Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Thousands of new startups are founded every year – emerging companies with the potential to disrupt the financial services industry. To give you a head-start on emerging technologies and startups that will impact the FinTech sector in 2022, we analyzed a total of 1 075 global RegTech startups & scaleups. Meet 5 of the most promising startups to watch!

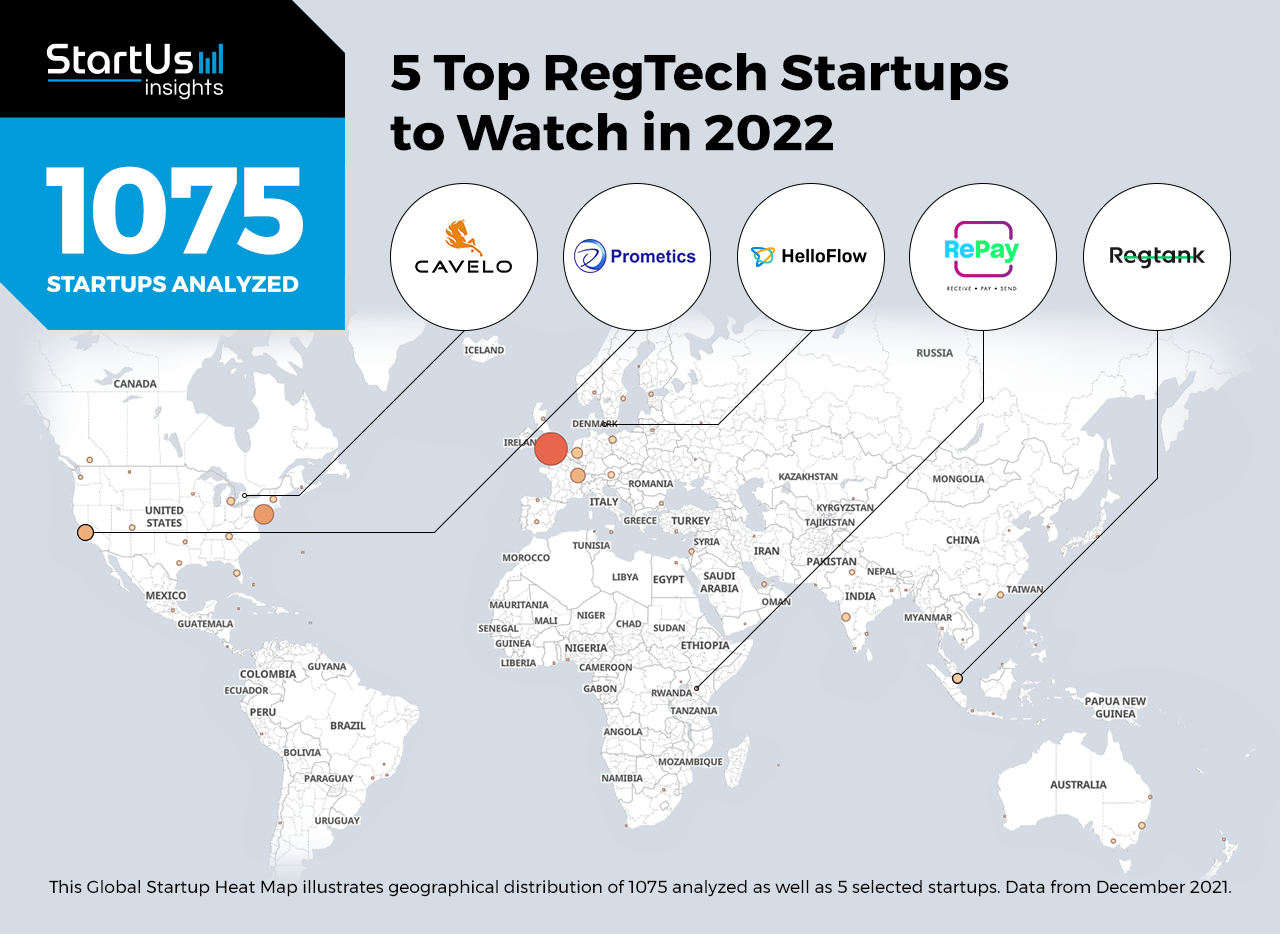

Global Startup Heat Map highlights 5 RegTech Startups to Watch in 2022

Out of 1 075, the 5 RegTech startups to watch are chosen through the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering over 2 093 000+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant startups, emerging technologies & future industry trends quickly & exhaustively.

