Organizations are adopting artificial intelligence (AI), ensuring real-time visibility, and leveraging supply chain as a service (SCaaS) to create more adaptable systems. Other supply chain industry trends improve cold chain logistics, warehouse automation, and last-mile delivery – increasing efficiency from production to final distribution. Understanding these trends will enable industry leaders and innovation managers to strengthen supply chains and remain competitive in a changing market.

What are the Top 10 Global Supply Chain Industry Trends in 2025?

- AI-Powered Supply Chain Operations

- Sustainable Supply Chain

- Supply Chain as a Service

- Supply Chain Traceability

- Risk Management

- Agile Supply Chain

- Last Mile Delivery

- Internet of Things (IoT)

- Cold Chain Innovations

- Warehouse Automation

Methodology: How We Created the Supply Chain Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 7M+ global startups, 20K technologies & trends, plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the supply chain industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the supply chain innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 10 Supply Chain Industry Trends & 20 Promising Startups

For this in-depth research on the Top Supply Chain Technology Trends & Startups, we analyzed a sample of 11 527 global startups & scaleups. The Supply Chain Innovation Map created from this data-driven research helps you improve strategic decision-making by giving you a comprehensive overview of the supply chain industry trends & startups that impact your company.

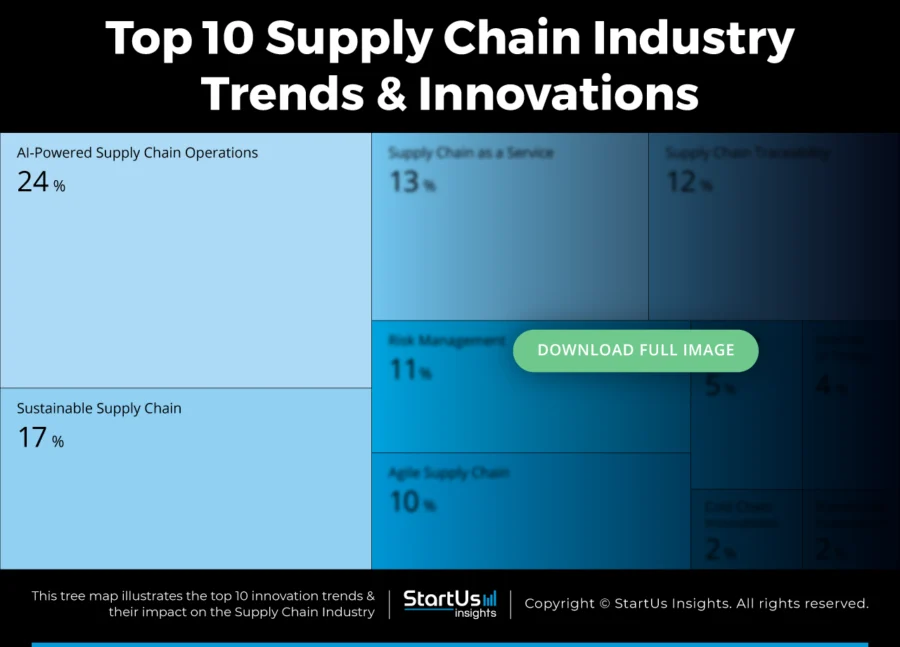

Tree Map reveals the Impact of the Top 10 Supply Chain Management Trends

The supply chain industry continues to evolve with innovations such as AI-powered operations that support predictive demand planning, automate procurement, and improve routing. Agile supply chain strategies allow companies to respond quickly to disruptions.

Further, IoT enhances asset tracking and condition monitoring in transport and storage environments. In cold chain logistics, precise temperature control ensures product integrity. Moreover, supply chain traceability strengthens transparency across suppliers with digital ledgers and automation. These trends reflect a shift toward adaptive, customer-focused supply chain systems.

Global Startup Heat Map covers 11 527 Supply Chain Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 11 527 exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the US and India, followed by the UK and Germany. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Supply Chain Innovations & Trends?

Top 10 Emerging Supply Chain Industry Trends & Innovations [2025 and Beyond]

1. AI-Powered Supply Chain Operations

Supply chains are growing more complex due to global operations, diverse product portfolios, and rising customer expectations. To manage these challenges, companies use AI to improve visibility and enhance predictive capabilities.

Ongoing labor shortages in logistics and warehousing further drive greater adoption of AI-powered automation. These technologies improve efficiency and reduce reliance on human labor.

McKinsey reports that AI-based forecasting reduces errors by 30% to 50%. As a result, product unavailability, which leads to lost sales, may decrease by 65%. Additionally, transportation and warehousing costs could fall by 5% to 10%, while supply chain administration expenses may decline by 25% to 40%.

Machine learning and statistical models also allow organizations to forecast demand more accurately. AI analyzes datasets like sales history, promotions, and external factors like local events. These insights enable businesses to align inventory with expected consumption by reducing overstock and stockouts.

Additionally, AI platforms provide real-time operational visibility for supply chain companies to make data-driven decisions.

