Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

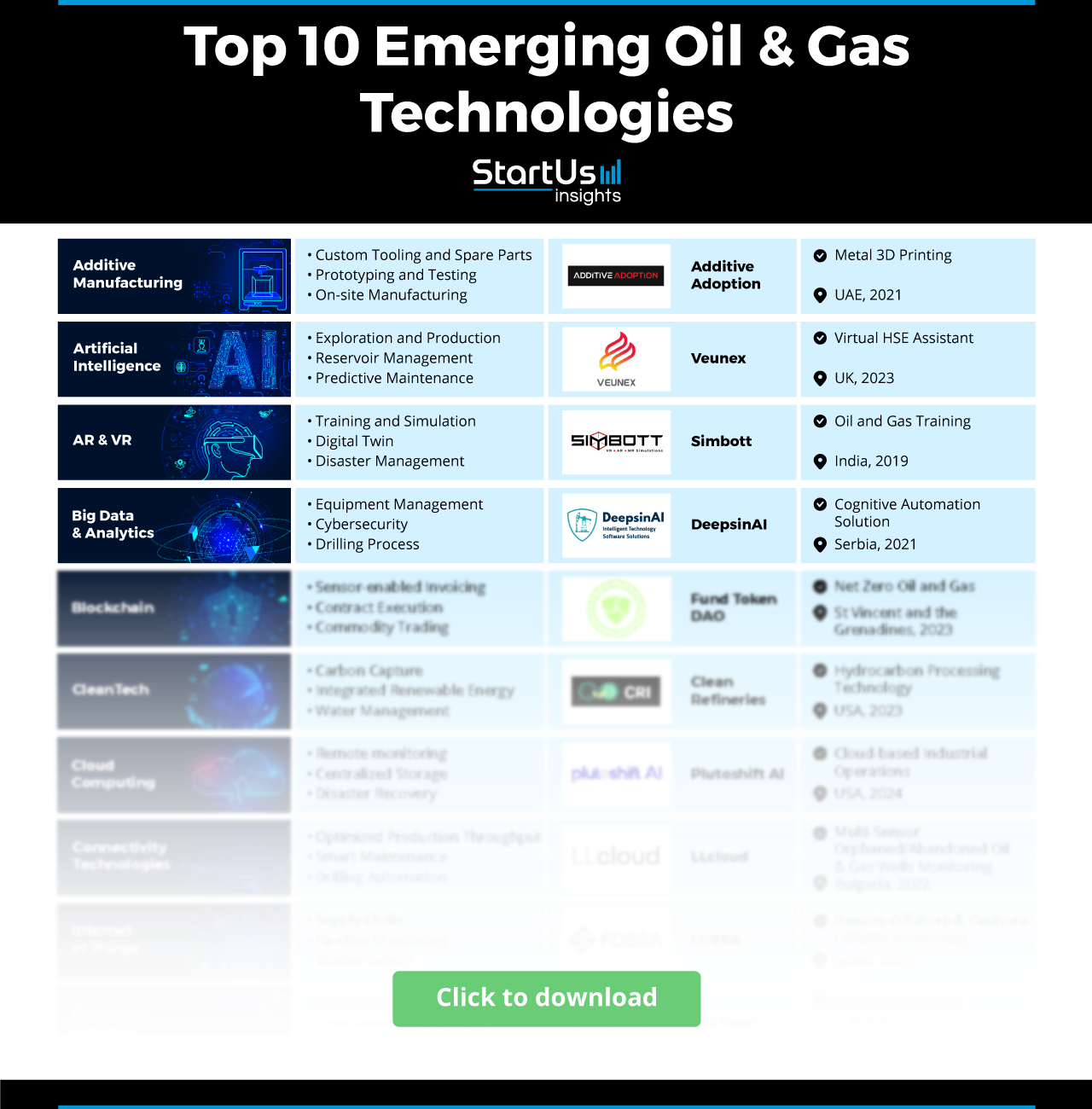

The oil and gas industry is leveraging emerging technologies to enhance remote operations, minimize environmental impacts, and improve operational efficiency. Innovations such as 3D printing, artificial intelligence (AI), augmented reality (AR), virtual reality (VR), and more are reshaping the industry. For example, 3D printing reduces downtime with custom tooling, while AI optimizes reservoir management. Similarly, companies, like Veunex, offer virtual health, safety, and environment (HSE) assistants that automate safety tasks with AI-driven communication, risk assessments, and observations. Further, blockchain ensures secure transactions of energy commodities, supply chain data, and contractual agreements. As the industry evolves, key decision-makers must adopt the latest oil and gas technology innovations to address immediate challenges and establish a foundation for long-term growth and innovation.

