The rise of the cashless economy brings a myriad of innovations and applications, transforming the way people conduct financial transactions. With the advent of mobile payment platforms and digital wallets, individuals make payments using their smartphones, eliminating the need for physical cash. This increases convenience, efficiency, and security in everyday transactions. Further, cashless economies pave the way for contactless payments, biometric authentication, and blockchain-based transactions, enhancing the overall user experience and security. Additionally, the cashless economy facilitates financial inclusion by providing access to banking services for the unbanked population, fostering economic growth globally.

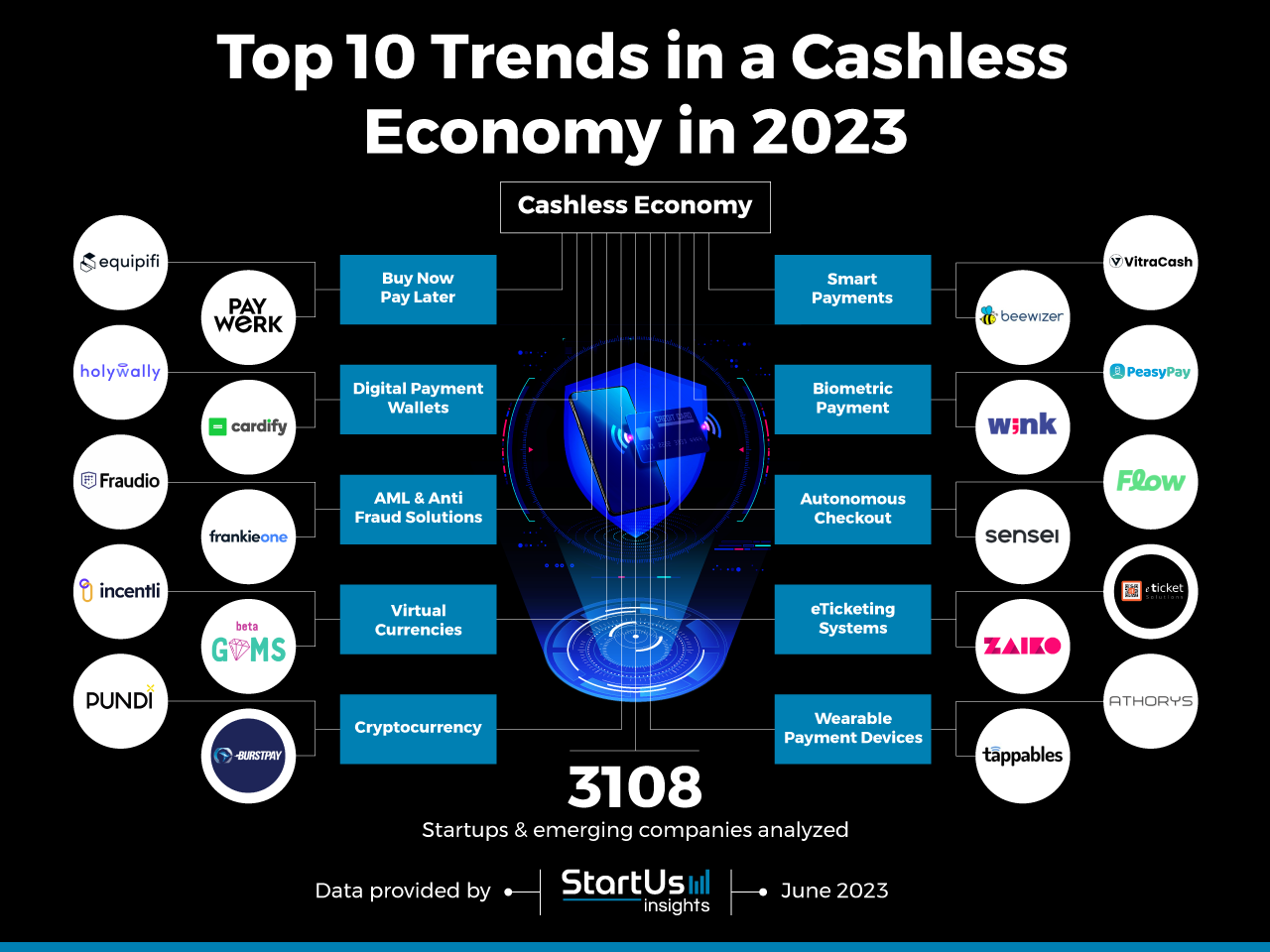

Innovation Map outlines the Top 10 Trends in Cashless Economy & 20 Promising Startups

