Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked startups building FinTech platforms.

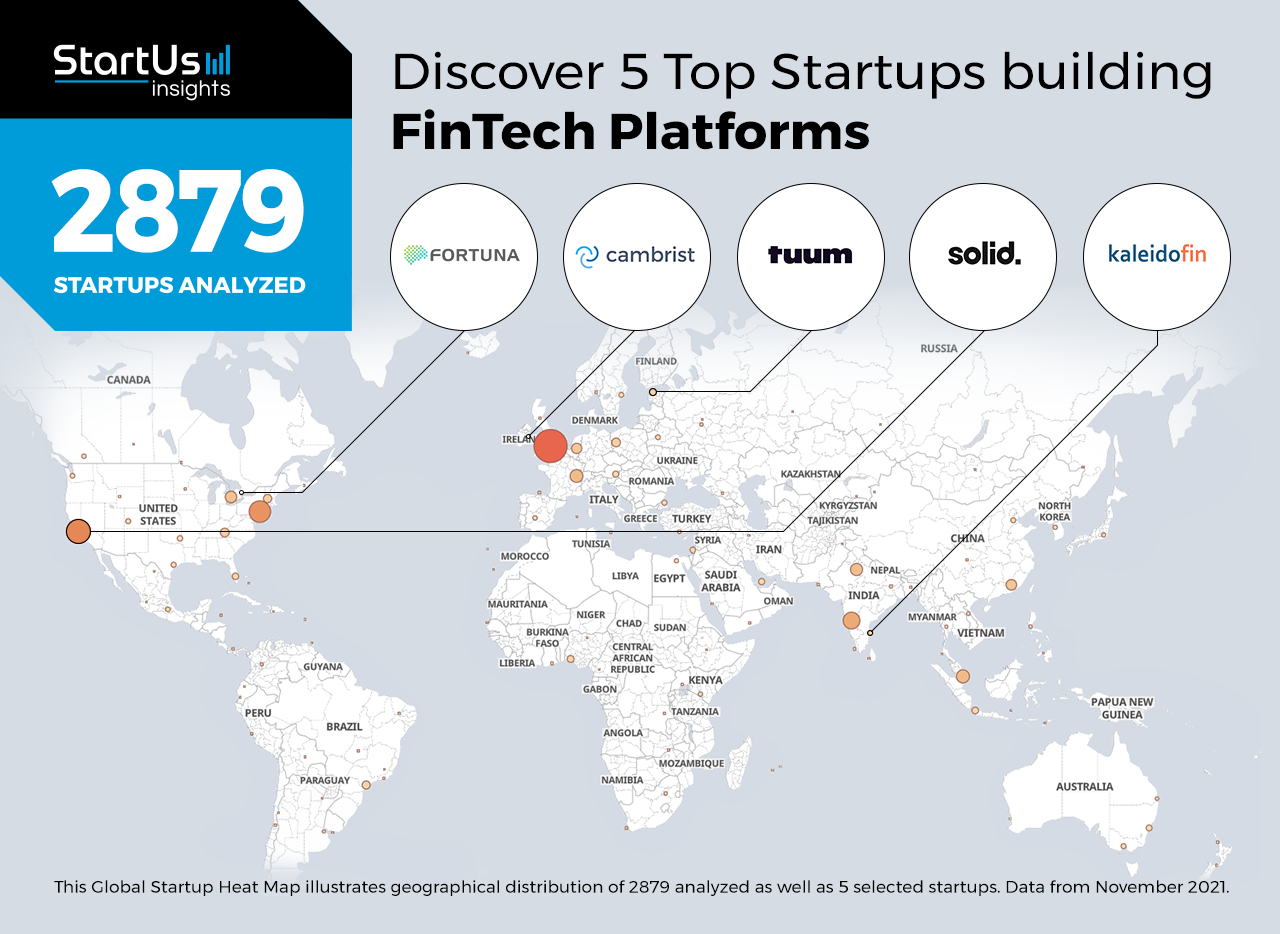

Out of 2 879, the Global Startup Heat Map highlights 5 Top Startups building FinTech Platforms