In transportation, AI transforms long-haul logistics with autonomous driving technologies. Companies like Plus develop virtual drivers that interpret road conditions and respond quickly.

AI-powered drones optimize routes and navigate obstacles, and adjust dynamically to environmental conditions for efficient deliveries.

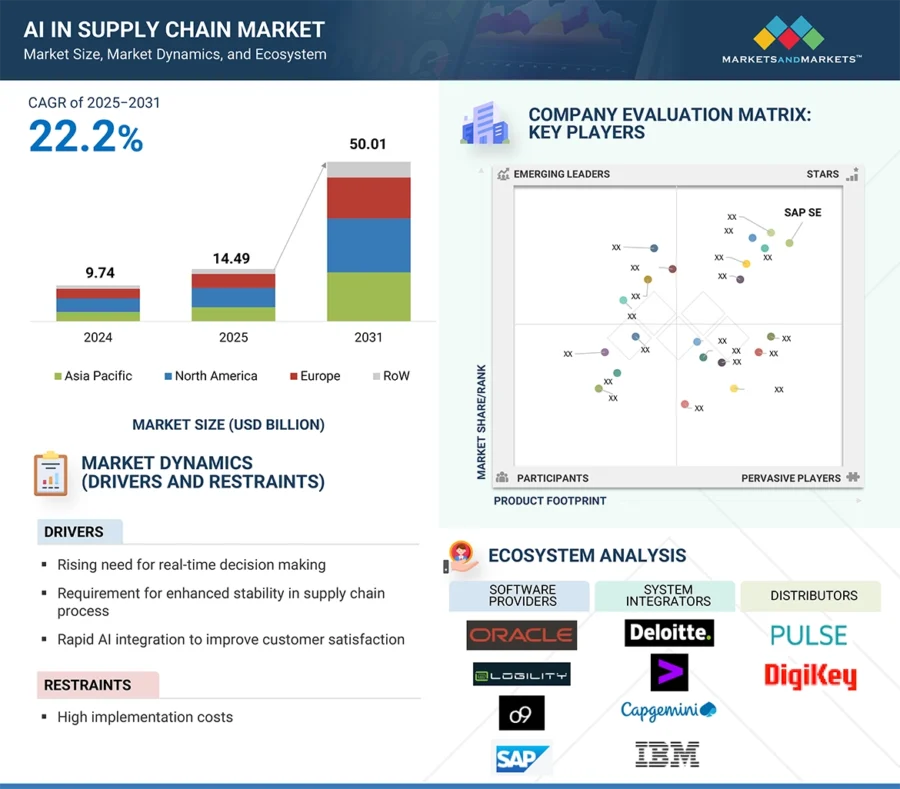

Moreover, the global AI in supply chain market is expected to grow from USD 14.49 billion in 2025 to USD 50.01 billion by 2031, at a CAGR of 22.9%.

Credit: Markets and Markets

Logpilot provides an AI Platform for Supply Chain Automation

UK-based startup Logpilot builds an AI-powered platform that simplifies supply chain operations. It automates procurement, order management, inventory optimization, and logistics coordination.

The platform utilizes proprietary large language models (LLMs) and predictive analytics to process real-time supply chain data. It generates autonomous decisions and proactively manages risks, including demand fluctuations and transport delays.

Logpilot also integrates with existing enterprise resource planning (ERP) and warehouse management systems (WMS) without setup, training, or system replacement. The platform consolidates data from multiple sources to create a unified view of supply chain performance. It continuously learns and adapts to improve responsiveness.

TetriXX leverages AI & Advanced Analytics for ESG Scope 3 Management

Singaporean startup TetriXX provides a platform that optimizes logistics through AI-driven SaaS products for freight, container, and shipment management. The platform digitizes freight invoices to identify cost deviations, applies anomaly detection to flag irregularities, and measures Scope 3 emissions with precision.

Its algorithms generate optimized shipping and repositioning instructions by considering constraints to reduce operational costs and improve asset utilization. Each product includes real-time reporting features that transform logistics data into actionable insights on trade lanes, costs, and carbon impact.

2. Sustainable Supply Chain

Global environmental, social, and governance (ESG) regulations are focusing on supply chain emissions. Policies like the European Union’s Deforestation Regulation (EUDR) and the Carbon Border Adjustment Mechanism (CBAM) require companies to audit suppliers for deforestation, greenhouse gas emissions, and labor practices.

Further, green supply chain integration (GSCI) allows companies to align sourcing and production decisions with sustainability goals. A study of 405 Chinese manufacturing companies found that GSCI improves supply chain agility, which leads to advances in green product development and process innovation.

Logistics providers are also adopting green practices to meet corporate and consumer expectations. DHL Express’s GoGreen Plus service offsets carbon emissions using sustainable aviation fuel (SAF) and attracted 12 000 Asia-Pacific customers in its first year.

In Thailand, DHL Supply Chain partnered with Boots to deploy a fully electric vehicle (EV) fleet for last-mile delivery to 250 retail locations.

Moreover, companies use digital twins to map Scope 3 emissions and build chain-of-custody models. These tools identify emission-heavy activities across supplier tiers.

