Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the FinTech industry. This time, you get to discover 5 hand-picked decentralized finance solutions.

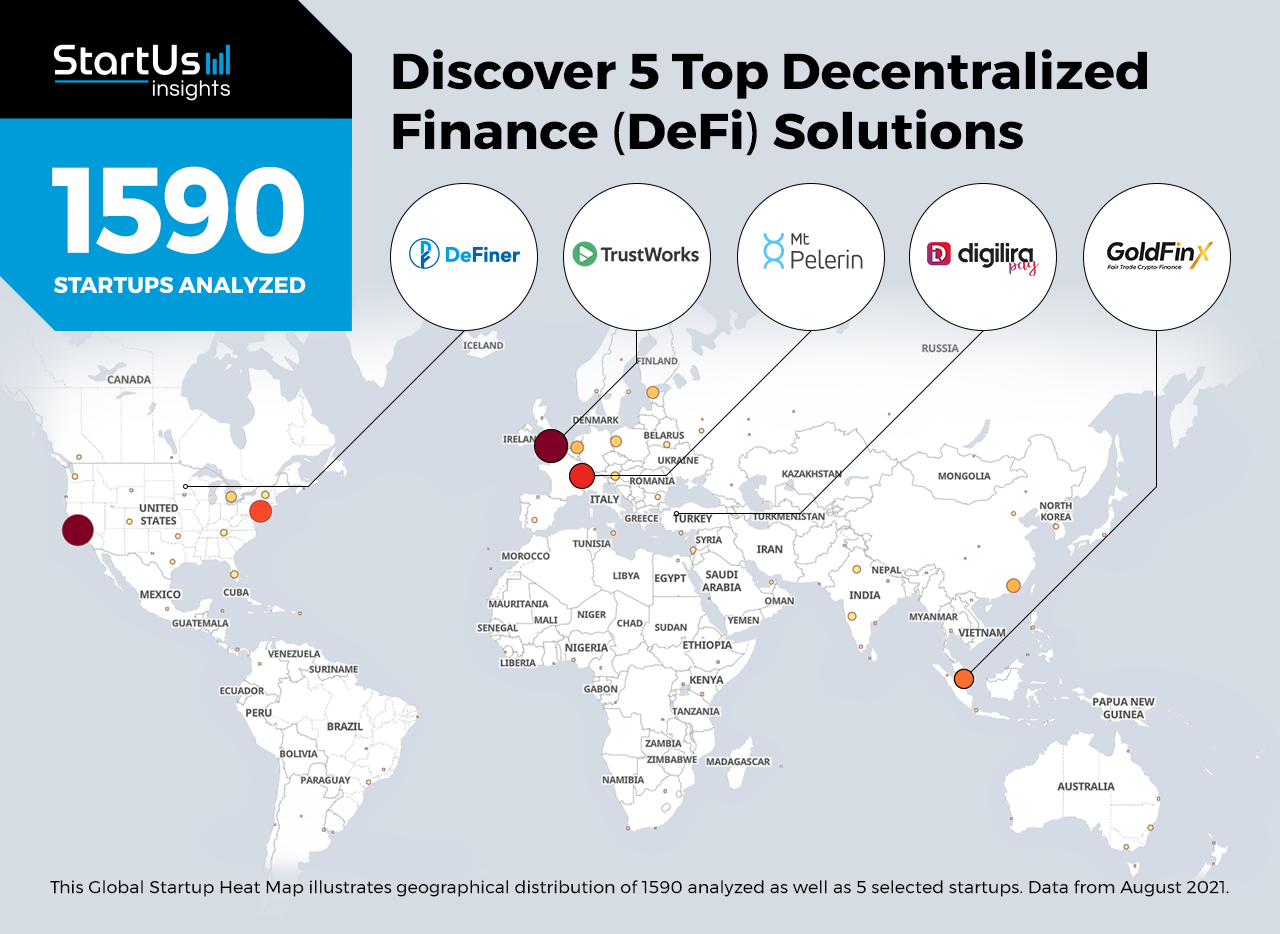

Global Startup Heat Map highlights 5 Top Decentralized Finance Solutions out of 1 590

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 1 590 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 1 585 decentralized finance solutions, get in touch.

