Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2025 Semiconductor Market Outlook analyzes the global semiconductor industry and focuses on innovation, supply chain resilience, and strategic investment shaping its future. As semiconductors support technologies across automotive, consumer electronics, telecommunications, and defense, the industry continues to adapt to meet evolving and complex demands.

Key trends include advancements in next-generation chips for AI and high-performance computing, the rising relevance of chiplet architectures, and the use of 3nm and smaller process nodes.

The report highlights ecosystem startups and offers insights into investment trends, patent activity, and technology roadmaps.

Executive Summary: Semiconductor Market Outlook 2025

- Industry Growth Overview: The semiconductor industry achieved 0.58% annual growth. Over 34 000 companies and 1400 startups contributed to advancements in chip design, packaging, and materials engineering. Moreover, the global semiconductor market size is estimated at USD 627.76 billion in 2025 and is projected to reach USD 1207.51 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.54% from 2025 to 2034.

- Manpower and Employment Growth: The sector employs over four million people globally. Last year, 240 000 new professionals joined roles across R&D, fabrication, and systems integration.

- Patents and Grants: Global applicants have filed over 3 million patents, with more than 332 000 contributors. In addition, 8600 grants support ongoing advancements in semiconductor technologies.

- Global Footprint: Major country hubs include the United States, China, India, Germany, and Japan. Prominent city clusters are Shenzhen, Singapore, Shanghai, Bangalore, and Tokyo.

- Investment Landscape: The industry completed over 16 000 funding rounds. More than 13 000 investors contributed, with the average investment per round valued at USD 70.4 million.

- Top Investors: Leading investors include Denso, Wise Road Capital, KB Securities, and more. Together, their investments surpass USD 21 billion in semiconductor technologies.

- Startup Ecosystem: Five innovative startups include RRP Electronics (semiconductor packaging), Last Mile Semiconductor (NR+ SoC), Inversion Semiconductor (lithography platform), Chipmetrics (3D metrology), and RED Semiconductor (AI-focused architecture).

![]()

Methodology: How We Created This Semiconductor Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of semiconductors over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within semiconductor

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the semiconductor market.

What Data is Used to Create This Semiconductor Market Outlook?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the semiconductor market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: The semiconductor industry generated over 54 000 news publications last year, reflecting its presence in media and research discussions.

- Funding Rounds: The sector completed more than 16 000 funding rounds as recorded in our database. This indicates steady investor engagement and consistent capital inflow.

- Manpower: It employs over four million people globally and added 240 000 workers last year.

- Patents: The sector produced over 3 062 000 patents, which showcases ongoing innovation.

- Grants: More than 8 600 grants support research and development in advanced semiconductor technologies.

- Yearly Global Search Growth: The global search interest dropped by 1.58%, however, the industry maintains strong performance across key indicators.

Explore the Data-driven Semiconductor Market Outlook for 2025

Did you know that over 80% of semiconductors are manufactured in Asia, with Taiwan producing 92% of the world’s most advanced chips? Taiwan Semiconductor Manufacturing Limited (TSMC) leads global production, holding 54% of the market share.

According to Precedence Research, the global semiconductor market size is estimated at USD 627.76 billion in 2025 and is projected to reach USD 1,207.51 billion by 2034. This growth reflects a CAGR of 7.54% during the forecast period.

Credit: Precedence Research

The semiconductor industry recorded 0.58% annual growth, supported by over 34 000 companies and 1400 startups driving innovation in electronic and computing technologies.

Workforce expansion remained steady last year, with 240 000 new employees joining roles across research, manufacturing, and system integration. This increased the global talent pool to over four million professionals.

Patent filings exceeded 3 million globally, while more than 8600 grants funded advancements in chip architecture, photonics, materials engineering, and semiconductor process automation.

Further, major semiconductor hubs include the United States, China, India, Germany, and Japan. Leading city clusters are Shenzhen, Singapore, Shanghai, Bangalore, and Tokyo.

