Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Green Energy Market Report 2025 explores the advancements of global energy systems in photovoltaics, smart grid technologies, and wind energy. As innovation speeds up across solar cell efficiency, power distribution, and offshore wind deployment, the green energy sector gains momentum toward a decarbonized future.

This green energy industry report offers a targeted assessment of evolving market dynamics, infrastructure transitions, and emerging technologies. It also provides strategic insights for energy producers, infrastructure planners, and climate-conscious investors shaping the next chapter of global energy innovation.

Executive Summary: Green Energy Market Report 2025

- Industry Growth Overview: The global renewable energy market size is calculated at USD 1.74 trillion in 2025 and is anticipated to reach around USD 7.28 trillion by 2034 with a compound annual growth rate (CAGR) of 17.23% from 2025 to 2034. On a granular level, the green energy market experienced a growth rate of 3.23% over the past year, as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: The green energy market employs over 28.2 million individuals globally, with an increase of 1.4 million+ new jobs added in the last year.

- Patents & Grants: The green energy market holds over 953 110 patents and 28 060 grants. The patent growth rate is 6.03% yearly, with China and the US leading the patent issuance.

- Global Footprint: Key hubs for the green energy market include the US, Germany, the UK, India, and China. The major city hubs are London, New York City, Melbourne, Sydney, and Singapore.

- Investment Landscape: The average investment value per funding round exceeds USD 99.5 million, with over 63 610 funding rounds closed. More than 33.7K investors are actively engaged in the green energy market.

- Top Investors: Major investors, including the European Investment Bank (EIB), U.S. Department of Energy, KKR, Sumitomo Mitsui Banking Corporation, and BNP Paribas, collectively invested over USD 1.33 trillion across companies.

- Startup Ecosystem: Five innovative startups, Stellarsolve Energy (off-grid infrastructure solutions), GEI Power (solar photovoltaic (PV) with maximum power point tracking (MPPT) hybrid storage), E2E Energy Solutions (geothermal reservoir recovery system), Alotta (floating photovoltaic (FPV) system), and AbSOLAR (inter-seasonal underground energy storage), showcase the green energy market’s global reach and entrepreneurial spirit.

Methodology: How we created this Green Energy Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of green energy over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within green energy

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the green energy market.

What Data is used to create this Green Energy Market Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the green energy market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: The green energy has been featured in over 53 440 publications in the last year, which showcase major media attention.

- Funding Rounds: Our database recorded more than 63 610 funding rounds for this sector.

- Manpower: The global workforce in green energy exceeds 28.2 million, with an additional 1.4 million employees added in the past year alone.

- Patents: The green energy sector holds more than 953 110 patents.

- Grants: Over 28 060 grants have been awarded to companies within the green energy market.

- Yearly Global Search Growth: The green energy market experienced a yearly global search growth of 10.64%.

Explore the Data-driven Green Energy Market Report for 2025

According to Precedence Research, the global renewable energy market size is calculated at USD 1.74 trillion in 2025. It is anticipated to reach around USD 7.28 trillion by 2034, expanding at a CAGR of 17.23% from 2025 to 2034.

Credit: Precedence Research

Data from the Discovery Platform highlights the key metrics that show the sector’s growth and innovation. Our database features 14 120+ startups and over 226 660 companies, which reflect the green energy market’s scope with an annual growth of 3.23%. It also highlights 953 110+ patents and 28060+ grants.

Another resource suggests that the global renewable energy market size is projected to grow from USD 1.26 trillion in 2024 to USD 4.61 trillion by 2035, representing a CAGR of 12.48%.

Credit: Roots Analysis

Additionally, the global workforce exceeds 28.2 million with 1.4 million new employees added last year. Major hubs include the US, the UK, Germany, India, and China, while cities like London, New York City, Melbourne, Sydney, and Singapore stand out as the epicenters of green energy activity.

