Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

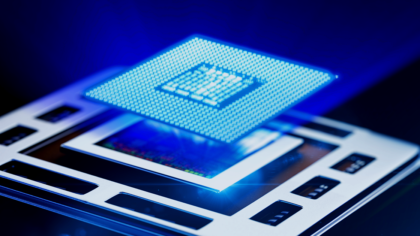

The global semiconductor industry is a powerhouse of innovation, and increasingly vital for numerous sectors. The industry continues its growth trajectory, fueled by burgeoning demand and a surge in new semiconductor companies. This report delves into the key trends shaping the semiconductor landscape. It analyzes market dynamics, maps geographic hubs, and spotlights emerging companies poised to revolutionize the field. As technological needs evolve, is the semiconductor industry ready to deliver the solutions that will power the future?

This report was last updated in July 2024.

This semiconductor industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Semiconductor Industry Report 2024

- Executive Summary

- Introduction to the Semiconductor Industry Report 2024

- What data is used in this Semiconductor Report?

- Snapshot of the Global Semiconductor Industry

- Funding Landscape in the Semiconductor Industry

- Who is Investing in Semiconductors?

- Emerging Trends in the Semiconductor Industry

- 5 Semiconductor Startups impacting the Industry

![]()

Executive Summary: Semiconductor Industry Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 1100+ semiconductor startups developing innovative solutions to present five examples from emerging semiconductor industry trends.

- Industry Growth Overview: The 2024 Semiconductor Industry Report showcases a 3.11% industry contraction but with robust expansion in human resources (141000+ new employees).

- Manpower & Employment Growth: The semiconductor workforce swelled to 2.7 million globally, signifying the industry’s substantial employment demand.

- Patents & Grants: Innovation is strong, with over 104000+ patents held by companies in the sector and 1387 grants awarded, fueling research and development.

- Global Footprint: The United States, China, Germany, South Korea, and India are the leading country hubs, while Shenzhen, Shanghai, Singapore, San Jose, and Tokyo are top city hubs.

- Investment Landscape: Average investment in the semiconductor industry stands at USD 62 million, with over 3600 investors and 12700+ closed funding rounds.

- Top Investors: Semiconductors are of keen interest to several big and small investors from Big Fund, Bosch, Guangzhou Yuexiu Industrial Investment Fund, and China National Building Material to Oaktree Capital Management, GIC, and Qiming Venture Partners, among others.

- Startup Ecosystem: LeapWave Technologies (High-bandwidth interconnections), Lumiphase (Photonic communication chips), Black Semiconductor (Graphene-based photonic chips), Winovus (AlGaN)-based Semiconductor Platforms), and Mivium (High-speed Data Transmission).

- Recommendations for Stakeholders:

- Invest in specialized areas: Target investment and development toward high-growth niches like nanoimprinting and semiconductors for space.

- Continue R&D focus: Prioritize innovation in cutting-edge techniques and materials to maintain growth momentum.

- Nurture the talent pipeline: Address the surge in employment demand by investing in training and attracting the next generation of semiconductor professionals.

Explore the Data-driven Semiconductor Report for 2024

The 2024 Semiconductor Industry Outlook uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Despite revealing a 3.11% contraction in industry growth over the past year, the sector has seen a significant expansion in human resources. Employee numbers rose by over 141000 in the last year. The database also covers 27000+ companies, underscoring the industry’s vast and intricate landscape.

What data is used to create this semiconductor market report?

Based on the data provided by our Discovery Platform, we observe that the semiconductor industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The semiconductor industry has achieved significant recognition with more than 150000 publications in the last year, placing it at the top end of all industries for news coverage and publications.

- Funding Rounds: With data on over 12700 funding rounds available in our database, the semiconductor sector also ranks high among investment activities across industries.

- Manpower & Employee Data: Boasting a workforce of more than 2.7 million individuals, the industry added over 142000 new employees in the last year.

- Patents: The industry’s commitment to innovation is underscored by its holding of over 104000 patents, making it one of the top industries for intellectual property generation.

