Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The utilities industry is primarily driven by a shift to cleaner and more resilient energy systems in 2025. Renewable energy growth and decarbonization efforts are reshaping power generation strategies, while energy storage advances and grid modernization improve power delivery stability and flexibility. Further, IoT-enabled utility management, generative artificial intelligence (AI), and digital twins enhance maintenance, forecasting, and decision-making processes.

From the rapid growth of renewables and grid modernization to AI-enabled forecasting and decentralized systems, this trend report explores the top trends shaping the future of utilities – and how you can leverage these technologies to stay resilient and competitive.

What are the Top 10 Utilities Industry Trends in 2025?

- Renewable Energy Expansion

- Decentralized Utility Strategies

- Energy Storage Innovations

- IoT-led Utility Management

- Generative AI for Utility Operations

- Decarbonization

- Utility Infrastructure Digital Twin

- Advanced Nuclear Technologies

- Customer Experience Optimization

- Grid Modernization

Methodology: How We Created the Utilities Industry Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 7M+ global startups, 20K technologies & trends plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative technology trends in the utilities industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the utilities innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 10 Utility Industry Trends & 20 Promising Startups

For this in-depth research on the Top Utilities Industry Trends & Startups, we analyzed a sample of 7150+ global startups & scaleups. The Utilities Industry Innovation Map, created from this data-driven research, helps you improve strategic decision-making by giving you a comprehensive overview of the utilities industry trends & startups that impact your company.

Tree Map reveals the Impact of the Top 10 Utilities Trends in 2025

The Tree Map below outlines trends shaping the utilities industry in 2025. Digital twins in utility infrastructure enable real-time monitoring, predictive maintenance, and efficient asset planning. Generative AI also optimizes load forecasting, outage prediction, and customer support automation.

Moreover, decentralized utility strategies support peer-to-peer (P2P) energy trading and localized generation. Customer experience platforms use behavioral insights and real-time data to personalize billing, alerts, and services.

Besides, IoT-enabled utility management improves grid visibility and automates energy flows, and advanced nuclear technologies provide low-carbon baseload options. Together, these trends indicate a shift toward smarter and more adaptive utility systems.

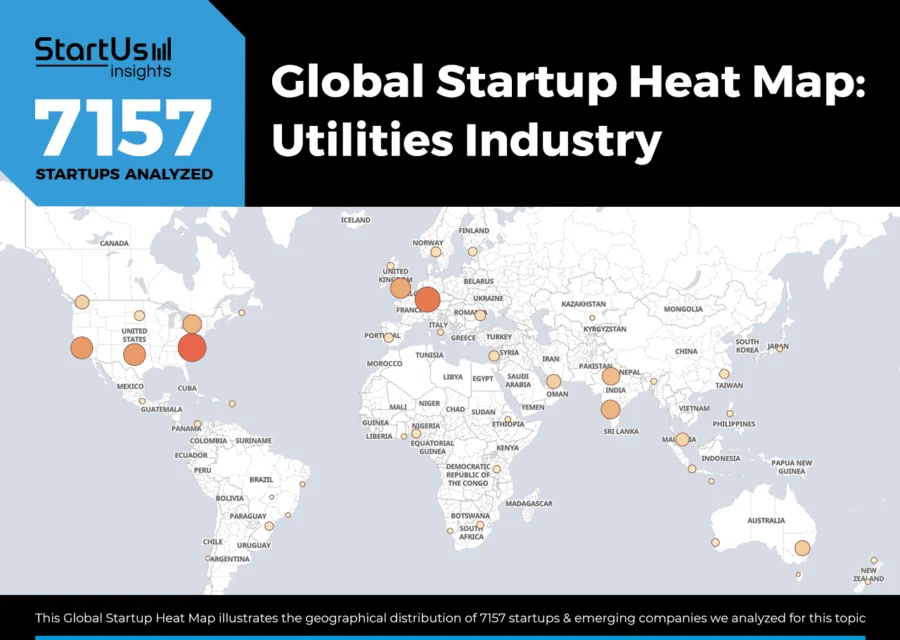

Global Startup Heat Map covers 7150+ Utilities Industry Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 7150+ exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the US and India, followed by the UK. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Utilities Industry Innovations & Trends?

Top 10 Emerging Utilities Industry Trends [2025 and Beyond]

1. Renewable Energy Expansion

The Utilities for Net Zero Alliance (UNEZA), a coalition of leading utilities, plans to invest over USD 116 billion annually in clean power generation and grid infrastructure.

Such investments expand wind, solar, geothermal, hydropower, and battery storage system integration, which account for 30% of the US’s large-scale power generation capacity. In 2024, renewables supplied nearly 25% of total US electricity, and this reflects similar trends globally.

China remains the top contributor to renewable deployment, having added nearly 64% of new capacity in 2024. It is set to meet its 1200 GW renewable energy target five years ahead of schedule.

India is also progressing, with non-fossil fuel-based capacity reaching 217.62 GW by January 2025 and a target of 500 GW by 2030.

Further, solar cell innovations are reducing costs and increasing deployment. The advances in silicon, perovskite, and tandem cells improve energy efficiency, while dual-use applications, such as building-integrated photovoltaics (BIPV) and agrivoltaics, enhance land use and broaden solar integration.