Why should you read this report?

- Gain in-depth insights into the top 10 emerging technologies in oil and gas.

- Learn about three practical use cases for each technology.

- Meet 10 innovative startups advancing these technologies.

Key Takeaways

- Additive Manufacturing

- Use Cases:

- Custom Tooling and Spare Parts

- Prototyping and Testing

- On-Site Manufacturing

- Startup to Watch: Additive Adoption

- Use Cases:

- Artificial Intelligence

- Use Cases:

- Exploration and Production

- Reservoir Management

- Predictive Maintenance

- Startup to Watch: Veunex

- Use Cases:

- Augmented Reality & Virtual Reality

- Use Cases:

- Training and Simulation

- Digital Twin

- Disaster Management

- Startup to Watch: Simbott

- Use Cases:

- Big Data & Analytics

- Use Cases:

- Equipment Management

- Cybersecurity

- Drilling Process

- Startup to Watch: DeepsinAI

- Use Cases:

- Blockchain

- Use Cases:

- Sensor-enabled Invoicing

- Contract Execution

- Commodity Trading

- Startup to Watch: Fund Token DAO

- Use Cases:

- CleanTech

- Use Cases:

- Carbon Capture

- Renewable Energy Integration

- Water Management

- Startup to Watch: Clean Refineries

- Use Cases:

- Cloud Computing

- Use Cases:

- Remote Monitoring

- Centralized Data Storage

- Disaster Recovery

- Startup to Watch: Plutoshift AI

- Use Cases:

- Connectivity Technologies

- Use Cases:

- Optimized Production Throughput

- Smart Maintenance

- Drilling Automation

- Startup to Watch: LLcloud

- Use Cases:

- Internet of Things (IoT)

- Use Cases:

- Supply Chain Monitoring

- Worker Safety

- Pipeline Monitoring

- Startup to Watch: FOSSA

- Use Cases:

- Advanced Robotics

- Use Cases:

- Subsea Exploration

- Environmental Monitoring

- Pipeline Inspection Robots

- Startup to Watch: AIS Field

- Use Cases:

- Additive Manufacturing

Oil & Gas Industry FAQs

How much is the oil and gas industry worth?

The global oil and gas market was recorded at USD 6705.68 billion in 2023, with an estimated value of USD 6923.33 billion in 2024. It is projected to grow to USD 8917.40 billion by 2031, with a compound annual growth rate (CAGR) of 3.68% from 2024 to 2031. This growth is driven by the ongoing demand for oil and gas, despite challenges posed by energy transitions and decarbonization efforts.

What are the three sectors of the oil and gas industry?

The industry is divided into three key sectors:

- Upstream: Focused on exploration and production, it involves locating and extracting oil and gas reserves.

- Midstream: This sector handles crude oil and natural gas transportation and storage.

- Downstream: Responsible for refining crude oil into usable products like gasoline, diesel, and natural gas

What are the challenges facing the oil and gas industry?

- Decarbonization pressures: With global shifts toward clean energy, companies focus on reducing carbon emissions and investing in low-carbon technologies.

- Technological transformation: The need to adopt digital tools such as AI, cloud computing, and automation for operational efficiency is rising. Companies face challenges in scaling these technologies while maintaining profitability.

- Regulatory compliance and environmental risks: Governments worldwide are tightening regulations on methane emissions and other pollutants. This forces companies to innovate while staying compliant.

Where is this Data from?