For this in-depth research on the Top Cashless Payment Trends & Startups, we analyzed a sample of 3108 global startups & scaleups. This data-driven research provides innovation intelligence that helps you improve strategic decision-making by giving you an overview of emerging technologies in the finance industry. In the Cashless Economy Innovation Map below, you get a comprehensive overview of the innovation trends & startups that impact your company.

These insights are derived by working with our Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 3 790 000+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant technologies and industry trends quickly & exhaustively.

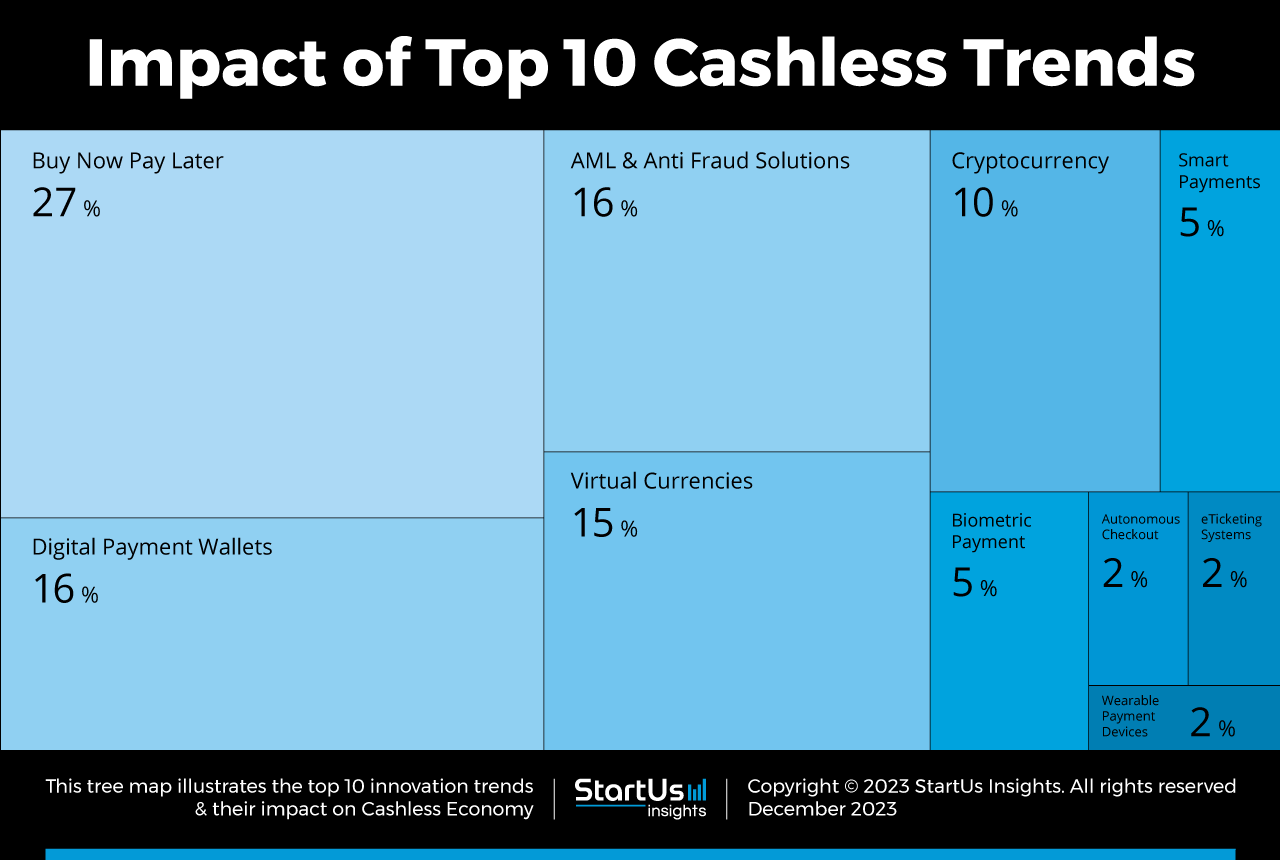

Tree Map reveals the Impact of the Top 10 Cashless Trends in 2024

Based on the Cashless Economy Innovation Map, the Tree Map below illustrates the impact of the Top Digital Payment Trends in 2024. Buy now pay later and digital payment wallets allow consumers to make purchases and pay in installments or with stored payment information. Banks and retailers use AML & anti-fraud solutions to ensure compliance and prevent fraud in cashless transactions. Virtual currencies enable borderless transactions, eliminating the need for currency exchange while cryptocurrencies enable secure peer-to-peer transactions, disrupting traditional banking systems. Smart payments use AI for contactless transactions, improving speed and convenience while biometric payments use fingerprint or facial recognition for security. Autonomous checkout enables customers to scan and pay for items without manual cashier interaction while eTicketing systems eliminate physical tickets by allowing digital purchase and validation. Finally, wearable payment devices offer a convenient and hands-free payment experience using smartwatches and other wearables.

