Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

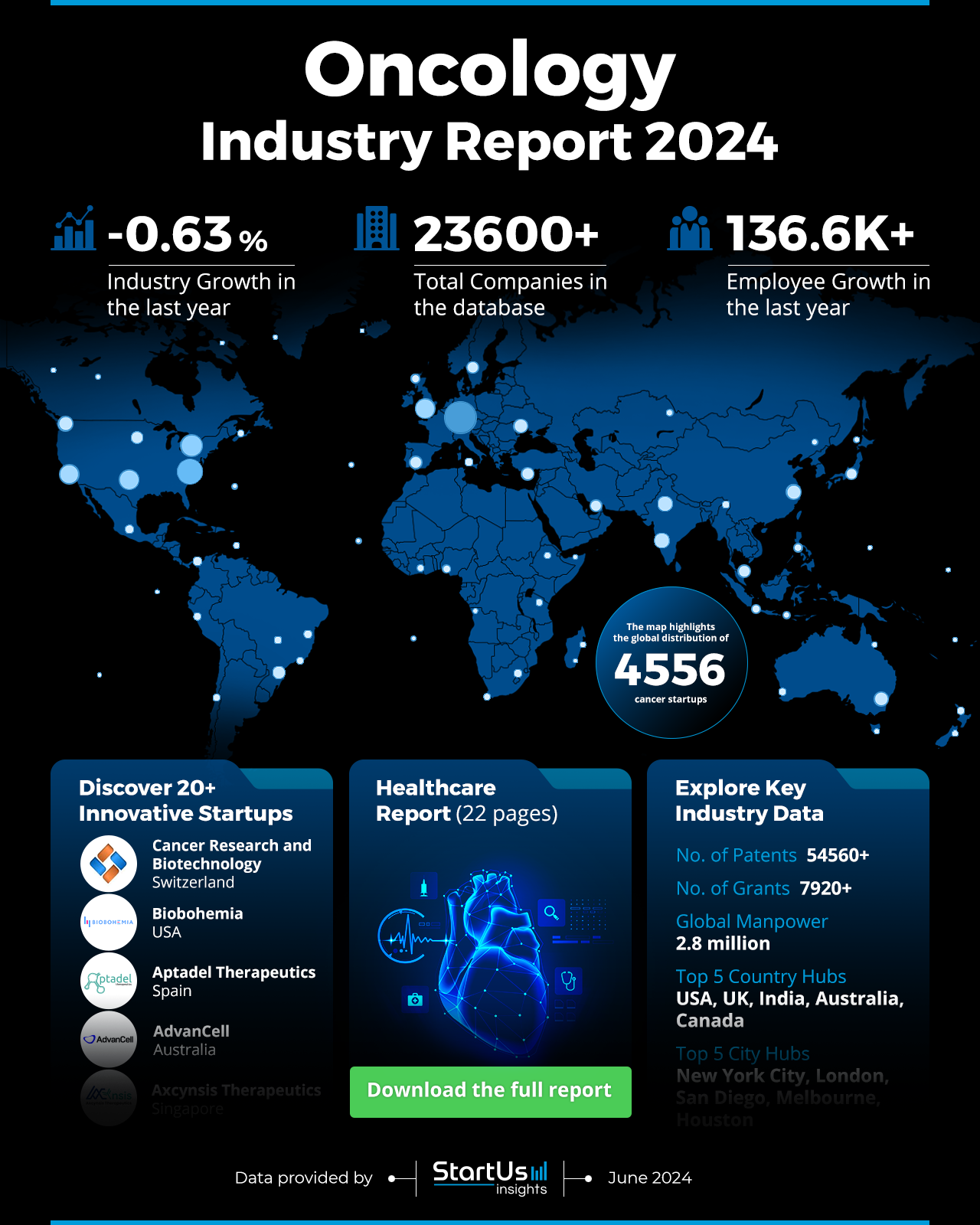

The 2024 Oncology Report provides an in-depth analysis of the current landscape and future trends within the cancer sector. This report highlights key metrics, including workforce growth, investment patterns, and innovation benchmarks. The oncology industry experiences advancement with an increase in funding, patents, and global search interest.

This oncology report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Oncology Industry Report 2024

- Executive Summary

- Introduction to the Oncology Report 2024

- What data is used in this Oncology Report?

- Snapshot of the Global Oncology Market

- Funding Landscape in the Oncology Industry

- Who is Investing in Oncology?