Smart grid technologies are transforming electricity distribution. Real-time data and analytics balance supply and demand dynamically to improve the management of variable renewable inputs.

In addition, IoT sensors embedded in solar arrays, wind turbines, and battery systems deliver performance insights to enable predictive maintenance, minimize downtime, and enhance overall efficiency.

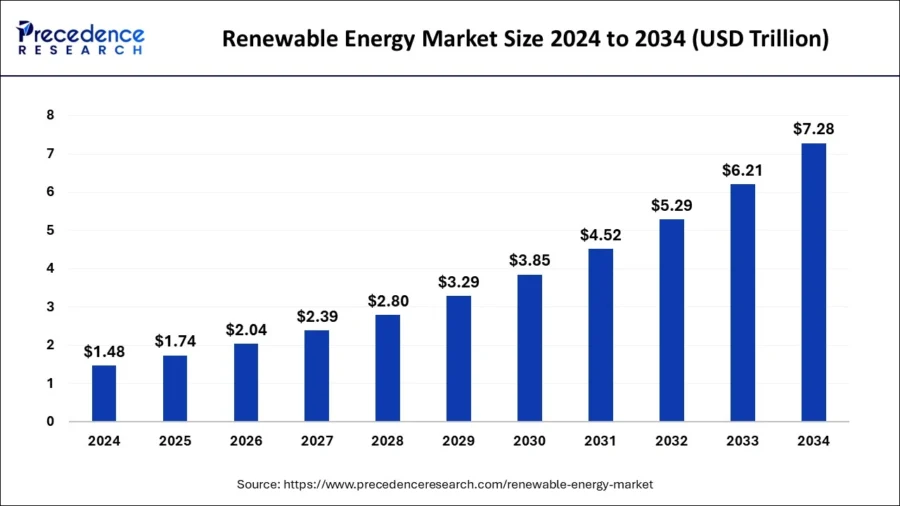

The global renewable energy market reached USD 1.48 billion in 2024 and is expected to grow to USD 7.28 billion by 2034, with a CAGR of 17.23% over the forecast period.

Credit: Precedence Research

Flux builds Bi-directional Charging Technology

US-based startup Flux develops bi-directional electric vehicle (EV) charging technology that allows electric vehicles to store and supply power. Its system converts electricity between the grid and the EV. This enables the vehicle’s battery to support homes, businesses, and utility infrastructure.

Additionally, the startup offers a two-way charger, a companion app for real-time control, and integration with renewable energy for sustainable operation. It collaborates with utilities to utilize EVs as distributed storage assets to improve grid resilience and provide services like frequency regulation, demand response, and grid support.

Further, the platform allows utilities to analyze peak demand, lower reliance on peaker plants, and create new revenue streams through strategic capacity services.

ABEN HUB manufactures AI-designed Energy Farms

Canadian startup ABEN HUB creates an AI-powered cloud platform to automate the design of utility-scale renewable energy farms. The platform guides businesses through entering project specifications to define site boundaries and generate layouts using computational modeling.

Its AI engine assesses configurations based on businesses’ requirements, environmental factors, and technical details to produce tailored designs. Moreover, the platform includes a simple interface that reduces manual work, speeds up planning, and improves accuracy and design outcomes.

Additionally, ABEN HUB automates early-stage project development and transitions projects from concept to construction. It also supports renewable energy developers in deploying effective infrastructure.

2. Decentralized Utility Strategies

In the US, electric utilities allocated 42% of their USD 174 billion capital expenditures to transmission and distribution systems. This capital modernizes grid infrastructure and integrates decentralized generation assets like rooftop solar, small-scale wind, and battery storage.

Moreover, European countries, like Germany and the UK, are speeding up microgrid deployment with targeted policy incentives. These systems improve local energy autonomy while contributing to sustainability and resilience goals.

Smart grids play a key role in this shift. They use AI and machine learning to forecast demand spikes, optimize energy distribution, and improve system reliability. Real-time, two-way communication between utilities and consumers also facilitates flexible grid operations. Additionally, virtual power plants (VPPs) aggregate and manage distributed generation at scale.

Further, blockchain decentralizes energy markets through peer-to-peer energy transactions. With secure smart contracts, prosumers trade excess electricity directly with other users to reduce reliance on intermediaries and promote local energy economies. These automated systems simplify settlements and build trust.

In addition, microgrids are gaining traction for their ability to function in both grid-connected and islanded modes. Their modular design suits electrification in rural areas, remote facilities, and disaster-prone areas where uninterrupted energy access is vital.

Utilities in water-stressed regions include decentralized water-risk assessments in financial disclosures to address scarcity linked to data centers. In cities like Delhi, smart streetlights with embedded sensors help reduce energy use by using decentralized control systems.

Moreover, the decentralized inverter market is projected to reach USD 31.9 billion in 2025 and grow at a 12.5% CAGR through 2035. This market is essential for solar and distributed generation integration. Further, rising solar adoption and smart inverter deployment drive this growth. Inverters also support real-time control, voltage regulation, and fault detection in decentralized networks.

The global decentralized electricity generation market is expected to expand from USD 52.75 billion in 2025 to USD 102.78 billion by 2034, with a CAGR of 7.69% during the forecast period.