Top 10 Cashless Trends in 2024

- Buy Now Pay Later

- Digital Payment Wallets

- AML & Anti Fraud Solutions

- Virtual Currencies

- Cryptocurrency

- Smart Payments

- Biometric Payment

- Autonomous Checkout

- eTicketing Systems

- Wearable Payment Devices

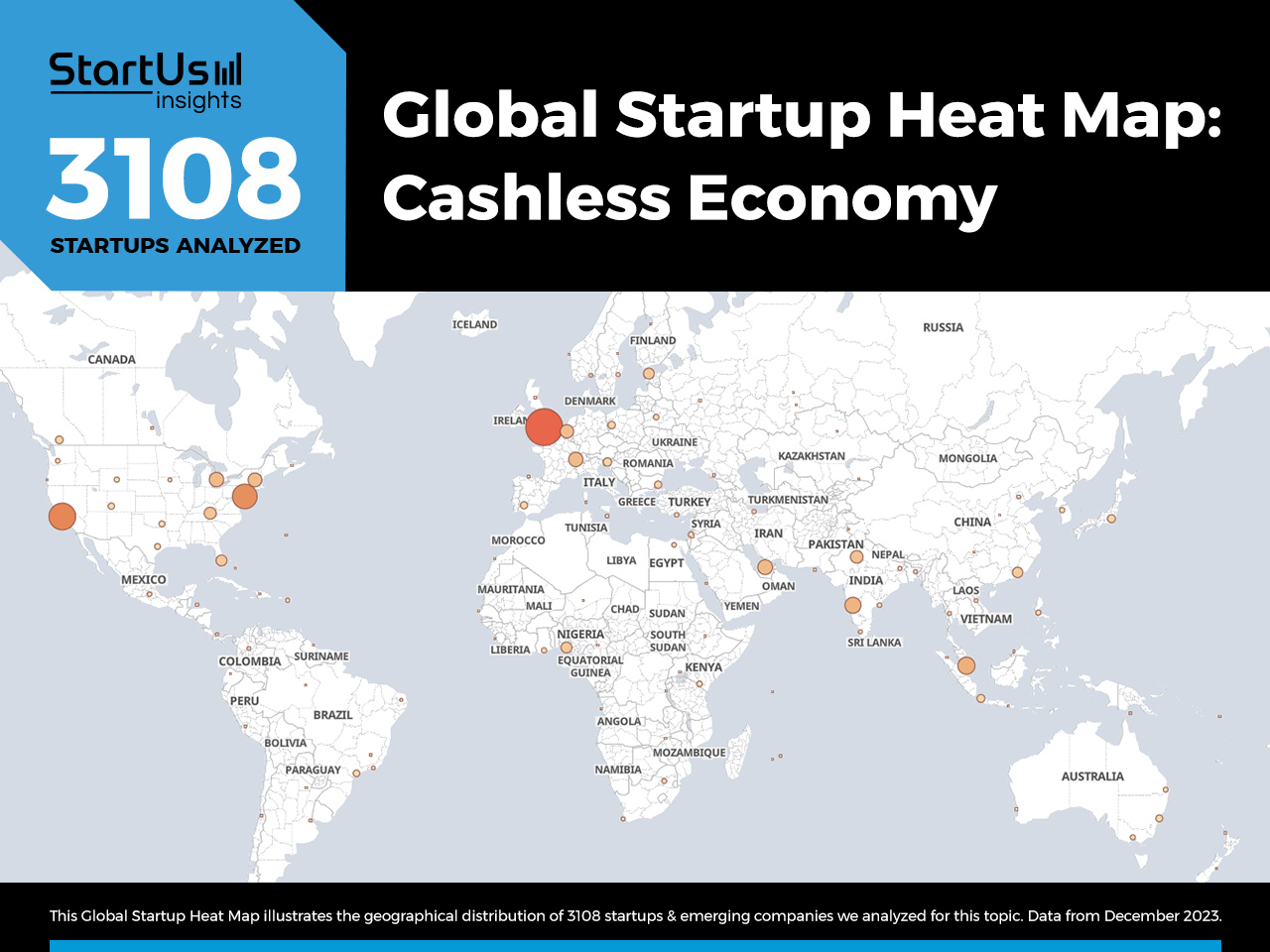

Global Startup Heat Map covers 3108 Cashless Economy Startups & Scaleups

The Global Startup Heat Map below highlights the global distribution of the 3108 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals high startup activity in the UK, followed by US and India. Below, you get to meet 20 out of these 3108 promising startups & scaleups as well as the solutions they develop. These cashless payment startups are hand-picked based on criteria such as founding year, location, funding raised, & more. Depending on your specific needs, your top picks might look entirely different.

Top 10 Current Cashless Market Trends in 2024

1. Buy Now Pay Later

Buy now pay later (BNPL) is popular within cashless economies, offering consumers a flexible payment option for their purchases. eCommerce platforms integrate BNPL services more frequently, simplifying the payment process and enabling consumers to make purchases without the need for immediate payment. Customers also use BNPL apps linked to their accounts to make purchases at physical retail locations, providing a seamless experience across both online and offline channels. Small and medium-sized businesses now use BNPL platforms to offer installment-based payment options to their customers. This helps smaller businesses compete with larger retailers by providing customers with payment flexibility, potentially increasing sales and customer loyalty.

Equipifi develops Integrated BNPL Dashboard

US-based startup Equipifi offers an integrated banking platform with BNPL facility for banks and credit unions. It integrates with the bank’s core systems and mobile apps to generate pre-approved BNPL offers for debit cardholders. The platform bases these offers on the users’ transaction data and financial goals. It offers a BNPL Insights dashboard that provides an understanding of