The recycling report presents an industry that plays a significant role in fostering environmental sustainability by converting waste materials into useful resources. The report delves into the present condition of the recycling industry, underlining key trends, challenges, and innovations that contribute to its expansion. It also investigates the firmographic data, investment patterns, influence of regulatory structures, market forces, and more.

The report was last updated in January, 2025.

This recycling industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

Executive Summary: Recycling Industry Report 2025

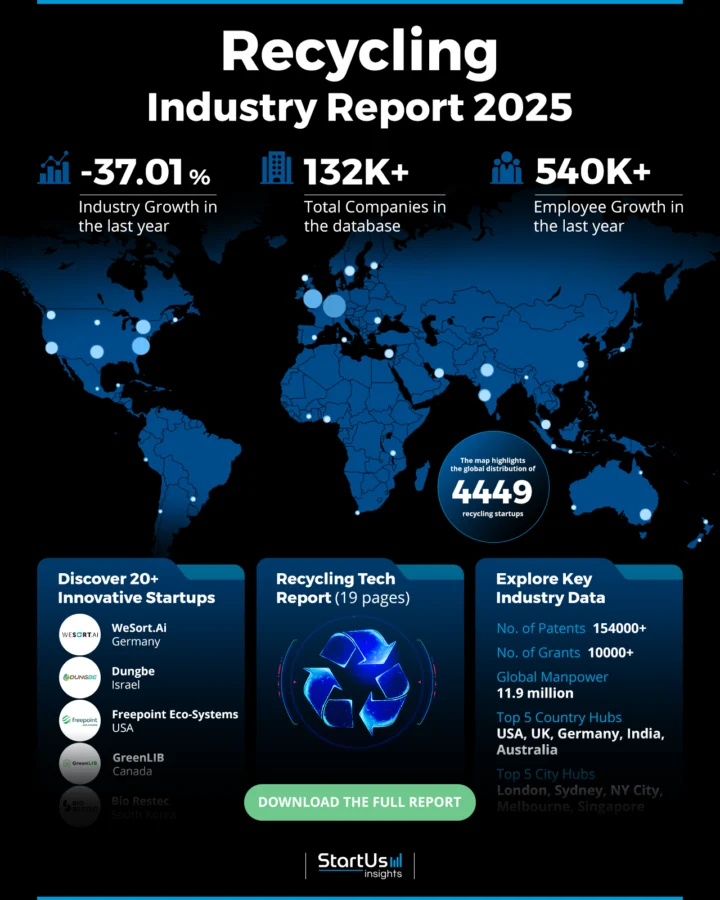

- Industry Growth Overview: The recycling industry has seen a growth rate of -37.01% in the last year and comprises more than 132000 companies.

- Manpower & Employment Growth: The sector employs 11.9 million individuals, with an increase of 540 000 employees in the previous year. The US recycling industry generates USD 117 billion in economic activity annually and accounts for 681 000 jobs.

- Patents & Grants: The industry’s innovative efforts are evident from the 154000 patents filed and over 10 000 grants received.

- Global Footprint: Key hubs are in the US, UK, Germany, India, and Australia. Significant city hubs include London, Sydney, New York City, Melbourne, and Singapore. China’s paper recycling market is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2034, driven by its large pulp and paper industry and emphasis on domestic supply.

- Investment Landscape: The typical investment value per round stands at USD 47.2 million. The industry has drawn the interest of over 8500 investors, with more than 23 000 funding rounds completed.

- Top Investors: Institutions such as the European Investment Bank, HSBC, and Fasanara Capital, among others, have invested a total exceeding USD 10 billion.

- Startup Ecosystem: The report features innovative startups like WeSort.Ai (AI-based Analytics & Sorting), Dungbe (Molecular Dismantling), Freepoint Eco-Systems (Recycling Waste Plastic), GreenLIB (Material Upcycling), and Bio Restec (Energy Sources from Waste).

Methodology: How we created this Recycling Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports. Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies, and market trends.

For this report, we focused on the evolution of recycling over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the recycling sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the recycling market.

What data is used to create this recycling report?

Based on the data provided by our Discovery Platform, we observe that the recycling industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The news coverage and publications of the industry have reached 51 000 in the previous year.

- Funding Rounds: Our database contains data on over 23 000 funding rounds for recycling companies.

- Manpower: The industry provides employment to over 11.9 million workers and saw an increase of more than 540000 employees in the previous year.

- Patents: There are over 154 000 patents filed in the recycling sector.

- Grants: Over 10000 grants have been given to recycling initiatives.

- Yearly Global Search Growth: The industry has seen a yearly global search growth of 9.44%.