StartUs Insights provides data through its comprehensive Discovery Platform, which covers 4.7 million startups, scaleups, and tech companies globally, as well as 20,000 emerging technology trends. The platform excels in startup and technology scouting, trend intelligence, and patent searches, offering a detailed view of the innovation landscape. For this report, we analyzed technologies within specific industries using the trend intelligence feature. During this research, we identified patterns and trends, pinpointing relevant use cases and the startups developing solutions for each. More capabilities and details are available at StartUs Insights Discovery Platform.

10 Emerging Technologies Impacting the Future of Oil & Gas Industry

1. Additive Manufacturing

3D printing facilitates rapid prototyping, on-site manufacturing, and efficient component repairs through techniques like powder bed fusion (PBF), stereolithography (SLA), and fused deposition modeling (FDM). These methods use materials such as metals (like titanium) and polymers (such as PEEK) to reduce lead times, streamline supply chains, and minimize downtime. This allows the oil and gas industry to reduce the need for extensive inventories, improve operational efficiency through faster production of replacement parts, and reduce environmental impact by cutting material waste and carbon emissions.

3 Practical Use Cases of Additive Manufacturing in Oil & Gas

- Custom Tooling and Spare Parts: This involves the production of specialized tools and replacement parts, customized to fit specific requirements. 3D printing allows for on-demand production of these parts to reduce downtime and the need for extensive inventory.

- Prototyping and Testing: 3D printing enables engineers to produce and test prototypes for equipment, such as valves or heat exchangers, and accelerate product development.

- On-site Manufacturing: In remote locations like offshore oil platforms, 3D printing allows for the immediate fabrication of critical parts, such as spare parts for turbines or drilling equipment to avoid procurement processes.

Startup to Watch: Additive Adoption

UAE-based startup Additive Adoption delivers 3D printing solutions through its desktop metal products for all scales of production such as complex prototypes and on-demand tooling. It integrates agile additive manufacturing technology to shorten product design cycles of critical oil and gas components. It allows fast prototyping through multiple design iterations and quick testing of design concepts. The company’s solutions enable the rapid production of jigs, fixtures, prototypes, and tooling while offering benefits such as bridge tooling, low-volume production, and supply chain reorganization.

2. Artificial Intelligence

AI improves seismic analysis to enhance exploration accuracy and reduce environmental impacts in the oil and gas industry through better management of emissions and leaks. It automates drilling processes, optimizes energy usage, and assists in real-time reservoir management. For example, predictive analytics combined with IoT sensors allow continuous monitoring of drilling rigs and pipelines, while AI algorithms process seismic data for better reservoir modeling. Digital twins, another AI application, create virtual representations of physical assets to simulate and optimize performance.

3 Practical Use Cases of Artificial Intelligence in Oil & Gas

- Exploration and production: By reducing dependency on geological investigation for exploration, AI analyzes large datasets for geoscientists to identify new drilling locations. AI also increases the well productivity and reduces exploration risks by forecasting potential failures.

- Reservoir Management: AI algorithms simulate and manage complex subsurface reservoirs, optimizing oil and gas recovery and extending the operational life of fields. AI-driven models predict reservoir behavior, optimize production rates, manage reservoir pressure, and improve recovery techniques.

- Predictive Maintenance: AI analyzes sensor data from equipment such as pumps, compressors, and turbines to forecast potential breakdowns to avoid unexpected failures and reduce repair costs.

Startup to Watch: Veunex

UK-based startup Veunex provides a virtual health, safety, and environment assistant for the oil and gas industry. The platform leverages AI to allow HSE teams to automate communication, risk assessments, and safety observations. Its platform integrates into existing operations and enables teams to generate actionable insights and deliver targeted training in real time. The startup’s technology, trained on offshore and onshore rigs, turns raw data into valuable assets that accelerate risk management processes across multiple operations and enhance the overall safety of rigs, refineries, and fabrication sites.

3. Augmented Reality (AR) & Virtual Reality (VR)

AR headsets offer technicians hands-free access to critical data like schematics, sensor readings, and maintenance instructions. This allows real-time troubleshooting and remote assistance that, in turn, reduces errors and improves efficiency during equipment inspections and repairs. VR immerses personnel in simulated environments, such as virtual oil rigs or refineries, to train in hazardous scenarios without physical risks. Integrating AR and VR with digital twins and 3D models further enables advanced planning and predictive maintenance.