Decentralized production using 3D printing reduces mass production and long-haul transport. Medical manufacturers now print and ship custom prosthetics from local hubs to cut logistics emissions and delivery times.

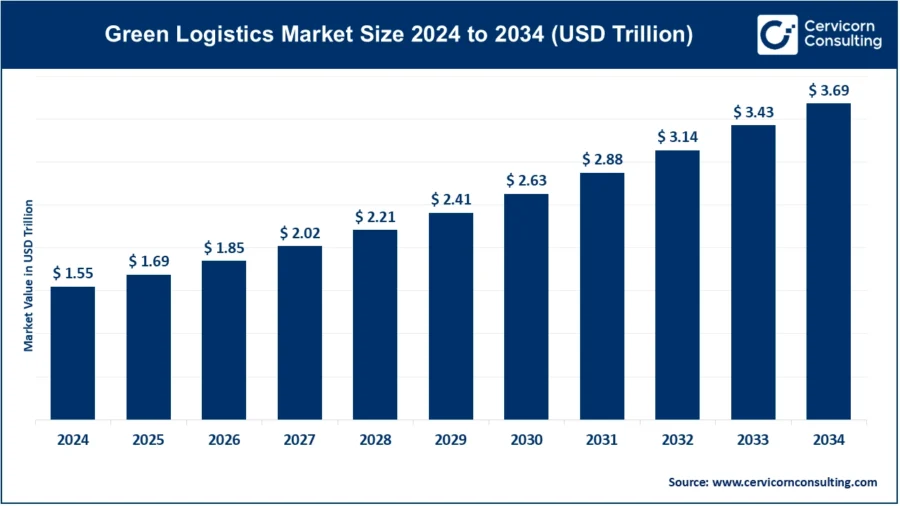

Besides, the global green logistics market is projected to grow from USD 1.69 trillion in 2025 to USD 3.69 trillion by 2034, with a CAGR of 9.06% during the forecast period.

Credit: Cervicorn Consulting

Responsibly automates Sustainability Due Diligence

Danish startup Responsibly develops an AI-driven ESG data platform that automates supplier sustainability assessments. It allows businesses to maintain compliance and reduce procurement risks.

The startup’s platform gathers structured data from third-party sources, supplier websites, certifications, and audit reports. It also creates real-time ESG profiles covering human rights, carbon emissions, and supply chain due diligence.

The platform scores, normalizes, and analyzes supplier data against evolving regulations like LkSG and CSDDD. The startup’s platform provides detailed risk insights across topics, geographies, and industries.

Further, it streamlines supplier engagement with customizable multilingual templates and automates outreach based on risk priorities. It integrates via API with procurement systems to deliver ESG ratings and emissions data.

GreenStitch accelerates Supply Chain Decarbonization

Indian startup GreenStitch offers an AI-driven platform that simplifies carbon accounting, product life cycle assessment, ESG reporting, and supply chain decarbonization for the fashion and textile industry.

The platform collects emissions data across Scopes 1, 2, and 3 from internal systems and suppliers. It supplements missing inputs with databases like Ecoinvent and generates audit-grade calculations using its engine.

The startup tracks environmental metrics, including carbon emissions, water usage, and land impact, throughout product lifecycles. This enables companies to produce ESG reports that meet CSRD, GRI, CDP, and other regulatory standards.

GreenStitch identifies emissions hotspots and recommends reduction strategies for effective decarbonization planning.

3. Supply Chain as a Service

A 2025 report by MHI and Deloitte states that 55% of supply chain leaders plan to increase technology investments, with 60% allocating over USD 1 million for end-to-end orchestration.

The shift toward advanced digital infrastructure responds to the need for real-time visibility, labor shortages, and operational complexity. Cloud computing also plays a key role, with 91% of firms prioritizing it for inventory, shipment, and production monitoring.

Gartner predicts that 90% of organizations will adopt hybrid cloud strategies by 2027. This signals a move away from rigid, on-premise systems.

Legacy systems often fragment data and require manual integration of logistics, supplier, and inventory records. SaaS-based solutions address this issue by unifying disparate systems in a centralized cloud environment.

General Electric (GE) reported a 20% improvement in operational efficiency after adopting SaaS solutions that provided real-time supply and production insights.

SaaS platforms such as SAP‘s Integrated Business Planning (IBP) automate purchase orders, invoice reconciliation, and approvals. These solutions reduce manual processes by 73%, and improve accuracy and speed in sourcing.

In warehousing, AI-driven systems like Blue Yonder’s warehouse management platform optimize labor allocation and picking paths. These technologies increase throughput by 50% while maintaining high inventory accuracy.

The global SaaS-based SCM market is expected to grow at a CAGR of 12.27% from 2025 to 2034. At the same time, the cloud SCM market is projected to reach USD 280.89 billion by 2032, with a CAGR of 35.09% between 2026 and 2032.

Fauree develops a Supply Chain Finance Platform

UAE-based startup Fauree offers a cloud-based supply chain finance platform that automates invoice management, working capital optimization, and financial collaboration.