cardholders’ BNPL engagement and preferences. This allows cardholders to view, accept, and manage their BNPL plans on their banking app, and pay for their purchases in flexible installments. Equipifi helps financial institutions increase engagement, and market share, by providing a transparent, and satisfying BNPL experience for their cardholders.

Paywerk develops BNPL as a Service

Paywerk is an Estonian startup that offers a plugin to enable BNPL as a service for online merchants and banks. It uses card infrastructure to allow flexible payment options for customers, such as paying now, paying later, or slicing the payment. It enables banks to rebrand and roll out their own BNPL product to the market in lower time and cost as compared to building the solution in-house. Paywerk’s plugin integrates with all popular e-commerce platforms and provides a fast credit decision process. It also supports international merchants, improving user experience and reducing costs with a standardized cross-border payment solution. Paywerk’s BNPL as a service helps merchants increase sales, conversion rates, and customer loyalty while offering interest-free financing backed by traditional banks.

2. Digital Payment Wallets

Digital payment wallets are increasingly popular, offering banks and financial institutions to simplify transactions and enhance financial inclusion. By linking bank accounts or credit/debit cards to the wallet, users initiate transactions with smartphones, making it easier to pay for goods and services. Wallets also facilitate peer-to-peer transfers, allowing users to send money directly to friends and family. They enable users to pay bills and utilities digitally. By integrating with service providers, wallets consolidate payment options into a single platform, simplifying the process and ensuring timely bill settlements. Startups also develop wallets that integrate loyalty programs, offering users incentives to choose digital payments over cash. Wallets also enable low-cost cross-border remittances. Users send money to people abroad, leveraging wallet providers’ partnerships with international remittance networks.

