Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2025 Shipbuilding Report highlights advancements in eco-friendly ships, smart technologies, and automation, with decarbonization driving investments in green shipbuilding and retrofitting. It offers insights into industry trends, major players, and emerging startups, guiding stakeholders and policymakers.

This report was last updated in January 2025.

Executive Summary: Shipbuilding Industry Outlook 2025

- Industry Growth Overview: The shipbuilding market is projected to grow from USD 160.13 billion in 2024 to USD 197.94 billion by 2030, exhibiting a compound annual growth rate of 2.67%. On a granular level, the shipbuilding industry faces a slight contraction, with an annual growth rate of -1.37%.

- Manpower & Employment Growth: The global workforce in the industry exceeds 830K, with over 30K new employees added last year. This shows resilient job growth despite economic challenges.

- Patents & Grants: Innovation remains a priority, with more than 3500 patents and over 390 grants supporting technological advancements and sustainable development in shipbuilding.

- Global Footprint: Leading shipbuilding countries include the USA, Germany, India, China, and the Netherlands. Top city hubs are Singapore, Mumbai, Istanbul, Dubai, and Hamburg.

- Investment Landscape: The average investment per funding round is USD 47 million. More than 430 investors supported over 550 closed funding rounds across 220 companies.

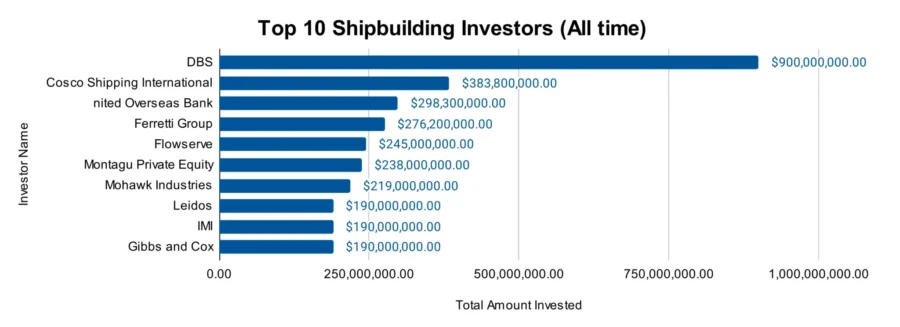

- Top Investors: DBS, Cosco Shipping International, United Overseas Bank, and more are top investors, contributing to a combined investment value of over USD 2 billion.

- Startup Ecosystem: Notable startups include AlongRoute (AI-based ship routing), GT Wings (wind propulsion), Ghostworks Marine (air encapsulation), Elvene Boats (solar electric boats), and Varuna Sentinels (ESG reporting tools).

Methodology: How We Created This Shipbuilding Industry Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of shipbuilding over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within shipbuilding

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the shipbuilding industry.

What Data is Used to Create This Shipbuilding Report?

Based on the data provided by our Discovery Platform, we observe that the shipbuilding industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The news coverage and publications surpassed 5300 articles last year. This is a reflection of significant media and research attention.

- Funding Rounds: Over 550 funding rounds are recorded in our database. This highlights active financial support for shipbuilding ventures.

- Manpower: The industry, with a workforce of more than 830000, added over 30000 new employees last year.

- Patents: The sector holds more than 3500 patents, which underscores its commitment to technological advancements and innovation.

- Grants: The industry received over 390 grants, emphasizing governmental and institutional support for shipbuilding initiatives.

- Yearly Global Search Growth: The global search interest in shipbuilding grew by 1.91% annually. This indicates sustained public and business interest in the field.

Explore the Data-driven Shipbuilding Market Report for 2025

As per the Market Research Future report, the shipbuilding market is projected to grow from USD 160.13 billion in 2024 to USD 197.94 billion by 2030, exhibiting a compound annual growth rate of 2.67%.

The global shipbuilding market is projected to grow to USD 155.58 billion in 2025, reaching USD 203.76 billion by 2033, with a compound annual growth rate of 3.43% over the forecast period.

The Shipbuilding Outlook 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

A total of 310 startups have entered the market, adding to a database of over 6000 companies engaged in shipbuilding. Despite a slight contraction with an annual growth rate of -1.37%, innovation is evident through more than 3500 registered patents and over 390 grants.