The startup’s platform integrates with ERP and core banking systems to digitize payables, manage dynamic discounting, and support flexible pricing and credit limits through an automated web interface.

It enables banks and funders to finance low-value invoices using historical transaction data. This allows suppliers and buyers to gain real-time access, document visibility, and reporting tools.

Further, Fauree supports financial products such as payable finance, reverse factoring, and more as well as includes ESG modules for supplier compliance and certification.

Switchboard builds a Supply Chain Integration Platform

Australian startup Switchboard makes a cloud-based platform that automates operational data exchange between trading partners through EDI and API connections.

The platform integrates with ERP, WMS, TMS, and MRP systems to transmit purchase orders, inventory updates, shipment milestones, invoices, and remittance data in structured formats. It eliminates manual tasks like emailing spreadsheets or PDFs to enable real-time digital workflows that improve accuracy and reduce errors.

The platform features rapid onboarding, customizable automation, and enterprise-grade security compliance. It also enhances inventory visibility, simplifies transport coordination, and generates financial documents directly within partner systems.

4. Supply Chain Traceability

Loftware’s annual Top 5 Trends in Labeling & Packaging Artwork report states that 79% of organizations prioritize traceability today, and 94% expect its significance to grow over the next three years.

Regulatory mandates such as the European Union’s Digital Product Passport are accelerating adoption. It requires detailed lifecycle data for consumer goods in sectors like apparel and electronics.

Retail brands are implementing blockchain-based traceability. For example, Walmart mandates IBM’s blockchain platform for leafy green suppliers to reduce investigation times from days to seconds. Carrefour also extends IBM Food Trust across its global stores to improve transparency in private-label products.

Beyond food, Everledger enhances diamond traceability using blockchain, AI, IoT, and nanotechnology to document origin, ownership, and sustainability metrics.

Further, Adidas integrates traceability into its sustainability efforts by partnering with TrusTrace to track certified materials. The initiative supports its goal of using 100% recycled polyester by 2025. A USD 24 million funding round in the last year strengthened its investment in traceability technology.

Global standards are improving interoperability in traceability frameworks. GS1 identifiers, including Global Trade Item Numbers (GTINs) and 2D barcodes, ensure unique product recognition. Electronic Product Code Information Services (EPCIS) enables data exchange between supply chain participants to support end-to-end visibility.

As traceability becomes essential for risk management, sustainability, and compliance, the blockchain supply chain market is projected to grow from USD 1.26 billion in 2025 to USD 9.52 billion by 2030, reflecting a CAGR of 49.87% during this period.

Credit: Mordor Intelligence

Trusty enhances Food Supply Chain Traceability

Italian startup Trusty offers a blockchain-powered platform that tracks and verifies supply chain data from origin to final product. It integrates with ERP, MES, and CRM systems through REST APIs for farmers, cooperatives, exporters, and certification bodies to securely input and share data.

The platform assigns unique identifiers to batches, records geolocation data, and timestamps events on an Ethereum-compatible blockchain to maintain transparency and data integrity. It supports compliance with regulations such as the EUDR and facilitates geospatial monitoring, risk assessments, and submission of due diligence statements.

Additionally, the company offers QR code e-labels following GS1 Digital Link standards to provide consumers with product origin, certifications, and sustainability details.

Autify Network builds a Decentralized Vendor Aggregator Platform

Singaporean startup Autify Network develops Autify Verified, a blockchain and AI-driven platform that improves supply chain transparency and vendor sourcing. It integrates with enterprise systems to track product origin, inventory, and logistics in real time.

Blockchain ensures data integrity, while AI detects irregularities and optimizes operations. Autify Verified connects businesses with a global network of verified suppliers as well as features advanced search filters, real-time updates, and secure negotiation tools.

This allows vendors to monitor sustainability metrics, engage with a B2B community, and manage sourcing through a centralized dashboard.

5. Risk Management

Gartner reports that 79% of large companies have adjusted business operations post-COVID to strengthen resilience. By 2025, more than 50% of organizations are expected to consider supply chain risk management a critical success factor.

A 38% year-over-year (YoY) increase in global supply chain disruptions in the last year highlights the urgency of this shift. In Europe, 76% of shippers experienced at least one disruption, and nearly a quarter faced more than 20 incidents.

Further, cybersecurity threats are rising as supply chains become more digitized and interconnected. Gartner predicts that 45% of organizations will experience a cyber attack on their software supply chains by the end of this year – three times the rate recorded in 2021. These risks are prompting companies to rethink sourcing and logistics strategies.

A 2024 McKinsey survey found that 73% of companies had advanced dual-sourcing efforts for key inputs, while 60% were pursuing regionalization or nearshoring. IDC expects that 50% of all firms will adopt multi-shoring strategies this year to limit geopolitical and operational risks.

As a result, businesses are using advanced technologies to mitigate risk. AI-driven systems reroute shipments during disruptions and assess supplier risk in real time. Digital twins simulate supply chain configurations, which aids in optimizing inventory placement and redundant distribution nodes. Automotive and aerospace industries are leading the adoption of multi-tiered networks.

