Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked FinTech startups offering customer verification solutions.

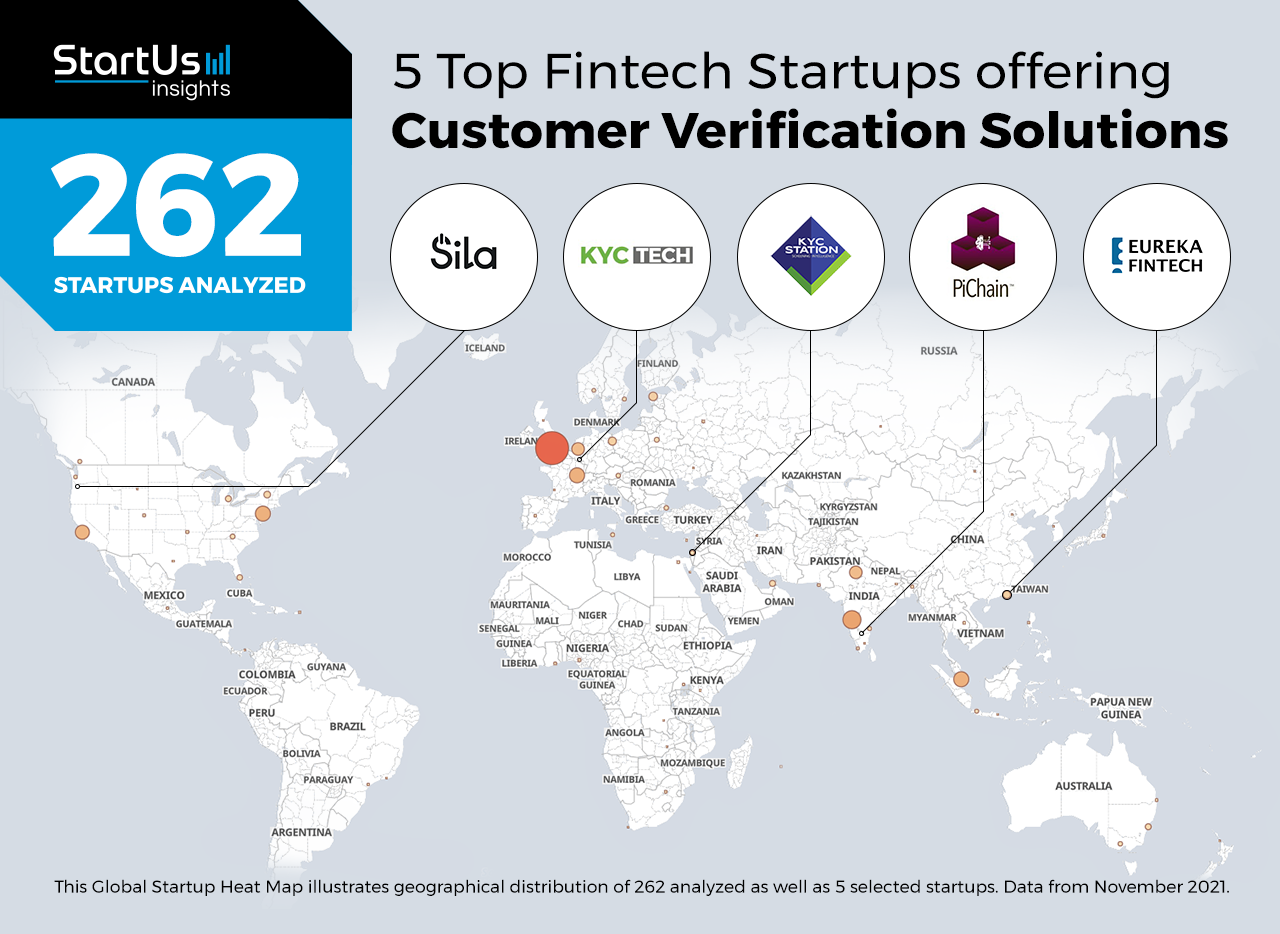

Out of 262, the Global Startup Heat Map highlights 5 Top FinTech Startups offering Customer Verification Solutions

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 262 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 fintech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 257 customer verification solutions developed by fintech startups, get in touch.

KYC Station offers Know Your Customer (KYC) Optimization

Founding Year: 2017

Location: Tel Aviv, Israel

Partner for: KYC Screening, Auditing

KYC Station is an Israeli startup that provides KYC optimization. The startup’s solution, Lynx, standardizes the open-web and deep-web information screening and empowers the staff to quickly generate high-quality reports. It leverages proprietary analytical engines with natural language processing (NLP) to present KYC-related information within minutes. The startup’s solution improves compliance verification processes and policy enforcement for banks and non-banking financial companies (NBFCs).

Sila provides Banking and Payments Application Programming Interfaces (APIs)

Founding Year: 2018

Location: Portland, US

Partner for: Digital Wallets, Direct Payments Automation

Sila is a US-based startup that develops a suite of payments and financial technology APIs in a single regulatory-compliant solution. The startup offers complete payments, KYC, and digital wallet solutions for developers to speed up FinTech application and product development, also making them safer and cost-effective. The KYC API reduces compliance costs and increases the speed to market as well as comes with a built-in compliance-as-a-service feature.

Eureka Fintech enables Anti-money Laundering (AML)

Founding Year: 2019

Location: Hong Kong

Partner for: Financial Risk Assessment

Hong Kong-based startup Eureka FinTech provides AML, KYC, and compliance solutions. The startup’s comprehensive financial service platform integrates private data, vendor databases, and banks’ internal data by utilizing big data and AI. The user-friendly platform provides users with easily accessible and comprehensive information. This allows manufacturers and financial institutions to detect potential supply chain risks and fraudulent activities.

PiChain develops a Compliance Management System

Founding Year: 2018

Location: Bangalore, India

Partner for: Know Your Business (KYB), Transaction Monitoring

PiChain is an Indian startup that offers an automated compliance management system. It uses AI and blockchain, along with deep domain expertise, to ensure sustainable compliance management. This allows compliance and regulatory professionals to make better decisions by significantly reducing false positives. The startup also provides AML compliance, digital KYC, and customer onboarding solutions.

KYC Technologies builds a Real-time Scanning Platform

Founding Year: 2016

Location: Bertrange, Luxembourg

Partner for: Anti-Money Laundering, Counter-Terrorist Financing

Luxembourg-based startup KYC Technologies develops a real-time scanning platform. The startup serves banks and financial institutions to implement know your customer, anti-money laundering, and counter-terrorism financing. It uses real-time scanning of people and entities to validate their identity and assess the risk of potential customers. This prevents losses resulting from frauds or illegal transactions.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on open finance, AML, and customer intelligence solutions. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.