Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2025 Green Technology Report provides a comprehensive overview of the green technology industry, examining key players, firmographic data, emerging trends, and groundbreaking innovations. It also explores the challenges the industry faces and the strategies employed to overcome them. From renewable energy and sustainable agriculture to water management and waste reduction, the report covers a wide range of topics within the industry sphere.

This report was last updated in January 2025.

This data driven market outlook provides suggestions for multiple stakeholders including policymakers, economic analysts, and investors.

Executive Summary: Green Technology Report 2025

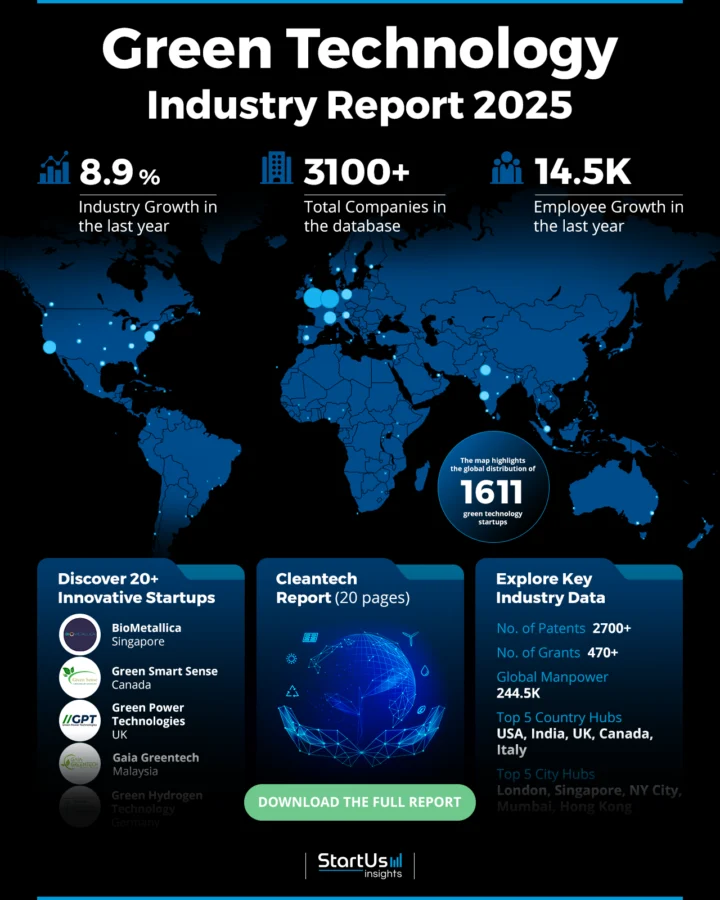

- Industry Growth Overview: The industry experienced a growth of 8.90% last year, indicating its steady development and includes over 3100 companies.

- Manpower & Employment Growth: The sector supports a workforce of 244.5K employees, with a growth of 14.5K employees in the last year.

- Patents & Grants: The green technology industry includes over 2700 patents and more than 470 grants, indicating innovation and funding activities.

- Global Footprint: The top five country hubs are the US, India, UK, Canada, and Italy, representing the industry’s geographical reach. Major city hubs include London, Singapore, New York City, Mumbai, and Hong Kong, indicating key urban centers driving industry activities. The U.S. green technology and sustainability market is expected to reach USD 10.1 billion in 2024 and grow to USD 60.7 billion by 2033 at a compound annual growth rate (CAGR) of 22%.

- Investment Landscape: The average investment value in the industry is USD 19.8 million per round. It has attracted more than 350 investors and over 800 funding rounds, indicating financial support. Global investment in clean energy is set to reach almost double the amount going to fossil fuels in 2024, with USD 2 trillion expected to go toward clean technologies

- Top Investors: Investors such as Piramal Finance, VantagePoint Capital Partners, Horizons Ventures, and more have collectively invested more than USD 165 million.

- Startup Ecosystem: Five startups include BioMetallica (Sustainable Metal Recycling), Green Smart Sense (Post-harvest Monitoring), Green Power Technologies (Remote Power Solutions), Green Hydrogen Technology (Industrial Hydrogen production), and Gaia Greentech (Bioresin Manufacturer).

Methodology: How We Created This Green Technology Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of green technology over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the green technology industry

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the green technology market.

What data is used to create this green technology report?

Based on the data provided by our Discovery Platform, we observe that the green technology market ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The green technology industry had more than 56K publications in the last year.