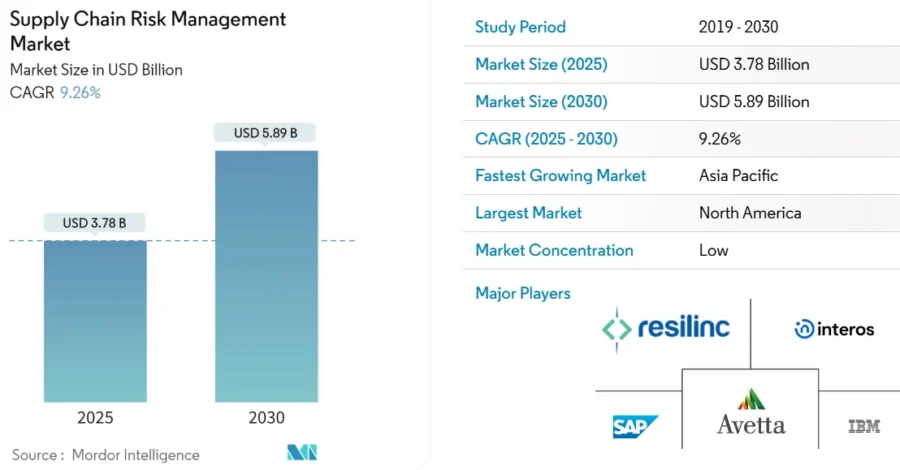

The global supply chain risk management market is forecast to grow from USD 3.78 billion in 2025 to USD 5.89 billion by 2030, reflecting a CAGR of 9.26% during this period.

Credit: Mordor Intelligence

Ceeyu offers a Risk Identification & Management Platform

Belgian startup Ceeyu builds a platform that enables organizations to identify and manage supply chain risks using digital questionnaires, automated attack surface scans, and external data lookups.

The platform continuously monitors digital footprints to detect vulnerabilities like unauthorized cloud usage, exposed credentials, and insecure domains. It also supports structured assessments of cybersecurity, ESG, financial, and regulatory risks.

The startup provides customizable risk ratings, interactive dashboards, and collaboration tools. This enables enterprises and suppliers to act on real-time insights.

Correntics provides Climate Risk Analytics

Swiss startup Correntics develops a climate risk analytics platform that allows organizations to assess, model, and mitigate climate-related vulnerabilities in supply chains and production assets. It combines hazard data, supply chain mapping, and probabilistic risk modeling to identify disruptions and evaluate exposure under different future scenarios.

The platform supports climate risk assessment, ESG evaluations, and sustainability reporting while enabling businesses to track disruptions, monitor trends, and develop adaptive strategies. Further, its scenario-based approach offers insights into operational and strategic risks.

Moreover, Correntics has secured a EUR 1.5 million Eurostar grant to develop advanced risk analytics for the agri-food sector.

6. Agile Supply Chain

Customer expectations continue to push supply chains toward greater agility, speed, and service. Gartner reports that 83% of supply chain practitioners are now responsible for improving customer experience.

Consumers expect real-time availability, fast delivery, and personalized service, which is driving demand for more responsive operations.

External volatility is also rising. Weather-related supply chain alerts more than doubled in the last year, with flood events increasing by 214%. Flooding accounted for 70% of all climate-related disruptions, affecting logistics and distribution networks worldwide.

Supply chain leaders remain divided on how to respond. More than 30% of chief supply chain officers (CSCOs) avoid agility investments due to concerns over higher operating costs. Additionally, 58% believe resilience strategies increase structural costs, limiting proactive adaptation despite rising disruptions.

Credit: Gartner

To address these challenges, companies are adopting AI, robotics, and automation. AI-powered analytics improve demand forecasting, enable real-time scenario planning, and automate decision-making to optimize flows.

Industry leaders like Zara and Amazon demonstrate this shift toward speed and automation. Zara’s integrated model moves designs to shelves in as little as two weeks by sourcing production close to key markets and using store-level data to guide inventory decisions.

Amazon has also expanded automation across its fulfillment network. It deploys mobile robots, computer vision systems, and AI models to accelerate order processing and reduce manual handling across millions of shipments.

GoodFloow automates Packaging Tracking & Management

French startup GoodFloow provides a tracking and management solution that allows companies to shift from disposable to sustainable logistics. It assigns each packaging unit to a designated supply chain partner and monitors its movement using AI-enabled connected devices.

The startup offers real-time inventory visibility, detects anomalies, and alerts users to take actions such as recovering isolated units or inspecting damaged packaging. This prevents overstocking, reduces losses, and minimizes manual monitoring efforts.

Patchwork builds an Agile Production Fulfillment Operating System

US-based startup Patchwork offers a manufacturer-to-consumer (M2C) supply chain platform that enables fashion brands to align inventory with real-time demand. The platform utilizes proprietary sales data to generate weekly purchase orders and guide production in small batches with low minimum order quantities and 14-day lead times.

Orders are fulfilled directly from factory-held inventory to reduce logistical costs and enable just-in-time (JIT) operations. It offers features such as automated invoicing, a centralized production management dashboard, and real-time analytics that track sales performance, inventory levels, and fulfillment rates.

