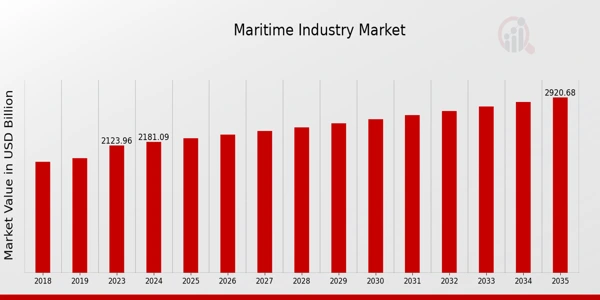

The 2025 Maritime Industry Outlook examines the sector’s current state and its growth trends. The global market is projected to reach 2920 USD billion by 2035. Analysts estimate a compound annual growth rate (CAGR) of 2.69% during the forecast period from 2025 to 2035.

The global maritime industry report explores employment trends, patent activity, innovation hubs, and investment patterns. It also covers key markets, major investors, and emerging startups influencing maritime operations.

These insights allow industry leaders and innovation managers to make informed decisions. They provide intelligence on investment shifts and global trade changes, which enables strategic navigation of the maritime market.

Executive Summary: Maritime Industry Outlook 2025

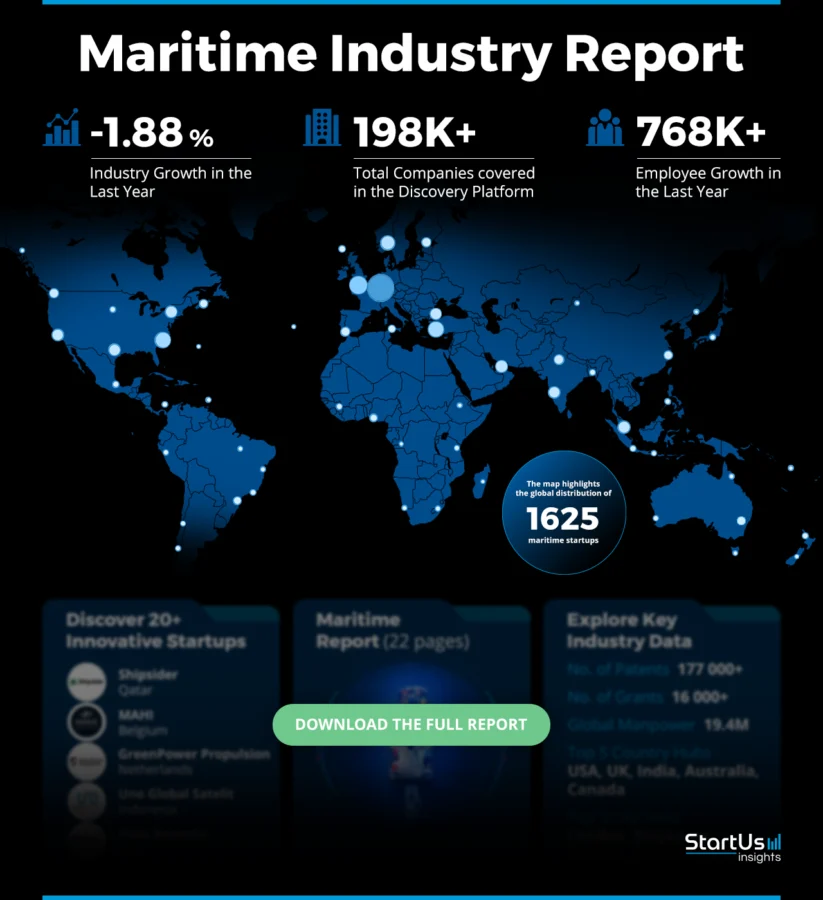

- Industry Growth Overview: The maritime industry recorded a -1.88% annual growth rate in the last year. Our database tracks over 198 000 companies and 1600 maritime startups.

- Manpower & Employment Growth: The sector employs more than 19.4 million people worldwide. In the past year, companies added over 768 000 new employees.

- Patents & Grants: The market holds more than 177 000 patents and 16 000 grants related to maritime innovation. Moreover, patent registrations grew by 0.19% annually.

