Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial technology sector. This time, you get to discover 5 hand-picked peer-to-peer payment solutions.

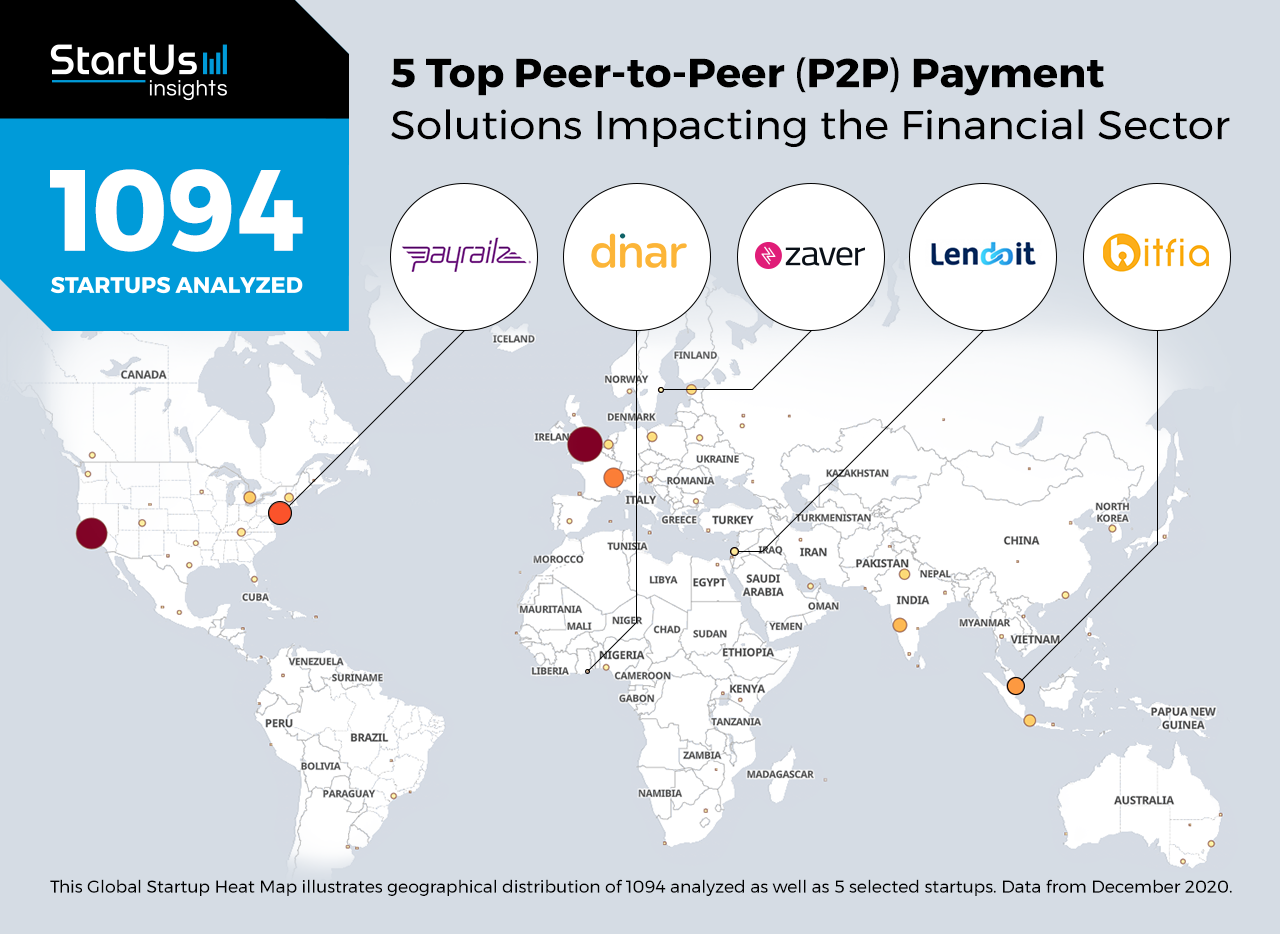

Global Startup Heat Map: 5 Top Peer-to-Peer Payment Solutions

The 5 FinTech startups you will explore below are chosen based on our data-driven startup scouting approach, taking into account factors such as location, founding year, and relevance of technology, among others. This analysis is based on the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering over 1.3 million startups & scaleups globally.