Patchwork also offers machine learning models customized to each brand’s sales patterns while preserving control over design, inventory, and quality standards.

7. Last Mile Delivery

Global parcel shipment volumes reached new highs last year. In the United States, annual parcel volume hit 23.8 billion packages, rising 4% from 2023 and 50% from 2019. This surge in e-commerce has increased pressure on last-mile logistics, which now accounts for 53% of total shipping costs.

Customer expectations for fast delivery continue to shape logistics strategies. About 78% of consumers expect online purchases within two days, while next-day delivery is becoming standard.

Same-day delivery is also growing in demand for time-sensitive purchases. Companies like Amazon and Walmart are scaling same-day and next-day capabilities to meet these expectations.

Retailers must refine delivery routes, position inventory strategically, and offer real-time tracking for easy fulfillment. Walmart uses its store network for local order fulfillment, relying on its gig-driver platform, Walmart Spark, for fast delivery. Likewise, Target employs a similar model with Shipt and new sortation centers to streamline same-day and curbside orders.

Besides, urban areas increasingly use cargo e-bikes and scooters to bypass traffic and lower costs. Drone delivery is also moving from pilot programs to commercial scale. Alphabet’s Wing has partnered with DoorDash to enable drone deliveries from local hubs, reporting more than 450 000 commercial deliveries globally.

As these innovations expand, the global last-mile delivery market is projected to grow from USD 176.99 billion in 2025 to USD 373.92 billion by 2033, with a CAGR of 9.8% over the forecast period.

QuickShipper builds Delivery Management Software

Georgian startup QuickShipper provides software that streamlines last-mile logistics for businesses with or without dedicated fleets. It aggregates orders from multiple sales channels and automates dispatch. The software calculates optimal delivery routes, batches nearby orders, and assigns tasks based on courier availability and proximity.

The startup supports in-house fleets and third-party logistics (3PL) providers. It offers features like branded customer communication, real-time tracking, automated order assignment, and flexible salary options for couriers.

Businesses access the platform via web or mobile, or integrate it with e-commerce platforms like WooCommerce through API and plug-ins. The startup also provides analytics dashboards that monitor delivery performance, cost drivers, and customer experience metrics.

Vaive Logistics manufactures an Autonomous Delivery Vehicle

Spanish startup Vaive Logistics develops Ona, an autonomous electric delivery vehicle series for last-mile logistics in urban and pedestrian areas. Ona uses robotics and sensors to navigate unstructured environments like city centers, superblocks, and pedestrian zones.

Ona-1 handles small parcel distribution with a compartmentalized storage system and automated delivery mechanism. Ona-2 transports larger cargo, which makes it suitable for logistics hubs and industrial zones. Both models operate quietly and emission-free, supporting urban mobility goals.

8. Internet of Things

IoT plays a key role in modern supply chains by enabling real-time monitoring of shipments, inventory, and equipment. Sensors and trackers send continuous data to control towers for companies to respond quickly to delays and disruptions. This improved visibility supports faster decision-making and enhances logistics agility.

Beyond tracking, connected devices improve safety and compliance by automating manual processes and ensuring regulatory adherence. IoT sensors log storage conditions like temperature and humidity, which is critical for perishable goods and pharmaceuticals. These automated records reduce human error and support compliance across global markets.

FedEx enhances shipment tracking with its SenseAware ID solution. The system uses Bluetooth low energy (BLE) sensors to transmit package location updates every two seconds to nearby WiFi or gateway devices. This provides hundreds of updates per shipment, compared to the limited data from traditional scanning.

Maritime logistics are also benefiting from IoT. Maersk’s smart containers provide continuous updates on location and environmental conditions. The company expanded its capabilities by partnering with ZEDEDA this year to implement advanced IoT connectivity across its global fleet.

By integrating real-time sensor data into virtual models, digital twins simulate decisions before implementation like adjusting factory locations or re-routing shipments. These simulations improve risk forecasting and support strategic planning.

The rollout of 5G is also accelerating IoT adoption. Dense connectivity supports up to one million IoT device per square kilometer. This benefits ports, warehouses, and smart factories. The low latency and high bandwidth of 5G improve video streaming and enhance control over autonomous vehicles, robots, and drones in logistics.

The supply chain IoT market is expected to reach USD 55.58 billion by 2031, growing at a CAGR of 12.70% during the forecast period from 2024 to 2031.

FreshSens makes Storage Boxes with IoT Sensors

Estonian startup FreshSens provides a storage platform that extends the shelf life of fresh produce and improves inventory management.

The platform integrates wireless sensors into controlled atmosphere (CA) storage bins. The special membranes regulate oxygen and carbon dioxide levels to slow respiration and delay ripening without chemicals.

Further, sensors track temperature, humidity, gas levels, and respiration rates, and send real-time data to a cloud-based system. This allows users to receive alerts through a web dashboard or mobile app when conditions shift beyond optimal ranges for immediate corrective actions. This enables growers and exporters to prioritize batch sales.