- Global Footprint: Leading country hubs include the US, UK, India, Australia, and Canada. Further, the top city hubs are London, Singapore, New York City, Dubai, and Sydney.

- Investment Landscape: Investors have participated in more than 33 000 funding rounds, with over 21 000 active investors. The average investment per round is USD 68.9 million. Also, more than 13 000 companies have secured funding.

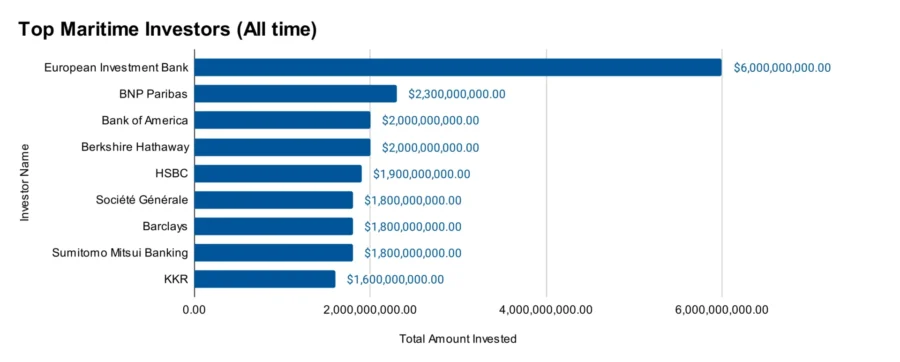

- Top Investors: European Investment Bank, BNP Paribas, and Bank of America rank among the leading investors. Their combined investments exceed USD 21 billion.

- Startup Ecosystem: Five innovative startups in this sector are Shipsider (AI-driven laytime solutions), MAHI (ship situational awareness and collision avoidance), GreenPower Propulsion (electric propulsion for vessels), UNO Global Satelit (high-speed maritime VSAT), and Fleet Robotics (hull-cleaning and inspection robots).

Methodology: How We Created This Maritime Industry Outlook

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles, and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of maritime over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within maritime

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the maritime market.

What Data is Used to Create This Maritime Industry Outlook?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the maritime market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: The maritime industry generated over 30 000 news publications last year.

- Funding Rounds: Investor engagement remains strong, with more than 33 000 recorded funding rounds reflecting consistent financial movement.

- Manpower: Employing over 19.4 million people worldwide, the industry added 768 000 new employees last year. This reinforces its position as a major global employer.

- Patents: Over 177 000 registered patents showcase advancements in vessel systems, logistics, and marine infrastructure.

- Grants: Institutional and public investment remains significant, as evident by more than 16 000 grants awarded to support maritime innovation.

- Yearly Global Search Growth: Additionally, global search interest in the sector has risen by 5.37% annually.

Explore the Data-driven Maritime Industry Outlook for 2025

Did you know that despite advances in air and land transportation, about 90% of global trade moves by sea?

More than 50 000 merchant ships operate internationally, and they transport a variety of cargo. The world fleet registers under 150 nations and employs over a million seafarers from different backgrounds.

Further, the maritime market is projected to grow from USD 2181.09 billion in 2024 to USD 2920 billion by 2035, with an estimated annual growth rate of 2.69%.

Credit: Market Research Future

Additionally, the marine vessels market is expected to expand from USD 111.10 billion in 2024 to USD 133.63 billion by 2030, at an annual growth rate of 3.1%. The active fleet is forecasted to increase from 61 671 units in 2024 to 70 237 units by 2030.

Besides, as per our platform data, the maritime industry recorded a 1.88% decline in the last year. Despite this, it supported over 19.4 million workers and added more than 768 000 new employees.

Our database tracks 198 000 companies and 1600 startups. It showcases innovation across regions, including the US, the UK, India, Australia, and Canada.

Cities such as London, Singapore, New York City, Dubai, and Sydney continue to drive industry growth through advancements in shipping, logistics, naval engineering, and port infrastructure.

Moreover, patent filings exceeded 177 000, with more than 16 000 grants awarded. It reinforces ongoing research and regulatory efforts in safety, vessel technology, and environmental operations.