- and more. Book a demo to explore all data points used to create this recycling report.

Explore the Data-driven Recycling Report for 2025

The heatmap shows the distribution and growth trends in the recycling industry. Our database includes 4400+ startups and over 132 000 companies in total. The industry saw growth in the previous year, marked by the addition of over 540 000 employees. Innovation continues to be a significant factor, with more than 154 000 patents filed and over 10 000 grants received.

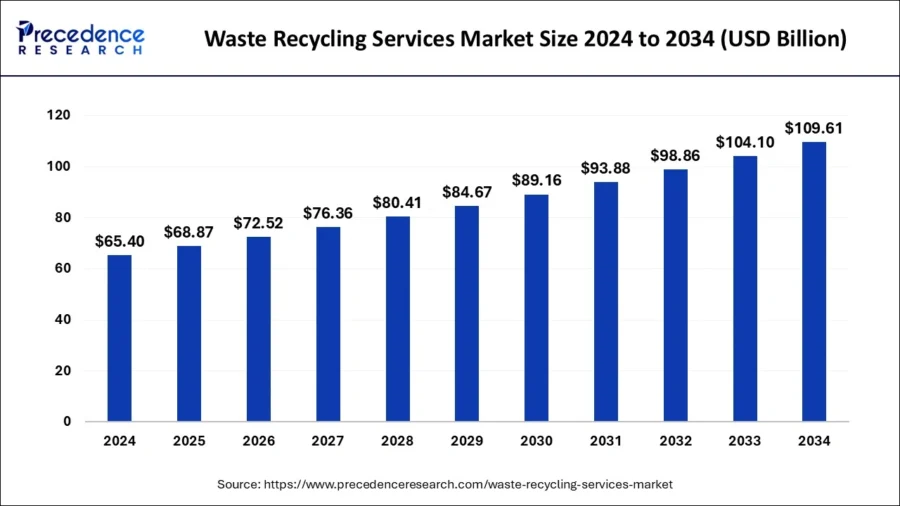

The global waste recycling services market size is anticipated to reach around USD 109.61 billion by 2034, growing at a CAGR of 5.30% from 2025 to 2034.

Credit: Precedence Research

The global workforce in this sector is 11.9 million individuals. Hubs contributing to this growth are the United States, the United Kingdom, Germany, India, and Australia. India’s plastics recycling market is projected to reach 23.7 million tonnes by 2032, growing at a CAGR of 9.86%. City hubs like London, Sydney, New York City, Melbourne, and Singapore highlight the geographical distribution and the importance of the recycling industry’s development.

A Snapshot of the Global Recycling Industry

The recycling industry shows growth across multiple dimensions. With a workforce of 11.9 million individuals, the industry has expanded by adding 540 000 new employees in the last year. The sector includes over 132 000 companies, indicating a wide presence in the global market.

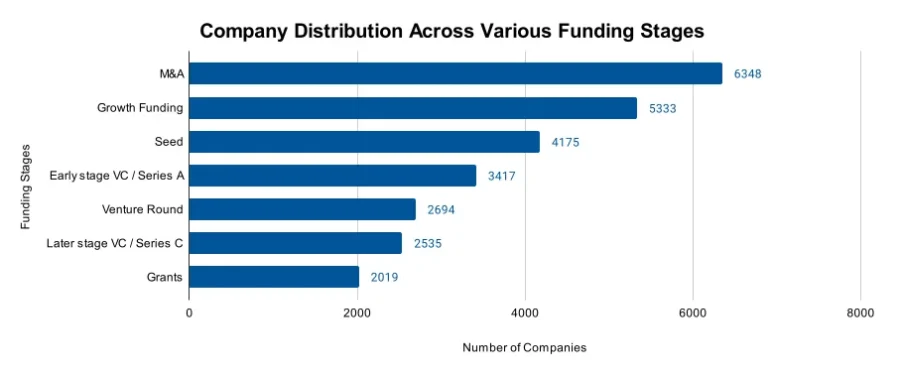

Explore the Funding Landscape of the Recycling Industry

Investment activity within the recycling industry is evident, with an average investment value of USD 47.2 million per round. The industry has attracted more than 8500 investors and has seen over 23 000 funding rounds closed.

These investments have been directed towards more than 10300 companies, indicating a commitment to fostering innovation and growth within the sector.

Who is Investing in Recycling Companies and Technologies?