HolyWally provides eWallet Builder Platform

HolyWally is a Singapore-based startup that offers a digital wallet platform that enables financial institutions and banks to create custom mobile payment wallets for their customers. Using HolyWally’s user-friendly wallet builder, banks select from a library of reusable mobile components to build a wallet solution faster. It also allows them to integrate various banking capabilities, such as contactless payments, transfers, remittances, bill payments, and rewards. It also allows users to hold multiple cards in their digital wallet and make in-store purchases using tap-to-pay. HolyWally’s wallet-as-a-service builder platform combines adaptability, rapid scalability, and optimized user experience.

Cardify offers Virtual Payment Cards

Nigerian startup Cardify develops the Cardify Dollar Card, a virtual payment card that it funds using its proprietary digital payment wallet. This card enables users to access their stablecoins, offering online transaction solutions for those holding digital wallet balances. It also enables users to instantly spend with a card upon creation, eliminating unnecessary delays. The Cardify Dollar Card eliminates wallet limitations by allowing payments for monthly subscriptions and transactions to all popular services and retailers. Cardify also allows users to create up to 5 separate cards and allows expenditure tracking. Moreover, Cardify also offers zero extra charges for using the card, making it a cost-effective option for banks and financial institutions to launch online payment services.

3. AML & Anti-Fraud Solutions

As technology continues to advance, so do the methods of transaction fraud to exploit vulnerabilities. Banks widely use machine learning algorithms to detect transaction fraud. They analyze vast amounts of transactional data to identify patterns and anomalies associated with fraudulent activities. Startups also develop behavioral analytics to monitor and analyze user behavior patterns to detect fraudulent transactions. Establishing a baseline of normal behavior for each user enables financial institutions to flag any deviations or suspicious activities for further investigation. Biometric authentication methods, such as fingerprint or facial recognition, add an additional layer of security to cashless transactions. Financial institutions and payment processors also collaborate by sharing transaction data and fraud-related information to enhance fraud detection capabilities. By pooling resources and combining datasets, they create more comprehensive and accurate fraud detection systems.

Fraudio develops Anti-Fraud Application Programming Interface (API)

Fraudio is a Dutch startup that offers a cloud-native, AI-enabled payment fraud detection API. Fraudio’s API integrates with checkouts and payment gateways of all payment service providers, financial institutions, and large merchants. The AI ensures the assessment of all transactions against updated fraud information, allowing users to reduce chargebacks. The API classifies transactions into colors based on the risk value and enables merchants to take action about them respectively. Fraudio’s machine learning models flag fewer false positives during transactions, ensuring more efficient use. This plug & play AI fraud detection API is cost-effective and easily integrates into any existing hardware, making it an efficient solution for all financial institutions.

FrankieOne offers a Fraud Prevention Platform

Australian startup FrankieOne develops a fraud prevention platform for banks and fintech companies. It offers a single API and dashboard, allowing for efficient management of know-your-customer (KYC), anti-money laundering (AML), and fraud-related processes. It has an API integration hub, customizable decision engine, and single customer view, p[rvifing intelligent fraud detection for organizations in the financial sector. By leveraging its extensive access to data sources, FrankieOne’s platform results in increased match rates and reduced fraud. The platform makes it easy for companies to quickly and safely onboard more customers, mitigating fraud and high-cost financial risk.

4. Virtual Currencies

Virtual currencies extensively find use within the online gaming community. Players earn or purchase virtual currencies to trade, buy in-game items, or access premium features. Some companies and organizations create their own virtual currencies for internal use within their ecosystem. They use these closed-loop virtual currencies for purchasing goods and services specific to that organization or platform. Some businesses issue their own virtual currencies to customers as rewards for purchases or engagement. They later redeem these virtual currencies for discounts, products, or exclusive offers within the business ecosystem. Central banks of various countries are issuing their own centralized virtual currencies that operate on a digital platform.

