Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2024 Heating, Ventilation, and Air Conditioning (HVAC) Outlook provides an overview of the latest trends, technologies, and market dynamics shaping the sector. As environmental concerns and demand for energy efficiency increases, this report discusses innovations such as smart HVAC systems, geothermal heating, and advanced airflow management. Also, the report examines the impact of regulatory changes and the increasing demand for sustainable solutions.

This report was last updated in July 2024.

This HVAC industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights HVAC Outlook 2024

- Executive Summary

- Introduction to the HVAC Report 2024

- What data is used in this HVAC Report?

- Snapshot of the Global HVAC Industry

- Funding Landscape in the HVAC Industry

- Who is Investing in HVAC?

- Emerging Trends in the HVAC Industry

- 5 HVAC Startups Impacting the Industry

Executive Summary: HVAC Industry Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 1700+ HVAC startups developing innovative solutions to present five examples from emerging HVAC industry trends.

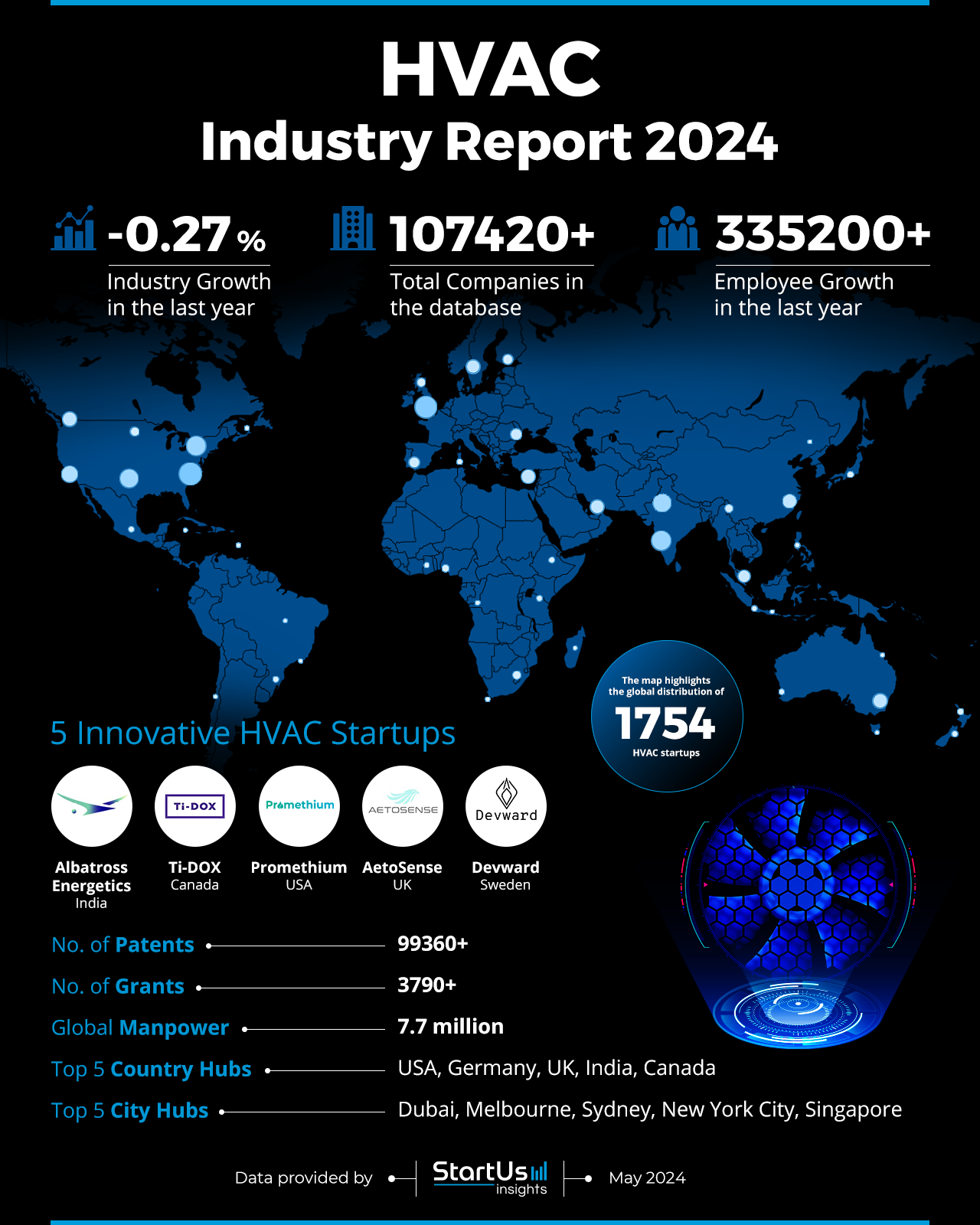

- Industry Growth Overview: The HVAC industry experienced a slight downturn (0.27% decline) in 2023, yet remains a massive global sector with over 107420 companies.

- Manpower & Employment Growth: The industry supports a workforce of over 7.7 million individuals, with an addition of over 335200 employees in the past year.

- Patents & Grants: Over 99360 patents and more than 3790 grants awarded to the sector.

- Global Footprint: The global presence includes countries such as the US, Germany, the UK, India, and Canada, along with key city hubs like Dubai, Melbourne, Sydney, New York City, and Singapore.

- Investment Landscape: Investment activity includes more than 9400 funding rounds and over USD 12 million average investment per round. It reflects financial backing and confidence in the industry’s growth.

- Top Investors: Major investors including Tiger Global Management, GIC, Goldman Sachs, and more have collectively invested more than USD 4 billion.

- Startup Ecosystem: Five startups include Albatross Energetics (active desiccant solutions), Ti-DOX (air cleaner technology), Promethium (photocatalytic solution), AetoSense (mini-CPC technology), and Devward (multi-sensor system).

- Recommendations for Stakeholders: Investors should prioritize funding companies that develop technologies such as geothermal heating or airflow management, and other emerging HVAC trends. While entrepreneurs explore new opportunities in smart HVAC systems and renewable energy integration, governments need to implement policies that incentivize green buildings. At the same time, stakeholders should continue supporting research and development in energy-efficient HVAC solutions.

Explore the Data-driven HVAC Report for 2024