3 Practical Use Cases of AR & VR in Oil & Gas

- Training and Simulation: AR & VR create realistic, immersive environments to engage workers in hands-on learning and strengthen their knowledge retention. By simulating hazardous scenarios such as gas leaks or equipment malfunctions, companies prepare employees to respond effectively in real life.

- Digital Twin: A virtual replica of a physical asset, such as a refinery or oil rig, created using data from sensors and IoT devices. This allows engineers to simulate and analyze complex systems to monitor operations, test scenarios, and predict outcomes.

- Disaster Management: VR generates detailed simulations of disaster scenarios, such as chemical spills or explosions, that allow employees to practice emergency responses in a controlled virtual setting.

Startup to Watch: Simbott

Indian startup Simbott offers AR and VR simulation and training solutions leveraging digital twins for real-time monitoring, offshore and onshore site planning, and geophysical data visualization. These tools improve workforce performance by providing realistic, hands-on experience in a controlled environment. Its AR Welding System combines real-world actions with digital feedback while the VR Welding Simulator immerses personnel in realistic environments to practice techniques like GMAW, FCAW, SMAW, and GTAW. Additionally, Simbott’s solutions for the oil and gas industry facilitate training in drilling, equipment operation, and safety protocols.

4. Big Data & Analytics

The big data market in the oil and gas sector is estimated to increase by USD 22.42 billion, at a CAGR of 27.17% between 2023 and 2028. This is due to fluctuating oil prices, stringent environmental regulations, and the need for optimized operations across upstream midstream, and downstream activities. Big data and analytics enable real-time monitoring of drilling operations, predictive maintenance of equipment, and seismic data analysis for accurate exploration. By integrating data from multiple sources such as sensors and IoT devices, it enables companies to reduce operational costs, minimize environmental risks, and maximize production efficiency.

3 Practical Use Cases of Big Data & Analytics in Oil & Gas

- Equipment Management: Big data and analytics coupled with IoT sensors deployed on drilling rigs and pipelines continuously collect temperature, pressure, and vibration data. Machine learning analyzes this data to forecast potential failures and perform maintenance before costly breakdowns occur.

- Cybersecurity and Risk Management: Big data analyzes network traffic, identifies anomalies, and predicts potential cyber threats. Along with blockchain technologies and AI, big data and analytics respond to cyber threats in real time to secure transactions and improve supply chains.

- Drilling Process: Advanced data analytics develops models using historical data and geological measurements, while real-time sensor data refine drilling parameters. Early identification of anomalies prevents blowouts and kicks.

Startup to Watch: DeepsinAI

Serbian startup DeepsinAI develops Deep Platform, a cognitive automation solution to enhance operational efficiency through AI and machine learning for the oil and gas industry. The platform integrates with existing systems to improve production management, asset performance, and operational optimization. It provides real-time insights, a customizable dashboard for monitoring well operations, and modules like DECO 2 for tracking and optimizing GHG emissions, AIR for automatic well diagnostics, and AIRFLOW for predicting future well flow rates. These features reduce operating costs, optimize well operations, and improve decision-making efficiency.

5. Blockchain

By using blockchain, the oil and gas sector achieves accountability, reduces costs, and optimizes its supply chain through enhanced data tracking and secure asset management. Distributed ledger systems transform transactional processes by automating contract execution and reducing human error. These technologies allow oil and gas companies to securely track every transaction and ensure compliance with regulations. Major players like BP and Shell integrate blockchain with their existing systems to enhance transparency in supply chains and streamline payments. Additionally, blockchain networks enable real-time collaboration between stakeholders and provide immutable records that reduce the risk of fraud and enhance trust across the industry.

3 Practical Use Cases of Blockchain in Oil & Gas

- Sensor-Enabled Invoicing: Blockchain integrates with IoT sensors in plants and pipelines to enable real-time invoicing based on actual chemical usage or production. The system triggers payment without manual intervention when conditions are met. This digital invoicing eliminates inaccuracies in invoicing.