- Emerging Trends in the Oncology Industry

- 5 Innovative Oncology Startups

Executive Summary: Oncology Market Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 4556 oncology startups developing innovative solutions to present five examples from emerging oncology industry trends.

- Industry Growth Overview: The cancer industry includes over 4556 startups and 23600+ companies. It saw a decrease in annual growth by about -0.63%.

- Manpower & Employment Growth: The industry employs 2.8 million people. It added over 136K new employees in the last year alone.

- Patents & Grants: Over 54560 patents were filed to showcase the innovation area. More than 7920 grants were awarded.

- Global Footprint: The top five country hubs include the USA, UK, India, Australia, and Canada. The top five city hubs include New York City, London, San Diego, Melbourne, and Houston.

- Investment Landscape: The industry received an average investment value of about USD 32 million per round. It attracted over 3100 investors. Also, it closed over 13020 funding rounds and more than 4840 companies benefited from these investments.

- Top Investors: Leading investors include RA Capital Management, Tencent, and ARCH Venture Partners. The combined value invested by top investors surpassed USD 17 billion.

- Startup Ecosystem: The top startups in this area include Cancer Research and Biotechnology (cell metabolic function restoration), Biobohemia (antigenic essence technology), Aptadel Therapeutics (RNA aptamer technologies), AdvanCell (212Pb production technology), and Axcynsis Therapeutics (antibody-X conjugate therapies).

- Recommendations for Stakeholders: Investors in the cancer industry should focus on funding early-stage startups developing therapies and diagnostic tools, particularly those exploring personalized medicine and immunotherapy. While entrepreneurs should prioritize technologies that improve early detection of cancer, governments need to increase funding for cancer research, especially for underserved areas such as rare cancers and pediatric oncology.

Explore the Data-driven Oncology Report for 2024

The Oncology Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The data reveals industry growth over the past year with a decrease of -0.63%, underscored by the filing of over 54560 patents and the awarding of more than 7920 grants. The global workforce in this sector stands at 2.8 million employees, with an annual growth of 136000 employees.

The top five country hubs include the USA, UK, India, Australia, and Canada with the top five city hubs as New York City, London, San Diego, Melbourne, and Houston. The heatmap above illustrates the geographical distribution and widespread nature of industry growth, with many hubs emerging as centers of innovation.

What data is used to create this oncology report?

Based on the data provided by our Discovery Platform, we observe that the oncology industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The global oncology market achieved media presence with over 79800+ publications released in the past year.

- Funding Rounds: Funding activities show data on more than 13020 funding rounds available in our database.

- Manpower: The industry includes more than 2.8 million workers and added over 136K new employees last year alone.

- Patents: Over 54560 technologies in the industry hold patents.

- Grants: The sector received more than 7920 grants.

- Yearly Global Search Growth: Interest in the global oncology market grew with an 8.57% increase in yearly search results.

- and more. Contact us to explore all data points used to create this oncology report.

A Snapshot of the Global Oncology Industry

The oncology market report provides an overview of the current state and dynamic growth within the sector. With a manpower of 2.8 million employees, the industry experienced growth, adding 136.6K new employees in the past year alone. The sector encompasses a network of 23636 companies that highlight its reach and influence.

Explore the Funding Landscape of the Oncology Industry

Investment in the industry is showcased with an average investment value of USD 32 million per round. The sector attracted more than 3100 investors who participated in over 13020 funding rounds. This level of financial activity underscores the investors’ confidence and the potential for innovation and growth within the industry. Additionally, more than 4840 companies benefited from these investments, further driving the sector’s expansion and development.

Who is Investing in Oncology?

The combined investment value of the top investors in the industry exceeds USD 17 billion. This demonstrates the financial support of the investors in this sector. The leading investors and their contributions include:

- RA Capital Management supported 29 companies with a total of USD 2.4 billion.

- Tencent backed 5 companies, contributing USD 2 billion.

- ARCH Venture Partners provided funds to 16 companies, amounting to USD 1.8 billion.

- Apollo financed at least 1 company with USD 1.8 billion.

- Softbank Vision invested in 7 companies, with a total of USD 1.7 billion.

- CDH Investments funded 7 companies, investing USD 1.6 billion.

- OrbiMed sponsored 33 companies, contributing USD 1.5 billion.

- Gilead Sciences backed 6 companies, with investments totaling USD 1.4 billion.

- and more. Get in touch to explore all investment data in the battery and energy storage industries.