Credit: Market Research Future

Blockchain for Energy enables Blockchain-based Emissions Management

US-based startup Blockchain For Energy makes B4ECarbon, a solution that manages emissions by combining blockchain, AI, and IoT. The platform measures, reports, and verifies carbon emissions and removals in the energy sector.

It uses a decentralized framework with Hedera Hashgraph’s distributed ledger to maintain data integrity and transparency. Enovate AI enhances its functionality with features like intelligent reporting, data modeling, and forecasting.

Additionally, the startup’s solution enables real-time data validation, cross-sector integration (oil, gas, CCUS, geothermal, hydrogen), and access to environmental asset marketplaces.

Combinder builds a Decentralized Energy Data Infrastructure

Austrian startup Combinder creates a decentralized physical infrastructure network (DePIN) to connect distributed energy resources (DERs) such as heaters, EV chargers, and solar systems to a global virtual power plant. Its platform serves as a connectivity layer between DERs and energy service providers to enable real-time data sharing and energy flexibility transactions.

The startup allows businesses to link devices to the network and earn BIND points by contributing energy data, participating in flexibility markets, and automating operations through AI agents. Further, the system facilitates use cases like selling demand-side flexibility, peer-to-peer energy trading, and generating verifiable carbon credits for compliance.

Combinder completed a USD 500 000 pre-seed funding round at a USD 10 million valuation. It is also supported by investors from Web3, Energy, and AI sectors, including 1kx, Outlier Ventures, DGFO, Moonrock Capital, and MN Capital.

3. Energy Storage Innovations

In 2024, global utility-scale energy storage cell shipments reached 283 GWh, a 68% year-over-year increase, with Q4 alone recording a 22.6% rise. This highlights the growing demand for large-scale storage capacity.

The US market reflected this trend, with energy storage installations reaching 12.3 GW/37.1 GWh in 2024, a 33% increase over 2023 levels.

Long-duration energy storage (LDES) is also gaining attention, supported by over USD 58 billion in combined public and private funding since 2019. This funding backs a cumulative capacity pipeline of 57 GW.

Battery chemistry is evolving, with lithium iron phosphate (LFP) becoming popular due to its improved safety and cost reduction. High-capacity cells, particularly those with capacities over 300Ah, now account for nearly half of utility-scale deployments. Production of 500Ah cells is expected to start in late 2025.

Meanwhile, alternative chemistries like Sodium-Sulfur (NaS), Zinc-Air, Nickel-Zinc, and Magnesium-ion are emerging as sustainable solutions for diverse grid and industrial needs.

In addition, compressed air energy storage (CAES), supercapacitors, and superconducting magnetic energy storage (SMES) offer long-duration, efficient alternatives.

Solid-state and flow batteries are also progressing rapidly to deliver higher energy densities, enhanced thermal stability, and extended lifespans.

The global energy storage market is expected to grow from USD 58.41 billion in 2025 to USD 114.01 billion by 2030, with a CAGR of 14.31% during the forecast period.

Credit: Mordor Intelligence

Mobius Energy Storage facilitates Distributed Grid-Scale Storage

US-based startup Mobius Energy Storage designs iron slurry flow battery (ISFB) technology for scalable, long-duration energy storage. The system circulates iron-based liquid electrolytes through a cell stack separated by a composite membrane to enable charge and discharge cycles through controlled chemical reactions.

It uses non-toxic, non-flammable, and chemically stable materials, which offer a safer and more sustainable option than lithium, vanadium, and zinc-based batteries.

Further, Mobius Energy Storage replaces conventional battery chemistries while reducing annual CO2e emissions by 0.5 gigatons.

BattMan Energy builds a Power Plant Controller

Danish startup BattMan Energy develops battery energy storage systems (BESS) and manages them with a power plant controller, BattCon, to optimize grid integration and operational performance. The BattCon system operates independently of BESS manufacturers and trading partners to support standard communication protocols.

It enables easy integration with wind turbines, solar photovoltaic, EV chargers, and power-to-X (P2X) infrastructure. The platform also uses proprietary control algorithms to optimize energy dispatch, minimize equipment stress, and increase returns.

Further, BattMan Energy strengthens its infrastructure with a cybersecurity strategy, which adheres to IEC 62443-3-3 standards. This integrates secure components and applies the least privilege access model.

4. IoT-led Utility Management

Utilities are deploying smart meters and sensors to monitor consumption, enable dynamic pricing, and improve grid reliability. For instance, Ningbo Sanxing Smart Electric has connected nearly one million smart meters across the Nordics.

As renewable energy sources are integrated into grids, IoT supports automated load balancing to enhance flexibility and responsiveness.

Predictive maintenance using IoT and AI is delivering operational savings. By analyzing sensor data, utilities detect early signs of equipment wear and schedule maintenance proactively. This approach reduces downtime, extends asset lifespans, and lowers ownership costs.

In buildings and facilities, IoT optimizes HVAC and lighting systems for energy efficiency. These systems adjust based on real-time occupancy and usage to reduce energy bills and emissions.

IoT-enabled water management systems also improve resource utilization by identifying leaks, optimizing pressure, and streamlining distribution. Further, IoT-enabled gas meters track consumption, improve billing accuracy, and enhance safety by allowing remote shut-off during detected leaks.

Also, IoT integration in urban infrastructure enables real-time resource management, supports predictive maintenance, and improves citizen services like water, waste, and transportation management.