A Snapshot of the Global Maritime Market Outlook

The maritime sector recorded a -1.88% annual growth rate in the last year. This highlights challenges in global shipping demand, fleet modernization, and regulatory compliance.

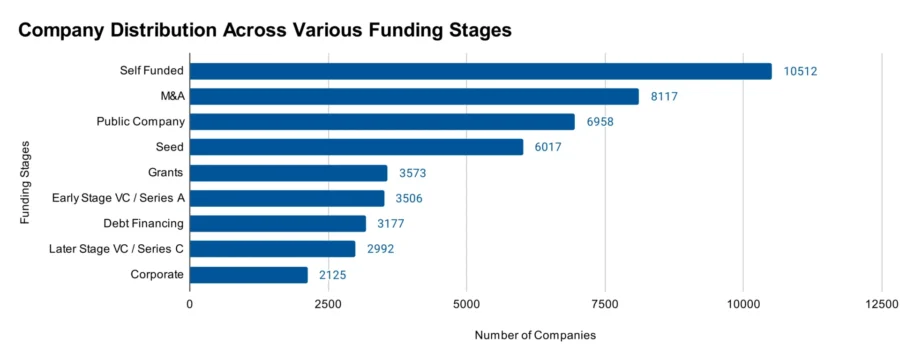

More than 1600 startups and 3500 early-stage companies continue driving innovation in marine logistics, vessel automation, and port technologies. Further, mergers and acquisitions remain active, with over 8100 deals shaping consolidation and strategic shifts.

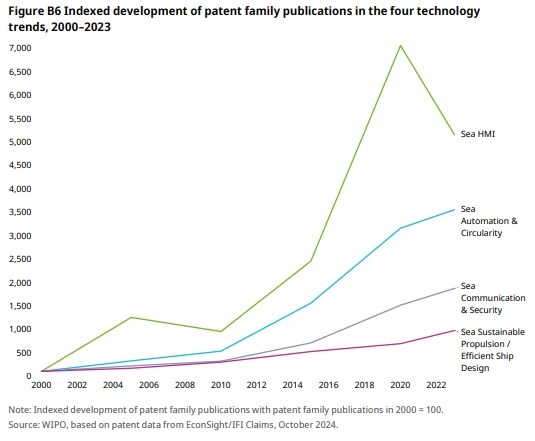

Patent activity remains stable, with over 177 000 filings and more than 68 000 applicants worldwide. China (43 000+) and the US (34 000+) lead in patent registrations. Although yearly growth stands at 0.19%, ongoing developments in maritime technology persist.

Credit: WIPO Technology

China accounts for more than 21 000 maritime patent families since 2000. The Republic of Korea and the United States follow, with specialization indices reflecting concentrated innovation.

International patent strategies increasingly rely on the Patent Cooperation Treaty (PCT) and European Patent Convention (EPC), which have recorded 8400 and 5800 filings, respectively.

Explore the Funding Landscape of the Maritime Industry Report

The maritime industry has drawn significant investor interest, with more than 33 000 funding rounds completed and over 13 000 companies securing capital.

The average investment per round stands at USD 68.9 million. It reflects the financial requirements for infrastructure, vessel upgrades, and maritime technologies.

Besides, the sector continues to attract funding for initiatives in decarbonization, digital logistics, and autonomous navigation, supported by a network of over 21 000 investors. This steady financial backing indicates confidence in maritime innovation and the future of global trade.

Who is Investing in the Maritime Industry Outlook?

Investors in the maritime industry have contributed over USD 19 billion to infrastructure, fleet development, and logistics modernization.

- The European Investment Bank allocated USD 6 billion to 30 maritime companies, including EUR 300 million for TEN-T infrastructure investments in Poland.

- BNP Paribas funded 27 companies with USD 2.3 billion, committing EUR 1 billion by 2025 to support the ecological transition of ships, particularly dual-fuel liquefied natural gas (LNG) propulsion projects.

- Bank of America invested USD 2 billion across 19 companies.

- Berkshire Hathaway deployed USD 2 billion to 9 companies.

- HSBC contributed USD 1.9 billion to 30 companies.

- Société Générale provided USD 1.8 billion to 15 companies.

- Barclays invested USD 1.8 billion in 11 companies.