Incentli offers Virtual Coins for Audience Engagement

Incentli is a Canadian startup that provides an audience engagement platform for conferences or events. It leverages redeemable virtual currency to gain audience traction and increase attention span. The platform allows attendees to earn virtual coins by performing activities such as registering, referring friends, attending sessions, networking, and engaging with exhibitors. Incentli allows the exchange of these coins for incentives through its proprietary incentive store. Exhibitors also participate by offering their own items and opportunities in the incentives store, managing their incentives, and capturing leads. Overall, Incentli’s usage of virtual coins to boost engagement and create a playful and rewarding experience for conference attendees proves useful for organizations in almost every industry.

G3MS develops Redeemable Coins for Online Tutoring

US-based startup G3MS offers a comprehensive educational platform that uses a vast library of vertical videos for tutoring enhancement. The platform employs virtual currency and a redeemable token system to foster student attention. It enables students to earn coins for their achievements and redeem them in a virtual store. The platform also incorporates quizzes and exit tickets to help measure student mastery. This encourages student engagement and motivation, fostering a positive learning environment.

5. Cryptocurrency

Startups and financial institutions leverage cryptocurrencies and blockchain payment systems to enhance the security and dependability of the cashless economy. Startups are developing platforms that utilize smart contracts for automated transactions, while also integrating decentralized finance (DeFi) applications. Additionally, companies are exploring stablecoins to provide stability in everyday transactions. Tokenization of assets is gaining traction, enabling fractional ownership and facilitating liquidity. Privacy enhancements, such as zero-knowledge proofs, ensure secure and confidential transactions. Further, startups are delving into the intersection of cryptocurrencies and emerging technologies like IoT and artificial intelligence, paving the way for seamless machine-to-machine payments. Startups also build blockchain payment gateways that facilitate transactions by accepting various digital currencies and converting them into the desired currency of the merchant.

Pundi X develops Blockchain Payment Ecosystem

Pundi X is a Singaporean startup that develops a crypto payment ecosystem to simplify the process of buying and using digital currencies. It offers point-of-sale devices (POS) that accept cryptocurrencies such as their own PUNDIX Token and fiat currencies. It also provides marketing and loyalty program capabilities. Publishing an app on the POS app store requires PUNDIX tokens to be a default token to settle the payment within the application. The POS provides PURES as a reward token to users, who then use it as loyalty points for a deduction of the transaction amount. This encourages consumers to use PUNDIX to make purchases. It also enables store owners to increase revenue and customer satisfaction.

BURSTPAY provides Green Digital Currency

Chinese startup BURSTPAY offers Burst, a digital currency that operates on the blockchain, secured by the Proof-of-Capacity (PoC) algorithm. Burst utilizes low-power hard drives instead of energy-intensive processors and graphic cards, making it an eco-friendly alternative to normal cryptocurrencies. Burst transactions consume less energy per verified transaction in comparison to regular digital currencies. It also offers asset exchange, smart contracts, and encrypted messaging. One notable advantage is that transactions using Burst do not require fees. Additionally, Burst’s blockchain has the capability to handle an unlimited number of transactions per second, making it a secure and efficient form of cashless payment.

6. Smart Payments

AI-powered smart payment systems automate and streamline financial processes, reducing manual efforts and processing times. AI algorithms handle larger volumes of data quickly and accurately, enabling faster transaction processing and settlements. Financial institutions use AI to incorporate biometric authentication methods, such as facial recognition, fingerprint scanning, or voice recognition, into smart payment systems. These biometric identifiers provide an additional layer of security and convenience, reducing the reliance on traditional methods like PINs or passwords. Startups integrate AI-powered virtual assistants and chatbots into smart payment systems, offering customer support, answering inquiries, and guiding users through the payment process. Smart payment systems also provide insights into spending habits and financial behavior, facilitating predictive analytics for financial planning. It also enables users to authorize transactions using voice commands, making the payment process more seamless and convenient.

VitraCash develops an AI-based Payment Card Selector

VitraCash is a UK-based startup that offers VitraCard, a digital debit card to manage multiple cards by combining them into one. VitraCard enables users to make payments anywhere and save money on every transaction and earn rewards. VitraCash bundles an app along with the card which encases its VitraChoose AI which intelligently selects the most suitable card for each payment. The AI considers factors such as insurance, cashback, and transaction fees to decide which card to use and where. The app also allows users to compare their cards and track their savings, leading to better financial planning.

