Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked startups advancing open finance.

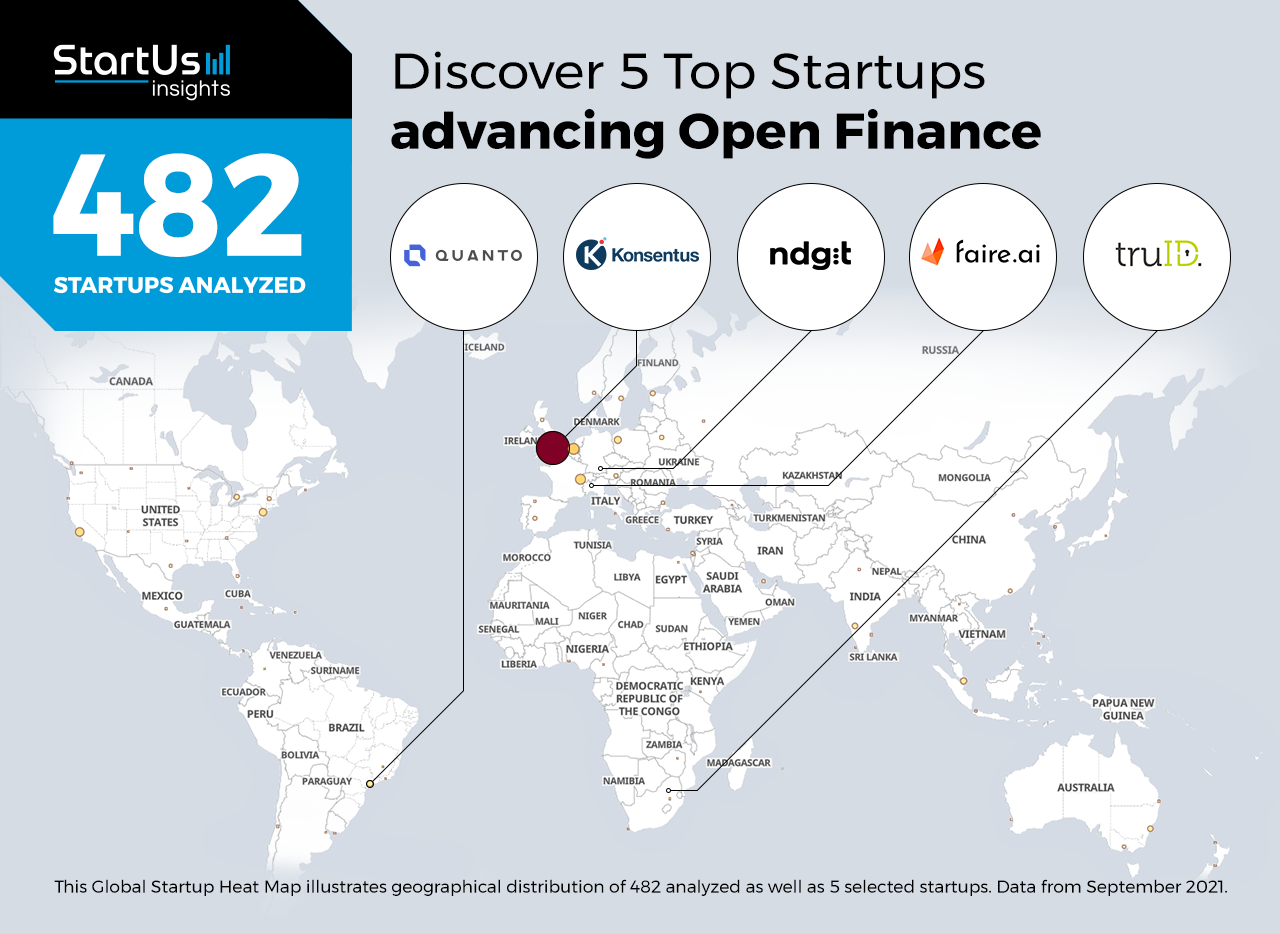

Global Startup Heat Map highlights 5 Top Startups advancing Open Finance out of 482

