Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2024 Global Diabetes Outlook provides an analysis of the latest trends, technologies, and innovations shaping diabetes care. This report highlights advancements in patient management, diagnostic tools, and new therapeutics. Key focus areas include insulin delivery systems, diagnostics and treatment, and advanced monitoring technologies. Exploring the intersection of healthcare and technology offers insights into the current state and future direction of the diabetes care industry.

Also, the diabetes care report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Global Diabetes Outlook 2024

- Executive Summary

- Introduction to the Global Diabetes Report 2024

- What data is used in this Global Diabetes Report?

- Snapshot of the Global Diabetes Industry

- Funding Landscape in the Diabetes Industry

- Who is Investing in Diabetes Care?

- Emerging Trends impacting Diabetes Care

- 5 Innovative Diabetes Startups

Executive Summary: Global Diabetes Outlook 2024

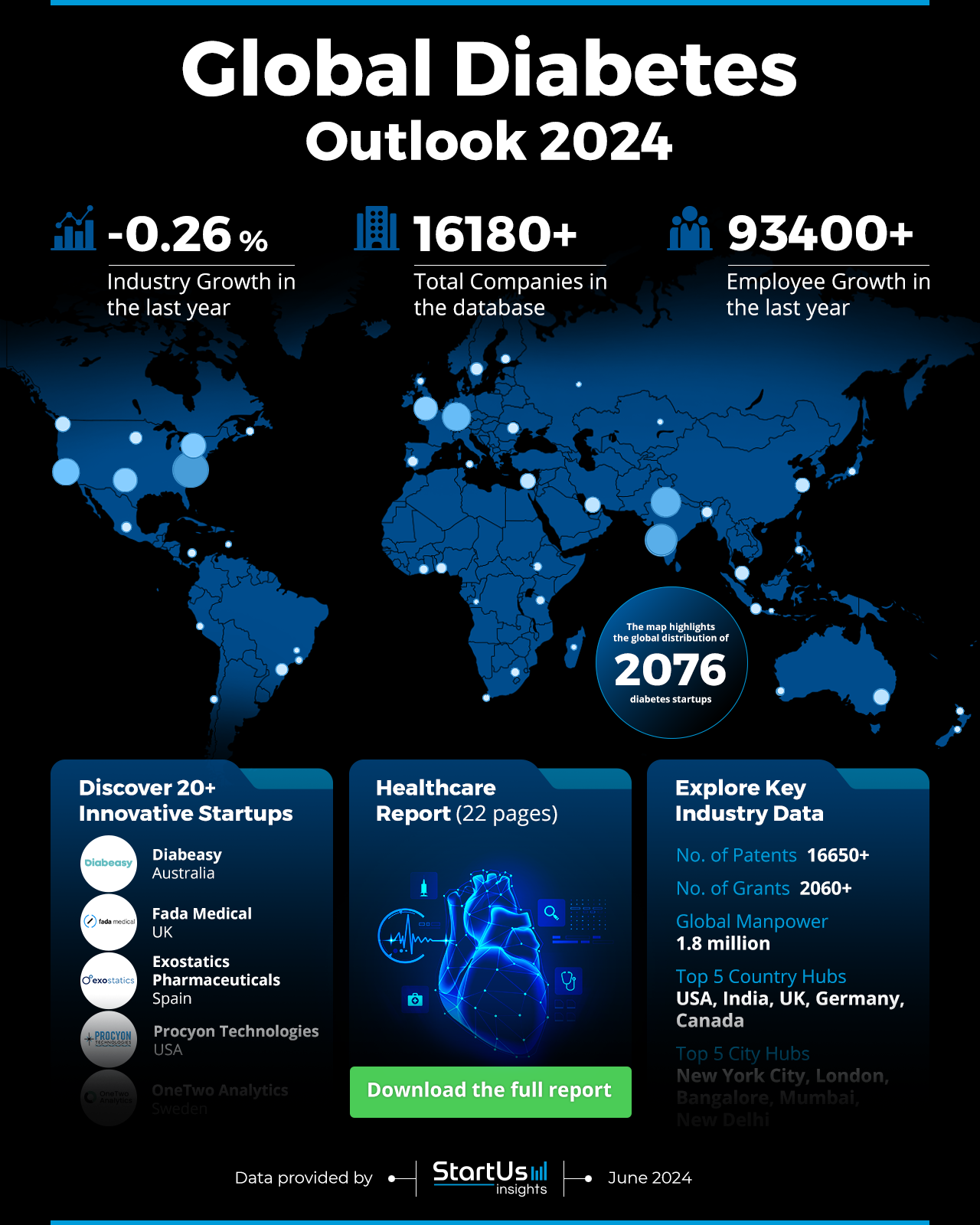

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 2076 global diabetes startups developing innovative solutions to present five examples from emerging global diabetes industry trends.

- Industry Growth Overview: The sector comprises over 16180 companies and the growth rate stands at -0.26%.

- Manpower & Employment Growth: The industry employs over 1.8 million people. The employee growth in the last year was 93000+.

- Patents & Grants: Over 16650 technologies in the industry received patents. In addition, more than 2060 companies received grants.

- Global Footprint: Major country hubs include the USA, India, UK, Germany, and Canada. The top city hubs for diabetes solutions are New York City, London, Bangalore, Mumbai, and New Delhi.

- Investment Landscape: The average investment value per round is USD 27.9 million. More than 1500 investors actively participated in the industry while they closed more than 4770 funding rounds.

- Top Investors: Leading investors include Techstars, Deerfield, and Y Combinator. The combined investment value from the top investors exceeds USD 614 million.

- Startup Ecosystem: Five startups in the industry include Diabeasy (patient management and audit software), Fada Medical (drug diffusion technology), Exostatics Pharmaceuticals (extracellular vesicles capture technology), Procyon Technologies (biocompatible synthetic membrane chambers), and OneTwo Analytics (AI-based diabetes management).