- Funding Rounds: Over 800 funding rounds of data are available in our database.

- Manpower: The manpower in the green technology industry exceeds 244K workers, with over 14K new employees added in the last year.

- Patents: The industry has 2700+ patents, indicating its innovation capacity.

- Grants: In addition, the green technology industry has secured 470 grants, indicating strong support and investment.

- Yearly Global Search Growth: The industry also sees a yearly global search growth of 9.39%. This indicates increasing interest and relevance.

Explore the Data-driven Green Technology Report for 2025

The heatmap highlights the data encompassing 1611 startups and over 3100 companies in our comprehensive database. This industry experienced a growth of 8.90% last year, indicating its steady development. The database includes over 2700 patents and more than 470 grants, indicating innovation and funding activities.

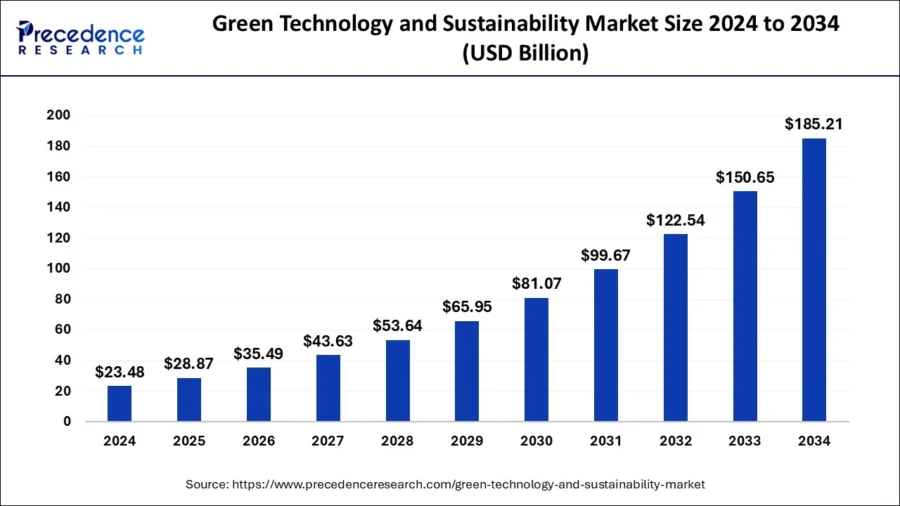

The global green technology and sustainability market size is set to grow to USD 185.21 billion by 2034, growing at a CAGR of 22.94% from 2025 to 2034.

Credit: Precedence Research

Globally, the industry supports a workforce of more than 244K employees, with a growth of 14K+ employees in the last year. The top five country hubs are the US, India, UK, Canada, and Italy, representing the industry’s geographical reach. Major city hubs include London, Singapore, New York City, Mumbai, and Hong Kong, indicating key urban centers driving industry activities.

A Snapshot of the Global Green Technology Industry

The green technology industry report provides an overview of key metrics, showing its growth and investment activity. The industry supports a workforce of 244.5K, with an addition of 14.5K new employees in the last year, indicating employment growth. The industry includes over 3100 companies, reflecting its reach and influence.

The North American green technology market is set to grow by a CAGR of 22.4% from 2024 to 2032. Additionally, North America held a 40.2% revenue share in the global green technology and sustainability market in 2024.

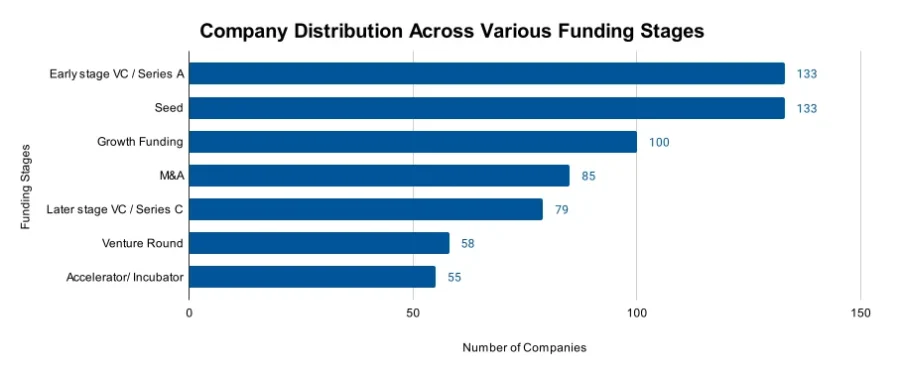

Explore the Funding Landscape of the Green Technology Industry

Investment activity within the green technology sector is steady, with an average investment value of USD 19.8 million per round. The industry has attracted more than 350 investors, indicating interest in green technology solutions. Moreover, over 800 funding rounds have been closed, providing financial support to numerous companies.