The growth of connected, electric vehicles is accelerating IoT deployment across the charging infrastructure. By 2025, utilities are expected to use IoT platforms to balance EV charging with grid capacity. These platforms enable load shifting and vehicle-to-grid (V2G) interactions to ensure grid stability and support EV adoption.

Further, advances in satellite IoT and terrestrial technologies, like 5G and low-power wide area network (LPWAN), improve connectivity for remote asset monitoring and grid automation. These networks provide the reliability and bandwidth needed for real-time decisions in dispersed or hard-to-reach service areas.

The global Internet of Things (IoT) in utilities market, valued at USD 47.53 billion in 2023, is projected to grow at a CAGR of 10.7% from 2024 to 2030.

Credit: Market Data Forecast

iGoal Tecnololgia advances Utility & Asset Management

Brazilian startup iGoal Tecnologia creates the DEx IoT platform and hardware solutions. It enables real-time monitoring, control, and automation across the energy, water, gas, and solar power sectors. The platform operates through a modular structure with specialist modules for automation, photovoltaic (PV) plants, utilities, and energy management.

The startup’s hardware includes iGate S, iGate IO, and iGate LoRa that collect data from distributed assets using Wi-Fi, Ethernet, LTE CAT-M1, NB-IoT, 5G, and LoRaWAN. This setup allows easy integration with equipment from different manufacturers.

AR Technology offers LoRaWAN Connectivity as a Service

Omani startup AR Technology builds utility and industrial IoT solutions to improve water, gas, and electricity distribution and management. Its solutions combine real-time monitoring, advanced analytics, and automated control.

The startup offers advanced metering infrastructure (AMI) for automated consumption tracking, leak detection systems for early fault identification, and energy management tools for residential, commercial, and industrial applications.

The startup’s ARNet LoRaWAN connectivity-as-a-service solution provides secure, scalable network coverage for IoT deployments with 24/7 monitoring and easy device integration. It also supplies industrial-grade IoT devices and high-precision sensors designed for harsh conditions and tailored to client needs.

Further, the company’s automated billing and payment systems ensure accurate invoicing and streamlined financial processes. These services run on the ARIoT platform, which includes real-time dashboards, customizable interfaces, and compatibility with third-party systems.

5. Generative AI for Utility Operations

In 2024, energy, mining, and utility companies spent over USD 1 billion on generative AI, with nearly half of them adopting or deploying its capabilities. This growth stems from its impact on grid reliability, operational efficiency, and infrastructure planning.

Generative AI is improving grid management through real-time optimization, demand forecasting, and scenario simulation. By modeling various grid conditions, utilities identify stress points, reduce energy waste, and strengthen resilience.

Additionally, companies like RetiPiu and Duke Energy have enhanced compliance, safety, and emissions outcomes using predictive maintenance powered by generative AI.

In cases with limited historical data, generative AI generates synthetic datasets to improve model accuracy. This function enables utilities to forecast demand fluctuations and manage energy distribution in decentralized, renewable-focused networks.

AI systems also monitor dam water levels, automate flood alerts, and reduce manual inspections. In gas utilities, AI analyzes pipeline pressure and methane levels to send instant alerts for leaks or pressure drops. Besides, AI predicts waste collection demand, adjusts routes, and lowers fuel consumption.

Moreover, generative AI models complex energy flows and grid contingencies to assist utilities in adapting to variable supply and evolving load patterns. This approach supports the integration of distributed energy resources such as rooftop solar, wind farms, and electric vehicles.

Further, integration with enterprise IT and operational technology (OT) systems is advancing. Platforms like SAP and Salesforce are incorporating generative AI to improve asset management, outage predictions, and customer service workflows.

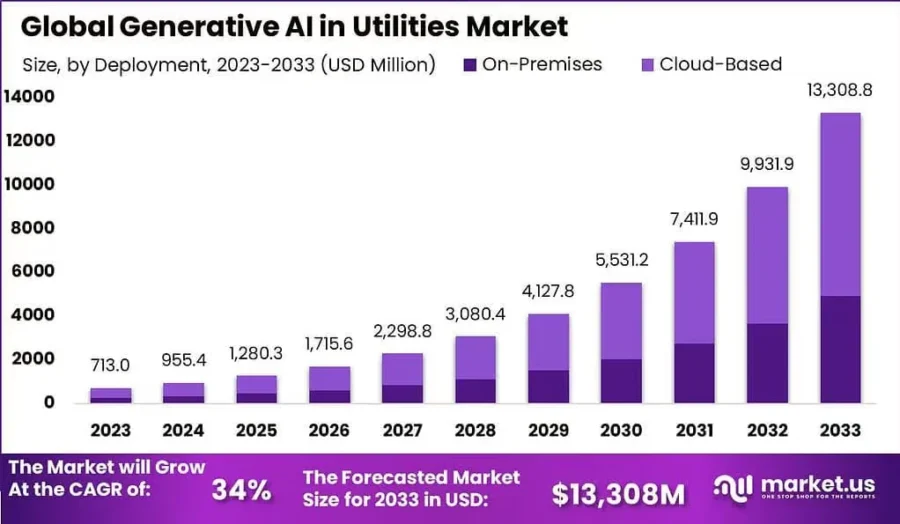

The global generative AI market in utilities is projected to reach USD 13.3 billion by 2033, growing at a CAGR of 34% between 2024 and 2033.