Credit: Market Research Future

The industry employs about 830K people globally, with 30K new jobs created last year. Leading shipbuilding countries include the USA, Germany, India, China, and the Netherlands.

The top city hubs are Singapore, Mumbai, Istanbul, Dubai, and Hamburg, which shows the sector’s regional concentration and importance.

Moreover, the USA’s shipbuilding capacity has significantly declined, producing fewer than five commercial ships annually, compared to China’s 1700 ships per year.

The U.S. Trade Representative deemed China’s shipbuilding dominance a barrier to USA industry revival in 2025.

A Snapshot of the Global Shipbuilding Industry

The industry faces a slight contraction with an annual growth rate of -1.37%, yet remains active with over 300 startups and 280 merger and acquisition deals.

Innovation continues as a priority with more than 3500 patents granted and 1300 applicants, leading to a yearly patent growth of 3.51%.

China leads in patent issuance with over 1400 patents, followed by South Korea with more than 500 which indicates strong technological advancement in shipbuilding.

Early-stage activity includes 50 startups, which reflects ongoing entrepreneurial interest and development.

Explore the Funding Landscape of the Shipbuilding Industry

The average investment per round is USD 47 million, showing investor confidence and commitment. More than 430 investors support the sector which contributes to over 550 closed funding rounds.

With investments spread across more than 220 companies, these figures highlight the industry’s economic importance and diverse range of stakeholders.

Who is Investing in Shipbuilding Companies?

The top investors in the shipbuilding industry have contributed a combined investment value exceeding USD 2 billion. Noteworthy investments include:

- DBS invested USD 900 million in at least one company. DBS provided a USD 296 million sustainability-linked loan to CDL.

- Cosco Shipping International contributed USD 383.8 million to at least one company. COSCO Shipping and Fortescue Metals signed an MoU to develop a green fuel supply chain.

- United Overseas Bank invested USD 298.3 million in at least one company. UOB’s FinLab awarded USD 100K to Green Tech firms to pilot 15 sustainability solutions in ASEAN.

- Ferretti Group allocated USD 276.2 million to at least one company. Ferretti Group announced a strategic partnership with Flexjet, a leader in private aviation.

- Flowserve contributed USD 245 million to at least one company. Flowserve partnered with Heide Refinery to implement its Energy Advantage Program.

- Montagu Private Equity invested USD 238 million in at least one company. Montagu Private Equity acquired Tyber Medical, a medical device company serving med-tech OEMs.

- Mohawk Industries provided USD 219 million to at least one company.

- Leidos invested USD 190 million in at least one company. Leidos partnered with the University of Edinburgh’s Bayes Centre to advance AI and data science solutions.

- IMI contributed USD 190 million across two companies.

- Gibbs and Cox also invested USD 190 million across two companies. Leidos acquired Gibbs & Cox for USD 380 million in cash.

Top Shipbuilding Innovations & Trends

Explore the emerging trends within the shipbuilding industry and their firmographic data:

- Digital Twin applications in shipbuilding are transforming operational efficiencies to enable real-time simulation and optimize resource allocation. It involves over 5000 companies and employs more than 360000 people. This technology added 33000 new employees last year, with a trend growth rate of 22.27%.

- Carbon Capture initiatives align with global environmental goals that allow shipbuilders to address emissions and improve their environmental footprint. This trend has over 1800 companies and 180000 employees. It added 15000 employees last year, growing at an annual trend growth rate of 16.58%.

- Fleet Management trend includes over 6500 companies and employs 620000 people. Last year, 31000 new employees joined, maintaining a trend growth rate of 1.45%. Fleet management’s scale and consistent growth highlight its importance in optimizing logistics, operational costs, and asset utilization in the shipbuilding sector.