- Contract Execution: Smart contracts offer a secure, transparent platform to manage contracts and eliminate the need for intermediaries. Blockchain provides a trustworthy source of information that mitigates risks associated with counterparty trust, fraud, and inconsistencies in transactions.

- Commodity Trading: Blockchain synchronizes data across all participants, offering real-time access to accurate information. In trading refined products, blockchain ensures that all parties have simultaneous access to the same data, which reduces the risk of errors, improves security, and streamlines the trade settlement process.

Startup to Watch: Fund Token DAO

Saint Vincent and the Grenadines-based startup Fund Token DAO develops a crypto platform to enable global investments in sustainable energy projects, including net-zero oil and gas, renewable energy, advanced carbon utilization technologies, direct air capture (DAC) technologies, and electric vehicles (EVs). By issuing the FTDAO utility token, the platform allows participation in decentralized decision-making processes, where token holders vote on funding and governance of green energy initiatives such as carbon sequestration initiatives. The FTDAO token integrates with decentralized finance (DeFi) protocols to ensure transparent and immutable transactions while promoting ESG-focused investments.

6. CleanTech

Technologies like carbon capture, utilization, and storage (CCUS) mitigate carbon emissions by capturing CO2 from production processes and storing it safely or using it in other applications. Hydrogen infrastructure advances with improvements in hydrogen production and transportation technologies to support a low-carbon future. Moreover, innovations in methane pyrolysis and emissions control reduce greenhouse gas emissions from operations. Cleantech solutions, such as energy storage systems including large-scale batteries and hybrid renewable systems, optimize energy usage and minimize reliance on traditional hydrocarbons in the oil and gas sector.

3 Practical Use Cases of CleanTech in Oil & Gas

- Carbon Capture: Carbon capture and storage (CCS) captures CO2 emissions from refineries and prevents them from entering the atmosphere. This lowers greenhouse gas emissions, meets regulatory requirements, and allows continued use of fossil fuels while transitioning to a low-carbon energy system.

- Integrated Renewable Energy: Integrating renewable energy sources, such as solar and wind, into daily operations—such as in remote oil fields enhances sustainability and operational efficiency. Companies implement hybrid energy systems that combine solar panels and wind turbines with traditional energy sources to reduce their reliance on diesel generators.

- Water Management: Advanced water treatment systems purify and recycle water used in hydraulic fracturing. Closed-loop water recycling systems minimize freshwater withdrawal and wastewater discharge and align with environmental regulations and community expectations.

Startup to Watch: Clean Refineries

US-based startup Clean Refineries offers a patented hydrocarbon processing technology that produces asphalt, diesel, gasoline, and aviation fuel while achieving net-zero greenhouse gas emissions and net-zero carbon dioxide output. The technology operates through a low-pressure, low-temperature closed-loop system, enhancing safety and minimizing environmental impact, while also reducing production costs. Its modular reactor units offer scalability and flexibility that allow the processing of various feedstocks and efficient site usage.

7. Cloud Computing

Cloud computing solves the longstanding challenges of the oil and gas industry in managing vast data generated from connected oilfields, sensors, and SCADA systems. As data complexity and scale increase, on-premise data storage becomes unsustainable, creating a demand for flexible, scalable, and cost-effective data management solutions. Cloud computing offers scalable storage to handle the dynamic nature of data in real time, thereby reducing costly on-premise infrastructure expenses.

3 Practical Use Cases of Cloud Computing in Oil & Gas

- Remote Monitoring: Data generated through IoT devices integrated with cloud platforms and placed in oil and gas assets such as wells, pipelines, and refineries allows the detection of anomalies and making adjustments remotely. As this data is transmitted to the cloud and accessed through a centralized dashboard, it enables operators to monitor asset performance, facilitating proactive maintenance and quick hazard response.

- Centralized Storage: Using cloud-based data lakes and analytics platforms, data is aggregated from various sources to perform predictive maintenance, resource optimization, and supply chain management. Centralized storage addresses the challenge of fragmented data storage to ensure data consistency, improve accessibility for decision-makers, and enhance collaboration across departments.