Access Top Oncology Innovations & Trends with the Discovery Platform

The Tumor Microenvironment trend gains traction within the oncology industry. A total of 350 companies are identified in this area, collectively employing 17.7K people. This workforce expanded with 1.6K new employees added in the last year alone. The annual trend growth rate for tumor microenvironment stands at 18.32%. This highlights the focus and investment in understanding and manipulating the tumor microenvironment to develop more effective cancer treatments.

Integrative Oncology integrates conventional cancer treatments with complementary therapies to enhance patient care. This trend is used in about 93 companies and employs a total of 3.4K individuals. In the past year, the sector added 306 new employees. The annual trend growth rate for integrative oncology stands at 3.78% which indicates a steady expansion.

Liquid Biopsy includes about 573 companies and employs approximately 38.8K people. The workforce sees growth, with 3.5K new employees added in the last year. The annual trend growth rate is 46.11% and reflects the demand and potential for this non-invasive diagnostic technology. It offers an alternative to traditional biopsies and enables earlier detection of cancer and more effective treatment monitoring.

5 Top Examples from 4556+ Innovative Oncology Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a platform demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Cancer Research and Biotechnology provides Cell Metabolic Function Restoration

Swiss startup Cancer Research and Biotechnology develops non-toxic small molecule drugs to treat cancer by restoring balance in metabolic cellular pathways. Its drug, CRB091, targets triple-negative breast cancer (TNBC) tumors and eradicates cancer cells without harming healthy organs. TNBC lacks estrogen receptors, progesterone receptors, and human epidermal growth factor receptor 2 (HER2) protein. CRB091 reduces the metastatic spread of tumors and prevents cancer recurrence.

Biobohemia uses Antigenic Essence Technology

US-based startup Biobohemia develops antigenic essence technology to enhance cellular cancer vaccines. The startup’s cell antigenic essence production via proteomics and cell culture technology upgrades conventional vaccination methods. It collects antigens from the cell surface using proteomics-grade protease. Also, it identifies the properties of cancer cells while controlling composition and purification. Further, it upgrades existing cellular compositions and creates new ones leading to the santavac brand of cancer vaccines that target virtually any solid cancer.

Aptadel Therapeutics builds RNA Aptamer Technologies

Spanish startup Aptadel Therapeutics uses ribonucleic acid (RNA)-Aptamer technology to provide therapeutic agents with high specificity and improved safety for treating various cancers. Aptamers or chemical antibodies exhibit high binding affinity and selectivity due to their complex tertiary structures. Unlike antibodies, aptamers undergo chemical synthesis and modification, allowing conjugation with chemotherapeutic agents, small interfering RNA (siRNA), and nanoparticles. The startup’s RNA aptamer targets receptor tyrosine kinase ephrin type-A receptor 2 (EphA2) for facilitating intracellular drug delivery by binding and internalizing. The startup’s pipeline treats childhood cancer, particularly Ewing Sarcoma which affects bones and soft tissue and includes a low survival rate for metastatic cases.

AdvanCell makes 212Pb Production Technology

Australian startup AdvanCell uses targeted alpha therapy to provide alpha particle radiation directly to cancer cells. The startup’s proprietary 212Pb production technology ensures a supply of alpha isotopes for clinical development. Alpha 212 or Lead-212, produced through 212Pb generators, advances AdvanCell’s therapeutic pipeline. These generators enable control of the supply chain and offer a scalable solution for manufacturing alpha radioligand therapies.

Axcynsis Therapeutics offers Antibody-X Conjugate (AXC) Therapies

Singaporean startup Axcynsis Therapeutics provides AXC therapies, AxcynMAB, AxcynCYS, and AxcynDOT. Its AxcynMAB platform integrates advanced antibody discovery with computational technologies to develop high-performance antibodies. AxcynCYS technology allows site-specific conjugation and produces a homogeneous antibody-drug conjugate (ADC) product with optimal drug-to-antibody ratios. AxcynDOT, a proprietary payload, is modified to increase potency and improve pharmacokinetic properties. These therapies overcome drug resistance seen with current ADC payloads.

Gain Comprehensive Insights into Oncology Trends, Startups, or Technologies

The 2024 cancer report illustrates the growth and innovation driving the sector forward. As the industry expands, the collaborative efforts of companies, investors, and researchers advance cancer treatment and care. This report underscores the industry’s landscape and its future, inspiring continued dedication and innovation in the fight against cancer. Contact us to explore all 4550+ startups and scaleups, as well as all industry trends impacting oncology companies.