Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

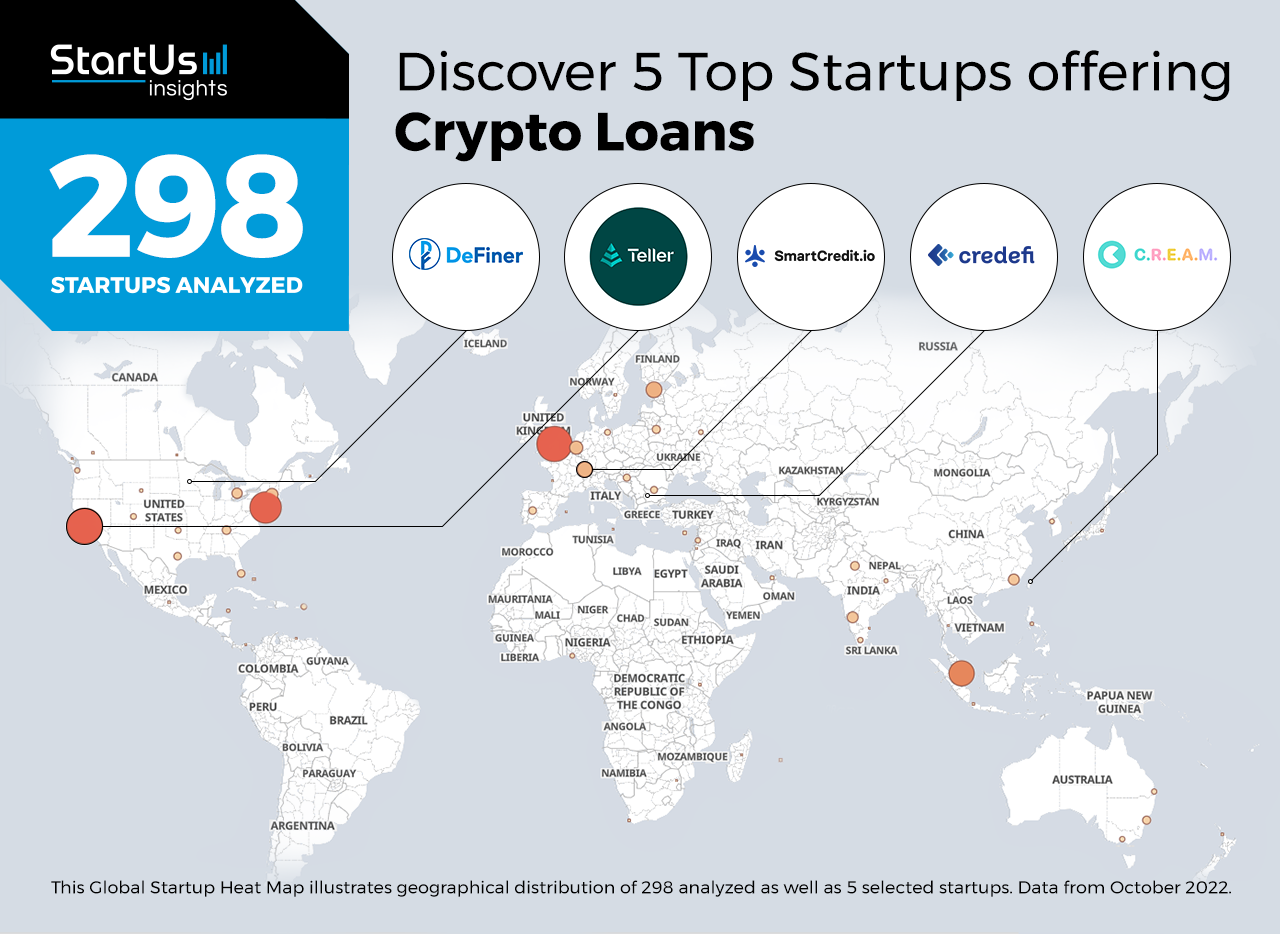

Out of 298, the Global Startup Heat Map highlights 5 Top Startups offering Crypto Loans

Startups such as the examples highlighted in this report focus on decentralized finance (DeFi), peer-to-peer (P2P) transactions, and permissionless protocols. While all of these technologies play a significant role in advancing FinTech, they only represent the tip of the iceberg. This time, you get to discover five hand-picked startups offering crypto loans.

The Global Startup Heat Map below reveals the geographical distribution of 298 exemplary startups & scaleups we analyzed for this research. Further, it highlights five FinTech startups that we hand-picked based on scouting criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 293 startups offering crypto loans, get in touch with us.

DeFiner builds a Token Holder Economy

Founding Year: 2018

Location: Minneapolis, US

Funding: USD 3,5 M

Use DeFiner’s solution for Decentralized Lending

DeFiner is a US-based decentralized autonomous organization (DAO) that develops a permissionless and configurable decentralized lending protocol. The startup maintains a token holder economy, Finconomy, with users holding its token, FIN. Through the network, users are able to lend crypto for passive income, start individual lending pools, and stake tokens to lock liquidity. This enables a community-driven lending platform that changes dynamically based on user preferences.

SmartCredit.io creates a P2P Crypto Marketplace

Founding Year: 2017

Location: Zurich, Switzerland

Funding: USD 100 000

Reach out to SmartCredit.io for Crypto Fixed Income Funds

Swiss startup SmartCredit.io makes a global P2P crypto lending marketplace. It directly connects lenders and borrowers, while offering lenders with fixed income funds. Users submit loan requests, transfer collaterals, and receive loan amounts. Further, users holding the startup’s token, SMARTCREDIT, earn weekly staking rewards.

Cream Finance enables Decentralized Lending

Founding Year: 2019

Location: Taiwan

Partner with Cream Finance for a Crypto Marketplace

Cream Finance is a Taiwanese startup that provides a P2P decentralized lending platform. It leverages liquidity mining to lend crypto assets through its marketplace. Cream Finance also allows CREAM token owners to participate in governance and voting rights. The startup’s decentralized exchange (DeX) protocol, Cream Swap, is permissionless, open-source, and blockchain-agnostic as well as an automated market maker (AMM). It thus automates token swapping and speeds up transactions while eliminating centralized components.

Teller Finance offers Crypto Business Loans

Founding Year: 2020

Location: San Francisco, US

Funding: USD 6,8 M

Innovate with Teller Finance for On-Chain Loan Books

US-based startup Teller Finance provides crypto loans for fintech companies. The startup’s composable lending protocol allows businesses using cryptocurrencies to raise debt capital and launch new services. Its marketplace enables companies to access loan opportunities across the world while providing transparent and immutable on-chain loan books. Moreover, the protocol allows market owners, lenders, and borrowers to set specific loan terms.

Credefi provides Portfolio Lending

Founding Year: 2020

Location: Sofia, Bulgaria

Funding: USD 1,8 M

Work with Credifi for Portfolio Risk Assessment

Bulgarian startup Credefi develops a portfolio lending solution. It connects crypto lenders with small and medium enterprise (SME) borrowers from the fiat economy. This allows users to lend stable coins to credit portfolios with varying risk profiles. The startup’s platform also offers risk assessments and credit score data to make informed lending decisions. Consequently, it ensures fair transactions and high annual percentage yields (APYs).

Where is this Data from & how to Discover More FinTech Startups?

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. The insights of this data-driven analysis are derived from our Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 500 000+ startups & scaleups globally.

The platform gives you an exhaustive overview of emerging technologies & lets you scout relevant startups within a specific field in just a few clicks. To explore financial technologies in more detail, let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.