Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2025 Space Industry Outlook provides a detailed analysis of the sector that is actively involved in technological innovation and exploration. This report investigates significant trends, firmographic data, and investment dynamics influencing space technology’s future. As we examine the active landscape of satellite monitoring, space domain awareness, and space robotics, we underscore the industry’s development, its hurdles, and the numerous opportunities.

This report was last updated in January 2025.

This spacetech report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

Executive Summary: Space Industry Report 2025

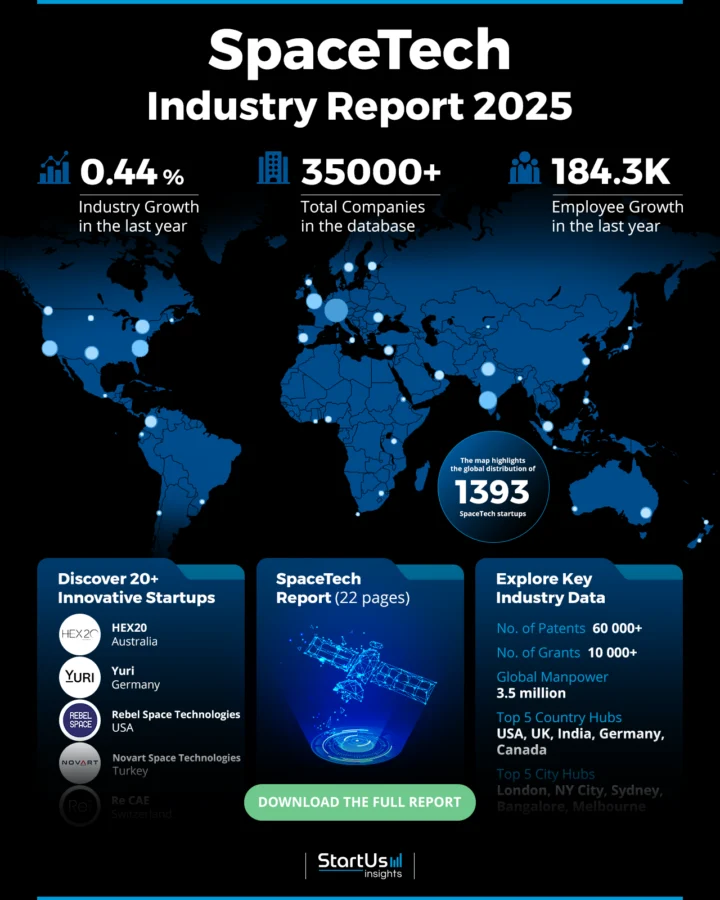

- Industry Growth Overview: The space tech industry is growing steadily with an annual trend growth rate of 0.44%, with more than 35 000 companies listed. The global space economy is set to reach USD 1.8 trillion by 2035.

- Manpower & Employment Growth: The sector employs more than 3.5 million workers, and in the last year, it added 184 000 new employees.

- Patents & Grants: The industry holds over 60000 patents and has received more than 10000 grants, showing its commitment to research and development.

- Global Footprint: The sector has a presence in key hubs across the USA, UK, India, Germany, and Canada, as well as in cities like London, New York City, Sydney, Bangalore, and Melbourne. China is set to become one of the major players in the space tech industry.

- Investment Landscape: The investment scene is active, with an average investment value of USD 61.5 million per funding round. It involves more than 3700 investors and impacts over 4700 companies. Additionally, FAA could approve SpaceX’s Starship for up to 25 launches and more in the year 2025.

- Top Investors: Investors such as Fidelity, Geely, BlackRock, and more have collectively invested more than USD 4 billion into the industry, indicating their financial commitment and belief in its growth. Additionally, the European Space Agency Is planning to conduct orbital test flights of its Space Rider uncrewed spaceplane in the third quarter of 2025.

- Startup Ecosystem: Notable startups include HEX20 (Satellite Platforms), Yuri (Space Biotech), Rebel Space Technologies (Space System Cybersecurity), Novart Space Technologies (Orbital Transfer) and Re CAE (Spacecraft Management).

Methodology: How We Created This Space Tech Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports. Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies and market trends.

For this report, we focused on the evolution of space tech over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the space tech industry

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the space tech market.

What data is used to create this Space Tech report?

Based on the data provided by our Discovery Platform, we observe that the space tech market ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The space tech industry is notable in news coverage and publications, with around 12000 articles and reports published last year.

- Funding Rounds: It also does well in funding, with data on approximately 10000 funding rounds available in our database.

- Manpower: With around 3.5 million workers and over 184000 new employees added last year, manpower is a considerable asset.