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 2 879 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 2 874 FinTech platforms, get in touch.

cambrist facilitates Forex Transactions

Founding Year: 2016

Location: Dublin, Ireland

Funding: USD 1,2 M

Partner for: Crossborder Forex Processing

cambrist is an Irish startup that develops a Software-as-a-Service (SaaS) platform which enables payment card issuers and processors to manage the foreign exchange (FX) requirements. The startup’s platform connects payment processing systems to global FX markets seamlessly as well as provides an extensive management information system (MIS) and data analytics that offer insights into cross-border payments. cambrist’s solution is Payment Card Industry (PCI) Level 1 certified, thus ensuring the security of its partner’s card-issuing domains. The startup’s Notify, Optimize, and Wallet solutions further minimize banking costs and forex risks, and automate currency trading.

solid provides Fintech-as-a-Service

Founding Year: 2018

Location: San Mateo, USA

Funding: USD 18 M

Partner for: Banking-as-a-Service, Card Management

US-based startup solid provides Fintech-as-a-Service solutions that integrate functions like banking, payments, cards, and compliance. The startup’s banking-as-a-service solution enables companies to build and launch products like business and consumer checking accounts. Its payment-as-a-service solution provides application programming interfaces (APIs) or hosted user interface (UI) that supports Automated Clearing House (ACH), wires, checks, and on-us transactions. solid’s card issuance and management platform provide a single API that issues and manages credit, debit, and prepaid cards both in physical and virtual form factor. The startup also provides a compliance-as-a-service platform that facilitates and simplifies adherence to the system’s regulatory requirements.

kaleidofin enables Paperless Financial Planning

Founding Year: 2018

Location: Chennai, India

Funding: USD 2,8 M

Partner for: Fund Analysis, Customer Insights

kaleidofin is an Indian startup that develops digital payment solutions for individuals to achieve financial security. The startup provides a collection of APIs and algorithms that provide recommendations based on demographics, credits, and behavior. udaan is a long-term goal-based savings solution that allows customers to maintain a carefully balanced asset mix of equity and debt instruments. lakshya and ummeed are the startup’s other solutions that aid in medium- and short-term goals, respectively. Kaleidoyantra is the startup’s tool that does technical analysis of a wide range of funds and recommends the most suitable fund to invest in. This way, kaleidofin sets up a backend system that uses fast paperless processes for customized financial planning.

Fortuna supports Assets Under Management (AUM) Growth

Founding Year: 2017

Location: Toronto, Canada

Funding: USD 135 000

Partner for: AI-based Sales Assistant, Automated Telecaller

Canadian startup Fortuna provides an AI-based solution to grow assets under management. The startup’s platform builds a lead generation funnel that provides an AI-powered sales assistant, ConnectPro, to reach out to the ideal clients. This allows financial services to find, engage, and convert leads round-the-clock through automated campaigns. The platform also enables the creation and recording of personalized videos to reach out to every client, nurturing a more intimate and sustainable relationship with prospects and clients. In addition, it offers round-the-clock support with a dedicated account manager that assists in every aspect of the AUM growth campaign.

Tuum provides Modular Banking Services

Founding Year: 2019

Location: Harjumaa, Estonia

Funding: USD 4,8 M

Partner for: Debt Management, Collateral Management

Estonian startup Tuum provides cloud-based modular banking platforms that cover end-to-end banking processes. The startup’s platform is API-first and built around a microservice architecture that ensures quick and simple integration of functional modules. These modules include services like banking, deposits, assets & collateral, lending, payments, cards, and debt management. The platform also features a proprietary workflow engine that is fully adaptable to fit the customer’s business operations. This allows the quick detection of problems, which the platform automatically corrects without interrupting the customer’s business, enabling a seamless banking experience.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on FinTech-as-a-Service, open finance, and autonomous finance. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.