Connected Load Carrier builds IoT-based Asset Management Systems

Dutch startup Connected Load Carrier offers The Travelling Asset Network, an IoT-as-a-Service platform for asset tracking in complex supply chains.

The platform combines sensor-equipped devices, various connectivity options, and data processing to monitor high and low-value assets in real time. It integrates with existing infrastructure and adjusts sensor costs based on asset value to make large-scale tracking cost-effective.

Its centralized dashboard offers predictive insights, environmental monitoring, and operational optimization by identifying bottlenecks and improving inventory turnover. The platform also supports circular economy principles and responsible asset usage for industries like transport, logistics, asset pooling, and warehouse management.

9. Cold Chain Innovations

Biologic therapies, including monoclonal antibodies, gene therapies, and mRNA vaccines, require strict temperature regulation. Nearly half of new pharmaceuticals need cold storage, and 45% of the top 20 global drugs by sales are temperature-sensitive.

Globalization of the food supply and changing consumer preferences are also driving demand for temperature-controlled transportation. Artyc’s Chain Reaction report estimates that 40% of the world’s food relies on refrigerated logistics to stay fresh. The rise of e-commerce has increased online orders for fresh produce, meat, and chilled meals, with consumers expecting them in optimal condition.

To meet this demand, logistics providers are expanding cold chain infrastructure. In 2024, DHL allocated EUR 2 billion over five years to enhance life sciences logistics. Its plan includes new temperature-controlled warehouses, advanced equipment, and insulated air cargo containers for medical shipments.

Further, UPS strengthened its pharmaceutical distribution network by acquiring European cold logistics firms Frigo-Trans and BPL.

Lineage Logistics, the largest cold storage operator, continues to advance automation. In late 2024, the company opened a 386 000-square-foot fully automated cold warehouse in Hazleton, Pennsylvania. The facility includes 85 000 pallet positions, robotic cranes, rail-guided vehicles, and AI-powered systems for efficient storage and retrieval in sub-zero conditions.

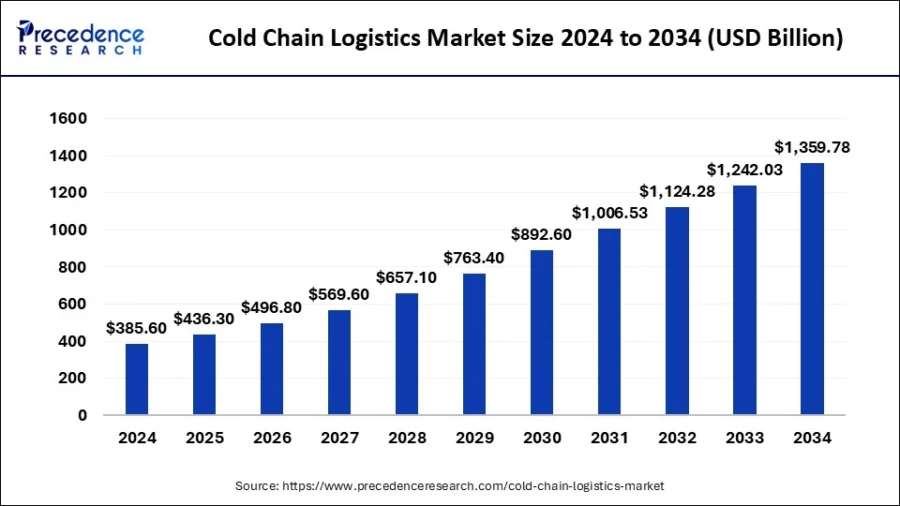

The global cold chain logistics market is expected to expand from USD 436.30 billion in 2025 to USD 1359.78 billion by 2034, reflecting a CAGR of 13.46% during the forecast period.

Credit: Precedence Research

Tecsence Cold Chain manufactures Refrigeration & Freezing Equipment

Chinese startup Tecsence Cold Chain builds refrigeration and freezing equipment for medical, biological, commercial, and retail applications. Its product range includes cooling series such as PC, SC, BC, LSC, SD, SCD, SM, AI, and YLPC, each suited for specific temperature control needs.

The equipment features technologies to maintain precise temperature regulation, improve energy efficiency, and ensure reliability. Tecsence also provides specialized equipment, including mold systems, injection molding machines, and assembly facilities, to support various operational requirements.

SnoFox Sciences develops a Thermodynamically Informed Data Analytics Platform

US-based startup SnoFox Sciences provides a data analytics platform that creates a live digital twin of industrial refrigeration facilities using schematics and sensor data. It models cooling systems based on physical principles and then integrates real-time sensor inputs to monitor operational modes and calculate metrics like refrigeration output and refrigerant flow rates.

The platform’s proprietary algorithms identify inefficiencies, detect underperforming equipment, and benchmark performance against optimal standards. SnoFox Sciences delivers insights at operational and executive levels, which allows businesses to make informed decisions on energy consumption, maintenance, and system optimization.

10. Warehouse Automation

Labor shortages and rising costs continue to challenge global supply chains, especially in warehouse operations.