Credit: market.us

GEN8 Intelligence builds Energy & Utilities GenAI Platforms

UK startup GEN8 Intelligence creates generative AI platforms to enable organizations to build, deploy, and scale AI solutions in industries like energy, utilities, manufacturing, and finance. The platform includes capabilities such as large language models (LLM) agnostic orchestration, hallucination control, enrichment engines, and centralized governance.

Moreover, the startup’s GEN8 AI Studio allows users to prototype, validate, and deploy models using no-code or low-code tools. In the energy and utilities sector, the platform addresses use cases including operational efficiency, meter troubleshooting, knowledge management, and automated training.

Further, GEN8 Workspace provides AI-powered tools for search, verification, and reporting. It allows users to collaborate, validate data using traceable references, and generate tailored BI insights.

TeamSolve advances Asset Maintenance & Field Operations

Singaporean startup TeamSolve develops Knowledge Twin, an AI-driven platform that converts unstructured institutional knowledge into real-time operational intelligence for utilities, industrial facilities, and commercial environments. The platform combines historical records, telemetry data, and field feedback to deliver root cause analysis, step-by-step guidance, and predictive maintenance insights.

Moreover, it supports alarm triage, minimizes field visits, and provides tailored procedures and site orientation data to improve maintenance safety and efficiency. The platform also speeds up incident response, simplifies work order processing, and enhances asset management by automating reports and optimizing contractor decisions.

Engineering teams use the startup’s platform to summarize technical documents, execute projects efficiently, and shorten review times.

6. Decarbonization

Investment in the clean energy supply chain is projected to rise to USD 164 billion in 2025.

In the US, the power sector accounts for nearly one-third of national emissions and plays a key role in decarbonization. The top three investor-owned utilities have shifted over 80% of their owned electricity generation to carbon-free sources.

Both the US and the European Union aim to reduce emissions by 40% by 2030 and achieve climate neutrality by 2050. Interim targets include cutting utility emissions by 50% by 2030 and reaching net zero by 2050.

Besides, carbon capture, utilization, and storage (CCUS) removes over 50 million tonnes of CO₂ annually, and the announced CCUS capacity for 2030 grew by 35% in 2023 alone.

Green hydrogen, another key decarbonization tool, is scaling quickly. Lower renewable electricity costs and technological advancements are projected to reduce green hydrogen production costs by 30–40% by 2025.

The key applications include smart water management that relies on digital monitoring to track water use, while smart pumps adjust flow to conserve energy and cut emissions.

Additionally, wastewater-to-energy systems leverage anaerobic digestion to process organic waste and generate biogas for renewable energy and lowering emissions. Low-carbon construction also incorporates lifecycle assessments to evaluate environmental impact, and recycled materials minimize carbon in infrastructure.

Further, US DER capacity is expected to grow by 217 GW by 2028. This shift enables utilities to integrate customer-generated renewable power to improve grid resilience and advance decarbonization efforts.

The global decarbonization market was valued at USD 2.09 trillion in 2024 and is expected to grow at a CAGR of 11.7% between 2025 and 2030.

Credit: Grand View Research

Anevo builds a Unified Energy Data Platform

Swiss startup Anevo makes an energy data platform that connects real estate companies to utility providers. The platform centralizes access to standardized energy and emissions data across property portfolios. It integrates utility and third-party data sources and incorporates smart meter readings into a single system.

The startup’s platform automates compliance and sustainability reporting by generating annual or quarterly energy and CO₂ summaries. This removes the need for manual data processing and supports internal and external benchmarking.

Further, advanced algorithms analyze performance, identify optimization opportunities, detect consumption anomalies, and track progress toward decarbonization targets. It integrates with existing workflows and invoicing systems to enhance operational efficiency.

InfigoLabs simplifies Industrial Heat Electrification

Australian startup InfigoLabs offers Hydrox Cycle and Hydrox Combustion Technology systems that electrify high-temperature thermal energy generation for sectors like cement, steel, petrochemicals, and chemicals.

These systems facilitate controlled combustion of hydrogen with oxygen inside a ceramic-lined reactor. This produces steam at temperatures above 1200 degrees Celsius without emissions or combustion-related risks.

Its UniPhi Control System ensures safe combustion with minimal residual gases. The design accommodates hydrogen from various sources and integrates with different upstream supply options.

The platform includes low-cost gaseous energy storage, which offers up to 425 MWh of thermal energy in a compact form and delivers consistent, high-grade heat without temperature fluctuations. InfigoLabs’ systems also operate without a water footprint in closed-loop processes and eliminate chimney stacks by producing zero emissions.

7. Utility Infrastructure Digital Twin

Investor confidence in digital twins remains steady, with companies developing digital twin technologies securing over USD 1.2 billion in funding in the past two years. In addition, several deals exceeded USD 10 million.

A key application of electrical digital twins is grid management and optimization. Utilities use digital twins to simulate entire power grids in real time for load flow analyses, renewable energy integration, and contingency planning.

Major utilities, like National Grid in the UK, Duke Energy in the US, Singapore Power, and Ausgrid in Australia, use digital twins. These applications improve grid reliability, enable predictive maintenance, and improve emergency responses.