The Global Startup Heat Map below highlights the 5 RegTech startups you should watch in 2022 as well as the geo-distribution of the other 1 070 startups & scaleups we analyzed for this research. We hand-picked the 5 highlighted RegTech startups based on our data-driven startup scouting approach, taking into account factors such as location, founding year, the relevance of technology, and funding, among others.

Prometics provides Automated Lending Analytics

Founding Year: 2021

Founding Year: 2021

Location: Palo Alto, US

Partner for: Credit Fraud Detection

US-based startup Prometics offers an automated lending analytics solution. The startup’s Lending Strategy System uses artificial intelligence to clean and classify structured and unstructured data for regulatory compliance. This provides insights across all lending asset classes and throughout the lending life cycle, starting from product and credit fraud detection to account management. The startup’s solution allows banks, FinTechs, and credit unions to test different lending strategies as well as be more inclusive in their lending practices.

RePay Africa enables Commission-free Remittances

Founding Year: 2020

Founding Year: 2020

Location: Nairobi, Kenya

Funding: USD 10 000

Partner for: Cross-Border Payments

RePay Africa is a Kenyan startup that develops an application programming interface (API) platform for remittances and cross-border payments. It enables commission-free money transfers across Africa through a network of agents. The agents also assist users with a lack of knowledge or access to mobile wallets to load cash into their wallets. For merchants, it combines payments, analytics, and user management in a single solution. By lowering the regulatory obstacles in sending money across Africa, the startup brings banking to underserved populations.

Regtank Technology facilitates Crypto Compliance

Founding Year: 2020

Founding Year: 2020

Location: Singapore

Funding: USD 2 M

Partner for: Anti-Money Laundering (AML)

Regtank Technology is a Singaporean startup that provides a regulatory compliance solution. Many businesses are still hesitant in receiving payments or paying vendors in cryptocurrency, largely due to the risk of illegal activities in the crypto market. By combining advanced risk algorithms and a crypto address database, Regtank Technology’s solution manages risk exposure. It screens high-risk patterns as well as facilitates suspicious activity reporting (SAR). Moreover, Regtank’s solution also enables AML and know-your-customer (KYC) screening and regulatory reporting.

HelloFlow offers Digital Onboarding

Founding Year: 2020

Founding Year: 2020

Location: Copenhagen, Denmark

Funding: USD 1,6 M

Partner for: Customer Verification

Danish startup HelloFlow builds a no-code digital onboarding platform for FinTechs, law firms, and online marketplaces, among other businesses. With a range of services moving online, businesses find it challenging to thoroughly vet all customers to stay compliant with local and international rules. HelloFlow’s solution combines customer onboarding with AML/KYC compliance to speed up the verification. For investment platforms, this provides the flexibility of exploring users in new markets without being burdened by local compliance requirements.

Cavelo simplifies Compliance Reporting

Founding Year: 2020

Founding Year: 2020

Location: Kitchener, Canada

Funding: USD 1,3 M

Partner for: Automated Data Discovery & Reporting

Canadian startup Cavelo develops a compliance reporting platform. Manual data tracking is not only time-consuming and expensive but risks exposing sensitive data. Cavelo’s platform, on the contrary, uses machine learning (ML) to scan through large amounts of metadata, reveal sensitive data, and reduce false positives. It also cleans and classifies data before reporting while protecting the data privacy of its users. By simplifying data discovery and reporting definitions across local, global, or industry-specific regulations, Cavelo’s solution ensures comprehensive regulatory compliance.

Discover All Emerging FinTech Startups

The FinTech startups showcased in this report are only a small sample of all startups we identified through our data-driven startup scouting approach. Download our free FinTech Innovation Report for a broad overview of the industry or get in touch for quick & exhaustive research on the latest technologies and emerging solutions that will impact your company in 2022!