Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Executive Summary: Industrial IoT Market Report 2025

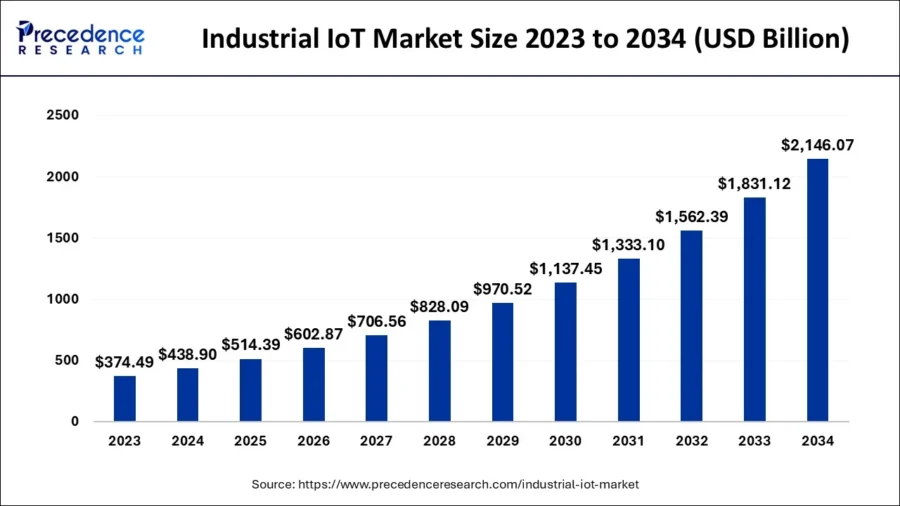

- Industry Growth: The global industrial IoT market size was estimated at USD 438.90 billion in 2024 and is anticipated to reach around USD 2146.07 billion by 2034, expanding at a compound annual growth rate of 17.20% from 2024 to 2034. On a micro level, there is a – 0.22% yearly growth rate as per the Discovery Platform’s latest data.

- Manpower & Employment: There are more than 1.2 million workers in the IIoT industry globally, which has grown by 64 900 during the last 12 months.

- Patents & Grants: 12 200+ applicants have submitted 80 800+ patents in the IIoT sector. Additionally, more than 1290+ grants have been awarded, which highlights continuous research and development initiatives.

- Global Footprint: The United States, India, Italy, Germany, and China are the top industrial IoT hubs. The top cities pioneering the innovations in IIoT domain are Bangalore, Pune, Chennai, Singapore, and Shenzhen.

- Investment Landscape: Throughout 5300+ fundraising rounds, IIoT firms have raised an average of USD 20.9 million each round. These funds secured more than 1380 startups.

- Top Investors: Leading investors include Rockwell Automation, Bosch Capital, Parametric Technology, and more which funded the IIoT sector with a total of USD 4.97 billion.

- Startup Ecosystem: Innovative startups like Koeebox (5G-based IIoT for remote equipment monitoring), Knowix (real-time data for rope and cable systems), Dalnex (factory and shop floor automation), Subsoil Technologies (networking and WiFi infrastructure), Adaptive Systems (IIoT ecosystem for companies) fuel the sector’s development.

Methodology: How We Created This Industry IoT Market Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of industrial IoT over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within industrial IoT

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the industrial IoT market.

What Data is Used to Create This Industrial IoT Market Report?

Based on the data provided by our Discovery Platform, we observe that the IIoT industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage and Publications: The news organizations and trade journals published 2900+ articles about asset management in the last 12 months.

- Funding Rounds: Our database records 5300+ funding rounds in the IIoT sector.

- Manpower: Currently, the IIoT market supports 1.2 million manpower out of which 64 900+ employees joined last year.

- Patents: 80 800+ patents in the IIoT sector indicate a significant emphasis on technology development and intellectual property protection.

- Grants: The industry records 1200+ grants, which indicates support from financing organizations for further development and innovations.

- Yearly Global Search: Over the past year, there has been a 61.48% growth in global search interest in the IIoT domain.

Explore the Data-driven Industrial IoT Market Report for 2025

As per the Precedence Research report, the global industrial IoT market size was estimated at USD 438.90 billion in 2024 and is anticipated to reach around USD 2146.07 billion by 2034, expanding at a compound annual growth rate of 17.20% from 2024 to 2034.

