Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

In this pharma industry report 2024, you will explore the dynamic industry as a leader in medical innovation. It addresses complex health challenges and enhances global well-being. This analysis uses advanced data analytics to examine current trends, breakthroughs, and the pharmaceutical development’s future.

This report was last updated in July 2024.

The report focuses on the merger of technology and medicine. It shows how data-driven insights boost drug efficacy, personalized medicine, and regulatory compliance. This report is essential for industry professionals, healthcare providers, and policymakers. It also offers an in-depth look at how data transforms healthcare and pharmaceuticals.

StartUs Insights Pharma Industry Report 2024

- Executive Summary

- Introduction to the Pharma Industry Report 2024

- What data is used in this Pharma Industry Report?

- Snapshot of the Global Pharma Industry

- Funding Landscape in the Pharma Industry

- Who is Investing in Pharmaceuticals?

- 5 Pharma Startups impacting the Industry

Executive Summary: Pharma Industry Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 3.7 million global startups, as well as 20K+ technologies and emerging trends across industries. We also analyzed a sample of 2200+ pharma startups developing innovative solutions to present five examples from emerging pharma trends.

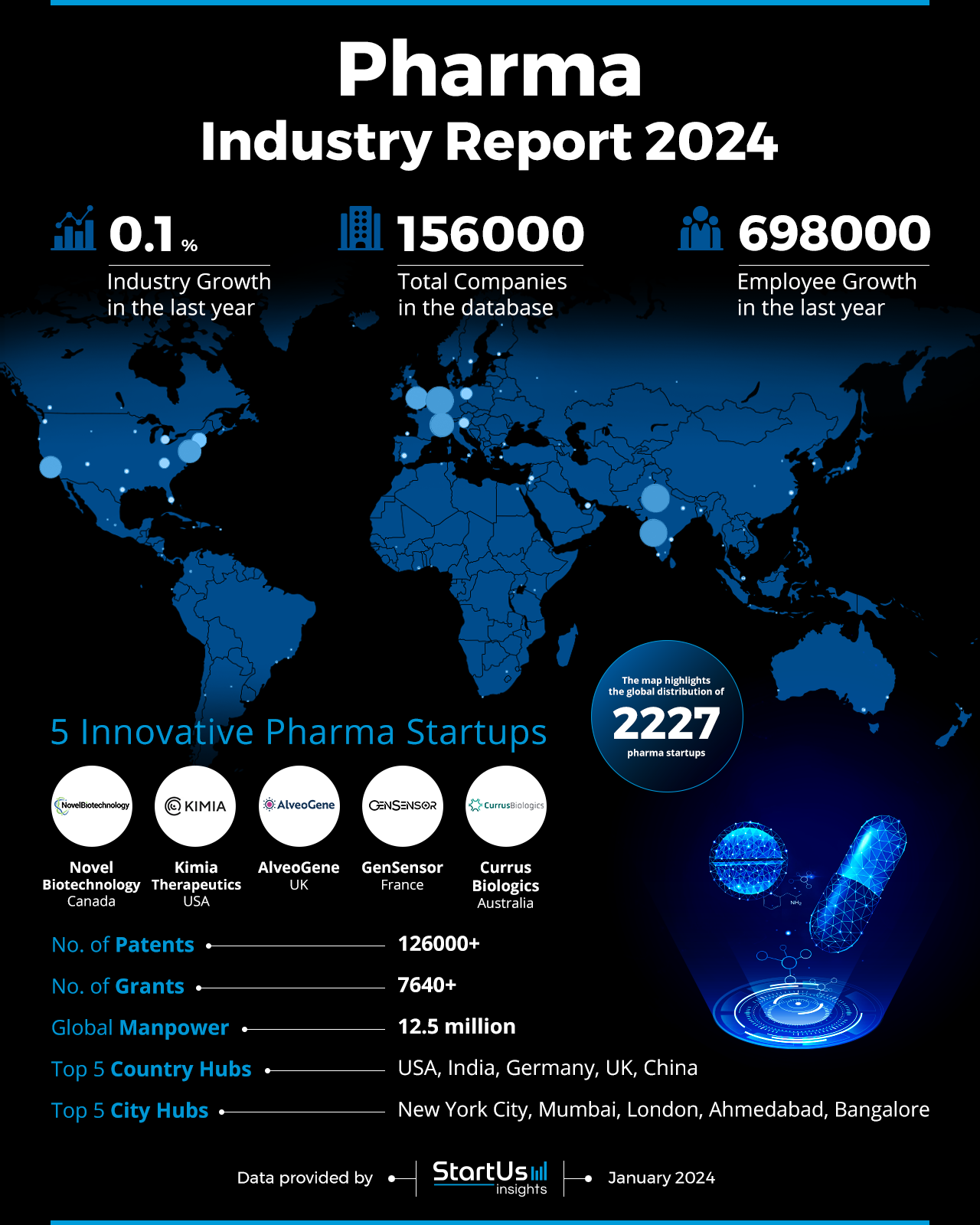

- Industry Dynamics: Despite modest growth of 0.1%, the pharmaceutical sector remains integral, with 156 000 companies and a focus on advancing medical therapies.

