Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

If you’ve ever read a novel or watched a movie, you have surely seen the hero’s journey in motion. First, there’s a promising start, then there are challenges that push the hero to stand up to them, and the cycle goes on a few times before an often satisfactory end. This is the story of many popular technologies as well. Emerging technologies promise many things and generate a lot of hype – but some of them don’t live up to it. That’s why assessing innovation hype cycles is a challenge for innovation managers when deciding whether to invest in technology trends or not.

The Challenge of Technology Investments

Technology bubbles occur when a large number of companies invest in new technologies because they fear being left behind. For instance, the dot-com crash was preceded by over-optimistic projections of internet user growth. But in the two decades since the crash, internet penetration has exceeded those projections. However, companies that entered the market at the wrong time (at the peak of the hype) were badly burnt, many of them being pushed out of existence.

Are you investing in emerging technology trends? How do you know they will provide your company with long-lasting value? Short answer: technology feasibility assessment.

While startups are a major driver of innovation, hypes make it difficult to separate the truly innovative ones from the rest. Innovation intelligence enables you to innovate through hype cycles.

Separating Fact from Fiction

While the industry moves incrementally most of the time, it is disruptive innovations that push the industry to the next level of growth. As legacy companies move slow, they increasingly rely on external innovation from startups for ideation and product development. But there lies the catch — every startup says their technology is disruptive. Being able to not get caught in the hype cycle prevents expensive innovation decisions and delivers a competitive advantage in the long run.

For instance, take a startup that claims that their deep learning algorithms predict the onset of mental health illnesses with high precision or another one that suggests that their CRISPR technology will make gene therapy affordable. For a more recent example, think of Web3 startups claiming to decentralize and democratize everything under the sun? How do you weigh their claims? More importantly, if you feel the technology is still too early, how do you wait when everyone around you is investing in deep learning, CRISPR, or Web3 right now?

Technology feasibility assessment allows companies to make more informed decisions in situations like these. It is an innovation intelligence service offering that places emerging technology trends in the context of startups building them, competing technologies, their potential marketability, and their value propositions.

Investing in a Technology when Others Are Fearful

Conversely, there are technologies that are not often in the news but hold a lot of promise. On investing, Warren Buffet famously said that one should be fearful when everyone is greedy and greedy when everyone is fearful. This applies to companies investing in technologies as well. When the industry is dismissive of a particular technology at large, companies with strong innovation culture find unique ways to incorporate it into their products or processes.

By analyzing the technology landscape, innovation intelligence reveals hidden gems that your company should be interested in. These are innovations that are past the hype cycles but with commercial potential or those that are yet to go through the hype cycle but will have an outsized impact on your industry.

4 Questions that Technology Feasibility Assessment answers

Technology feasibility assessment allows you to answer these questions:

1. Is Technology or Marketing Driving the Hype?

The Internet loves viral marketing campaigns. Previously mainly a domain of B2C companies, even B2B companies now run marketing campaigns across channels. With startups featured in the news more than ever before, it is common for investors and innovation managers to have a fear of missing out (FOMO). Innovation intelligence allows companies to assess the startup’s technologies more critically. Combining firmographic data with technology news and patent databases separates technology-driven hype from marketing-driven hype.

2. How Long will the Hype Last?

If a large company seeks to acquire startups to further its innovation in a hyped area, it will find that the startup valuations are very high. While companies cannot afford to wait forever, holding out for a little longer often gets a better deal when the technology has matured and the hype is gone. Does your assessment tell you that a particular technology has long-term potential but is hyped at the moment?

If the answer is yes, trend intelligence can help you time the market. By continuously monitoring your industry for emerging trends, it provides you a snapshot of the competing trends in your industry, how they compete with each other, as well as their compatibility with your systems. More importantly, because innovation intelligence companies monitor your industry even before you reached out to them, they know how technology trends in your industry pan out over the years. For instance, the StartUs Insights Discovery Platform leverages trend intelligence to offer actionable insights that improve decision-making.

3. Can the Technology be Repurposed?

Alright, you buy the hype, but the technology doesn’t meet its promise over the next 5 years. What is the worst-case scenario? When you leverage technology feasibility assessment, you could still improve your processes or existing products. Innovation intelligence tools analyze the potential impact on the bottom line of a company as well. This means that they do not just estimate its long-term, disruptive potential but short-term, incremental benefits too. As a result, a company can repurpose a technology to address other needs than originally intended.

4. Is it Cheaper to Build this Technology Internally or Externally?

You decide that you will be investing in a particular technology, either now or at some point in the future. The next question is whether you should build the necessary capability (by hiring or upskilling) or externally (by acquiring startups with the know-how). For instance, as traditional car manufacturers transition to electric vehicles (EVs), should their internal teams make these cars, or is it more economical to partner with EV startups? Technology feasibility assessment allows you to resolve this conundrum as well.

