Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

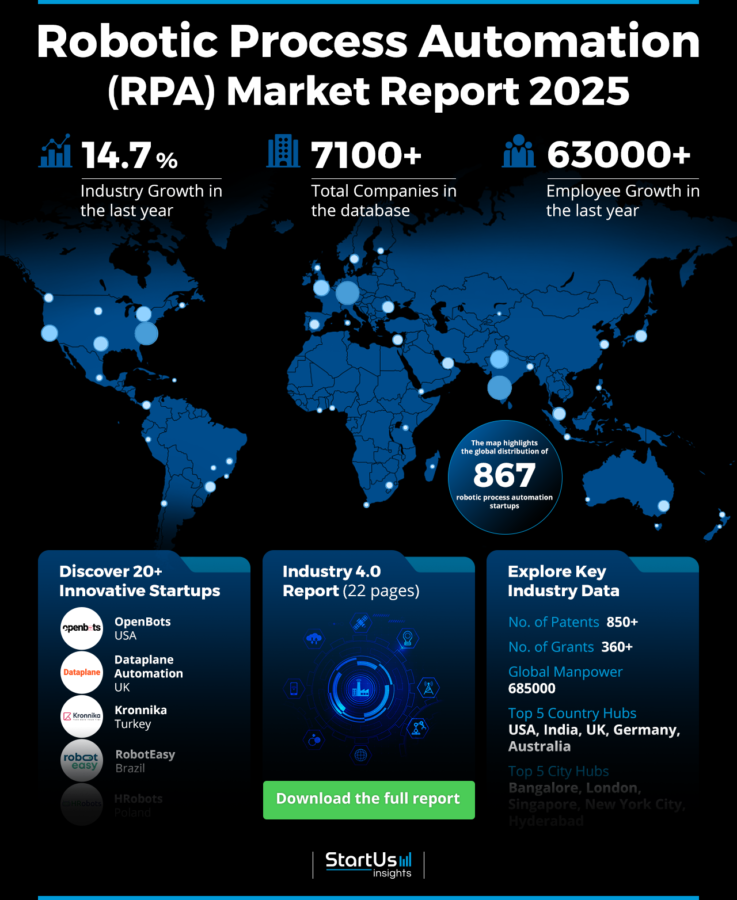

The Robotic Process Automation (RPA) Market Report 2025 highlights the rapid growth of RPA technologies, driving efficiency and cost reduction across industries. It examines key trends like AI bots, sentiment analytics, and investment opportunities while showcasing startups shaping the market’s future. This report offers valuable insights for stakeholders, investors, and policymakers on the market’s trajectory and innovation potential.

This report was last updated in January 2025.