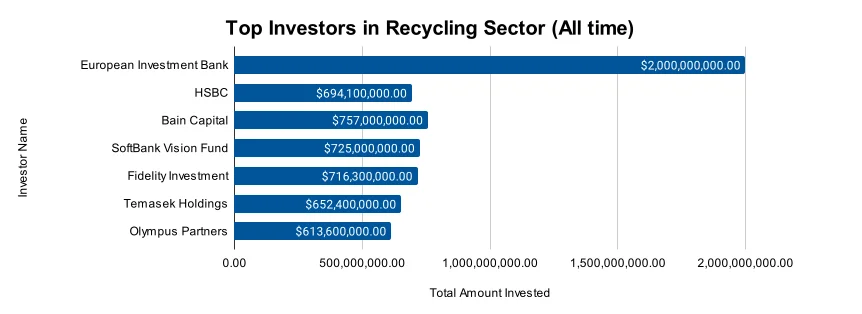

The recycling industry has seen an influx of investment from financial institutions and investors, highlighting its role in promoting sustainability. The combined value invested by these investors exceeds USD 10 billion.

- The European Investment Bank has invested USD 2 billion in 16 companies, showing its support for advancing recycling technologies and operations. It signed a USD 41.93 million loan agreement with Renewi to invest in recycling facilities in Belgium and the Netherlands.

- HSBC has directed USD 694.1 million into 22 companies, contributing to the industry’s growth and innovation. It invested in Bariq, an Egyptian company that recycles plastic bottles into new bottles and packaging materials.

- Bain Capital has contributed USD 757 million across 8 companies, showing a balanced approach to funding companies in recycling. It invested in EcoCeres, a biorefinery company that converts waste-based biomass into biofuels and biochemicals.

- SoftBank Vision Fund has invested USD 725 million in 4 companies, supporting projects within the sector.

- Fidelity Investment allocated USD 716.3 million to 6 companies showing its commitment to long-term sustainability initiatives. It has released a Fidelity Environment and Alternative Energy Fund (FSLEX), which focuses on companies involved in waste and recycling technologies, among other environmental sectors.

- Temasek Holdings has provided USD 652.4 million to 7 companies, aligning with its global investment strategy in green technologies. It co-led a USD 65 million series A+ funding round for Samsara Eco, an Australian enviro tech startup that has developed technology to recycle plastic waste.

- Olympus Partners has contributed, investing USD 613.6 million in 5 companies.

Access Top Recycling Innovations & Trends with the Discovery Platform

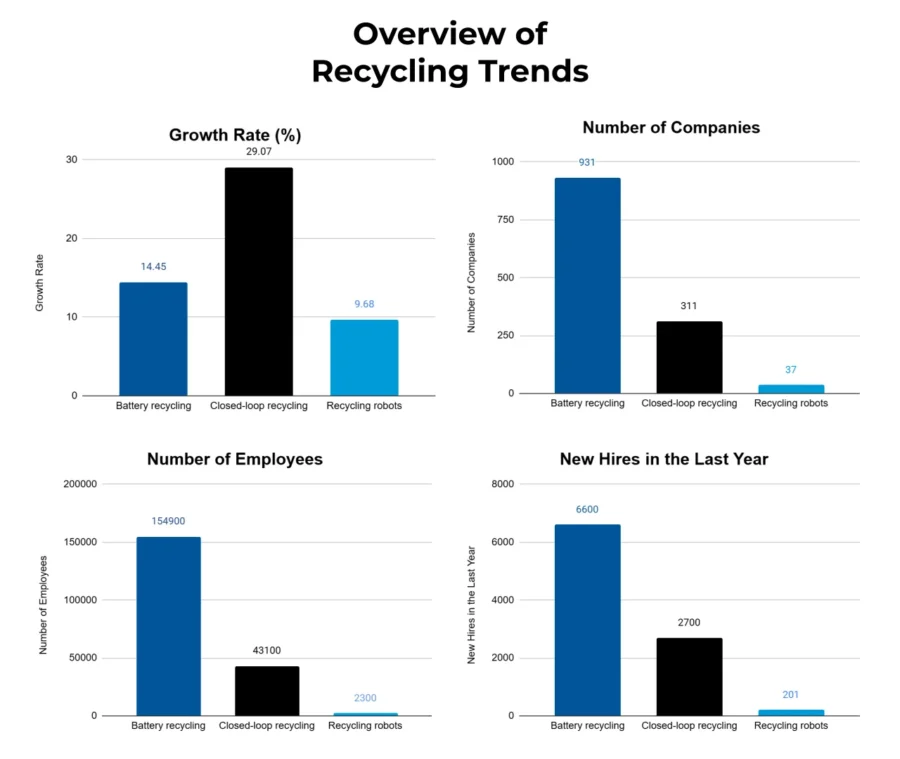

Emerging trends are transforming the recycling industry landscape. Here are a few of them, along with the firmographic insights:

- Battery recycling is a notable trend in the recycling industry, influenced by the growing demand for sustainable energy solutions. The sector comprises 931 companies, employing 154 900 individuals. It has also grown, adding 5600 new employees in the past year. Further, this trend experienced a growth rate of 14.45 % in the last year.

