Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked startups advancing autonomous finance.

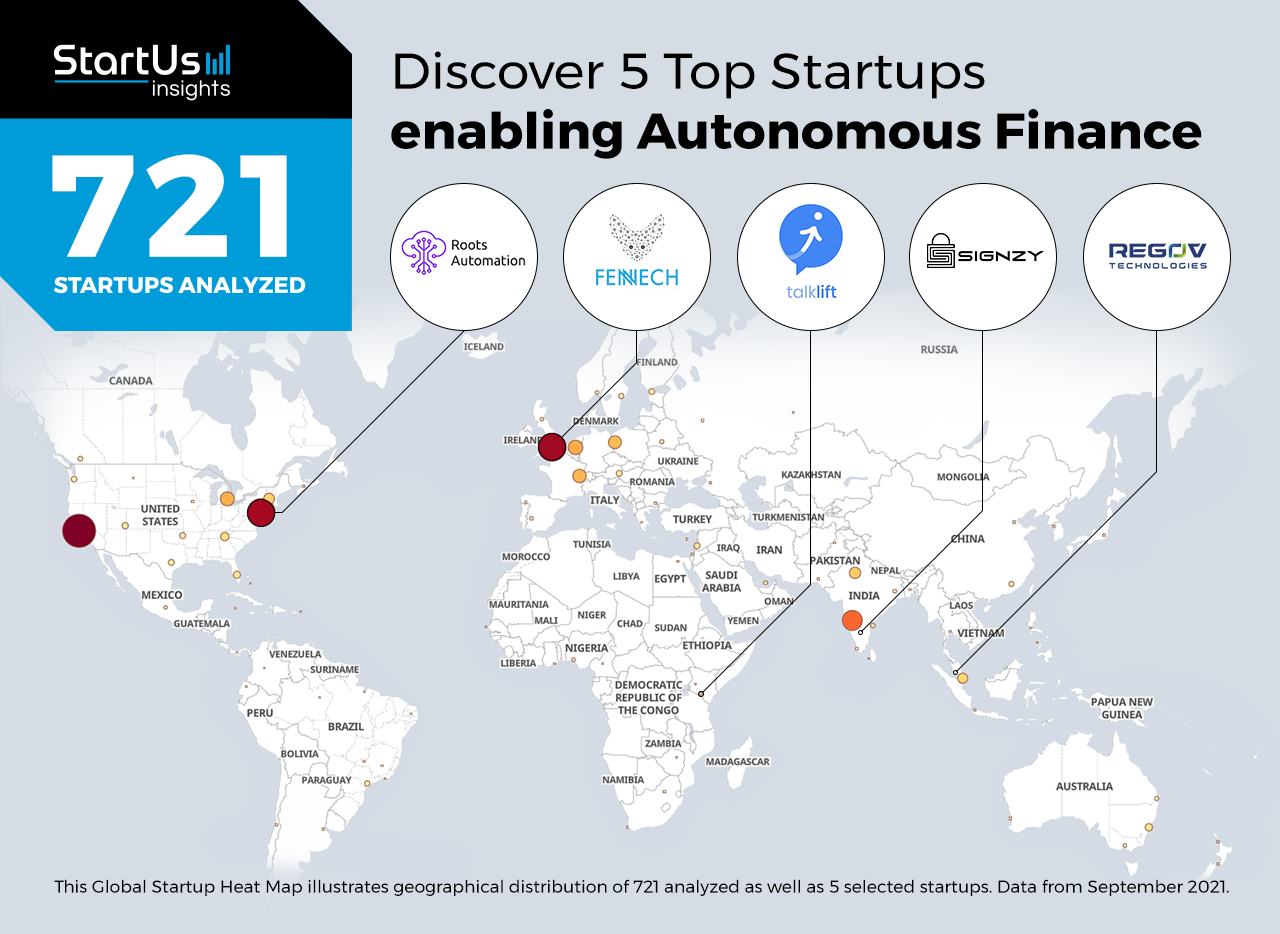

Global Startup Heat Map highlights 5 Top Autonomous Finance Solutions out of 721

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 721 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 716 autonomous finance solutions, get in touch.