Executive Summary: Robotic Process Automation Market Report 2025

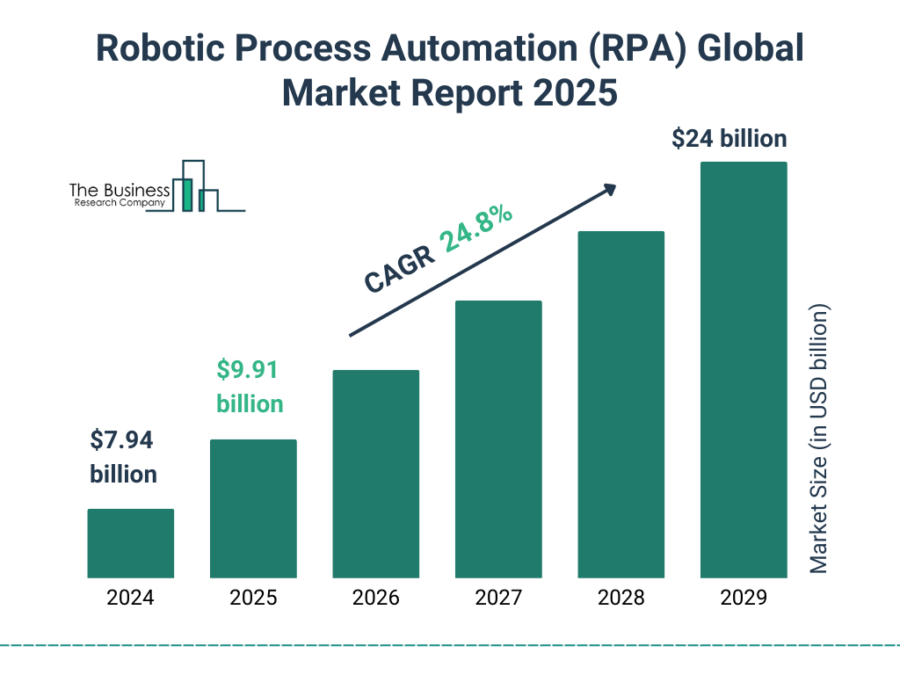

- Industry Growth Overview: The robotic automation process (RPA) market size will grow from USD 9.91 billion in 2025 to USD 24 billion in 2029 at a compound annual growth rate of 24.8%. On a micro level, the robotic process automation market experienced an annual growth rate of 14.70%.

- Manpower & Employment Growth: The RPA market employs over 685K individuals, with the addition of 63K+ new employees in the last year.

- Patents & Grants: Companies have filed over 850 patents and received more than 360 grants. The patent growth rate is 49.96% yearly, with China and the USA leading in patent issuance.

- Global Footprint: The RPA market demonstrates a diverse global presence, with key hubs in the USA, India, UK, Germany, and Australia, while major city hubs encompass Bangalore, London, Singapore, New York City, and Hyderabad.

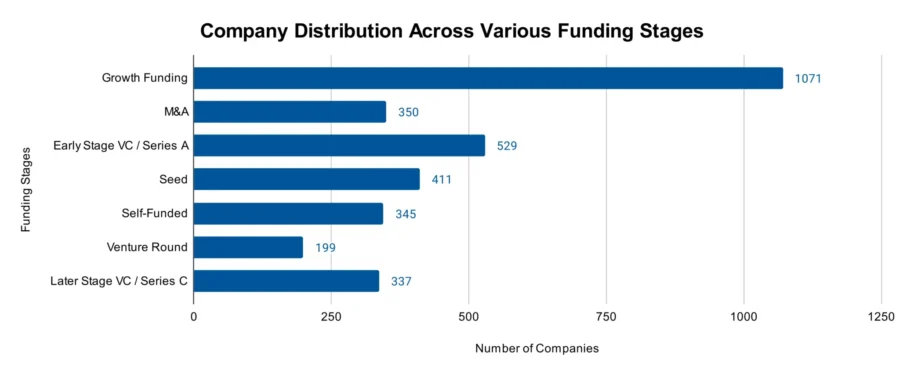

- Investment Landscape: The funding landscape has seen more than 3310 funding rounds, with an average investment value of USD 18 million per round. More than 2K investors are actively involved.

- Top Investors: Key investors are AIM Aerospace, Quebec Deposit and Investment Fund, Stone Point, and more have collectively invested over USD 2.5 billion.

- Startup Ecosystem: Five innovative startups, OpenBots (patient data automation), Dataplane Automation (data-driven automation platform), Kronnika (billing management for the energy sector), RobotEasy (robot management and workflow orchestration), and HRobots (HR document management for HR processes), showcase the market’s global reach and entrepreneurial spirit.

Methodology: How We Created This Robotic Process Automation Market Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of RPA over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within robotic process automation

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the robotic process automation market.

What Data is Used to Create This Robotic Process Automation Report?

Based on the data provided by our Discovery Platform, we observe that the RPA market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The RPA market received coverage in over 2680 publications within the last year.

- Funding Rounds: Our database contains data on more than 3310 funding rounds.

- Manpower: The workforce in the robotic process automation domain exceeds 685K workers, with an addition of over 63K new employees in the past year.

- Patents: The market holds more than 850 patents.

- Grants: More than 360 grants have been awarded within the robotic process automation market.

- Yearly Global Search Growth: The RPA market experienced a yearly global search growth of 63.90%.

Explore the Data-driven Robotic Process Automation Market Report for 2025

As per The Business Research Company report, the robotic automation process (RPA) market size will grow from USD 9.91 billion in 2025 to USD 24 billion in 2029 at a compound annual growth rate of 24.8%.

The RPA market report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

With 860+ startups and over 7100 total companies, the RPA market demonstrates a vibrant landscape. This segment highlights a major growth of 14.70% over the past year.

Credit: The Business Research Company

Additionally, the global workforce has also expanded and is at approximately 685K professionals, with an increase of 63K+ employees in the last year. The heatmap also highlights the top five country hubs as the USA, India, UK, Germany, and Australia.