The global IIoT market was valued at approximately USD 194.4 billion in 2024 and is projected to reach USD 286.3 billion by 2029, growing at a compound annual growth rate of 8.1%.

The IIoT Market Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

Out of 20 700+ businesses in our database, there are 550 startups, which shows a growing landscape for innovations.

With over 80 800+ patents and 1290+ grants submitted last year, the IIoT market promises a future of more application advancements. However, the sector witnessed a growth rate of -0.22% in the last year.

Credit: Precedence Research

It currently employs around 1.2 million people worldwide and added more than 64 900 employees in the last year.

In terms of country-level activity, the USA, India, Italy, Germany, and China are in the lead. Bangalore, Pune, Chennai, Singapore, and Shenzhen are among the leading cities at the forefront of innovation in IIoT.

In the USA, the IIoT market is expected to be worth USD 135.6 billion in 2025, with projections indicating growth to USD 568.9 billion by 2033, reflecting a compound annual growth rate of 17.1%.

A Snapshot of the Global Industrial IoT Market

Although the annual growth rate of the IIoT market is -0.22%, there are 550 startups actively contributing to the industry’s growth and innovation.

Additionally, there are 650 startups in the early stages and 680 mergers and acquisitions occurring in the sector. More than 12 200 applicants filed 80 000+ patents, which signals towards a promising future.

Moreover, the sector records an annual growth rate of 4.72% in patents. The top issuers of patents include China, with 32 000+ patents, followed by the USA, with 16 900+ patents.

Explore the Funding Landscape of the Industrial IoT Market

The IIoT sector receives an average of USD 20.9 million per investment round. More than 3 800 investors from different specialties invest in startups, which support 1 300+ businesses.

Moreover, 5300 successful funding rounds indicate growing support towards emerging startups and scaleups.

Who is Investing in the Industrial IoT Market?

With a combined investment of over USD 4.97 billion, the leading investors in the industrial IoT space have shown strong financial support for the sector’s expansion and innovation.

- Rockwell Automation has invested USD 333.3 million across 3 companies.

- Bosch Capital contributed USD 333.3 million to at least 1 company.

- Parametric Technology has made USD 333.3 million investments in at least 1 organization. PTC made a corporate minority investment in Eight Sleep, a company specializing in smart sleep technology.

- Morgan Stanley invested USD 291.9 million in 2 businesses. Morgan Stanley’s alternative investment division raised USD 750 million for its 1GT growth fund to support businesses in reducing carbon emissions.

- Deutsche Bank supported at least 1 business with USD 291.7 million. Deutsche Bank infused approximately USD 607.50 million into its Indian operations to support growth plans.

- IDG Capital invested USD 278.8 million in 4 businesses. IDG Capital led a USD 17 million seed funding round for ChainOpera AI to build a blockchain network for AI agents and applications.

- General Catalyst spent USD 249.5 million across 3 businesses. General Catalyst invested USD 120 million into Re:Build Manufacturing, a startup focused on revitalizing the USA’s manufacturing capabilities.

- NEO Performance contributed USD 239.2 million to at least 1 business. The company agreed to sell its majority equity interest in China-based rare earth separation assets for USD 30 million.

Top IIoT Innovations & Trends

Explore the emerging trends in the IIoT industry along with their firmographic report:

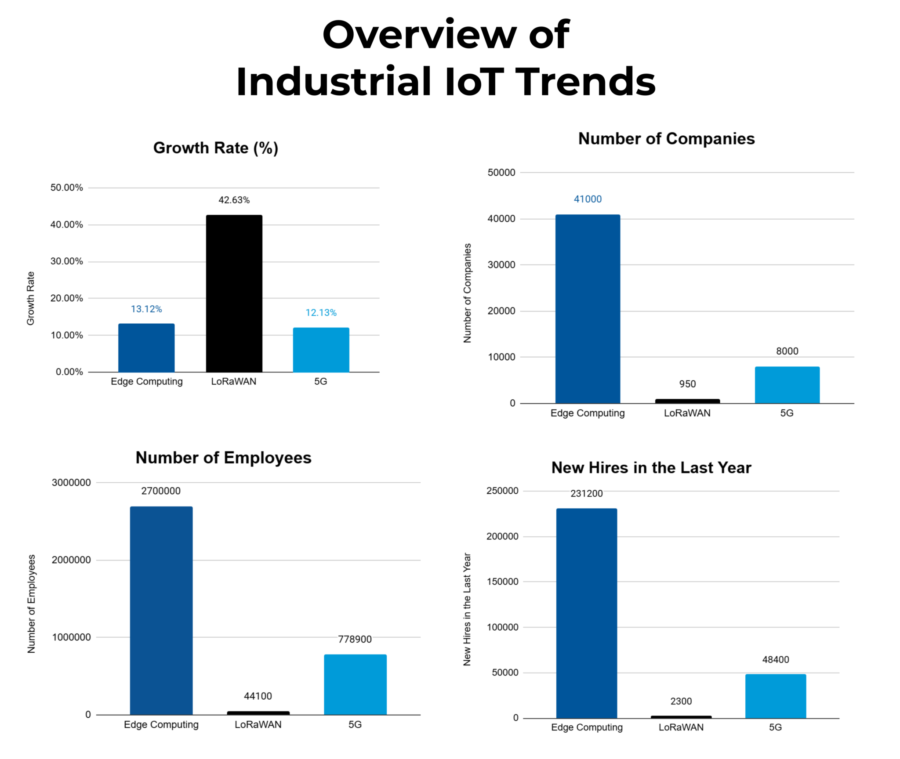

- With 41 000+ businesses, Edge Computing is a major trend in the IIoT domain. The annual growth of the trend is 13.12%. Currently, there are 2.7 million employees and 231 200+ were hired last year in this sector. Edge computing streamlines the data collection by industrial IoT sensors by bringing edge devices close to on-premise sensors.

- LoRaWAN trend has over 950 companies and records an annual growth rate of 42.63%. The domain supports 44 100+ employees out of which 2300+ were hired last year. With LoRaWAN connectivity, IIoT devices communicate with sensors, equipment, and machinery present in long-range, without using a significant amount of power.

- 5G development is essential for the IIoT domain. This sector shows a steady annual growth rate of 12.13%. There are more than 8000 companies in this domain which employ over 778 900+ employees. Additionally, the sector employed more than 48 400+ employees last year. 5G ensures faster data speed, higher bandwidth, low latency, and massive device connectivity for IIoT domain.

Further, IIoT applications are increasingly used to monitor and optimize energy usage, reduce waste, and track environmental impact in real time.

Adelaide-based nanosatellite company Myriota secured a USD 50 million investment to enhance its IoT technology and expand globally.

5 Top Examples from 500+ Innovative IIoT Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Koeebox builds a 5G-based IIoT for Remote Equipment Monitoring

Ukrainian startup Koeebox develops a 5G-based IIoT-powered hardware solution for remotely monitoring equipment in real-time.

The hardware solution consists of a sensor that attaches to the power cable for power measurement. The sensor identifies high overall equipment effectiveness (OEE) and low OEE and sends instant notifications for precise maintenance.

It further identifies weak points in production, prioritizes job orders for the workers, automates data collection, and reduces human errors.

It also classifies downtime, understands work modes, tracks operating time, and displays the current status of the equipment. The hardware solution connects to any equipment and is operated through mobile connection and smartphone support.

Manufacturers use the solution to ensure the long lifecycle of their equipment and simplify maintenance operations.