A Snapshot of the Global Semiconductor Market

The semiconductor industry recorded an annual growth rate of 0.58%, driven by over 1400 startups advancing chip design, materials, and manufacturing processes.

Among these, more than 1400 are early-stage companies, highlighting an active innovation pipeline and entrepreneurial activity across global markets.

The industry also saw over 1700 mergers and acquisitions, which demonstrates ongoing consolidation and strategic scaling among established firms and new entrants.

Innovation drives progress in the sector, with over 3 million patents filed by more than 332 000 applicants worldwide. This intellectual property covers key areas such as microarchitecture, lithography, semiconductor materials, and advanced packaging.

Besides, the United States leads patent filings with over 993 000 submissions, followed by Japan with over 497 000. Despite competition, the sector maintained steady innovation, recording a patent growth rate of 0.89% annually.

Explore the Funding Landscape of the Semiconductor Market

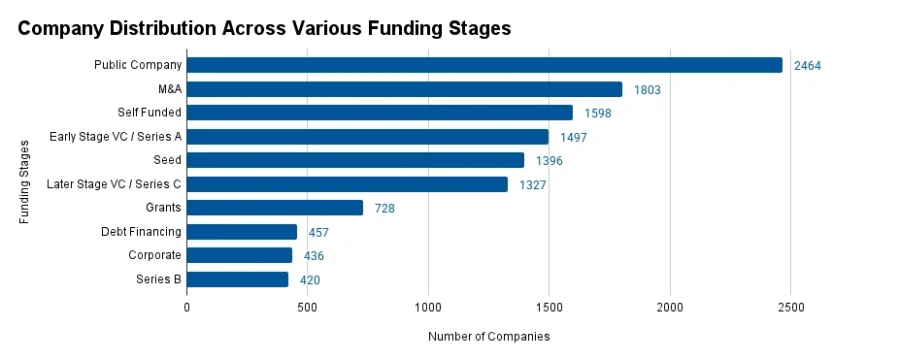

The semiconductor industry draws significant investor interest, with an average investment of USD 70.4 million per funding round across various technology segments. Over 13 000 investors have contributed to developments in chip fabrication, AI accelerators, and power electronics.

So far, more than 16 000 funding rounds have closed, which demonstrates consistent capital deployment across different company stages and regions. These investments have supported over 4700 companies, highlighting the sector’s innovation base and its importance in global technology infrastructure.

Who is Investing in the Semiconductor Market?

Leading investors in the semiconductor industry have contributed over USD 21 billion to facilitate innovation, scaling, and capacity expansion globally.

![]()

- DENSO allocated USD 3.5 billion across five companies, including USD 500 million for a 12.5% stake in Silicon Carbide LLC to secure SiC wafer supplies for EV components.

- Wise Road Capital invested USD 2.8 billion in four companies. This includes the acquisition of Magnachip Semiconductor in a take-private transaction worth USD 1.4 billion.

- KB Securities financed nine companies with USD 2.7 billion.

- Nokia Corporation invested USD 2.4 billion across three companies.

- The European Investment Bank supported 15 companies with USD 2 billion.

- Canyon Bridge invested USD 2 billion across two companies.

- The US Department of Commerce deployed USD 1.9 billion to seven companies.

- ASML invested USD 1.9 billion in two companies.