The Global Startup Heat Map below highlights the 5 P2P payment startups & scaleups our Innovation Researchers curated for this report. Moreover, you get insights into regions that observe a high startup activity and the global geographic distribution of the 1.094 companies we analyzed for this specific topic.

Zaver – P2P Payments Platform

Peer-to-peer payments allow users to send money to each other through a linked bank account or card. Unlike transactions through banks, P2P payments provide ease-of-use, convenience, and speed. P2P solutions are also secure with built-in encryption and fraud monitoring. FinTech startups offer a range of peer-to-peer payment solutions for individual and business customers.

Zaver is a Swedish startup developing P2P payment solutions. The startup’s platform enables businesses to receive payments through both online and offline channels. The app sends customers a payment link offering a range of payment methods. It works both online and in-store, allowing businesses to increase liquidity by getting paid instantly.

Lendoit – P2P Lending

P2P lending connects lenders with borrowers, without the need for financial institutions as intermediaries. By minimizing the overhead associated with banks, P2P transactions provide higher returns to lenders and lower rates to borrowers. By providing loans to unbanked individuals, P2P lending platforms further enable financial inclusion.

Israeli startup Lendoit develops a P2P lending platform. The platform combines smart contracts with principles for traditional lending to provide a seamless banking experience. It eliminates the need for intermediaries, allowing borrowers and lenders to transact directly with each other. The decentralized platform also allows lenders to remain completely anonymous throughout the process.

dnar – Mobile Banking

P2P apps are speeding up the global transition to mobile banking. P2P transactions allow users to instantly transfer money to mobile wallets or bank accounts. Startups, as well as larger financial institutions, offer a range of P2P banking solutions. Some of these solutions even allow mobile banking without internet connectivity.

dnar is a Ghanaian startup that brings together P2P transactions with mobile banking. The app allows users to pay via Unstructured Supplementary Service Data (USSD) or custom quick response (QR) codes. It facilitates transactions using both mobile money networks and digital currencies. dnar’s app also lets users invest in cryptocurrencies and digital currencies.

Bitfia – Crypto Wallet

The adoption of cryptocurrency is on the rise, with even traditional banks serving cryptocurrency customers. Crypto wallets secure cryptocurrencies and other digital assets using blockchain technology. Crypto wallets enable peer-to-peer transactions of cryptocurrencies, enabling their use just like fiat money.

Singaporean startup Bitfia offers a crypto wallet that also features a P2P marketplace. The PINT marketplace uses a blockchain-based escrow to ensure transparent and smooth transactions. PintPAY, the platform’s payment gateway, allows payments in both crypto and fiat at online and offline merchants. The startup’s app also features encrypted chat, private keys, and a multicurrency marketplace.

Payrailz – Bill Payment

P2P apps eliminate the need to carry cash for most purposes. Businesses accept P2P transactions by scannable codes or links sent via email or text. This takes the hassle out of bill payments, as well as allows for recurring payments. FinTech startups are innovating with a variety of custom, P2P bill payment solutions.

Payrailz is a US-based startup that provides advanced bill payment and money transfer solutions. SmartPay is an electronic bill presentation and payment platform that features conversational digital assistants and messaging bots. Pay A Person, the startup’s P2P solution allows both one-time and recurring digital payments between consumers. The startup also develops solutions for businesses and financial institutions.

Discover more FinTech startups

To keep you up-to-date on the latest technology and emerging solutions, we provide you with actionable innovation intelligence – quickly and exhaustively. You can download our free FinTech Industry Innovation Report and discover new business opportunities or save your time & let us look into your areas of interest. We provide you with an exhaustive overview of new startups, scaleups & emerging technologies that matter to you.