Digital twins also track water flow, pressure, and quality for real-time leak detection and demand forecasting. Further, simulating flood scenarios has strengthened response times in cities with IoT-enabled dam monitoring.

Moreover, digital twins improve predictive maintenance and asset management by identifying infrastructure damage and forecasting equipment failures to reduce unplanned downtime. For example, utilities have reported a 20% drop in unplanned stoppages and monthly cost savings of EUR 3.03 million for a single offshore oil rig.

In renewable energy integration, digital twins forecast power demand, identify faults, and plan grid expansions. Companies like Plexigrid use these tools to deploy intermittent resources like wind and solar more efficiently.

The electrical digital twin market is expected to reach USD 4836.51 million by 2030, growing at a CAGR of 16.13% from 2024 to 2030.

Credit: Maximize Market Research

Gizil builds a Digital Twin Suite

German startup Gizil creates Virtual Plant (VP), a digital twin suite that unifies engineering, operational, and IT data for asset-intensive industries such as power and utilities. The suite includes VP Viewer for managing point cloud or 3D mesh data, VP Asset for centralizing asset information with reality capture data, and VP Document for cloud-based document storage linked to operational datasets.

It also provides VP Training for immersive remote training, VP Map for real-time digital twin navigation, and VP Telepresence for virtual collaboration using VR and AR technologies. Each module integrates with varied data formats and systems to offer scalability, improved visualization, and real-time interaction.

Vertex 3D Solutions provides 3D LiDAR Scanning & Digital Imaging

US-based startup Vertex 3D Solutions offers spatial intelligence using 3D LiDAR scanning, drone imaging, and drafting services for the engineering, construction, telecom, and utility sectors. It captures existing conditions using LiDAR, thermal imaging, and photogrammetry to create accurate point clouds for measurement, analysis, and modeling.

In-house draftsmen process the point clouds into 2D CAD plans or 3D BIM models and tailor levels of detail to specific project needs. The startup also offers cloud-based 3D walkthroughs via the Matterport platform. These walkthroughs provide remote access to digital twins and collaborative tools for visualization, messaging, and project management.

Vertex 3D Solutions further uses drones for real-time imaging, topographic mapping, and orthomosaic production to support site monitoring and asset inspection.

8. Advanced Nuclear Technologies

The nuclear power market is experiencing significant growth due to increased private equity and venture capital funding, which rose to USD 783.3 million in 2024 – a thirteenfold jump from 2023. Recent investments include USD 700 million for X-energy and USD 130 million for Zap Energy.

In 2025, the US Department of Energy reissued a USD 900 million solicitation to support the deployment of Gen-III+ small modular reactors (SMRs). Utility partners such as TVA and Constellation are targeted for participation.

Over 70 GW of SMR capacity is under construction globally. Designs like NuScale’s VOYGR and GE Hitachi’s BWRX-300 are gaining traction for their scalability and reliability.

Moreover, fuel innovation is essential for advancing nuclear technologies. High-assay low-enriched uranium (HALEU) is becoming increasingly available, and it is critical for many advanced reactors.

The US government is investing in developing a domestic HALEU supply chain to reduce import reliance. Concurrently, commercial trials for accident-tolerant fuels (ATFs), aimed at improving reactor safety, are expected to begin by 2025.

Further, projects like NET Power’s 300 MW near-zero-emission natural gas plant in Texas demonstrate nuclear energy’s potential for industrial heat, hydrogen production, and desalination.

TRISO fuel, known for its containment and safety benefits, is approaching commercial readiness. Thorium-based fuels, particularly in India, are being explored for their waste-reducing and proliferation-resistant properties.

Growing electricity demand from energy-intensive applications, such as AI workloads and hyperscale data centers, is also accelerating nuclear investments. Further, companies like Amazon, Google, Meta, and Switch have signed agreements to secure nuclear power from SMR developers such as Kairos Power and Oklo.

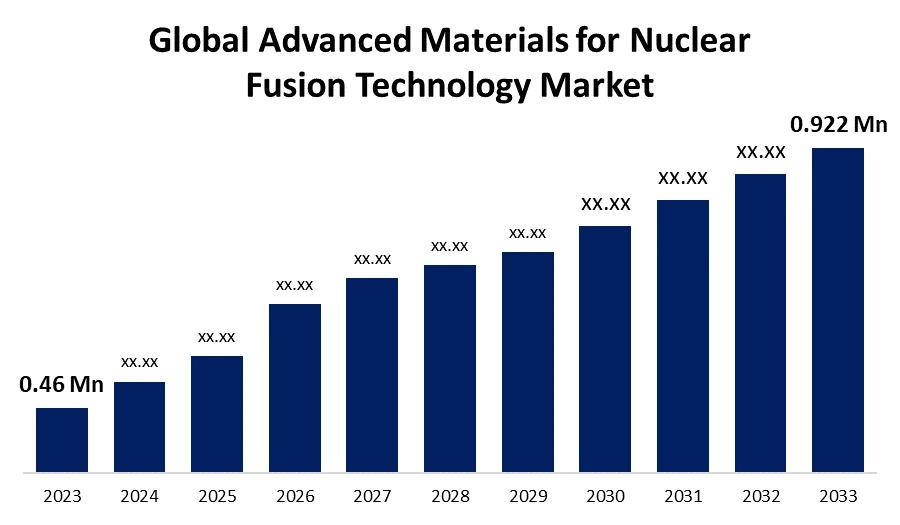

The global advanced materials for nuclear fusion technology market is projected to reach USD 0.922 million by 2033, growing at a CAGR of 7.20% between 2023 and 2033.