Top Semiconductor Innovations & Trends

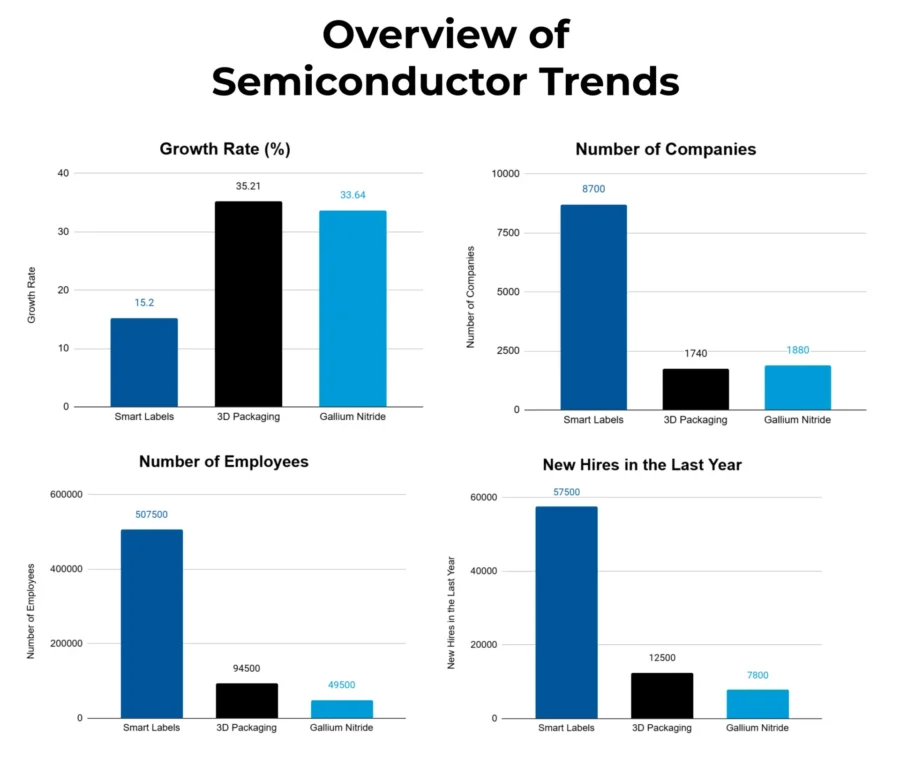

Discover the emerging trends in the semiconductor market along with their firmographic details:

- Smart Labels are becoming more popular in retail and supply chain applications, and 320+ companies with over 45 300 employees worldwide are supporting this trend. Moreover, 1600 new employees joined the workforce in the last year. The annual growth rate of 3.02% reflects expansion driven by logistics automation and real-time data capture.

- In-store Analytics involves 180+ companies employing over 7000 workers. In the last year, 690+ new roles supported activities such as shopper behavior analysis, layout optimization, and real-time sales tracking. The annual trend growth rate of 11.25% reflects increasing demand for data-driven tools to improve store performance and customer engagement.

- Retail Robotics comprises over 55 companies employing 7900+ individuals. The sector added 770+ jobs last year, focusing on automating tasks like shelf scanning, inventory management, and customer assistance. With an annual growth rate of 12.58%, large retailers are adopting robotics to improve efficiency and reduce operational costs.

5 Top Examples from 1440+ Innovative Semiconductor Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

RRP Electronics makes Semiconductor Solutions

Indian startup RRP Electronics provides semiconductor solutions through a vertically integrated platform that covers design, fabrication, testing, and packaging. It operates an OSAT facility, where it conducts wafer processing, die attach, wire bonding, molding, and laser marking within ISO 7 and ISO 8 cleanroom environments.

The startup produces QFN packages for applications in consumer electronics, industrial systems, and automotive sectors. These packages include wettable flank plated variants that enable automated visual inspection by exposing solderable edges for better solder joint evaluation.

Moreover, RRP Electronics also offers BGA packages that support high I/O devices while reducing coplanarity issues and improving assembly consistency. Further, it develops power modules that incorporate silicon carbide-based devices.

These modules combine components like MOSFETs and IGBTs into isolated units for high-power switching. They provide benefits such as reduced parasitic elements and improved heat dissipation.

Last Mile Semiconductor manufactures an NR+ based System on Chip

German startup Last Mile Semiconductor develops the LM10XX System on Chip, which combines a 200 MHz RISC-V processor, a 1.9 GHz NR+ transceiver, and a quantum-proof secure element.