- Grants: With 1387 grants awarded, the semiconductor sector also ranks high for research and development funding, showcasing strong support for advancing technology in this field.

A Snapshot of the Global Semiconductor Industry

The semiconductor industry is a cornerstone of the global technology landscape. It has showcased robust growth and substantial investment, reflecting its critical role in driving innovation across various sectors. With a workforce of 2.7 million, the industry has seen an influx of over 142000 new employees in the last year. This growth highlights the industry’s expanding capacity as well as its ability to attract and cultivate talent in response to increasing demand for semiconductors. The industry continues to grapple with geo-political wrangling and uncertainty but has seen more than 1000+ new companies formed in the last five years.

Explore the Funding Landscape of the Semiconductor Industry

Financially, the industry’s dynamism is evident by the average investment value of USD 62 million per round. This points to the significant capital flowing into semiconductor ventures. The involvement of more than 3600 investors further underscores the broad interest and confidence in the sector’s potential.

With over 12700 funding rounds closed, and investments in more than 4170 companies, the data reveals a vibrant ecosystem of companies working on semiconductor technology. This financial and workforce expansion is indicative of the semiconductor industry’s strategic importance in the modern digital economy. It powers everything from consumer electronics to critical infrastructure and emerging technologies such as AI and IoT.

Despite the industry’s growth trajectory, its investment patterns signal a strong commitment to advancing semiconductor capabilities. Globally, companies and governments are innovating to meet the technological needs of growing populations and cities.

Who is Investing in Semiconductors?

In the semiconductor industry, the top investors have collectively injected more than USD 5 billion into a range of companies. This showcases the sector’s significant potential and the strong confidence these financial backers have in its future.

- Big Fund has made an impact with a substantial investment of USD 713 million in just one company, highlighting the strategic importance placed on high-potential semiconductor ventures.

- Bosch follows closely, investing USD 700 million across two companies, demonstrating its commitment to fostering innovation and growth within the semiconductor sector.

- The Guangzhou Yuexiu Industrial Investment Fund has contributed USD 670 million to a single company, underscoring its targeted investment strategy in the semiconductor space.

- China National Building Material has allocated USD 630 million in investments across two companies, showing its support for the industry’s development and technological advancement.

- Oaktree Capital Management has diversified its investment portfolio, channeling USD 625 million into four companies, reflecting its strategic approach to capital deployment in the semiconductor industry.

- GIC has invested USD 610 million in two companies, indicating its confidence in the sector’s growth prospects and the potential for technological breakthroughs.

- Qiming Venture Partners stands out for its broad engagement, with USD 556 million invested across ten companies, showcasing its extensive support for innovation in the semiconductor field.

- The Advanced Manufacturing Industry Investment Fund has made a significant investment of USD 548 million in one company, highlighting the focus on advancing manufacturing capabilities in the semiconductor industry.

These investments illustrate the vibrant investment landscape within the semiconductor industry. Key financiers play a pivotal role in driving forward technological advancements and supporting the growth of companies at the cutting edge of semiconductor technology.

Explore Firmographic Data for All Semiconductor Industry Trends

The semiconductor industry is witnessing diverse trends that highlight the sector’s dynamic evolution and adaptation to new challenges and opportunities.

- Nanoimprinting stands out with an annual growth rate of 41.81%. With 97 companies and 6500 employees, this trend added 1000 new jobs in the last year. It underscores the industry’s shift towards innovative fabrication techniques that promise higher precision and lower costs. It also caters to the growing demand for nanoscale devices.

- Semiconductors for Space, involving 129 companies and 9700 employees, with 575 new additions last year. It showcases a moderate growth rate of 2.51%. This reflects the expanding frontier of space exploration and satellite technology, emphasizing the need for specialized semiconductors that can withstand extreme conditions and provide reliable performance in space applications.