Credit: Spherical Insights

Blue Energy manufactures Modular Power Plants

UK startup Blue Energy develops modular nuclear power plants for shipyard-based manufacturing to enable faster deployment, lower construction costs, and improved scalability. The design separates mature light water reactors and passive safety systems from non-nuclear components, such as turbine halls.

This allows standardized production in non-nuclear shipyards using automated machinery and a permanent workforce.

Each reactor unit operates within a protective pool that provides passive cooling and physical shielding to ensure safe operation without intervention. The plant’s compact footprint supports phased deployment and allows sites to start with a single reactor and expand as energy demand grows.

Deep Fission makes Underground Nuclear Reactors

US-based startup Deep Fission builds modular underground nuclear reactors that produce 15 megawatts of electricity per unit. Each reactor operates one mile below the Earth’s surface in 30-inch boreholes and uses pressurized water reactors (PWRs) running at 160 atmospheres and 315 degrees Celsius.

The standard fuel assemblies and control systems generate heat, which transfers to a steam generator at depth, whereas non-radioactive steam rises to the surface to power conventional turbines. Moreover, the reactor design minimizes maintenance by avoiding moving parts at depth, apart from control rods and coolant flow, while surface retrieval cables allow inspections when needed.

The system scales with 15 MWe modular units to support custom configurations for hyperscale data centers, urban infrastructure, and military installations. Deep Fission also provides safe, compact, and geopolitically secure energy solutions to meet global electricity demands with minimal land use and environmental impact.

9. Customer Experience Optimization

According to McKinsey, global utility investment in digital infrastructure is expected to exceed USD 300 billion by 2030.

Despite this momentum, J.D. Power’s 2024 US Utility Digital Experience Study reveals gaps in digital engagement. Only 35% of customers primarily interact with utilities through websites, while just 17% rely on mobile apps. Additionally, nearly one-third of utilities lack a mobile application, which shows opportunities for improvement in digital interfaces.

In response, utilities are focusing on enhancing customer experience (CX). For 2025, key priorities include leveraging advanced data analytics for personalized communication. This expands digital self-service options through mobile apps and portals, and enables the integration of virtual assistants and AI-driven tools to simplify customer support.

In 2024, water utilities in North America and Europe adopted digital self-service portals to reduce call center volume and improve customer satisfaction scores. Municipal water utilities using automated, real-time outage notifications experienced fewer customer complaints during service disruptions and achieved faster restoration times.

Further, cities that implemented digital CX platforms for waste collection, such as missed pickup reporting and schedule notifications, reported higher customer satisfaction and fewer service complaints.

Utilities are also adopting omnichannel communication strategies to deliver service across platforms, including web, mobile, voice, and smart home systems.

IoT and smart home integrations further drive smarter outreach, which enables utilities to engage proactively through automated alerts and tailored insights.

The utility customer information system (CIS) software market was valued at USD 1.37 billion in 2024 and is projected to grow to USD 2.86 billion by 2031, with a CAGR of 10.2% during the forecast period.

Credit: Verified Market Research

Synergi builds a Smart Electricity Platform

Finnish startup Synergi provides a cloud-based flexibility platform that allows utilities to integrate household energy assets into energy markets. The platform connects over 400 brands of electric vehicles, heat pumps, and solar panels through its companion app. The app allows consumers to automate energy use based on real-time spot-price signals.

The startup’s platform operates as a virtual power plant that optimizes household electricity consumption. Utilities monetize aggregated flexibility by participating in TSO, local, and wholesale markets.

Synergi manages backend integration and device connectivity to eliminate the need for in-house development. It also turns distributed energy resources into a coordinated system to generate revenue and stabilize the grid.

Enaptiq provides Energy as a Service

Italian startup Enaptiq creates a SaaS platform that enables energy retailers to transition into energy-as-a-service providers by converting fragmented consumption data into actionable insights. The platform utilizes machine learning models to build customer profiles and segment users based on energy consumption patterns and living conditions.

Moreover, these profiles allow retailers to match clients to services and enable timely recommendations that improve upselling. Enaptiq tracks customer value and lifecycle stages to support proactive engagement strategies that enhance loyalty and minimize churn.

The platform also connects utilities to leading energy service companies and allows tailored offerings that improve customer satisfaction and lifetime value.

10. Grid Modernization

AMI, which includes widespread deployment of smart meters, is central to this transformation. These systems enable real-time consumption tracking, support demand response programs, and facilitate microgrid operations.

By 2025, smart meter adoption is accelerating in both developed and emerging markets to enable utilities to manage distributed loads and maintain grid stability.

Utilities are also scaling distributed intelligence systems and edge devices. These include sensors, edge controllers, and automated switches that enhance outage detection to enable predictive maintenance and speed up service restoration.

Further, utilities are rolling out advanced distribution management systems (ADMS), distributed energy resource management systems (DERMS), and outage management systems (OMS) to improve operational efficiency and integrate DERs.

Additionally, drone-assisted inspections and high-resolution imaging technologies are enhancing asset monitoring while reducing maintenance downtime.