Signzy enables Back Office Automation

Back office operations at financial firms involve massive amounts of manual operations that are time-consuming and repetitive, and, hence, prone to errors. Digital banking further increases the back-office operation loads. To tackle this, FinTech startups develop autonomous finance solutions such as chatbots and process automation, among others. These solutions automate back office operations, thereby reducing data entry errors and saving employee work hours.

Signzy is an Indian startup that automates back office operations. The startup combines optical character recognition (OCR), intelligent character recognition (ICR), and object detection to enable branch and lending automation. Additionally, Signzy’s video-based know your customer (KYC) solution verifies the users with personal and governmental documents. This saves the overall document processing time and offers better accuracy compared to manual document verification both for banks and non-banking financial firms (NBFC).

Roots Automation provides Cognitive Process Automation (CPA)

Robotic process automation (RPA) solutions automate data capture, customer identification, as well as tax and regulatory reporting. However, while RPA is effective for repetitive tasks, activities like loan lending and audit reviewing are variable processes that need strategic decision-making. Cognitive process automation, a combination of RPA, artificial intelligence (AI), blockchain, and big data analytics, allows financial organizations to automate specific business processes. It uses pre-trained models and offers cognitive inputs for the employees. Moreover, CPA readily integrates into existing workflows without the need for historical data.

US-based startup Roots Automation develops Digital Coworker, a cognitive process automation bot. Digital Coworker automates banking, general finance, as well as tax preparation and review, which includes underwriting, loan processing, and fraud detection. This way, Roots Automation reduces the stress on employees during peak hours and improves banking operations, which further enhances customer satisfaction.

TalkLift develops Banking Chatbots

Autonomous finance is a customer-oriented technology that improves customer experience. These solutions use AI to analyze and predict customer preferences to personalize the banking services. Additionally, it automates various customer-facing operations, such as form-filling and customer service, with natural language processing (NLP). For instance, chatbots allow banks and non-banking financial firms to free customer service agents and focus them on higher-value interactions.

TalkLift is a Kenyan startup that provides banking chatbots for customer service, product recommendation, and customer onboarding. The startup utilizes conversation AI to automate customer interaction with instant responses. Besides, automating customer service reduces the inbound volume significantly by answering frequently asked questions (FAQs). Since TalkLift’s chatbot is a cross-platform service, the service stays consistent for the users irrespective of the device and social media application.

ReGov Technologies offers an AI-based Asset Management Platform

Asset management is a risky assignment for asset management companies (AMC) and their clients due to the volatility of stock rates. Conventional data-driven approaches are inefficient in an increasingly digital ecosystem. On the other hand, integrating AI into stock trading and strategy operations improves risk analysis of stocks and clients. This is why startups provide autonomous finance solutions tailored for asset management, thereby mitigating market risks and ensuring better risk management.

Malaysian startup ReGov Technologies develops OMNI.iAM, an AI-based asset management platform. The Platform-as-a-Service (PaaS) product digitizes investor onboarding and automates client risk assessment. It also generates product and service recommendations based on the risk assessment and offers an integrated client management system. This way, ReGov Technologies enables financial advisors to shift their focus from documentation to client servicing. In addition, the startup provides a voice-enabled chatbot, a blockchain-based digital identity management system, and a customer onboarding solution.

Fennech advances Treasury Process Automation

Treasuries often hold high levels of liquid assets that negatively impact their investment portfolios, decreasing profits. This is due to inaccurate forecasts of future market demands and customer behavior. Moreover, since treasury employees deal with customers at banks and financial institutions, they manually collect and record massive amounts of data every day. To tackle these challenges, treasuries now rely on autonomous finance that digitizes end-to-end finance operations. This speeds up customer-facing processes and enables more accurate forecasts by combining account, market, and customer data.

British FinTech startup Fennech develops F3, an automation platform for payments, finance, and treasury. F3 combines AI, digital contracts, smart transactions, and data analytics to automate bank reconciliation, agency management, and enable digital cash ledgers, among others. Moreover, it allows medium and large corporations to create in-house virtual banks to streamline subsidiary account maintenance. Fennech thus enables end-to-end digitization and automation of financial operations through a single platform, saving time and cost.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on blockchain, artificial intelligence, biometrics as well as open banking. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.