5 Top Examples from 300+ Innovative Shipbuilding Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

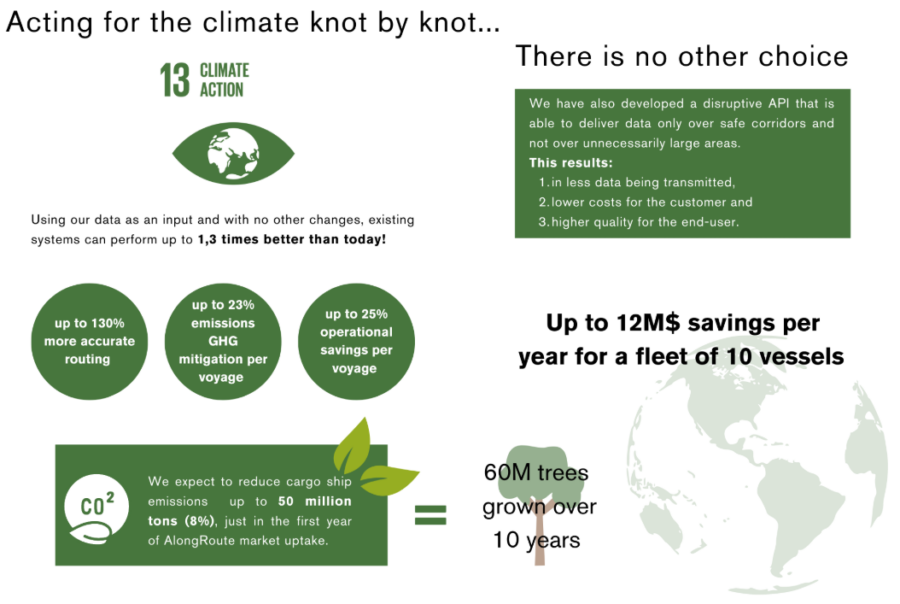

AlongRoute provides AI-based Ship Routing

Greek startup AlongRoute offers AI-based marine forecasts for weather routing in maritime operations. It uses machine learning models trained on historical data to predict ocean parameters like wind, wave, and current patterns in regions like the Mediterranean.

Its forecasts offer precision with hourly updates to optimize routes for fuel efficiency and emission reduction. AlongRoute’s solution allows maritime companies to save costs, reduce environmental impact, and navigate more safely.

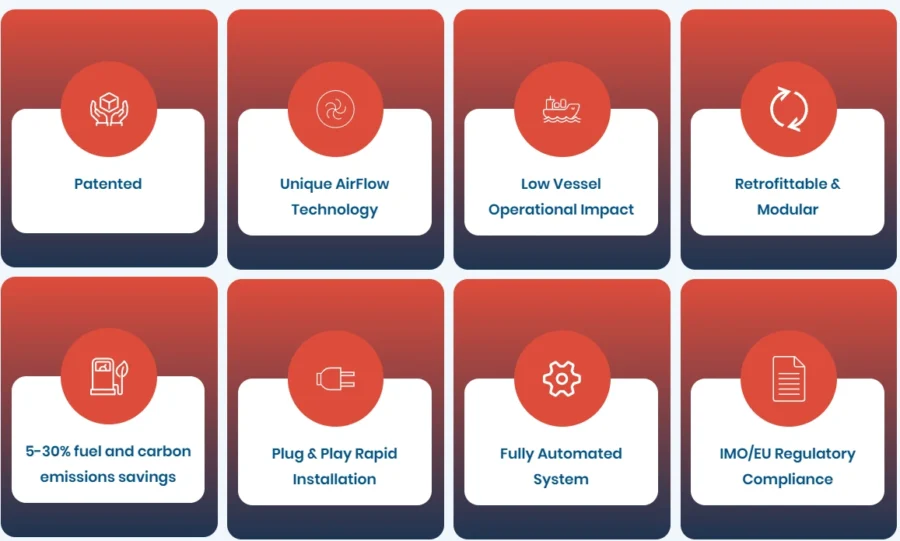

GT Wings develops Wind Propulsion System

UK-based startup GT Wings develops AirWing, a wind propulsion system with AirFlow Technology to enhance thrust and fuel efficiency for commercial vessels.

The AirWing system leverages wind power to save fuel and reduce greenhouse gas emissions. This makes it suitable for retrofit and new-build ships.

Its modular design allows for easy integration without impacting vessel operations, while its compact size ensures optimal performance even in challenging conditions.