Microgrids and virtual VPPs are emerging as key solutions for local energy resilience and grid support. These systems aggregate solar, storage, and flexible loads to provide ancillary services, reduce grid stress, and maintain power during disruptions.

To address climate-related challenges, utilities are reinforcing physical infrastructure by burying power lines, strengthening poles, and replacing aging equipment. For instance, Duke Energy has committed to hardening 15 000 poles and structures annually to improve grid resilience against hurricanes and extreme weather.

The smart grid market is expected to grow from USD 73.85 billion in 2024 to USD 161.15 billion by 2029, at a CAGR of 16.9% during the forecast period.

Source: MarketsandMarkets

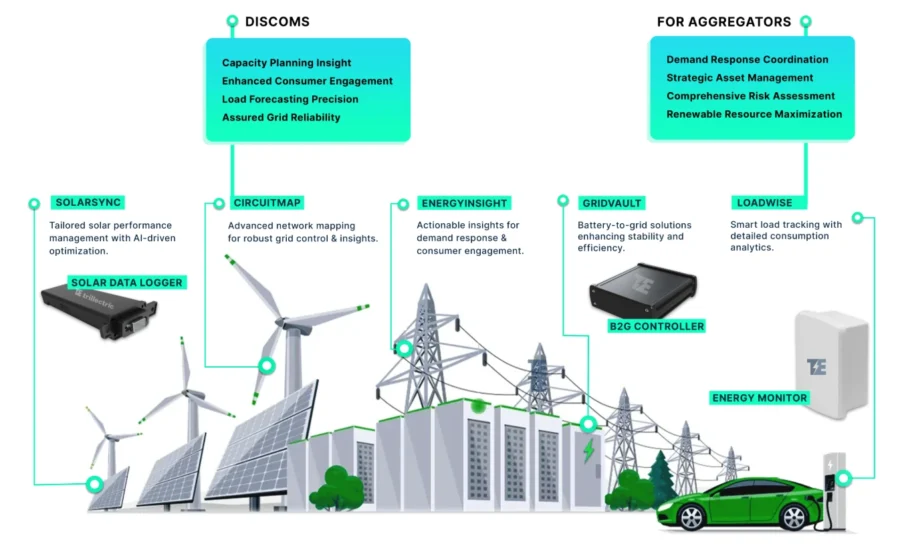

Trillectric advances Distributed Energy Management

Indian startup Trillectric develops an AI-powered distributed energy resource management platform that centralizes control and data integration for solar portfolios, battery systems, and other DER assets. The platform provides real-time visibility and control at the feeder level.

It addresses issues like mid-day overload caused by excess solar generation, evening demand surges from EV charging, voltage instability, and gaps in capacity planning. Trillectric’s Unified Data Highway streamlines real-time data flow and supports predictive modeling. Its AI Energy Control Bot automates analytics, sends proactive system alerts, and visualizes DER operations to enhance decision-making.

The system-agnostic design integrates easily with diverse grid infrastructures, supported by scalable, secure, and cost-effective hardware. Trillectric also enables distribution companies and aggregators to manage load, stabilize voltage, and optimize energy flow to build smarter and more resilient electricity networks.

NOMAD Transportable Power Systems offers Mobile Energy Storage Solutions

US-based startup NOMAD Transportable Power Systems provides mobile BESS for modular, grid-independent power applications in commercial, utility, and remote settings. The company’s products include the Pathfinder (214 kWh, 180 kW), Voyager Hawk (664 kWh, 500 kW), Voyager Falcon (1,328 kWh, 500 kW), Voyager Eagle (1,328 kWh, 999 kW), and Traveler (1,993 kWh, 999 kW).

These systems feature the proprietary PowerDock interface, which supports plug-and-play setup and optional tools like onboard EV charging, microgrid controls, and medium-voltage transformers. Moreover, the units discharge power for one to 2.4 hours and adapt to varied conditions, including marine environments, extreme cold (-40 degrees Fahrenheit), and warm climates (140 degrees Fahrenheit).

The solutions’ safety measures include outgas detection, fire suppression, and hydraulic lifting legs for secure placement. Additionally, the startup delivers flexible and scalable energy solutions for areas with limited or unreliable grid access. Further, its transportable high-capacity systems allow customers to reduce reliance on fossil fuels and enhance energy resilience.

Discover all Utility Trends, Technologies & Startups

The utilities industry is evolving with innovations, like hydrogen-based energy systems, that are emerging as cleaner options for grid support and storage. Carbon tracking and reporting platforms are also becoming crucial for utilities to meet regulatory requirements and ESG goals. At the same time, weather-adaptive grid systems and satellite-based utility monitoring are introducing new ways to enhance resilience and enable real-time decision-making. These technologies will create agile, transparent, and low-emission utility networks.

The Utilities Industry Trends & Startups outlined in this report only scratch the surface of the trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.

![Dive into the Top 10 Utilities Industry Trends & Innovations [2025]](https://www.startus-insights.com/wp-content/uploads/2025/04/Utilities-Industry-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)

WATCH THE VIDEO VERSION

WATCH THE VIDEO VERSION

![Dive into the Top 10 Water Management Trends & Innovations [2026]](https://www.startus-insights.com/wp-content/uploads/2025/07/Water-Management-Trends-SharedImg-StartUs-Insights-noresize-1-420x236.webp)