The chip achieves data rates of up to 10 Mbit/s, provides low-latency processing, and ensures IPv6 connectivity. Further, its features include secure boot, firmware updates, side-channel protected cryptographic accelerators, and tamper resistance, which enable end-to-end encryption.

![]()

With Zephyr RTOS-based SDK support, the chip simplifies secure software development for various protocols. Additionally, Last Mile Semiconductor offers cost-effective connectivity to support private wireless networks and enable IoT deployment across smart edge and critical infrastructure environments.

Inversion Semiconductor builds a Semiconductor Lithography Platform

US startup Inversion Semiconductor designs a lithography platform that uses a miniaturized particle accelerator to produce tunable high-power light for semiconductor fabrication. It employs laser wakefield acceleration to shrink the accelerator’s size by 1000 times to enable the generation of 13.5 nm EUV light in a compact, laboratory-compatible setup.

The startup’s platform improves transistor density at the same numerical aperture and achieves higher scanner throughput to support multiple scanners simultaneously. It also enhances critical dimension uniformity and aids the precise fabrication of high-aspect-ratio features essential for advanced transistor architectures, such as quantum and reversible computing.

Further, Inversion Semiconductor addresses lithography challenges and contributes to reshoring advanced chip manufacturing capabilities.

Chipmetrics advances Semiconductor 3D Metrology

Finnish startup Chipmetrics creates 3D metrology tools for semiconductor thin film characterization to offer silicon test chips and related measurement services. The PillarHall test chip uses lateral high aspect ratio (LHAR) cavities to assess thin film conformality and sidewall attributes in deep trenches for ALD and CVD processes.

The VHAR1 chip features a vertical arrangement of 1 µm diameter and 200 µm deep holes over a 15 × 15 mm area, which enables detailed analysis of film behavior in high aspect ratio structures.

Further, the ASD-1 test chip facilitates area-selective deposition by providing alternating material line structures to examine selective growth. For wafer-level processing, the startup supplies 300 mm pocket wafers to accommodate multiple 15 × 15 mm test chips.

Besides, Chipmetrics offers measurement services using optical and electron microscopy, such as SEM, line scan reflectometry, and image ellipsometry.

RED Semiconductor develops Microprocessor Architecture

UK startup RED Semiconductor makes versatile intrinsic structured computing (VISC), a microprocessor architecture that improves performance for AI, autonomy, and cryptographic workloads.

It’s Single-Issue; Multi-Execute (SiMex) design enhances parallel execution while condensing intricate mathematical operations with specialized instructions.

![]()

Additionally, the architecture supports security levels necessary for encryption and trusted computing by integrating features like true random number generation (TRNG) and physically unclonable function (PUF).

VISC achieves efficiency on widely used algorithms in AI/ML, codecs, and secure processing tasks. Moreover, it operates as IP cores compatible with RISC-V platforms and supports Linux environments. It enables developers to implement standard and custom instructions with existing toolchains.

Gain Comprehensive Insights into Semiconductor Trends, Startups, and Technologies

The growing need for AI, automotive, and edge computing applications is driving changes in the semiconductor industry. Further, design, usability, and accessibility are being redefined by emerging trends including chip-as-a-service (CaaS), open-source hardware ecosystems, and bio-integrated semiconductors.

Get in touch to explore 1440+ startups and scaleups, as well as all market trends impacting semiconductor companies.

![10 Top Startups Advancing Machine Learning for Materials Science [2025]](https://www.startus-insights.com/wp-content/uploads/2025/06/Machine-Learning-for-Materials-Science-SharedImg-StartUs-Insights-noresize-420x236.webp)

![10 Emerging AI Solutions for Material Science [2025]](https://www.startus-insights.com/wp-content/uploads/2025/06/AI-Solutions-for-Material-Science-SharedImg-StartUs-Insights-noresize-420x236.webp)