The HVAC Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap showcases the distribution and dynamics of the startup ecosystem across various global locations. With a total of 1754 startups cataloged in our database out of over 107420 companies, the industry experiences growth patterns, despite a slight decline in industry growth by 0.27% in the last year.

Our database also indicates intellectual property activity, with over 99360 patents and 3790 grants awarded. This highlights the environment for innovation and development within the startup ecosystem. Further, the global manpower in this sector reached approximately 7.7 million, with an increase of over 335K+ employees in the last year. It highlights employment opportunities and workforce mobilization.

The heatmap also highlights the top five country hubs for startups including the US, Germany, UK, India, and Canada. In addition, city hubs in Dubai, Melbourne, Sydney, New York City, and Singapore drive regional innovation and startup/business activities.

What data is used to create this HVAC report?

Based on the data provided by our Discovery Platform, we observe that the HVAC industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The HVAC industry had more than 6770 publications in the last year.

- Funding Rounds: Its funding activities show data on over 9400 funding rounds available in our database.

- Manpower: In terms of manpower, the industry employs more than 7.7 million workers and added over 335K new employees in the last year alone.

- Patents: The industry holds over 99360 patents.

- Grants: The HVAC industry received more than 3790 grants.

A Snapshot of the Global HVAC Industry

This HVAC outlook synthesizes data across several metrics, providing an in-depth view of its scale, growth, and investment dynamics. The industry employs a workforce of about 7.7 million individuals, reflecting its role in the global economy. Over the past year, the industry demonstrated growth, adding more than 335200 employees.

The sector includes 107420 companies operating within the industry that showcases a diverse and competitive environment. These entities drive innovation and business activities across various sectors.

Explore the Funding Landscape of the HVAC Industry

The average investment value of USD 43 million per funding round points to financial backing and confidence in the sector’s growth potential. With more than 4300 investors engaged, the industry benefits from different funding sources, including venture capitalists, private equity, and institutional investors.

The HVAC sector closed more than 9400 funding rounds featuring the active investment scene. Over 4580 companies received investments, which indicates a spread of funding across firms rather than concentration in a few large entities.

Who is Investing in HVAC?

The combined value invested by the top investors in the industry exceeds USD 4.5 billion. The investment landscape dominates with a mix of global financial institutions, venture capital firms, and strategic investors.