The key city hubs such as Bangalore, London, Singapore, New York City, and Hyderabad have emerged as centers of robotic process automation activity.

Asia-Pacific is projected to be the fastest-growing RPA market, driven by rising adoption in pharma, healthcare, IT, retail, and manufacturing.

A Snapshot of the Global Robotic Process Automation Market

The robotic process automation domain demonstrates an annual growth rate of 14.7%. It has 860+ startups which indicates a vibrant entrepreneurial ecosystem.

Among these, over 430 early-stage startups are developing innovative solutions, while more than 300 mergers and acquisitions have occurred.

The RPA market has secured over 850 patents, with more than 110 applicants contributing to this innovation landscape. Moreover, the yearly patent growth rate stands at 49.96%.

China leads as the top issuer of patents with over 400 grants, followed by the USA with more than 350 patents.

Explore the Funding Landscape of the Robotic Process Automation Market

The average investment value of USD 18 million per funding round reflects major financial interest. More than 2K investors actively participate in this RPA market. The total number of funding rounds closed exceeds 3310.

Additionally, these investors have collectively invested in over 800 companies which showcases the widespread interest and potential within the robotic process automation segment.

Who is Investing in the Robotic Process Automation Market?

The top investors in the robotic process automation market have collectively invested more than USD 2.51 billion.

- AIM Aerospace invested USD 510 million in at least 1 company. Future Flight Global and ANRA partnered to advance AAM, strengthening AIM Aerospace’s eVTOL presence.

- Quebec Deposit and Investment Fund invested USD 500 million in at least 1 company. Canada and Quebec renewed the USD 2.8 billion Canada community-building fund for Quebec municipalities over the next decade.

- Stone Point contributed USD 340.6 million across 3 companies. Stone Point Capital agreed to acquire a majority stake in Kestra Holdings, managing USD 117 billion in assets.

- Altas Partners invested USD 333.3 million in at least 1 company. Altas Partners invested USD 1 billion in Sedgwick, valuing the claims management firm at USD 13.2 billion.

- Carlyle Group contributed USD 333.3 million to at least 1 company. Carlyle partnered with North Bridge ESG, committing USD 1 billion for C-PACE loan origination.

- SMBC Nikko Securities Japan invested USD 275.1 million in at least 1 company. SMBC Nikko co-managed Otsuka’s USD 136 million Green Bond and GS Yuasa’s USD 68 million sustainability-linked bond.

- Sumeru Equity Partners invested USD 220 million in at least 1 company. Sumeru invested USD 330 million in JobNimbus, a Utah SaaS firm for roofing, to scale operations and expand products.

Further, GreyOrange raised USD 135 million in Series D, totaling over USD 428 million in funding for its warehouse robotics platform.

