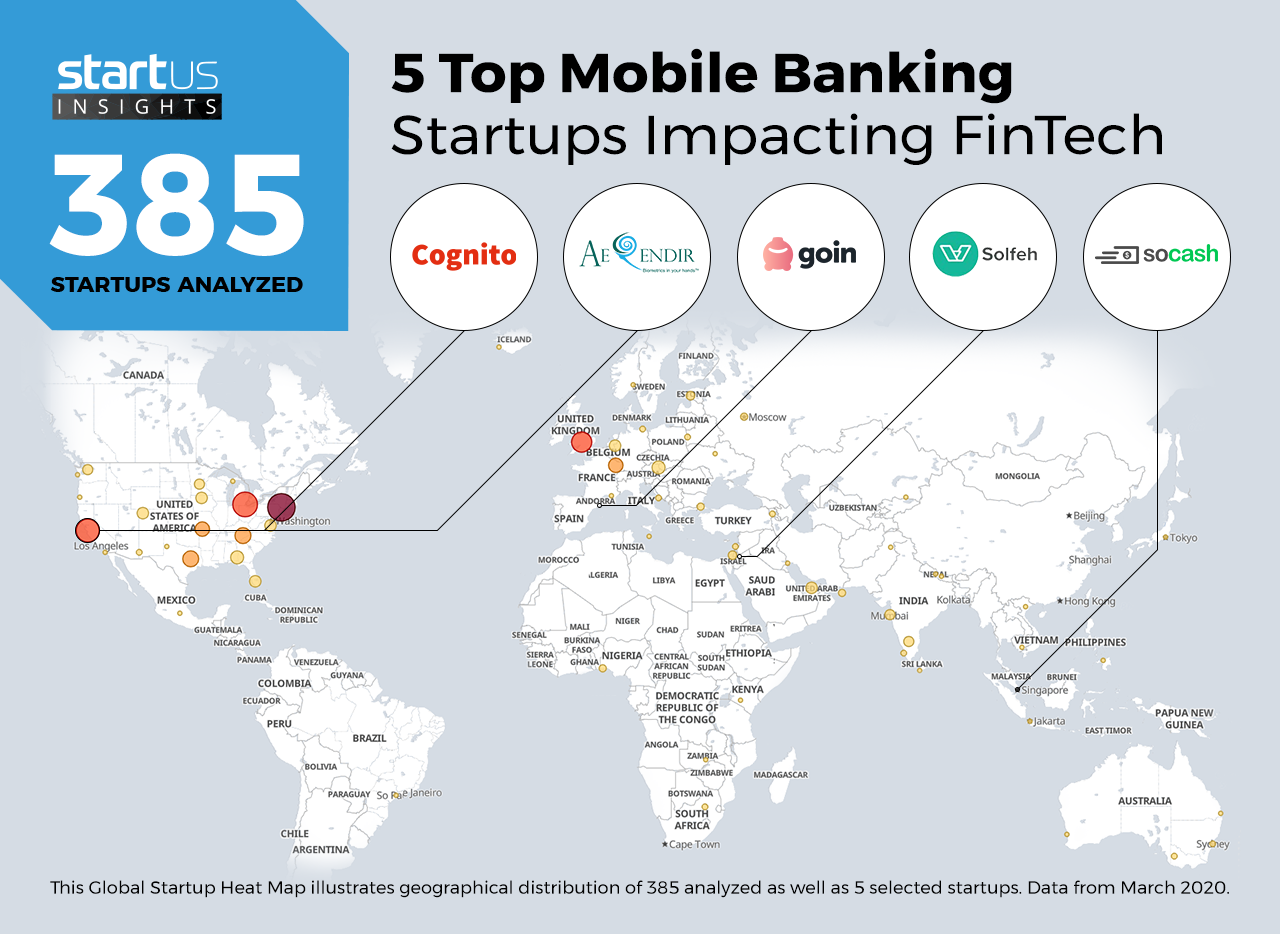

Heat Map: 5 Top Mobile Banking Startups

For our 5 top picks, we used a data-driven startup scouting approach to identify the most relevant solutions globally. The Global Startup Heat Map below highlights 5 interesting examples out of 385 relevant solutions. Depending on your specific needs, your top picks might look entirely different.

Cognito – Smart Chatbots

Banking institutions strive to provide their clients with first-class customer service. Demanding consumers expect personalized professional advice in real-time, with no delays or waiting lines. Banks cooperate with startups to build smart mobile customer assistance chatbots. These bots use artificial intelligence (AI) and predictive analytics to address a client’s concerns and instantly answer their questions.

The US-based startup Cognito utilizes AI and machine learning to offer a conversational banking experience. The company uses various messaging channels to address on-demand financial data access, prompt customer questions management, and offers a fully customized interface. Furthermore, the chatbot focuses on generating leads and strengthening existing clients’ loyalty.

Aerendir – Biometric Authentication

One of the most vital aspects of mobile banking is security. In the case of mobile phone theft and online fraud, the identity and funds from a user’s bank account are at risk. To address this issue, startups employ state-of-the-art biometric technologies, fingerprint scanners, and facial recognition modules. These strengthen account security and increase the reliability of mobile banking.

The US-based startup Aerendir develops a physiologic-based technology for authentication, identity protection, and bot identification in banking, finance, healthcare, and other sectors. The solution detects unique biometric specifics of human neural waves from micro-vibrational patterns in the user’s hands. To achieve that, it utilizes standard mobile phone sensors and does not require any additional hardware.

Goin – Money-Saving Applications

Money-saving applications employ smart budgeting and investment algorithms to help users achieve a reasonable distribution of their earnings. They also enable automatic transfer of some funds into a savings account, provide money-related tips, and offer personalized saving and investment options. They allow customers to create a savings plan, as well as assist in financial objectives monitoring and fulfillment.

Spanish startup Goin creates a financial management smartphone app for millennials. The platform gathers data on purchases to encourage users to save money, suggests automatic transfer and retention options, and hosts motivating lifestyle money-related challenges. Besides, it elaborates personalized investment strategies (e.g. cryptocurrencies, equity, or funds).

Solfeh – Loan Management

With increasing options for buying online and on credit, bank clients often need to be aware of overspending and loan repayment requirements. Debt management applications assist clients in tracking their liabilities, monitoring expenditures distribution, as well as handling loan repayment from their smartphones.

Jordan-based startup Solfeh develops a FinTech platform for salaried employees, focused on obtaining and managing same-day microloans online. This minimizes paperwork, calculates loan size, and provides flexible repayment options. Besides, the platform ensures financial data security and confidentiality.

soCash – Mobile ATM Withdrawal

Mobile ATM withdrawal enables banking clients to obtain cash without actually using one’s card or wallet, plus, it also avoids long queues. Startups across the world integrate QR codes and near-field communication (NFC) technologies into banking, financial, commerce, and other commercial settings to extend the list of possible withdrawal options and enhance customer experience.

Singapore-based startup soCash offers an ATM-free cash withdrawal service. The startup transforms shops and cafes into digital automatic telling machines. The user configures the required amount in the app, locates a potential withdrawal place (e.g. a nearby shop), scans the QR code, and conveniently collects the money.

What About The Other 380 Solutions?

While we believe data is key to creating insights it can be easy to be overwhelmed by it. Our ambition is to create a comprehensive overview and provide actionable innovation intelligence for your Proof of Concept (PoC), partnership, or investment targets. The 5 mobile banking startups showcased above are promising examples out of 385 we analyzed for this article. To identify the most relevant solutions based on your specific criteria and collaboration strategy, get in touch.