- Disaster Recovery: Cloud platforms offer secure data backup and disaster recovery options through information protection and restoration capabilities. They implement security protocols such as encryption and access controls to safeguard sensitive data.

Startup to Watch: Plutoshift AI

US-based startup Plutoshift AI offers a cloud-based operational data platform that centralizes and processes industrial IoT data to provide actionable intelligence across workflows, sites, and enterprise levels. Its platform, Gravity, aggregates data from various sources such as IoT sensors and business systems to deliver automated performance monitoring and predictive analysis for physical infrastructure, maintains the data pipeline without additional IT resources, and consolidates it into a single repository for analysis. It offers configurable alerts, response tracking, contextual reports, machine learning-driven insights, and proactive monitoring. This allows organizations to improve productivity, reduce downtime, and optimize resource allocation across the oil and gas industry.

8. Connectivity Technologies

Connectivity technologies such as fiber optics, 4G, 5G, LTE networks, and microwave communication advance the oil and gas industry toward automation, optimization, and minimizing environmental impact. The vast geographic distribution of assets, often located in remote and harsh environments, demands more efficient, safe, and cost-effective operations. To address bandwidth limitations and reliability issues, enhanced connectivity technologies provide real-time data transmission, facilitating automation and reducing reliance on human intervention in hazardous environments.

3 Practical Use Cases of Connectivity Technologies in Oil & Gas

- Optimized Production Throughput: Data collection devices deployed across the entire production process use high-bandwidth connections provided by fiber optics or advanced microwave systems to ensure real-time monitoring and adjustment of production parameters. Advanced analytics are then applied to optimize the performance of production facilities, improving throughput and reducing energy consumption.

- Smart Maintenance: Advanced connectivity deploys a dense network of sensors to monitor the condition of equipment for predictive maintenance. It reduces the frequency of equipment failures and extends the lifespan of critical assets by recommending actions before issues arise.

- Drilling Automation: Fiber optics and 5G networks enable real-time transmission from drilling sites to centralized control centers, reducing unproductive time and increasing drilling speed. Supported by reliable connectivity, automation technologies minimize human error by reducing the need for human intervention during critical operations.

Startup to Watch: LLcloud

Bulgarian startup LLcloud provides a cloud-based multi-sensor monitoring solution for tracking orphaned and abandoned oil and gas wells to monitor methane and other emissions from wells using a variety of sensor data. The platform automates the gathering, analysis, and visualization of data from various sources, including IoT data from drones, UAVs, and piloted aircraft that enables precise well detection and monitoring through GeoTIFF imagery and satellite data. The startup’s cloud-based system supports geospatial visualization, automated reporting, and data fusion from multiple sources, offering environmental agencies a scalable, customizable tool for accurate emissions monitoring, well status assessment, and operational efficiency across various regions.

9. Internet of Things

IoT sensors and device mitigates safety risks through real-time alerts, improving response times in emergencies. The dispersed nature of oil and gas operations, with assets spread across remote and often hazardous environments, complicates oversight and maintenance. Technologies such as advanced wireless networks and low-cost sensors allow for the integration of data across the supply chain to enable more informed decision-making and streamlined operations.

3 Practical Use Cases of the Internet of Things in Oil & Gas

- Supply Chain Optimization: IoT enables tracking of materials and equipment throughout the midstream supply chain to ensure timely deliveries and reduce logistics costs.

- Pipeline Monitoring: IoT monitors pressure, flow rate, and temperature along the pipeline infrastructure by analyzing real-time data. These embedded sensors identify anomalies or potential leaks to take immediate action and mitigate risk, prevent damage, and ensure safety.

- Worker Safety: Wearables like smart helmets, vests, and boots improve worker safety in hazardous oil and gas environments. These devices monitor vital signs, detect falls, and alert workers to dangerous conditions like gas leaks. Data from these wearables also enhances safety protocols and training.

Startup to Watch: FOSSA

Spanish startup FOSSA provides IoT connectivity and satellite communications solutions for the oil and gas industry to enable remote monitoring and real-time data tracking of onshore and offshore assets. It uses nanosatellite infrastructure and supports the integration of various monitoring technologies, including pipeline corrosion monitoring, pressure and flow velocity analysis, and machinery condition tracking. The platform offers global coverage with low-power, energy-efficient LPWAN technologies, ensuring reliable communication in remote areas.