- Sumitomo Mitsui Banking funded 9 companies with USD 1.8 billion.

- KKR invested USD 1.6 billion in 17 companies.

Top Maritime Innovations & Trends

Discover the emerging trends in the maritime market along with their firmographic details:

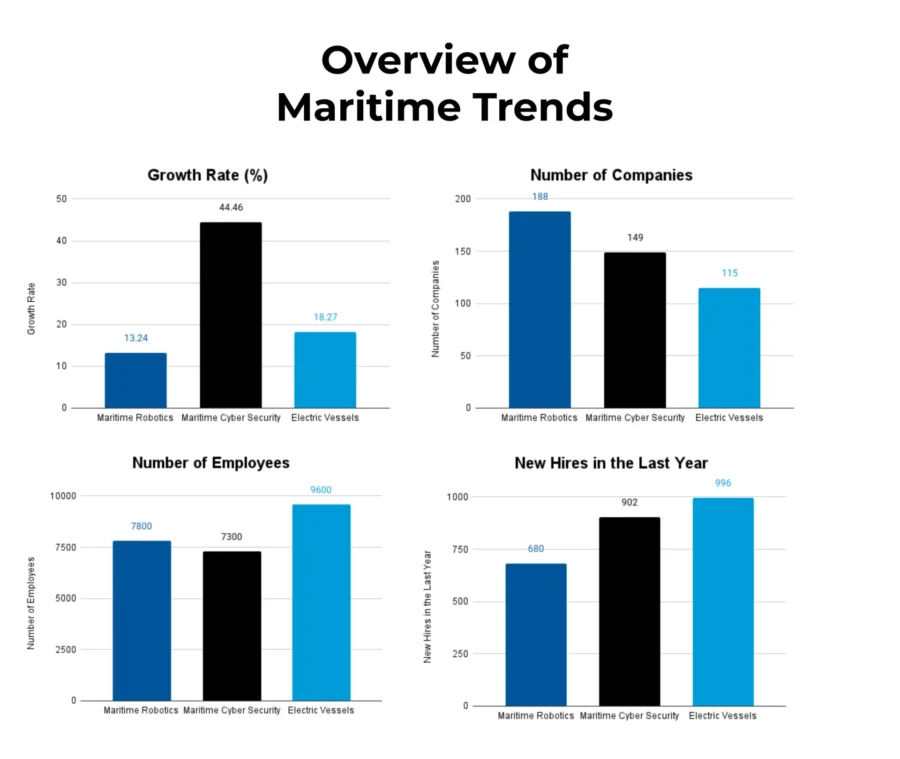

- Maritime Robotics includes 188 companies focused on autonomous navigation, underwater drones, and robotic inspection systems. The segment employs 7800+ professionals, with 680+ new roles added last year. Industry demand for automation in deep-sea exploration and cargo handling has driven annual growth of 13.24%.

- Maritime Cybersecurity continues to expand as digitalization increases across vessel systems, logistics software, and port operations. The sector includes 149 companies employing 7300 people, with over 900 new employees joining last year. Annual growth stands at 44.46%, which reflects efforts to secure connected maritime assets, protect data integrity, and meet evolving international cyber regulations.

- Electric Vessels are advancing as the maritime sector works toward carbon reduction and fuel efficiency. A total of 115 companies operate in this space, employing 9600 workers and hiring 990+ new employees last year. Annual growth of 18.27% signals the industry’s commitment to hybrid propulsion, battery-powered ferries, and emissions-free cargo vessels. This supports broader sustainability goals.

5 Top Examples from 1600+ Innovative Maritime Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Shipsider builds AI-driven Laytime Solutions

Qatar-based startup Shipsider provides an AI-driven cloud platform that simplifies maritime commercial operations. It covers pre-fixture planning, post-fixture management, laytime analysis, and charter party administration.

The platform integrates voyage cost estimation, real-time cargo tracking, demurrage calculation, and contract oversight. Its dashboard connects charterers, ship operators, brokers, and owners to improve coordination.

Further, AI tools improve laytime assessments, which minimize freight claim losses and support informed chartering decisions.