Beewizer provides an Automated Payment Reminder App

Israeli startup Beewizer develops PayPay Reminder, an automated invoice chaser app that aids small and medium size businesses (SMBs) in reducing late payments. The app works with billing platforms and sends tailored messages to debtors using AI and behavioral economics. The AI does not use aggression, instead determines and generates appropriate messaging based on the psychology of the debtor for better results. It uses B-Avatar, a cognitive audio-visual character that communicates with debtors and encourages them to pay faster. The app helps businesses reduce personnel costs, improve customer retention and achieve economic stability.

7. Biometric Payment

Within a cashless economy, biometric payments and authentication offer enhanced security, convenience, and efficiency. Authentication becomes convenient for users and financial institutions as it replaces physical cards, PINs, and passwords with biometric data like fingerprints or facial scans. Biometric payment promotes financial inclusion by allowing access to individuals without traditional identification or literacy levels. It enables frictionless payments through simple touch or glance, benefiting high-volume payment environments. It enables secure remote transactions, reducing reliance on vulnerable methods like passwords. Biometric automated teller machines (ATM) enhance security by replacing cards and PINs with fingerprint data.

PeasyPay offers a Biometric Payment Terminal

PeasyPay is a Hungarian startup that develops a biometric payment terminal. The terminal’s biometric identification system uses face recognition and palm verification, ensuring secure transactions. It even distinguishes between twins and remains unaffected by heavy makeup, body painting, pictures, or masks. Additionally, the system offers easily traceable income, allowing businesses to track earnings, study customer habits, and maintain full control. Deploying the terminal is hassle-free, involving ordering a terminal, downloading the Merchant app, and connecting the terminal to the merchant account. PeasyPay’s biometric terminal allows customers to enjoy a safe, fast, and reliable payment process and allows merchants to increase store efficiency and profits.

Wink develops a Voice-based Payment Platform

US-based startup Wink provides a biometric authentication platform that uses face and voice recognition to verify users. Its encryption technology is anonymous and multi-factor, providing unparalleled security. The platform is easy to integrate with major e-commerce platforms and supports both mobile apps and websites. Wink’s authentication combines facial recognition, digital voice printing, and payment tokenization to provide a safe checkout experience. The platform is device agnostic and works securely in the cloud. Wink’s AI and machine learning algorithms further enhance the shopping experience by providing personalized recommendations and offers. Wink’s platform establishes a direct encrypted connection between the shopper’s mobile device and the cloud, eliminating eavesdropping, malware, and data theft.

8. Autonomous Checkout

Autonomous checkout is rapidly becoming an integral part of the cashless economy, automating the retail experience. Technologies, such as computer vision and artificial intelligence, enable seamless and frictionless checkout experiences in grocery stores and other retail establishments. Startups leverage autonomous checkout systems to eliminate queues and waiting times, offering customers a seamless shopping experience. These startups utilize computer vision systems to track items selected by customers and automatically identify them. It then processes payments without the need for traditional checkout procedures enabling the development of smart stores or unmanned stores. By leveraging AI algorithms, these systems ensure accurate item recognition, enhancing efficiency and reducing errors.

Flow Retail offers a Machine Vision Auto-Checkout Platform

Flow Retail is an Israeli startup that develops FlowVision, a machine vision platform for the retail industry. It enables autonomous checkout with extreme classification in crowded retail stores with numerous product types. Flow Retail uses smart cameras and smart shopping carts that detect and prevent mis-scans, barcode switching, and non-scans. Retail stores retrofit FlowVision into any shopping cart and self-checkout device, creating a seamless and secure shopping experience for customers and retailers. Stores use FlowVision’s dashboard to monitor live shopping activities and optimize store operations and sales.

Sensei provides Autonomous Store Integration

Portugese startup Sensei provides autonomous store technology integration for retailers. It uses AI-powered sensors and cameras to track products and customers in real time, enabling checkout-free shopping and efficient operations. Shelf sensors and cameras use computer vision to understand which product the shopper is choosing and add to the cart automatically. The startup offers a companion app that allows shoppers to add products to virtual baskets and pay online with autonomous checkout. Sensei’s technology is scalable, flexible, and easy to integrate with existing systems, helping retailers increase sales, reduce costs and improve customer satisfaction.