10. Advanced Robotics

Robotics in the oil and gas industry is heavily used for autonomous operations, drilling optimization, plant inspections, and fleet optimization to address the increasing complexity of operations, fluctuating oil prices, safety concerns, and sustainability. Robots mitigate risks by reducing human exposure to tasks like inspecting noxious gases, fighting fires, and monitoring oil spills. Further, automation and control systems, drones, remotely operated vehicles, and pipeline robots streamline repetitive and labor-intensive tasks to reduce downtime and improve operational efficiency.

3 Practical Use Cases of Advanced Robotics in Oil & Gas

- Subsea Exploration: Subsea exploration relies on autonomous underwater vehicles (AUVs) that perform detailed inspections and surveys of underwater assets. Equipped with high-definition cameras, sonar, and laser scanners, AUVs navigate deep-sea rigs and pipelines. They operate in high-pressure, low-light conditions, making complex underwater structures accessible.

- Environmental Monitoring: Drones with environmental sensors and imaging technology, assess environmental conditions to track pollution levels, wildlife activity, and environmental changes in real-time. These technologies facilitate better decision-making due to their high accuracy in providing data.

- Pipeline Inspection Robots: Robots equipped with inspection sensors, locomotion systems, and data analytics travel through pipelines to inspect conditions, detect leaks, and identify potential failures. They provide real-time data on pipeline integrity to ensure reliable operation of pipeline systems.

Startup to Watch: AIS Field

Turkish startup AIS Field develops industrial robotic inspection solutions for the oil and energy sectors. It offers PAARS for automated annular ring inspections in storage tanks and RUVI WALLKER for the visual and ultrasonic corrosion mapping inspection of remote areas for industrial boilers. The company’s RUVI OilDiver offers ATEX-certified robotic systems for ultrasonic thickness measurement and corrosion mapping of storage tanks in explosive environments, while the I-Cleaner and RUVI Diver facilitate non-invasive cleaning and underwater inspections. Also, AIS Field’s software solution, FIL, for inspection management improves asset reliability and operational efficiency through automated data analysis and real-time monitoring.

Outlook for the Oil & Gas Industry

Patents & Grants

The oil and gas industry is advancing technologically, with over 196000 patents filed and 12700+ grants awarded. These numbers show the industry’s ongoing innovation in improving exploration, production, and sustainability.

For more actionable insights, download our free Oil & Gas Innovation Report.

Investment Landscape

Key players like EnCap Flatrock Midstream, Carnelian Energy Capital, Techstars, Y Combinator, and B29 Investments support the investment landscape. Seed round, early-stage VC/series A, accelerator/incubator, pre-seed and angel investments provide essential funding for innovative oil & gas technology solutions that enhance operational efficiency and sustainable energy practices.

Global Footprint

Technological advancements are concentrated in regions including the US, India, UK, Canada, and Germany. There are also hubs in cities like Houston, Dubai, Mumbai, Calgary, and London. These centers drive the adoption and implementation of new technologies, reflecting the industry’s global transformation and growth.