- Patents: The industry is recognized for its innovation, holding around 60000 patents.

- Grants: Moreover, it has obtained over 10000 grants, which highlights substantial financial and institutional support.

- Yearly Global Search Growth: The yearly global search growth rate of 6.15% indicates spacetech as a sector of considerable public and commercial interest.

Explore the Data-driven Space Outlook for 2025

The heatmap presents important data from our broad database, which encompasses around 35000 companies and 1300+ startups. In the past year, the industry has seen a growth of 0.44%, with contributions from the global workforce of 3.5 million employees. Moreover, there has been an increase of 184 300+ employees in the last year.

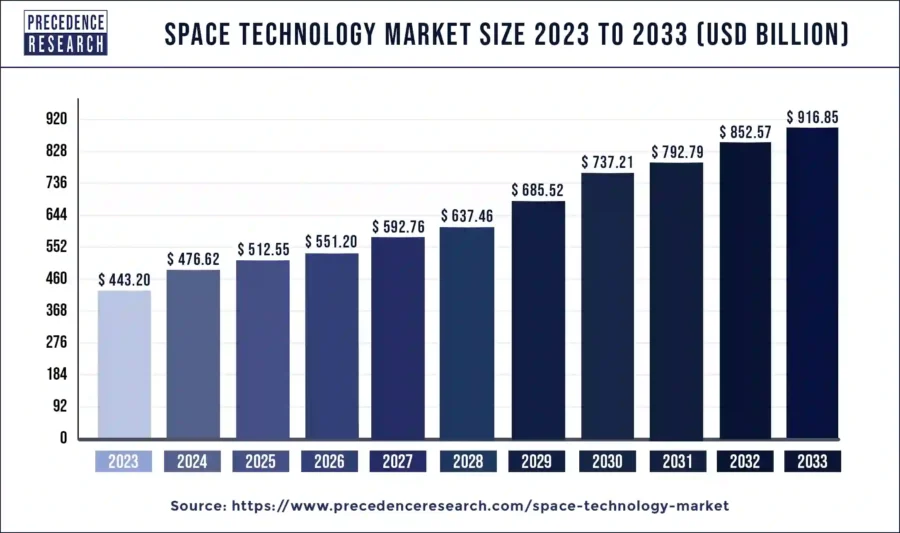

The space tech market is set to reach USD 916.85 by 20233. The projected CAGR from 2024 to 2033 is 7.54%.

Credit: Precedence Research

Further, the United States, the United Kingdom, India, Germany, and Canada are prominent country hubs. Meanwhile, London, New York City, Sydney, Bangalore, and Melbourne are recognized as active city hubs that function as main centers of activity and development in the sector. India is planning to invest USD 44 billion in the space economy by 2033. The industry also comprises approximately 60 000 patents and 10000 grants, which suggests strong innovation and backing.

A Snapshot of the Global SpaceTech Industry

Did you know? NASA selected 15 innovative concepts for its NIAC program in January 2025, including studies on sustainable lunar habitats and exploring Saturn’s moon.

The SpaceTech industry displays steady growth and active investment activities. With a workforce of around 3.5 million, the sector added about 184000 employees over the last year. This indicates a positive trend in job creation. The industry includes over 35000 companies that demonstrate its considerable scale and importance.

Explore the Funding Landscape of the SpaceTech Industry

Investment in SpaceTech is also active, with an average investment value of approximately USD 61.5 million per funding round. The data shows that more than 3700 investors have participated and closed around 10000 funding rounds.

The Indian government is allocating USD 119 million in venture capital funds in 2024 for supporting space startups. Similarly, the US government allocated USD 45 million for its space startups.

Further, these investments have covered more than 4700 companies which emphasizes the wide interest and trust in the financial feasibility and innovative potential of the SpaceTech sector. This financial involvement is crucial for fostering further innovation and growth within the industry.

Who is Investing in SpaceTech?

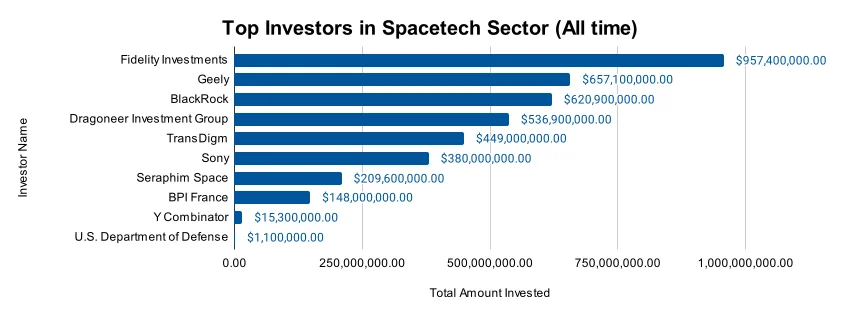

The SpaceTech industry has received financial commitments from its top investors, with a combined investment surpassing USD 4 billion. Here’s a closer look at the main contributors:

- Fidelity Investments is a key investor, directing USD 957.4 million into 4 companies.