Top Robotic Process Automation Innovations & Trends

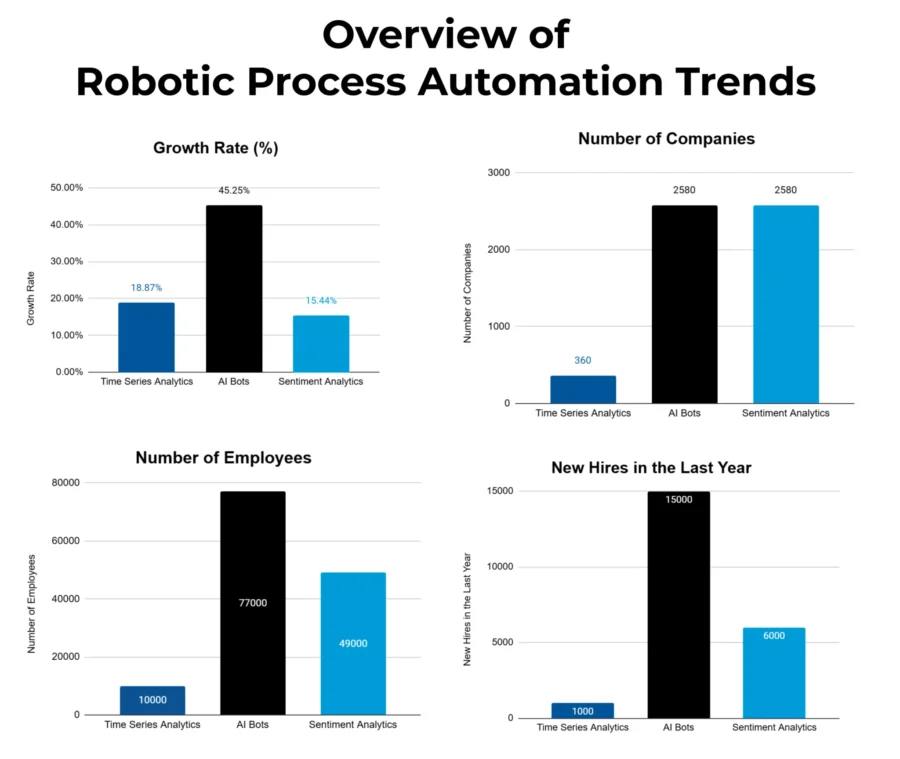

This section highlights the top three trends in the robotic process automation market, supported by firmographic data.

- Time Series Analytics includes over 360 total companies actively engaged. Collectively, these companies employ more than 10K workers, with over 1K new employees joining in the last year. This market showcases an annual growth rate of 18.87%, indicating a growth fueled by RPA solutions that automate data collection, cleaning, and analysis, for more accurate insights.

- AI Bots have seen a substantial presence, with more than 2580 companies identified. This domain employs over 77K individuals, reflecting a major workforce. In the past year, this segment added more than 15K new employees. The annual growth rate of 45.25% highlights the rising adoption of AI bots to automate repetitive tasks and increase productivity across industries.

- Sentiment Analytics represents a growing segment, with 1310+ companies engaged in this domain. These companies employ over 49K workers, with approximately 6K+ new employees hired in the last year. This market exhibits an annual growth rate of 15.44%, indicating the increasing demand for technologies that analyze customer opinions, and improve decision-making, and user experience.

5 Top Examples from 860+ Innovative Robotic Process Automation Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

OpenBots simplifies Patient Data Automation

US-based startup OpenBots automates healthcare administrative tasks by providing prebuilt and configurable RPA solutions.

The startup’s platform integrates AI-driven automation with ready-to-deploy document classification and extraction models.

It aligns processes like lab report and prescription data entry, payment posting, and accounts receivable follow-ups.

Additionally, through pre-built automation templates and document models, OpenBots enable rapid deployment for faster implementation and quicker return on investment (ROI).

Further, the platform improves claims validation and reduces the transaction rate for claim processing.