- Employment Growth: The creation of 698 000 new jobs within the last year highlights the sector’s expansion and its role as a significant employer.

- Innovation and Patents: Over 126 000 patents were filed, demonstrating the industry’s commitment to R&D and innovation.

- Global Footprint: The sector has a significant presence in the USA, India, Germany, the UK, and China, with major city hubs as central nodes for pharma innovation.

- Investment Landscape: It also boasts an active investment scene with almost 60 000 funding rounds closed with an average investment value of USD 33 million.

- Top Investors: Significant financial input from top investors like RA Capital Management, SoftBank Vision Fund, and OrbiMed, collectively exceed USD 27 billion.

- Startup Ecosystem: Five innovative pharma startups, Novel Biotechnology (Recombinant DNA Technology), Kimia Therapeutics (Nanotechnology), AlveoGene (Gene Therapy), GenSensor (Robotic Bioprocessing Technology), and Currus Biologics (Solid Tumors) showcase the sector’s global reach and entrepreneurial spirit.

- Future Outlook: Continued innovation and growth are expected, driven by global health needs and advancements in pharmaceutical technologies.

- Recommendations for Stakeholders: Focus on continuous innovation, leveraging data-driven insights for drug efficacy and personalized medicine, and aligning with regulatory compliance for future growth.

Explore the Data-driven Pharma Report for 2024

The Pharma Industry Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Despite a very slight increase in industry growth of 0.1% in the last year, the vastness of the sector is evident with 156 000 companies present in the database, showcasing its extensive infrastructure and market presence.

The report notes the creation of 698 000 new jobs within the year, signifying an increase in employment opportunities and reflecting the industry’s resilience and adaptation in a rapidly evolving healthcare landscape.

The report also focuses on innovation, highlighting an impressive tally of over 126 000 patents filed. This underscores the industry’s robust commitment to research and development, crucial for advancing medical science and delivering next-generation therapies. The support for innovation is further evidenced by the awarding of 7600+ grants, which fuel ongoing research and facilitate the advancement of novel pharmaceuticals.

The industry’s manpower stands at 12.5 million globally, with top country hubs in the USA, India, Germany, the UK, and China. This indicates the sector’s broad geographic distribution, as shown in the heat map above. Showcasing five innovative pharma startups, the report illustrates the sector’s active entrepreneurial activity. It also showcases five solutions spanning drug discovery, AI, precision medicine, and specialized therapeutics.

What data is used to create this pharma industry report?

Based on the data provided by our Discovery Platform, we observe that the pharma industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: Last year, the pharmaceutical industry was featured in over 200 000 publications, showing its role in healthcare and medicine research.

- Funding Rounds: The pharma sector’s 60 000 funding rounds show a highly active investment scene, signaling strong financial interest and innovation potential.

- Manpower: Globally, the industry employs over 12.5 million workers and added 698 000+ new jobs last year.

- Patents: With over 126 000 patents filed in the pharmaceutical industry, it highlights a strong commitment to R&D, pushing drug discovery and new therapies.

- Grants: The 7600+ grants awarded to the sector also demonstrate significant support for research, development, and new medical solutions advancement.

- and more!

A Snapshot of the Global Pharma Industry

The pharmaceutical industry is a key part of global healthcare, showing significant growth and substantial investment. Its 12.5 million-strong workforce highlights its scale and role as a major employer globally. Adding 698 000 jobs last year, the industry not only responds resiliently to global health challenges but also expands to meet rising demands for innovation and production in pharmaceuticals.

This data reveals a thriving pharmaceutical industry, marked by strong employment growth, active investment, and a steady capital influx. It’s a sector set for ongoing innovation and growth, driven by a worldwide need to advance healthcare solutions.

Explore the Funding Landscape of the Pharma Industry

Financially, the industry has attracted an average investment of USD 33 million, showing high investor confidence in its profitability. The involvement of over 12 800 investors reflects a diverse and solid investment landscape. This includes stakeholders from venture capital firms to institutional investors, all valuing the strategic importance of pharmaceuticals.

With nearly 60 000 funding rounds closed, the sector presents a dynamic financial environment. This activity level indicates a ripe setting for innovation and growth, with funding supporting initiatives from early drug discovery to late-stage development and market expansion.

Who is Investing in Pharmaceuticals?

The pharmaceutical industry’s growth trajectory is bolstered by the robust investment from top investors. Together, their investments exceed USD 27 billion. This impressive figure reflects the sector’s critical importance and the investors’ confidence in its potential for yielding high returns and contributing to the global health agenda.