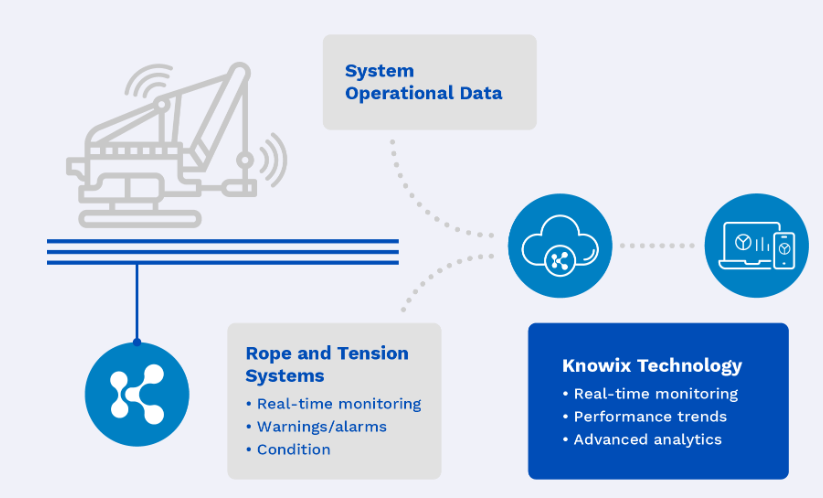

Knowix offers Real-Time Data for Rope and Cable Systems

US-based startup Knowix builds proprietary software and uses patented technology to collect in-use data for rope and cable systems.

The patented technology monitors the location, performance, and condition of the infrastructure. The details are available on the data dashboard, which is accessed from desktop and mobile devices.

Using the data, the user device maintenance plans, condition-based inspections, inventory management, end-of-life disposal, and more.

The data is also useful for approving design plans, creating a digital twin system, and planning a long-term performance plan.

Mission-critical industries like mining, oil and gas, lifting and construction, maritime, and offshore energy use the solutions to improve safety measures, reduce operational costs, and ensure system-wide improvements.

Dalnex automates Factory and Shop Floor

Indian startup Dalnex offers an IIoT-based platform FactOS for digital factory management. It provides real-time visibility into factor and shop floor activities. The platform comes with paper digitization modules and machine digitization modules.

It has different dashboards for different stakeholders like the CEO, production head, machine operator, and business head. FactOS features a real-time dashboard, one-click real-time reports, web/mobile-based applications, low capex, customization, and more.

The platform uses data from the EdgeGateway, an IIoT gateway to manage sensors, controllers, and actuators. It also connects to different server endpoints, databases, and supervisory control and data acquisition (SCADA) systems.

Dalnex also develops EdgeConnect, a software gateway for integrating information technology (IT)-operational technology (OT) infrastructure.

The plastic industry, automobile industry, heavy engineering, consumer electronics, oil gas, and OEM industry use the platform for machinery maintenance, automated alerts, and monitoring production in real time.

Subsoil Technologies builds Networking and WiFi Infrastructure

Subsoil Technologies, based in South Africa, develops N-Connex, a networking and Wi-Fi infrastructure that ensures efficient communication in harsh environments.

The N-Connex distribution module forms the core component, which uses a gigabit Ethernet network to optimize network performance, simplify maintenance, and secure network safety.

The module comes with eight managed power over Ethernet (PoE) ports, two non-PoE ports, and four single-mode fiber ports.

Its other product, N-Connex Edge Module, provides local networking access using PoE and cat6 cables .

Subsoil Technologies also builds a power module and a battery to provide backup power to the distribution module. The N-Connex Bolt, a high-power access point provides WI-Fi connectivity to the network.

Lastly, the company provides a control I/O module for controlling various connections and an alarm module for emergency warnings.

Adaptive Systems designs IIoT Ecosystem for Companies

Dutch startup Adaptive Systems builds IIoT products to provide digital transformations to different industries.

The products feature a human-centered design and use artificial intelligence to consolidate data collected by devices and sensors.

The Smart Vision uses video sensors for inspections. The Smart Logging tracks service quality.

The startup also provides a Smart Display for users to interact with the surroundings and a Smart Trace to monitor incoming and outgoing people in the facility.

Additionally, it uses end-to-end encryption and secure data centers to secure the data collected by the products.

Different organizations use these products to detect trends, improve operating conditions of buildings, anticipate critical situations, and increase the well-being of the occupants.

Gain Comprehensive Insights into Industrial IoT Market Trends, Startups, or Technologies

The industrial IoT market report conveys that the rising requirements for connectivity in developing industries like mining, shipping, oil and gas, etc. are accelerating IIoT development. The major trends influencing the development of the industry are edge computing, LoRaWAN, and 5G. The global interest and diversified investment further support the innovations in the industry. The future of IIoT sector is set to witness sustainable applications and more inclusive applications in a variety of industries.

Get in touch to explore all 500+ startups and scaleups, as well as all industry trends impacting IIoT companies.