More than 370 companies have received investments, showing the distribution of funding across the industry. Green tech investment could reach USD 5 trillion by 2025.

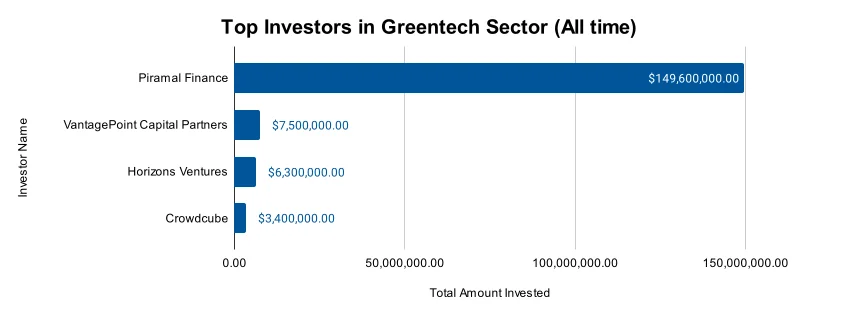

Who is Investing in Green Technology?

The total investment value by a group of investors in the green technology industry is over USD 165 million, indicating substantial financial support and belief in the sector’s potential. Here is a list of these investors, the value they have invested, and the number of companies they have invested in:

- Piramal Finance has invested USD 149.6 million in at least 1 company, showing a notable commitment to green technology innovation. It also secured USD 100 million social loan to fund impactful social projects.

- VantagePoint Capital Partners has invested USD 7.5 million across 2 companies, indicating a strategic investment in various green tech ventures. It was one of the first companies to invest in the electric vehicle manufacturer Tesla Motors.

- Horizons Ventures has invested USD 6.3 million in 2 companies, aiding the growth and development of new green technologies.

- Crowdcube has invested USD 3.4 million in 3 companies, demonstrating a varied investment approach within the industry.

Access Top Green Technology Innovations & Trends with the Discovery Platform

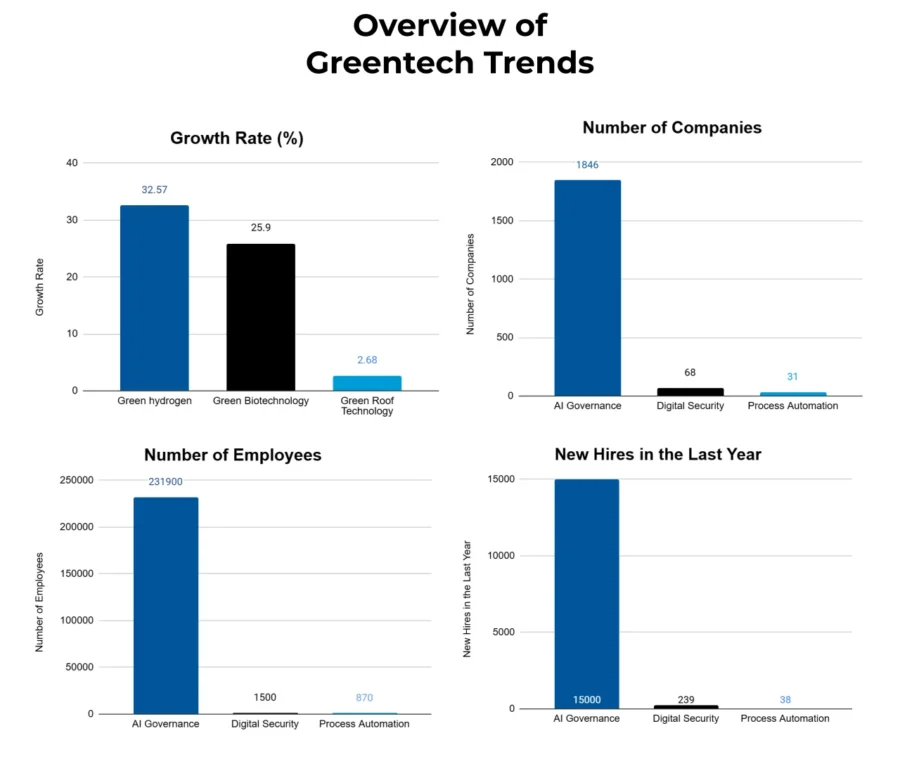

Explore the top trends in the green technology sector including the firmographic insights:

- Green hydrogen is a growing sector, with 1846 companies identified, employing 231 900 individuals. The sector has added 15 000+ new employees in the last year. With an annual trend growth rate of 32.57%, green hydrogen is a part of renewable energy technologies.