- RA Capital Management: it stands out with its USD 5.4 billion investment across 78 companies. Its commitment signals a targeted strategy to support a broad spectrum of pharmaceutical innovation. Its portfolio includes everyone from nascent biotech startups to well-established drug manufacturers.

- SoftBank Vision Fund: with its expansive tech expertise, its investments in the pharma sector stand at USD 4.5 billion across 24 companies. Its involvement underscores the growing intersection of technology and healthcare.

- OrbiMed: investing USD 3.8 billion in 90 companies, OrbiMed shows the industry’s appeal to specialized healthcare investors. Its broad portfolio promotes a wide variety of medical solutions and advancements.

- Deerfield: by directing USD 3.2 billion into 42 companies, it displays a strategic investment approach, covering various drug development and commercialization companies.

- Kohlberg Kravis Roberts (KKR): with USD 3 billion invested in 12 companies, KKR focuses on high-value opportunities. These promise innovation and market leadership in the pharmaceutical sector.

- Hercules Capital: its USD 2.6 billion investment in 38 companies shows a keen interest in the sector’s growth and its potential to deliver healthcare solutions.

- Adams Street Partners: its concentrated USD 2.4 billion investment in 6 companies reflects a strategic, high-stakes approach. This targets companies on the brink of breakthroughs or major expansion.

These top investors are pivotal in driving the pharmaceutical industry forward. They provide the capital that fuels research, development, and global distribution of medical innovations. Their investments are also more than financial endorsements, they show confidence in the industry’s capacity to address pressing healthcare challenges.

5 Top Examples from 2200+ Innovative Pharma Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Novel Biotechnology advances Recombinant DNA Technology

Novel Biologics is a Canadian startup that provides plasmid DNA services including construction, manufacturing, quality control testing, and sequencing. It offers different grades of plasmids for research or pre-clinical use. It offers custom services for each client and includes designing new plasmids, producing cell lines, fermentation, purification, and comprehensive analysis.

Further, the plasmids are delivered with a certificate of analysis and standard operating procedures are followed to ensure quality. The startup’s cloud-based electronic systems further secure data and intellectual property.

Kimia Therapeutics enables Nanoscale Technology-based Drug Discovery

US-based startup Kimia uses high-throughput nanoscale technology to generate libraries of novel compounds. These compounds target proteins implicated in human disease. Through iterative cycles of synthesis and screening, the startup aligns chemical diversity with druggable protein sites to create maps for therapeutic intervention.

However, massive datasets from this process require extensive computational analysis. For this, machine learning algorithms identify patterns that inspire new experiments and discoveries. Kimia integrates these technologies into ATLAS, which stands for AcTive Learning through Automated Synthesis. ATLAS guides Kimia in exploring the chemical universe to develop better medicines.

AlveoGene tackles Respiratory Disease using Gene Therapy

UK-based startup AlveoGene is a startup focusing on transforming outcomes for rare respiratory diseases through inhaled gene therapy. Its technology platform focuses on rare diseases and gene therapy via inhalation to cater to treatments for conditions where existing options are limited.

The startup’s unique design enables targeted high transduction efficiency across the respiratory epithelium and all types of lung cells. Its solution has also been tested in multiple in-vivo models and ex-vivo human tissue. AlveoGene has also demonstrated its scalable manufacturing process.

GenSensor develops Robotics-based Bioprocessing Technology

French startup GenSensor develops technology for genomic-based in-line monitoring of bioproduction. The company combines a robotic device with advanced analytics software. Together, they monitor, characterize, and optimize the production of advanced therapy medicinal products and vaccines. GenSensor’s approach addresses the challenges of limited bioproduction capacity and performance as demand for biologic drugs increases.

Currus Biologics develops Therapies for Solid Tumors

Australian startup Currus Biologics is developing its proprietary BEAT technology to enable CAR-T cell therapies for treating solid tumors. CAR-T cell therapy works by extracting a patient’s T-cells and engineering them to produce chimeric antigen receptors that seek out and destroy cancer cells.

However, solid tumors have remained largely impervious to treatment with current CAR-T cell technologies. The BEAT technology aims to overcome this by addressing many of the challenges that traditional CAR-T cell therapies face when treating solid tumors. Currus Biologics’ BEAT technology expands the use of CAR-T cell therapy to help patients with various solid cancer types.

Gain Comprehensive Insights into Pharma Trends, Startups, or Technologies

The pharma industry report underscores the industry’s robust commitment to innovation, with significant R&D investments, the filing of numerous patents, and the creation of new job opportunities. It also demonstrates how specialized technologies are revolutionizing drug development and personalized medicine, among other trends. Get in touch to explore all 2200+ startups and scaleups, as well as all industry trends impacting pharma companies.