DigiliraPAY offers a Blockchain Payment Gateway

Traditional financial models rely on centralized institutions such as banks or lending institutions. This makes transactions slow, inefficient, and often an unpleasant experience for both the sender and the receiver. Decentralized finance (DeFi) models move away from this paradigm by enabling permissionless transactions. Moreover, the use of blockchain technology ensures immutability and transparency in transactions.

Turkish startup DigiliraPAY develops a decentralized blockchain payment gateway. The startup’s app enables businesses to receive payments in cryptocurrencies and cash them out in fiat. It allows users to store cryptocurrencies, shop using them, as well as send them to friends without any commission. To make all transactions safe, it integrates smart contracts and smart token technologies.

DeFiner provides DeFi Lending

Traditional lending involves banks and institutions that usually act as centralized bodies. This makes the lending process susceptible to third-party interferences, insider jobs, and frauds. Moreover, the decisions of banks whether to provide loans or not to a customer are often opaque. DeFi lending solutions are transparent by design and address these problems in lending.

DeFiner is a US-based startup that builds a DeFi lending protocol. The startup’s permissionless solution allows users to lend, borrow, and stake any cryptocurrency without any limit. The users earn interest on the crypto assets they deposit, as well as are able to borrow against their deposits. The startup’s decentralized services are built on top of FIN, the startup’s Ethereum-based token, with all profits redistributed to the token holders.

Mt Pelerin offers Asset Tokenization

Due to the immutability, decentralization, and transparency of blockchain, more investors are turning to cryptocurrencies. However, there is a challenge of comparable decentralized models for individuals and institutions who invest in real-world assets. Asset tokenization allows startups to tokenize and trade real-world and digital assets on the blockchain. This is why FinTech startups offer tokenization solutions for all kinds of assets ranging from real estate and expensive paintings to securities.

Swiss startup Mt Pelerin develops an asset tokenization technology. Bridge Protocol, the startup’s free and open-source platform, brings digital securities to public blockchains. Its non-custodial framework manages the issuance, transfer, distribution, and compliance of these securities as digital assets. Moreover, the platform allows multi-asset compliance as well as delegating know your customer (KYC) or anti-money laundering (AML) compliance to different providers.

TrustWorks promotes Financial Inclusion

Many people, especially those from marginalized sections, are unbanked due to a lack of proper documents. Moreover, not all financial instruments, such as loans, are accessible to everyone. This is why FinTech startups are developing DeFi solutions to lower barriers to entry. Such solutions bring the convenience of banking to the unbanked population, as well as provide access to decentralized lending.

British startup TrustWorks brings the benefits of decentralized finance to the underbanked. Its solution uses stable coins and blockchain technology to deliver instant and scalable transactions. It is a self-custody solution, integratable with wallets or applications across smart and feature phones. This way, TrustWork’s solution enables humanitarian networks and mobile operators to provide fast and low-cost financial services.

GoldFinX enables Decentralized Microfinance

Many small and medium enterprises (SMEs), as well as unbanked individuals, take loans from informal lenders. These lenders often charge a much higher interest rate, effectively trapping customers in a debt cycle. Decentralized microfinance solutions provide loans at low-interest rates to SMEs. Moreover, such solutions allow anyone to become a lender and earn interest while helping local businesses flourish.

GoldFinX is a Singaporean startup that provides microfinance to artisanal small gold mines (AGSM). The startup’s token, GiX, is a socially responsible cryptocurrency solution that is traded on both centralized and decentralized exchanges. With its value secured by accumulating gold, it is a viable payment option for the mining community. Moreover, the startup provides microloans to AGSM while enabling them to adopt sustainable mining methods.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on smart contracts, peer-to-peer (P2P) payments, and asset tokenization. While all of these technologies play a major role in advancing financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.