- Closed-loop recycling is a trend that emphasizes the continuous reuse of materials within production cycles. There are 311 companies involved in closed-loop recycling, employing a total of 43 100 people. The industry has experienced growth, with 2700 new employees added in the past year. Its 29.07% annual growth rate underscores an industry striving to reduce waste and enhance resource efficiency.

- The application of recycling robots is an emerging trend that utilizes automation and AI to improve recycling efficiency. Despite only 37 companies currently identified in this area, they employ 2300 individuals. The sector has experienced growth, with 201 new employees added in the past year. The annual growth rate of 9.68% signifies the growing interest in and use of robotic solutions in recycling operations.

5 Top Examples from 4400+ Innovative Recycling Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a platform demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

WeSort.Ai offers AI-based Analytics & Sorting

German startup WeSort.AI specializes in granular analysis and sorting of waste objects in recycling facilities. This deep-learning technology identifies a wide array of objects, from bottles and food to electrical appliances and silicone cartridges.

The Easy-NIR feature adds another layer of detail, identifying weight, size, shape, material type, damage, and color. The AI-based Sensor & Analysis module combines cost-effective hardware, NIR, and digital camera systems. Real-time process monitoring is enabled through dashboards, providing immediate insights into material flows and alerting to faults, hazards, and unusual events.

The system also offers a pneumatic Sorting Module, which expands the AI sensors’ capabilities and uses air pressure nozzles to eject selected objects.

Dungbe enables Molecular Dismantling

Israeli startup Dungbe develops a recycling technology that turns municipal solid waste (MSW) into a new thermoplastic raw material. This technology eliminates the need for pre-sorting, cleaning, and preparing waste for recycling. It handles everything from organic waste to paper, wood, plastic, and food. Further, it also tolerates high moisture levels in the waste and eliminates the need for drying or pre-treatment.

Freepoint Eco-Systems accelerates Recycling Waste Plastic

US-based startup FreePoint EcoSystems develops a system to divert plastic waste from landfills, oceans, and incinerators, promoting a circular reuse pathway. The startup’s advanced recycling process enables the recycling and reuse of a vast majority of plastic types.

High-temperature reactors vaporize plastic waste in an oxygen-free environment, transforming it into a liquid for new plastic creation. The process begins with the aggregation and delivery of post-consumer and post-industrial waste to the facility.

Following this, plastic undergoes separation from other waste materials such as glass, metals, and organics. The plastic is then shredded into smaller pieces, heated, and reduced into pellet form. These pellets are fed into the pyrolysis reactor and vaporized, and the resulting vapors are condensed and liquefied.

GreenLIB enhances Material Upcycling

Canadian startup GreenLIB focuses on upcycling materials such as lithium and graphite from used batteries. The process recovers essential metals and minerals, including iron, cobalt, nickel, copper, aluminum, carbon, and electrolyte.

It adapts to diverse battery chemistries like NMC and LFP/LMFP and employs cost-effective smelting and pyrolysis methods. With eco-friendly operations, effective fluorine management, and waste reduction, the process also minimizes reliance on hazardous waste permits.

It optimizes smelter assets and integrates sustainable hydro-metallurgical processes, supporting environmental objectives.

Bio Restec generates Energy Sources from Waste

South Korean startup Bio-Restec transforms household and industrial waste into carbon-neutral energy. The startup’s HMBT-10TD & HMBT 1TD are hybrid mechanical equipment that simultaneously handles mixing and drying functions through aerobic microbial fermentation technology.

Its VMBT-5TD offers similar capabilities but in a vertical mechanical-biological treatment format. JWZL-688D is an optimal mechanical equipment for converting biomass into pellets. EBP-1 is an alternative energy source offering more energy than wood pellets. Bio-Restec’s process includes classification, shredding, fermentation drying, mixing, and forming machine stages.

Looking for Comprehensive Insights into Recycling Trends, Startups, or Technologies?

The recycling industry is set for ongoing growth and innovation in 2025, influenced by trends like battery recycling, closed-loop recycling, and the use of recycling robots. These developments underscore the industry’s dedication to sustainability and efficiency, indicating a potential transformation in the way materials are reused and managed. Book a platform demo to explore all 4400+ startups and scaleups, as well as all industry trends impacting recycling companies.