- The green biotechnology sector includes 68 companies, employing 1500 individuals with an addition of 239 new employees in the last year. The sector’s annual trend growth rate is 25.9%, reflecting its role in sustainable agriculture, biofuels, and environmental management.

- Green roof technology contributes to urban sustainability by improving energy efficiency, reducing urban heat island effects, and enhancing biodiversity. It includes 31 companies, employing 870 individuals, with 38 new employees added in the last year. The sector has an annual trend growth rate of 2.68%.

5 Top Examples from 3100+ Innovative Green Technology Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

BioMetallica enables Sustainable Metal Recycling

Singaporean startup BioMetallica specializes in sustainable precious metal recycling. It utilizes bio-metallurgy, employing biological agents for metal extraction from ores, minerals, and waste streams. A specific bacterial strain, engineered for increased biogenic cyanide production, enhances the efficiency of recycling precious metals.

The recycling process comprises four steps: Pre-treatment, Bioleaching, Metal Reduction, and Separation & Purification. Further, BioMetallica’s technology recovers palladium, platinum, and rhodium at room temperature.

Green Smart Sense offers Post-harvest Monitoring

Canadian startup Green Smart Sense provides AI-powered monitoring solutions for agricultural products. The startup’s IoT sensors utilize LoRa WAN technology for superior coverage. These sensors collect data on temperature, humidity, and CO2 levels.

The GreenSense dashboard summarizes this data and sends notifications when anomalies are detected. The Green Intelligence web application presents the results of the IoT data analysis. Further, the anomaly detection algorithms run continuously in the background. Green Smart Sense’s system predicts the quality of stored grains for the next 3-6 months.

Green Power Technologies provides Remote Power Solutions

UK-based startup Green Power Technologies offers sustainable remote power solutions. The startup’s products, The Power Box and The Juice Box, transform renewable energy use. The Power Box reduces fuel usage and carbon emissions whereas The Juice Box, a mobile solar generator, provides efficient and portable power output.

These products offer a smarter alternative to traditional diesel generators and reduce operational costs and carbon emissions.

Green Hydrogen Technology produces Industrial Hydrogen

German startup Green Hydrogen Technology developed a patented solution to produce industrial hydrogen from plastic waste. As raw materials, the climate-neutral hydrogen is made using plastic, wood waste, and sewage sludge. The decentralized production process minimizes the requirement of elaborate infrastructure or high transport costs.

The process consists of synthesis gas generation, synthesis gas purification, and synthesis gas separation. The modular setup of the infrastructure allows the use of various materials as raw materials like biomass, biogas, dried sewage, etc. Additionally, the excess heat produced from the production process is also suitable as raw material. The industrial hydrogen is ideal for utilities and municipal businesses.

Gaia Greentech manufactures Bioresin

Malaysian startup Gaia Greentech manufactures bio-resin, eJau, using palm stearin. The startup utilizes the abundant renewable palm oil grown in Malaysia. It is a thermoplastic resin produced using palm stearin and polyolefins. The biohybrid resin is certified by TUV Austria.

It reduces the carbon footprint compared to the conventional resins. Additionally, the startup also manufactures reneu (water filtration/purification source), greenery (organic good), biotic (cultures meat technology vaccine), and compost (biodegradable resin).

Gain Comprehensive Insights into Green Technology Trends, Startups, or Technologies

The 2025 green technology industry report shows growth and investment in innovative solutions such as green hydrogen, biotechnology, and roof technology. As the industry progresses, trends like clean hydrogen and developments in sustainable biotech suggest a positive outlook for green technologies. Get in touch to explore all 3100+ startups and scaleups, as well as all industry trends impacting green technology companies.

![Explore the Top 10 Waste Management Industry Trends & Innovations [2025]](https://www.startus-insights.com/wp-content/uploads/2025/06/Waste-Management-Industry-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)