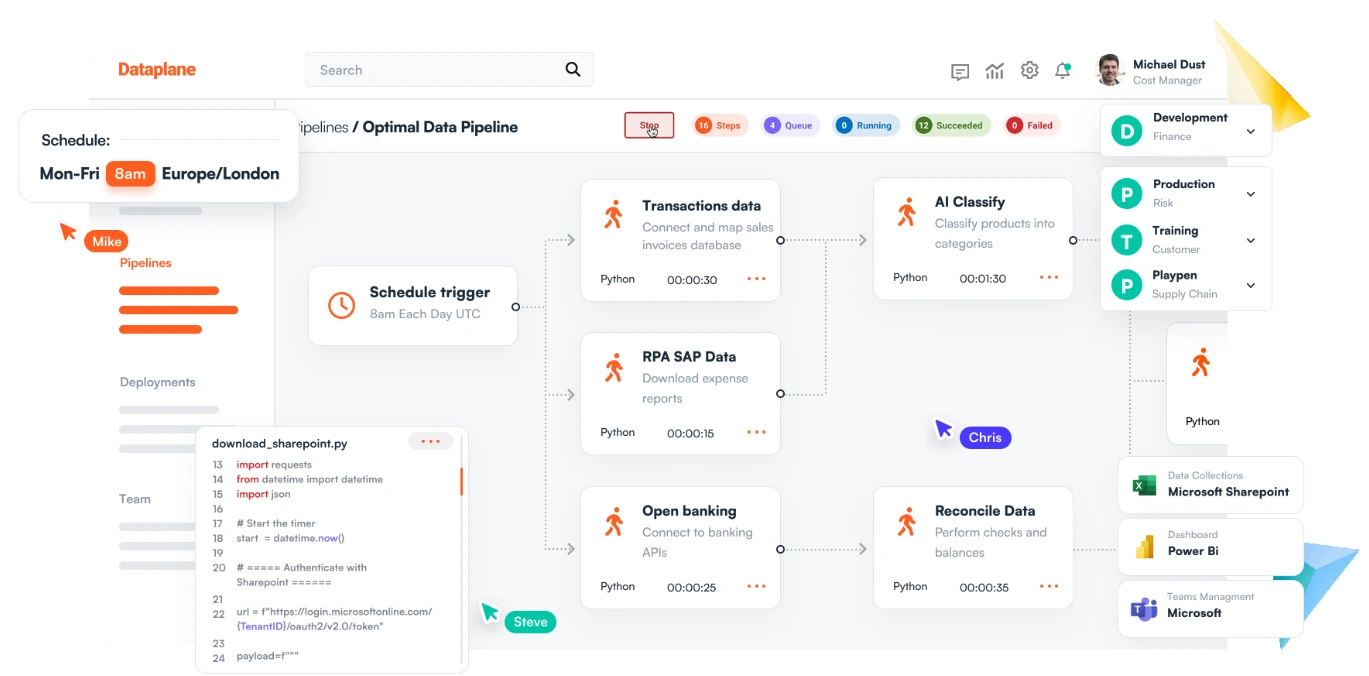

Dataplane Automation offers a Data-Driven Automation Platform

Dataplane Automation is a UK-based startup that provides a data-driven automation platform for financial processes. It reduces the time finance teams spend on repetitive tasks such as data entry, report preparation, and reconciliation.

The platform integrates with existing financial systems to automate processes like journal creation, transaction reconciliation, and invoice matching.

It also features custom tools like budgeting, forecasting, cash flow management, and tax preparation to streamline workflows and financial decision-making.

By automating manual tasks, Dataplane enables finance teams to focus on value-added activities, such as strategic analysis and business insights.

Kronnika enables Automated Billing Management for the Energy Sector

Kronnika is a Turkish startup that automates complex business processes using RPA. It offers solutions for email processing, web scraping, application programming interface (API) automation, optical character recognition (OCR), desktop automation, and more.

By using its robotic libraries and scalable robot farms, Kronnika automates key business processes such as transferring data between systems (data migration), onboarding new customers, processing invoices quickly, and generating accurate reports.

Additionally, its software robots find applications in the telecommunications, healthcare, finance, retail, and logistics industries.

RobotEasy aids in Robot Management and Workflow Orchestration

Brazilian startup RobotEasy offers a platform that automates business processes. The company offers two products, Studio RobotEasy and Orchestrator RobotEasy.

Studio RobotEasy provides a low-code, drag-and-drop interface for building robots, with a built-in studio recorder feature to automatically generate robots by recording processes.

Its AI capabilities enable functions, such as solving captchas and interpreting documents using optical character recognition.

Further, Orchestrator RobotEasy handles the management and monitoring of robot executions for easy scheduling and oversight.

Together, these products improve efficiency, reduce errors, and allow businesses to scale operations with automated workflows.

HRobots simplifies HR Document Management for HR Processes

Polish startup HRobots offers eFOB, a platform that provides robotic process automation solutions for HR, finance, and sales.

It stores all employee-related documents, including contracts, annexes, certificates, and applications, in a secure cloud-based system.

eFOB also automates various HR processes like document generation, optical character recognition-based reading, and electronic signature management.

This platform features advanced search capabilities for businesses to find documents by name, date, or tags, and enable easy document retention and management.

Additionally, the flexible configuration of approval workflows streamlines document approval processes.

Gain Comprehensive Insights into Robotic Process Automation Trends, Startups, or Technologies

In 2025, the robotic process automation market will expand as advancements in cognitive automation, intelligent document processing, and AI-driven decision-making accelerate.

Autonomous process orchestration and hyper-automation strategies will streamline complex workflows, allowing businesses to adapt quickly to market changes and reduce reliance on manual tasks. These shifts will optimize processes, introduce growth opportunities, and keep organizations competitive.

Get in touch to explore all 860+ startups and scaleups, as well as all industry trends impacting 7100+ companies.

![10 Top Digital Twin Startups and Companies for Industry 4.0 [2025]](https://www.startus-insights.com/wp-content/uploads/2025/06/Digital-Twin-Startups-for-Industry-4.0-SharedImg-StartUs-Insights-noresize-420x236.webp)