- Geely has invested USD 657.1 million across 2 companies, demonstrating targeted, high-value contributions. Geepsace, a subsidiary of Geely focuses on building satellite constellations as various applications. In 2024, it launched 11 new satellites into low earth orbot.

- BlackRock has diversified its SpaceTech portfolio by investing USD 630.9 million in 7 different companies. It led a USD 140 million funding round for Loft Orbital, a space infrastructure-as-a service startup.

- Dragoneer Investment Group has committed USD 536.9 million to 2 companies, emphasizing its strategic investment focus.

- TransDigm follows with USD 449 million invested in 5 companies, indicating solid financial involvement.

- Sony supports 3 companies with a total investment of USD 380 million, highlighting its stake in technology and innovation. It also set up Sony Space Communications Corporations (SSCC) to conduct space optical communications operations.

- Seraphim Space, supporting 10 companies, has invested USD 209.6 million, focusing on emerging entrants in the industry. In April 2024, Seraphim Space launched its second venture capital fund, Seraphim Space Ventures || (SSV ||), which plans to build a global portfolio of almost 30 startups and focus on seed and series A investments.

- BPI France extends its reach by investing USD 148 million across 12 companies, showing a wide support network. Its Large Venture fund participated in investing rounds along with Tikehau Capital and Temasek to provide USD 174 million in series C funding to Loft Orbital.

- Y Combinator, known for nurturing early-stage startups, has allocated USD 15.3 million to 17 companies. In 2024, it invested in six space tech startups.

- The U.S. Department of Defense takes a broad approach, with modest investments totaling USD 1.1 million across 33 companies. In 2025, it proposed an expansion of the quantum space collaboration.

These investments illustrate the strategic and diverse approaches to promoting growth within the space tech industry.

Gain Access to Top SpaceTech Innovations & Industry Trends with the Discovery Platform

The space industry is showing notable growth and innovation. These developments are contributing to global capabilities and technological advancements.

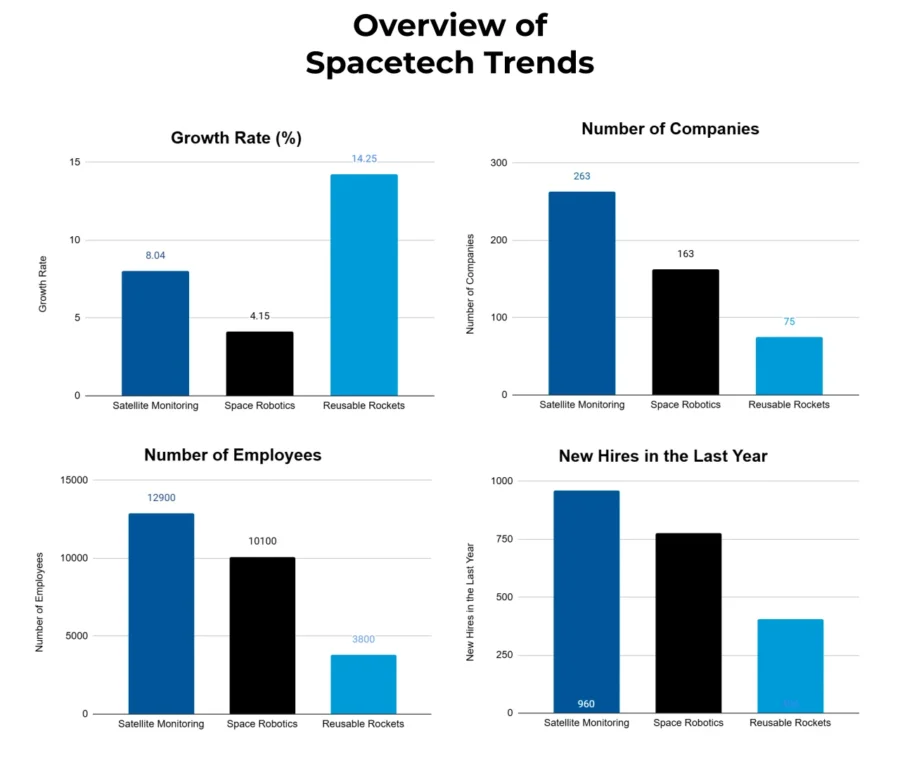

- Satellite Monitoring engages 307 companies and employs over 16 100 individuals. This trend has seen the addition of 2000 new employees in the last year, indicating expansion. The annual trend growth rate is at 14.37% which shows a developing interest and investment in satellite technologies. These companies are focused on enhancing real-time monitoring capabilities, which are important for global communication, weather forecasting, and environmental monitoring.