It evaluates the costs of acquiring or partnering with a startup and its potential impact on the top line and bottom line. Beyond a threshold, it’s usually cheaper to acquire or partner with startups than to build the required technology stack in-house. More often, it takes far less time as well.

Leverage Data-Driven Innovation Intelligence

Businesses are always looking out for threats and opportunities that will impact their industry. As hype cycles become more common across technology verticals, separating hype from reality is critical to your innovation strategy. By analyzing hundreds of millions of data points, innovation intelligence empowers you to make informed decisions. The StartUs Insights Discovery Platform takes a systemic data-driven approach to find trends that are most likely to impact your industry and are most relevant to your needs.

Depending on your innovation goals and requirements, we at StartUs Insights customize the deliverables of our innovation intelligence services. These deliverables include:

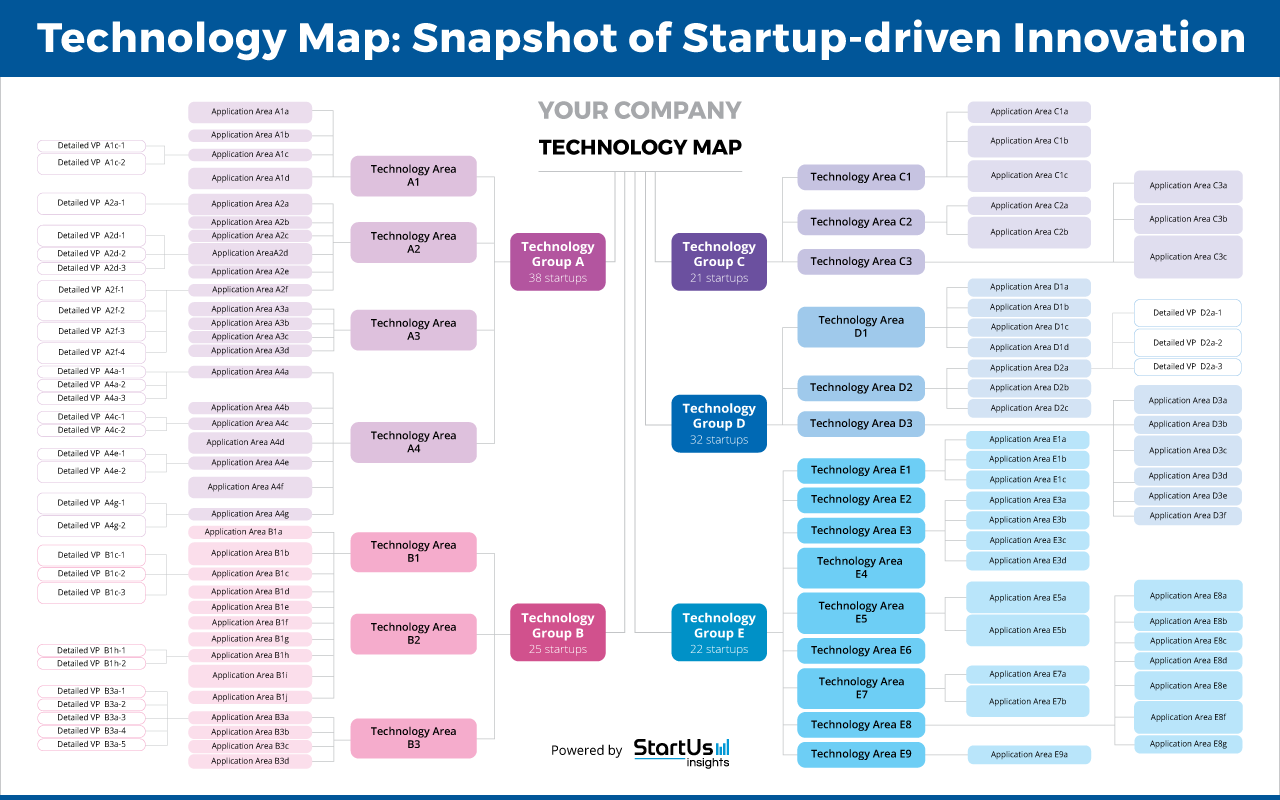

- Trend Analysis Map: Based on data-driven research, we classify emergent trends and group them into categories so you discover them at one glance.

- Trend Analysis Report: This report provides quantitative insights into top relevant trends as well as exemplary startups.

- Exemplary Startups Database: Gives you a list of relevant, innovative startups that are advancing emerging technologies in your industry.

To explore how you can drive innovation through hype cycles in a dynamic market, we offer a free consultation. If you want to quickly find and track industry trends that will shape your industry, get in touch today!

![Business Resilience Planning: 10 Strategies & Technologies to Tackle the Current Market [2025-2026]](https://www.startus-insights.com/wp-content/uploads/2025/06/Business-Resilience-Planning-SharedImg-StartUs-Insights-noresize-420x236.webp)

![10 Biggest Business Trends: What to Invest in, Build, and Watch Closely [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/06/Business-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)