For instance, the US warehousing employment grew from 707 000 workers in 2013 to 1.93 million in 2023, but expansion slowed in late 2022 due to limited labor availability. As supply chains recover, companies struggle to hire and retain skilled workers.

Cainiao is advancing automated logistics infrastructure. In fiscal 2024, the startup’s network of parcel hubs and cross-border sorting centers shipped over 5 million international packages daily. That year, it opened Vietnam’s largest automated sorting facility, which uses AI-driven sortation and computer vision for 99% accuracy in parcel routing.

Autonomous mobile robots (AMRs) are also now essential in warehouses. Unlike automated guided vehicles (AGVs) that follow fixed paths, AMRs use sensors and AI to navigate dynamically. These robots perform order picking, transport goods, and monitor inventory. DHL’s partnership with Robust.AI to pilot the “Carter” AMR highlights the shift toward flexible automation.

Further, Amazon’s Sparrow robot arm, powered by AI vision, recognizes various products and assembles customer orders. These systems handle high SKU complexity and enhance fulfillment scalability.

AI-driven warehouse software is also transforming operations. Warehouse management systems (WMS), warehouse execution systems (WES), and analytics platforms now coordinate tasks between human workers and machines to optimize throughput and resource allocation.

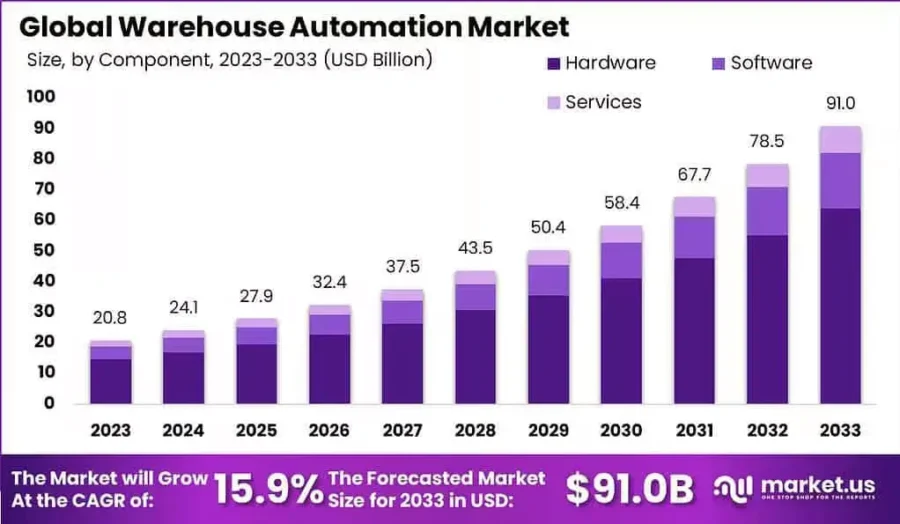

With labor constraints and increasing service expectations, the global warehouse automation market is expected to grow to USD 91.0 billion in 2033, reflecting a CAGR of 15.9% over the forecast period 2023 to 2033.

Credit: Market.Us

Onomatic builds a Warehouse Automation Orchestration Platform

Canadian startup Onomatic provides a platform that integrates legacy equipment with modern automation technologies to create a scalable warehouse control system. The platform connects with ERP and WMS systems to convert orders into optimized tasks. It distributes these tasks across conveyors, robotics, and light-directed systems without costly custom integrations.

The startup enables real-time workflow control and simplifies the onboarding of new equipment. Its vendor-agnostic architecture adjusts to operational needs. Through its SaaS subscription model, Onomatic reduces the need for repeated integration projects and provides predictable automation costs.

InLog Robot makes a Warehouse Shuttle System

Turkish startup Inlogrobot develops a multi-shuttle system that automates storage, retrieval, and order fulfillment. Shuttle robots move bins weighing up to 30 kg along horizontal tracks. The vertical lifts transfer these bins to goods-to-person (GTP) stations for order assembly.

The startup’s integrated software coordinates movements and optimizes task assignments based on order volume and system configuration. The system processes multiple orders simultaneously, averaging 200 per hour. It also connects with e-commerce platforms and ERP systems to streamline operations.

Inlogrobot provides benefits like better storage density, lower manual labor, improved order accuracy, and scalability for changing operational demands.

Discover all Supply Chain Trends, Technologies & Startups

Supply chain management is evolving with advances like digital twins, circular supply chains, and autonomous delivery systems. Digital twins enable real-time simulation and stress testing of supply networks to improve decision-making and resilience. Circular supply chains are also becoming more common, prioritizing reuse, recycling, and reverse logistics to minimize waste and resource consumption. Autonomous delivery systems, including drones and ground robots, are set to transform fulfillment by increasing speed and efficiency.

The Supply Chain Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.

![Explore the 10 Latest Trends in Warehouse Management [2025]](https://www.startus-insights.com/wp-content/uploads/2025/05/Latest-Trends-in-Warehouse-Management-SharedImg-StartUs-Insights-noresize-420x236.webp)

![AI in Supply Chain: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/05/AI-in-Supply-Chain-SharedImg-StartUs-Insights-noresize-420x236.webp)