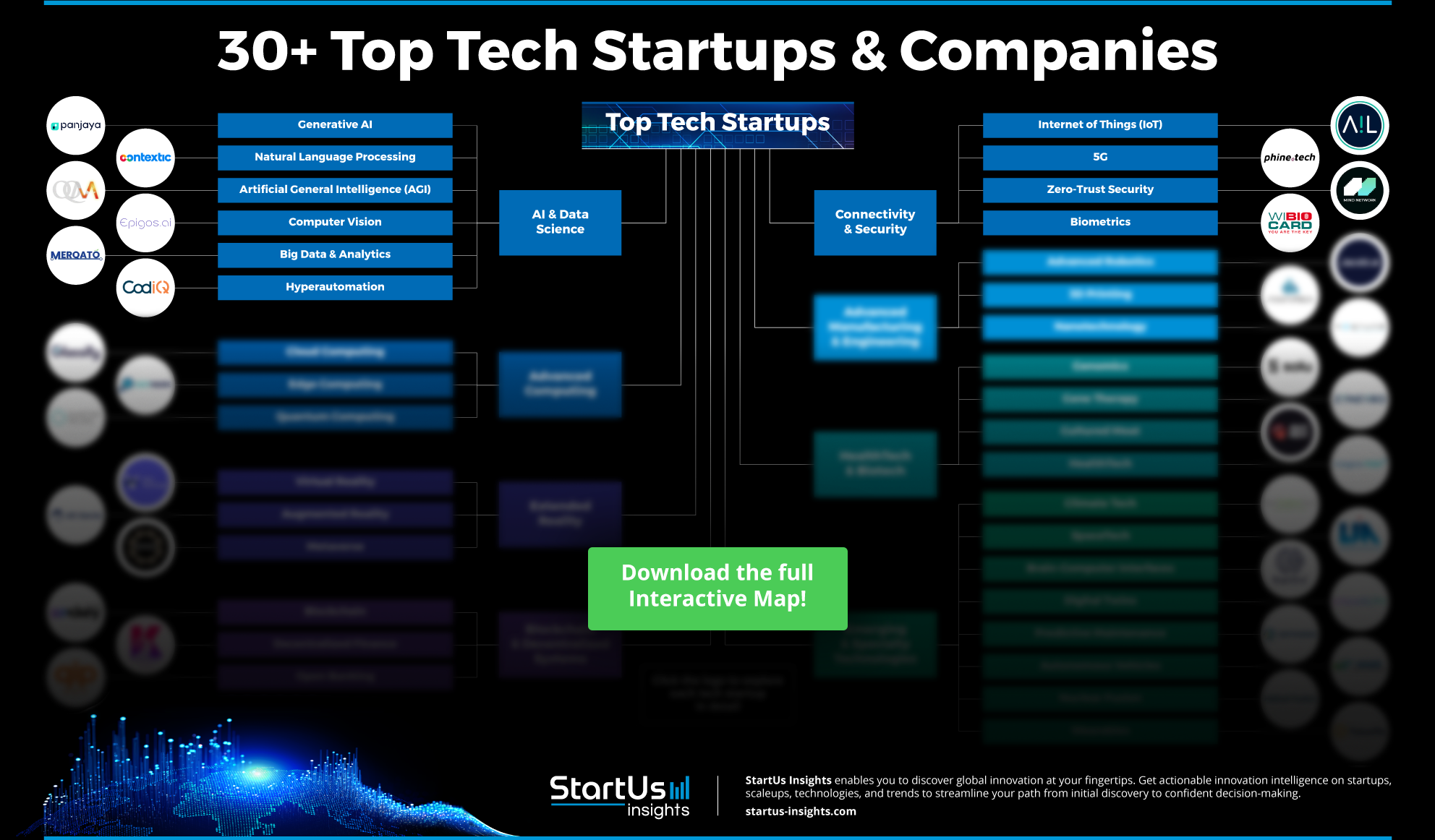

Leverage Emerging Oil & Gas Technologies

Act now on the new technology in the oil & gas industry. With StartUs Insights, you swiftly discover hidden gems among over 4.7 million startups, scaleups, and tech companies, supported by 20,000 trends and technologies. Our AI-powered search and real-time database ensure exclusive access to innovative solutions, making the global innovation landscape easy to navigate.

Trusted by industry leaders like Samsung, Nestlé, and Magna, we provide unmatched data, a 360-degree industry view, and data-driven intelligence for confident strategic decisions. Nadir Badji, Manager of the Industrial Maintenance Process Team at TRAPIL says “StartUs allowed us to save a considerable amount of time in the search of potential partners for our activities. Its ergonomic platform and its state-of-the-art algorithm make the listing of companies of interest. Good experience guaranteed!”. Like them, leverage our innovation services to optimize costs, streamline operations, and stay ahead of the curve. Get in touch today to explore how our comprehensive innovation intelligence can drive your success.

Discover All Emerging Oil & Gas Technologies & Startups