9. eTicketing Systems

e-ticketing systems witness significant innovation and widespread adoption within cashless economies. Public transportation utilizes mobile apps, smart cards, and NFC for ticket purchase and validation. Parking management employs mobile apps and RFID tags, generating eTickets to enable cashless payments. Tourism attractions like museums and theme parks offer e-tickets on smartphones or via QR codes. Airlines simplify booking, check-in, and boarding processes through e-ticketing. These eTicketing systems enhance operational efficiency, reduce queues, and facilitate a seamless payment experience in cashless economies.

eTicket Solutions facilitates eTicketing as a Service

eTicket Solutions is a US-based startup that offers eTPaaS, a web and mobile platform that offers e-ticketing for events, such as concerts, movies, sports, and theater. The platform allows customers to create an account, purchase e-tickets and receive email receipts with QR codes. It also provides promoters with daily payouts, customer service, and user-friendly software to sell tickets online. The startup provides the hardware at no cost, allowing for ticket scanning, POS payments, and mobile app support. It eliminates the need for large upfront capital investments and shifts costs to pay-as-you-go operating expenses. eTPaaS offers a single point of contact for ticketing operations and support, reducing the complexity of managing larger events for various industries.

Zaiko develops Self-Serve eTicketing Platform

Japanese startup Zaiko provides an eponymous platform that allows event organizers to sell tickets online. It supports online, offline, and hybrid events for various categories, such as live streams, concerts, e-sports, theatre, sports, and business. The platform works by allowing users to sign up for free, create a branded checkout page, share it on social media and other websites, and accept multi-currency payments. It also provides extensive ticket customization options, ticket transfer, customer support, automatic seating numbers, and fan club API integration. Zaiko’s platform helps creators and organizations track sales, marketing, and analytics in one place and leverage email marketing capabilities for efficient communication with customers.

10. Wearable Payment Devices

Within cashless economies, wearable payment devices are significantly popular in recent years, offering convenient and secure ways to make transactions. It reduces the need to carry a physical wallet for all intents and purposes. Smartwatches with near-field communication (NFC) allow users to make payments by simply tapping their watch on a payment terminal. These devices often integrate with mobile payment platforms, enabling users to link their credit or debit cards and make payments on the go. Startups also develop fitness bands and smart bracelets that not only track health and fitness metrics but also function as payment devices. Companies also develop smart rings to be worn on the finger, offering a discreet way to make payments. These rings allow users to tap or wave their hands to complete transactions.

Athorys provides Contactless Payment Ring

Athorys is a Belgian startup that offers a contactless payment ring. It uses near-field communication (NFC) to communicate with any POS terminal that accepts Mastercard. Athorys links the ring to a digital wallet which users top up with any bank card or account. The ring is also water-resistant, durable, and customizable. It is made of ceramic or metallic materials and comes in different colors, shapes, and sizes. The rings allow banks to offer new payment solutions without incurring operational costs and experience lower reissuing costs compared to traditional cards. For customers, it provides a convenient, secure, and innovative payment solution making transactions faster, easier, and more fun.

Tappables develops Wearable Payment Devices for Kids

Canadian startup Tappables offers contactless wearable payment devices for kids. The devices use NFC to enable secure and convenient transactions at any contactless terminal. It also allows parents to control and fund the devices. It enables parental control capabilities, such as setting spending limits, blocking categories, and receiving payment notifications on use. If lost or stolen, parents lock the device away, not allowing for misuse. Kids don’t need a PIN to make a payment as the parents control it from the parental companion app. Tappables’ wearable payment device provides a safe, and educational way for kids to learn about money management and financial literacy while promoting a cashless economy.

Discover all Cashless Economy Trends, Technologies & Startups

The future of the cashless economy promises newer innovations from mobile payment platforms and digital wallets and automated large language models like AutoGPT that allow users to autonomously perform investments and trading. The integration of cryptocurrencies like Bitcoin further advances the financial system, providing decentralized and transparent transactions. The cashless economy trends & companies outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.