- Semiconductor Assembly, despite a dip in growth rate at -3.83%, remains significant with 135 companies, over 32000 employees, and 1300 new hires. This trend suggests a period of consolidation and efficiency optimization in the assembly process. The focus is moving towards improving yield and integrating advanced packaging technologies to meet the complex demands of modern electronics.

5 Top Examples from 1187 Innovative Semiconductor Startups

The five innovative semiconductor companies showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

LeapWave Technologies advanced High-bandwidth Interconnections

Spanish startup LeapWave Technologies specializes in high-bandwidth interconnections. Its platform targets applications such as Broadband interconnects and millimeter-wave technology. Emphasizing wafer-level testing, the startup addresses the need for high-speed semiconductor device evaluation. The company also pioneers Ultra Wide Band interconnections for new communication devices to ensure robust performance. LeapWave’s hybrid assembly integrates photonics and RF interconnects, combining the best available technology for semiconductor assembly and packaging.

Lumiphase designs Optical Engines using Barium Titanate (BTO)

Lumiphase is a Switzerland-based startup that utilizes the properties of Barium Titanate (BTO) to revolutionize photonic engines on silicon with its proprietary optical crystal. The startup’s optical engines enable efficient light interaction, catering to the demands of datacom, telecom, and sensing applications. Utilizing BTO’s large electro-optical effect, Lumiphase provides scalability, cost-efficiency, and reliability by integrating the process into a CMOS platform. This technology addresses the bottlenecks in data centers and high-performance computing systems, enabling faster and more sustainable networking.

Black Semiconductor develops Graphene-based Photonic Chip Technology

German startup Black Semiconductor tackles challenges in the semiconductor industry with graphene-based solutions. It focuses on bringing graphene-based photonic chip technology from research labs to real-world applications. Black Semiconductor aims to address the industry’s demand for high bandwidth and low power consumption. This technology paves the way for faster, smarter, and more efficient applications in various fields like AI and autonomous driving. This approach also allows for more powerful computing capabilities and efficient data center operations.

Winovus enables High-speed Data Transmission for Semiconductor Systems

Singapore-based startup Winovus specializes in nanofabrication technology, specializing in nanoimprinting and nanoinjection molding. It enahnces wireless connectivity with its focus on mmWave and terahertz technologies. The company develops chips and complete semiconductor system solutions for high-speed data transmission. Additionally, Winovus enables new opportunities in sectors like sensing, imaging, and spectroscopy. The company’s expertise further extends to optical thin-film coating, contributing to advances in microarrays and lens manufacturing. Winovus manufactures nanoscale patterned Nickel molds through electroforming and also produces high-reflectance technical glass, showcasing its diverse manufacturing capabilities.

Mivium offers Aluminum Gallium Nitride (AlGaN)-based Semiconductor Platforms

Mivium is a US-based startup that develops semiconductor platforms using gallium nitride (GaN) and aluminum gallium nitride (AlGaN), among other wide bandgap materials. The company’s patented process yields high-quality GaN particles and substrates, emphasizing precision and scale. The company improves performance and energy efficiency with its neuromorphic computing technology. Mivum’s approach allows for faster, low-power computation, making it ideal for edge devices and data-intensive AI workloads. Its manufacturing approach produces consistent results without environmental impact, featuring zero carbon emissions. Moreover, Mivium’s techniques exclude the use of solvents, acids, and contaminants, further ensuring clean production.

Gain Comprehensive Insights into Semiconductor Trends, Startups, or Technologies

The 2024 Semiconductor Industry Report highlights the industry’s resilience and capacity for reinvention. The rise in specialized semiconductor applications reflects a maturing market, eager to meet the demands of an increasingly tech-driven world. Collaborative innovation efforts and significant R&D investments have kept the industry at the forefront of technological progress. Get in touch to explore all 1100+ semiconductor companies and scaleups, as well as all industry data and trends impacting your business.

![Future of Robotics: 12 Trends Powering the Next Wave [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/06/Future-of-Robotics-SharedImg-StartUs-Insights-noresize-420x236.webp)