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 482 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 477 open finance solutions, get in touch.

ndgit develops End-to-End Open Finance Tools

Traditional banking services maintain restricted access to customers’ financial data for both customers and third-party providers (TPPs) that are essential in creating financial products and services. Due to this, governments now regulate open banking services that enable data sharing and collaboration with FinTech companies. This further facilitates the transition to a secure open finance ecosystem that provides greater transparency and convenience for availing investments, lending, and mortgages.

ndgit is a German startup that offers an open finance Software-as-a-Service (SaaS) platform. The application programming interface (API) management platform combines tools for identity management, microservice, security, and analytics. The platform functions as a middleware for financial services to enable fast and secure rollouts, thereby, enabling efficient collaboration with banks for financial and insurance companies. ndgit leverages its open finance platform to offer banking-as-a-service, ecosystem banking, digital lending, and wealth management.

Konsentus enables TPP Verification

Conventional banking provides minimal transparency and flexibility to monitor financial transactions and activities. At the same time, advancements in online banking offer real-time cash flow details to customers. However, FinTech companies and third-party providers need full access to customers’ financial data to further enhance their services. This is why startups develop open finance tools that offer end-to-end visibility into customer activities. In addition, authorities devise regulations to standardize this process and ensure the safety of sensitive information, Payment Services Directive 2 (PSD2), for example.

UK-based startup Konsentus develops Konsentus Verify, a SaaS platform for third-party verification. The startup identifies TPPs using electronic IDentification, Authentication, and trust Services (eIDAS) certificates. If there are any data inconsistencies, it reports suspicious activity to issuers. Additionally, Konsentus Verify checks the regulatory compliance of the TPPs with the National Competent Authorities (NCAs) data. Thus, it allows financial institutions, API aggregators, and technology service providers to ensure the safety of their customer information.

faire.ai advances Credit Automation

Traditional credit scoring systems are static and this approach denies loans to borrowers with a weak or nonexistent credit history. Open finance facilitates data sharing between banks and service providers, especially non-banking financial companies (NBFCs). They use data analytics and machine learning (ML) to develop an alternative credit scoring system that utilizes the overall financial activities of customers to predict their credit scores, increasing the customer base.

faire.ai is an Italian startup that provides AI-based credit automation for banks and financial institutions. The startup uses open banking to retrieve customers’ data and transaction history as well as applies artificial intelligence to predict their spending behavior. This allows faire.ai to offer retail credit score-as-a-service, analyze cash flow, and quantify loan eligibility. It further provides a loan management system that enables instant credit approval and disbursement.

truID provides Open Finance Integration

Traditional banking lacks the ability to personalize its financial products and services for customer requirements, mainly because of the conventional credit scoring system. On the contrary, open finance offers extended visibility into customer activities, allowing retailers and TPPs to personalize their products and services. This forces major issuers to streamline their services to offer their customers more financial freedom.

truID is a South African startup that enables end-to-end open finance integration for financial applications. The startup attains compliance and customer consent to connect the banks and customers. It then collects customer information and generates beneficial insights with data analytics to improve customer experience and net profit. truID’s solution enables credit providers, retailers, insurers, and banks to speed up their application’s time to market while ensuring compliance and security.

Quanto develops an Open Finance Platform

Traditional third-party lenders manually audit customer finance to assess their credit eligibility, which is time-intensive and error-prone. Open finance forms a network of banks and third parties that grants transparency into financial activities for both customers and lenders. As a result, it facilitates the centralization of financial services, including loans, transfers, and financing. That is why FinTech startups provide open finance APIs for retail and other third-party service providers.

Brazilian startup Quanto develops Quanto Link, an open finance platform. Quanto Link connects customer bank accounts to third-party apps to simplify user onboarding and know-your-customer (KYC). Besides, it evaluates credit card consumption profiles and credit overdrafts along with income and expense analysis. This enables recurring and standardized access to users’ financial information, thereby, improving credit analysis.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on open banking, open finance, artificial intelligence as well as alternative credit systems. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.