GT Wings’ technology supports the maritime industry’s goals of reducing operational costs and advancing environmental sustainability in global shipping.

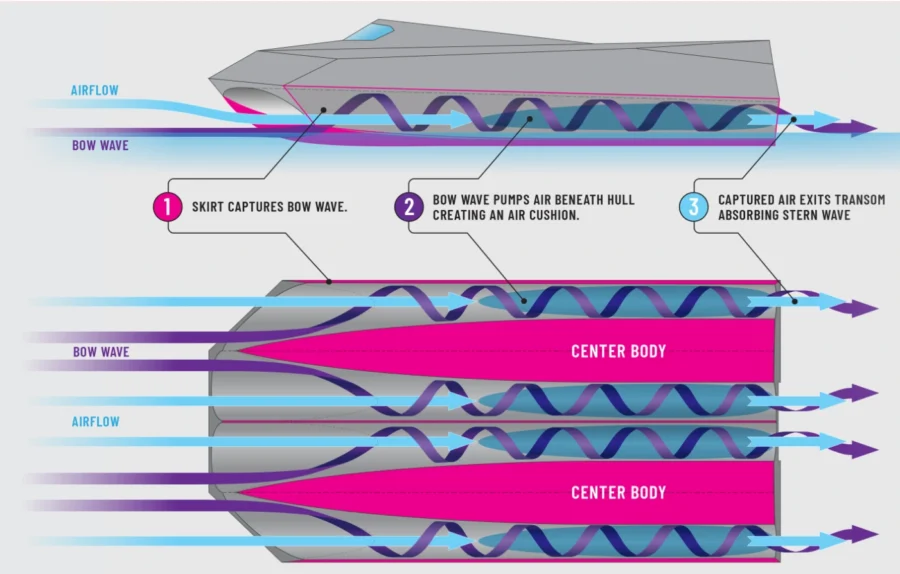

Ghostworks Marine implements Air Encapsulation Technology

US-based startup Ghostworks Marine designs M-Hull vessels with air encapsulation technology to enhance stability and speed in various marine conditions.

The M-Hull structure channels bow wave energy into its M-shaped hull to generate hydrodynamic lift, reduce drag, and enhance fuel efficiency.

It also includes damping features that minimize pitching and slamming resulting in a smoother, quieter ride. Further, its low-wake capabilities support environmental protection in sensitive marine areas.

Elvene Boats manufactures Solar Electric Boats

Finnish startup Elvene Boats manufactures solar-powered electric vessels with solar panel systems for zero emissions and noiseless operation.

The startup’s model, Amber, combines a center console’s practicality with a day cruiser’s comfort. It features two independent motors, an infotainment system, seating for seven, and a cuddy cabin for two.

Amber offers a top speed of 15 knots and an infinite range at low cruising speeds to ensure maintenance-free and self-sustainable boating. Its other model, Greta, is versatile for fishing and family day trips.

It achieves a top speed of 5 knots and a minimum reach of 20 nautical miles per day. Elvene Boats’ designs prioritize sustainability and user experience to offer eco-friendly alternatives to traditional boating that reduce environmental impact and operational costs.

Varuna Sentinels offers ESG Reporting Tools

Dutch startup Varuna Sentinels provides ESG compliance and sustainability management solutions for the marine and shipbuilding industries. The startup’s platform integrates emissions management, hazardous materials tracking, and lifecycle assessment tools.

It enables shipbuilders and operators to meet standards like Inventory of Hazardous Materials (IHM) and Circular Ship Recycling Design (CSRD) while streamlining reporting for frameworks such as GRI, SASB, and TCFD.

By collecting and analyzing data on emissions, accident prevention protocols, safety measures, and resource use, Varuna delivers a view of operational impact, enhancing accountability throughout the vessel lifecycle.

Gain Comprehensive Insights into Shipbuilding Trends, Startups, or Technologies

In 2025, the shipbuilding industry will focus on innovation, sustainability, and digital advancements. Trends like digital twin technology, carbon capture, and fleet management will transform operations and reduce environmental impacts.

Get in touch to explore all 300+ startups and scaleups, as well as all industry trends impacting shipbuilding companies.