- Space Robotics includes 185 companies and employs 9700 individuals. Last year, this trend grew by 764 new employees, with an annual growth rate of 5.98%. Space Robotics is important for missions that require high precision and reliability under extreme conditions. For instance, repairs, explorations, and the construction of space stations. This area highlights the ongoing technological advancements and the increasing automation in space exploration tasks.

- Reusable Rockets represent an active and progressive segment of the industry, with 65 companies leading this initiative. These companies collectively employ 6300 individuals, including 810 new hires over the past year. This indicates a steady growth and development. The trend’s annual growth rate is at 13.03%, which emphasizes its important role in reducing costs and increasing the frequency of space missions.

5 Top Examples from 1300+ Innovative SpaceTech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

HEX20 builds Satellite Platforms

Australian startup HEX20 develops satellite platforms for a variety of missions spanning academia, commerce, and government sectors. It provides CubeSat platforms, such as 3U, 6U, 12U, and 27U, each designed to meet specific mission needs like earth observation and tactical communications.

These platforms incorporate features like precise pointing accuracy and adaptable payload configurations to cater to a wide range of scientific, commercial, and defense applications. HEX20’s platforms are based on established flight heritage programs and provide mission solutions that are reliable and cost-effective.

Yuri advances Space Biotech

German startup Yuri develops space biotech products utilizing microgravity. It manages the ScienceTaxi, an advanced life science incubator to perform a variety of experiments in space. This facility enables detailed biotech research and manufacturing on spacecraft and utilizes its full automation and temperature control features. In addition, Yuri Clinostat and the Random Positioning Machine (RPM) simulate microgravity conditions for ground-based experiments.

Rebel Space Technologies offers Space System Cybersecurity

US startup Rebel Space Technologies develops advanced cybersecurity software to protect space systems from potential cyber threats using AI and RF sensing. Its platform offers cybersecurity solutions to dynamically defend spacecraft, ground stations, and mission operations.

The startup’s technology enables real-time monitoring and rapid response to RF and cyber threats and enhances the security of critical space infrastructure. The platform’s AI-driven features provide in-depth insights and proactive risk management capabilities and ensure the safety of space operations against evolving cyber risks.

Novart Space Technologies optimizes Orbital Transfer

Turkish startup Novart Space Technologies develops space vehicle solutions. Its product, Badger, functions as an orbital transfer vehicle that is designed to improve space transportation for small satellites. This space vehicle incorporates a NOX-Propane liquid-fueled rocket engine and cold gas thrusters for accurate attitude control.

Further, it has a payload capacity of up to 48 kg and a total delta-V at full payload of 600 m/s. Badger performs RAAN and inclination adjustments, which represents a significant innovation in orbital mechanics. The vehicle is a key component of the Novart OMV family, which signifies a shift towards more efficient and dependable satellite deployment.

Re CAE enables Spacecraft Management

Swiss startup Re CAE provides a cloud-based spacecraft management solution to enhance space operations through advanced, automated technologies for space debris management, re-entry prediction, and satellite tracking. It offers RE.PROPAGATE, which focuses on orbital mechanics, including state and attitude propagation, collision risk assessments, and maneuver analysis. This enables effective satellite management and operational planning.

In addition, RE.ENTRY offers tools for detailed re-entry trajectory predictions, including ablation and breakup modeling, for assessing end-of-life disposal strategies for spacecraft. RE.CFD is another product that simulates hypersonic flows and heat diffusion for analyzing spacecraft behavior under high-speed atmospheric re-entry conditions.

Gain Comprehensive Insights into SpaceTech Trends, Startups, or Technologies

As we wrap up our 2025 SpaceTech Industry Outlook, it’s evident that the industry’s future is shaped by innovation and growing global interest. Trends such as improved satellite monitoring and the incorporation of AI in space robotics are paving the way for advancements. These developments improve operational capabilities in space and create new paths for commercial and research opportunities. Contact us to explore all 1300+ startups and scaleups, as well as all industry trends impacting space tech companies.