A Snapshot of the Global Green Energy Outlook

Over the past year, the green energy market grew at a 3.23% annual rate, driven by early-stage innovation and patent activity. It includes 5700+ early-stage startups and more than 8790 mergers and acquisitions (M&A) deals.

Patent filings exceed 953 110 globally, with 332 790+ applicants, although yearly growth in filings remains at 6.03%. Further, China and the USA lead the innovation front, issuing 368 310+ and 151 890+ patents, respectively.

Explore the Funding Landscape of the Green Energy Market

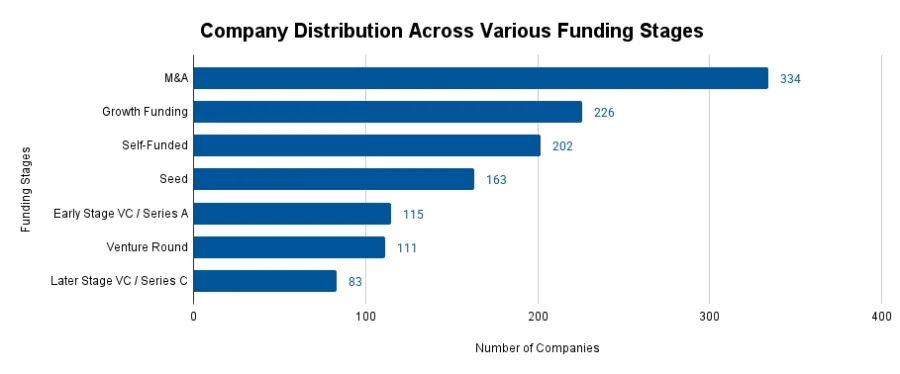

The green energy sector continues to attract investor interest, with over 63 610 funding rounds closed to date. This reflects sustained momentum across renewable technologies and infrastructure.

Additionally, the average investment per round stands at USD 99.5 million, which signals a trend toward large-scale deployments and capital-intensive innovation.

More than 33 700 investors backed the sector, channeling funds into over 20 030 companies worldwide. This broad participation highlights the industry’s importance in the global change toward decarbonization, energy resilience, and sustainable growth.

Who is Investing in the Green Energy Market?

The combined investment value of the top investors in the green energy market exceeds USD 133.6 billion. Here is a breakdown of their contributions:

- EIB invested USD 27.9 billion in 133 companies. BNP Paribas and the EIB announced EUR 1 billion to support wind energy projects across Europe.

- U.S. Department of Energy committed USD 23.7 billion to 88 companies.

- KKR backed 45 companies with USD 15.1 billion.

- Sumitomo Mitsui Banking Corporation invested USD 11.2 billion in 80 companies.

- BNP Paribas invested USD 10.3 billion in 96 companies.

- Deutsche Bank committed USD 9.6 billion to 56 companies.

- Société Générale invested USD 9.2 billion in 61 companies.

- Bank of America invested USD 9.1 billion in 49 companies.

- Goldman Sachs invested USD 8.9 billion in 64 companies.

- Rabobank invested USD 8.6B in 69 companies.

Top Green Energy Innovations & Trends

Discover the emerging trends in the green energy market along with their firmographic details:

- Photovoltaics drives the green energy transition with over 89 530 companies employing approximately 8.5 million professionals worldwide. With an annual growth rate of 3.46%, the domain scales the deployment of solar power through panel efficiency, material innovation, and installation techniques. The addition of 438 700 new employees last year highlights the global momentum in expanding solar capacity across residential, commercial, and utility-scale applications.

- Smart Grid modernizes the energy infrastructure, represented by more than 3470 companies and a workforce of over 492 500 professionals. Growing at an annual rate of 1.26%, the domain integrates digital technologies, Internet of Things (IoT) sensors, and AI-driven analytics to improve grid reliability and real-time energy management. The creation of 21 600 new roles last year reflects continued investment in adaptive, data-centric power systems.

- Wind Energy includes over 143 300 companies and employs 9400 professionals, and added 20K new roles in the past year. With an annual growth rate of 13.04%, the domain leverages turbine innovation, offshore expansion, and hybrid integration to meet rising green energy demand.