- Tiger Global Management invested in 8 companies with a total of USD 736.4 million.

- GIC follows closely, investing USD 718.1 million across 5 companies.

- Goldman Sachs contributed USD 682 million to 7 companies.

- Bank of America allocated USD 572.9 million to 4 companies.

- SoftBank Vision Fund injected USD 499.4 million into 2 companies.

- Generation Investment Management invested in 4 companies, totaling USD 451.1 million.

- Munich Re Ventures placed USD 414 million into 2 innovative ventures.

- The European Investment Bank supported 4 companies with a total investment of USD 405.1 million.

Access Top HVAC Innovations & Industry Trends with the Discovery Platform

Several key trends are shaping the HVAC industry. Here’s an in-depth look at a few of them:

- Geothermal heating continues to show steady growth in the HVAC industry, with 628 companies currently engaged in this technology. These companies employ over 31500 individuals, with approximately 1100 new employees added last year. Further, it is experiencing an annual growth rate of 1.03%.

- Airflow management represents a smaller niche within the HVAC sector, with 92 companies specializing in this area. Despite the smaller number of companies, the sector supports 10400 employees and saw an increase of 222 new hires over the past year. It shows an annual trend growth rate of 7.54%.

- Smart HVAC includes 85 companies integrating advanced technologies into HVAC systems. These companies employ about 4300 workers and added 209 new employees last year. Moreover, it is experiencing an annual trend growth rate of 25.14%.

5 Top Examples from 1700+ Innovative HVAC Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Albatross Energetics offers Active Desiccant Solutions

Indian startup Albatross Energetics develops solutions for energy efficiency and sustainability. The company’s Active Liquid Desiccant Dehumidification system uses a desiccant solution to remove moisture from the air without excessive cooling. It operates without high-grade heat for regeneration and at lower temperatures reducing overall energy consumption. Its active-passive cooling system provides evaporative cooling and reduces fresh AC power load for outdoor air systems or while treating fresh air.

Ti-DOX uses Air Cleaner Technology

Canadian startup Ti-DOX offers the HydroxylizAire device, an air decontamination device that attaches to the centralized forced air ventilation systems. It destroys chemicals and pathogens and reduces radon and smoke to create a healthier environment. The device consists of a combination of UVC light and titanium dioxide coating generating hydroxyl radicals. It finds applications in places with people suffering from respiratory or chemical sensitivity issues or with poor indoor air quality.

Promethium provides a Photocatalytic Solution

US-based startup Promethium optimizes a light-activated natural process to manufacture air treatment systems. Its photocatalytic oxidation technology, GreenBlend, reduces airborne bacteria, viruses, gasses, and organic compounds by mimicking and accelerating the upper atmosphere’s natural processes. Its plant system protects the well-being of the building’s occupants from indoor and outdoor pollutants while reducing energy consumption and carbon footprint.

AetoSense develops Mini-CPC Technology

UK-based startup AetoSense enhances air quality and optimizes energy efficiency with its Mini-CPC technology. This technology measures harmful airborne particles smaller than 300 nm. The company integrates real-time data monitoring and adjusts air quality while measuring the visible particles. It prioritizes those particles that penetrate into the lungs to avoid health hazards. This ensures healthier indoor air and reduces energy consumption by recycling conditioned air.

Devward builds a Multi-Sensor System

Swedish startup Devward’s Smart RoomHub integrates a multi-sensor system with on-device AI for optimal energy efficiency and enhanced user experience. The system uses customized sensors for occupancy and behavior analysis for energy savings and improves operational and maintenance efficiency. With its on-device AI, Smart RoomHub provides a deeper understanding of indoor environments to enhance user comfort and productivity. The system’s connectivity to the building management system (BMS) allows for control over HVAC systems, lighting, and other smart devices based on real-time occupancy data.

Gain Comprehensive Insights into HVAC Trends, Startups, or Technologies

The 2024 HVAC Outlook highlights technological advancement and shifting market demands. The increasing focus on energy efficiency and reduced environmental impact continues to drive innovation and investment. Get in touch to explore all 1700+ startups and scaleups, as well as all industry trends impacting HVAC companies.

![Explore the Top 10 Waste Management Industry Trends & Innovations [2025]](https://www.startus-insights.com/wp-content/uploads/2025/06/Waste-Management-Industry-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)