Through its CarbonGo mobile app, the startup enables real-time tracking of fleet carbon emissions and compliance with EU ETS tax regulations. The app also simplifies charter party management with digital contract storage and streamlined processes.

MAHI improves Ship Situational Awareness & Collision Avoidance

Belgian startup MAHI builds autonomous navigation systems for surface vessels, integrating onboard computing, control interfaces, and remote operation capabilities.

It’s the MAHI Sense system, a marine-grade autonomous computer, that uses sensor fusion to process navigation data from radar, cameras, and audio. This technology supports real-time perception and suggests collision avoidance paths.

The startup’s MAHI Aware mode enables line-of-sight navigation through a rugged IP65 handheld remote. Further, the MAHI Handheld device provides joystick-based manual control over propulsion, steering, and payload systems.

Besides, MAHI’s Remote Operations Center (ROC) offers shore-based operators a multi-screen interface for 360° visual monitoring, real-time vessel communication, and emergency maneuvering.

Lastly, the MAHI Remote Supervisory Station (RSS) allows centralized fleet management with real-time data visualization and limited control over multiple vessels using satellite and broadband links.

MAHI improves safety, reduces crew dependency, and facilitates the transition to autonomous and remotely operated maritime operations.

GreenPower Propulsion makes Electric Propulsion for Vessels

Dutch startup GreenPower Propulsion develops electric and hybrid marine propulsion systems through its Blue Marlin series for efficient vessel operation.

The startup offers the Blue Marlin Inboard, a full-electric permanent magnet motor with a liquid-cooled design and an integrated low-maintenance gearbox. It delivers continuous output from 5kW to 265kW to support various vessel types.

For hybrid applications, GreenPower Propulsion provides the Blue Marlin Hybrid, which works alongside diesel engines. This emission-free electric motor ranges from 5kW to 25kW and uses a timing belt with pulleys to drive the propeller shaft.

Both models support multiple reduction ratios and allow customization to match propulsion specifications for new builds or retrofits. These systems reduce noise and pollution while maintaining performance and reliability.

Uno Global Satelit develops High Speed Maritime VSAT

Indonesian startup UNO Global Satelit makes a maritime communication platform that integrates high-speed VSAT internet, asset tracking, CCTV surveillance, and IoT-based vessel monitoring.

Its Gyro Maritime VSAT uses a three-axis stabilized antenna to maintain satellite connectivity during vessel movement. The system ensures uninterrupted broadband access, supports fast installation, and offers predictable costs.

For asset monitoring, the Orbcomm ST-6100 terminal enables two-way data transmission and remote configuration. It tracks ships, vehicles, and heavy equipment in dynamic environments.

The startup provides FTP-capable CCTV systems with infrared illumination. These cameras, housed in explosion-proof and corrosion-resistant enclosures, support continuous maritime surveillance.

Further, its IoT suite integrates sensors for RPM, fuel levels, engine hours, and temperature. The system sends real-time operational data to users via web and mobile applications.

Fleet Robotics offers Hull-cleaning and Inspection Robots

US-based startup Fleet Robotics develops autonomous submersible robots for continuous hull cleaning and structural inspection. These robots magnetically attach to submerged surfaces and operate while vessels are underway. They remove early-stage biofouling and dry bulk buildup without requiring port stops or diver supervision.

Each unit cleans up to 400 m² per hour using replaceable nylon bristle brushes. It also captures high-resolution thickness and coating integrity data through three layers with the precision of ±25–50 µm.

The startup’s system scales across fleets using swarm-based deployment and onboard autonomy software. It collects millions of data points in real time to support operational insights.

Fleet Robotics’ robots enhance proactive maintenance, reduce drag, lower fuel consumption, and extend coating lifespan.

Gain Comprehensive Insights into Maritime Trends, Startups, and Technologies

The maritime industry is undergoing a transition and adapting to digital transformation, sustainability targets, and regulatory demands while experiencing modest growth.

Further, AI-based route optimization, autonomous cargo ships, and blockchain-driven port logistics are expected to advance. As global trade stabilizes and environmental regulations become stricter, innovation will drive efficiency, security, and decarbonization in maritime operations.

Get in touch to explore 1600+ maritime startups and scaleups, as well as all market trends impacting 198 000+ companies.