5 Top Examples from 14 120+ Innovative Green Energy Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Stellarsolve Energy provides Off-Grid Infrastructure Solutions

Nigerian startup Stellarsolve Energy develops renewable energy systems that power off-grid infrastructure and industrial operations across Sub-Saharan Africa. The systems utilize solar, wind, biomass, hydropower, and geothermal energy for agricultural processors and data centers. Its technology enables standalone power generation by integrating modular, site-specific installations that reduce carbon emissions and dependence on traditional grids.

Stellarsolve’s biomass systems convert local agricultural waste into energy, while hybrid configurations using geothermal and solar sources support continuous industrial activity. These systems together lower energy costs and environmental impact.

GEI Power advances Solar PV with MPPT Hybrid Storage

Zambian startup GEI Power offers hybrid solar home systems that integrate high-efficiency solar panels, pure sine wave inverters, MPPT charge controllers, and lithium battery storage. They supply stable, off-grid, and backup electricity for residential, commercial, and industrial use. Further, the systems optimize solar input using MPPT technology and store excess energy in lithium batteries for nighttime consumption or power outages.

Additionally, the startup manufactures methanol-fueled green cookstoves to reduce charcoal dependence and indoor air pollution. Thus, it advances decentralized solar power and green cooking solutions to strengthen energy access, improve grid resilience, and reduce environmental impact.

E2E Energy Solutions enables Geothermal Reservoir Recovery

Canadian startup E2E Energy Solutions develops a geothermal heat and power system that converts overlooked subterranean reservoirs into steady sources of baseload green energy. It applies the enhanced geothermal reservoir recovery system (EGRRS), which merges conventional geothermal and enhanced geothermal system (EGS) technologies, to repurpose depleted oil and gas wells and saline aquifers. The system injects fluid through a designated leg into a stimulated radiator, heats it, and directs it to the surface via a production well for energy conversion.

Further, the startup eliminates the use of surface water and lowers carbon emissions by reusing existing infrastructure such as pipelines, roads, and power lines. Thus, it converts previously uneconomic geothermal sites into viable assets, increases access to low-carbon baseload power, and supports a sustainable net-zero energy system.

Alotta builds Floating Photovoltaic Systems

Norwegian startup Alotta builds Alotta Solar Hybrid system, a floating photovoltaic system that reduces fossil fuel dependency in coastal and off-grid locations. The system captures solar energy and integrates it with existing sources such as diesel generators and battery storage to maintain continuous power.

Moreover, hybrid systems deploy quickly in remote areas with limited infrastructure and operate on water surfaces to avoid ecological disruption. It proves effective in aquaculture, adapts across sectors, and reduces fuel use and emissions to reduce operational costs.

AbSOLAR facilitates Inter-seasonal Underground Energy Storage

French startup AbSOLAR develops a green energy system that combines solar thermal energy with underground geothermal storage to provide carbon-free heat and cold. The startup builds and operates central solar on underground energy storage (C2SES) installations that collect solar thermal energy. It stores excess heat in the subsoil using borehole thermal energy storage.

Additionally, the green energy system uses the thermal inertia of rocks to retain heat for months. It also enables interseasonal energy use to address the intermittency of solar power. This conversion supports long-term decarbonization of heating and cooling in buildings, agriculture, and industrial sites.

Gain Comprehensive Insights into Green Energy Trends, Startups, and Technologies

In 2025, the green energy sector improves toward decentralization, storage innovation, and sector coupling. Developments in green hydrogen, AI-optimized grids, and seasonal thermal storage redefine how energy is produced, stored, and shared.

As fossil fuel divestment rises and net-zero targets tighten, distributed renewables, carbon capture integration, and energy-as-a-service models gain momentum. Green energy moves from isolated deployments to interconnected systems supporting grid flexibility and climate resilience.

Get in touch to explore 14 120+ startups and scaleups, as well as all market trends impacting green energy companies.