- Recommendations for Stakeholders: Investing in insulin delivery systems and extending wear time to reduce therapy interruptions will increase. Focusing on patient management tools that integrate various aspects of diabetes care will help entrepreneurs. Governments should provide grants and incentives to encourage innovation and research in new technologies. Finally, the stakeholders should collaborate to promote data sharing, create new products and treatments, and enhance interoperability.

Explore the Data-driven Diabetes Industry Report for 2024

The Global Diabetes Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The industry growth stands at -0.26%. Innovation is highlighted with over 16650 technologies receiving patents and more than 2060 receiving grants. The global workforce of 1.8 million employees showcases the sector’s growth, with an addition of 93K employees last year.

The top five country hubs leading this industry include the USA, India, UK, Germany, and Canada. The top city hubs are New York City, London, Bangalore, Mumbai, and New Delhi. The heat map above showcases the geographical spread of startup activity. It highlights the concentration of industry activity and innovation and emphasizes the regions driving industry growth.

What data is used to create this diabetes care report?

Based on the data provided by our Discovery Platform, we observe that the global diabetes industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The industry received extensive news coverage and publications. More than 25000 news articles were published on diabetes in the last year.

- Funding Rounds: Our database includes data on over 4770 funding rounds. This highlights the financial activity in the sector.

- Manpower: With a workforce exceeding 1.8 million workers, the diabetes industry added more than 93000 new employees in the past year.

- Patents: Over 16650 patents for the technologies within the industry were registered.

- Grants: More than 2060 companies received grants for supporting ongoing research and development.

- Yearly Global Search Growth: Yearly global search growth for the diabetes industry stands at 9.67%. It reflects the increasing public interest and awareness about diabetes care.

- and more. Reach out to us to explore all data points used to create this global diabetes report.

A Snapshot of the Global Diabetes Industry

The industry includes manpower of 1.8 million to showcase its scale and workforce engagement. This figure is complemented by an employee growth of 93 thousand in the last year. This demonstrates the sector’s expansion and increasing job opportunities. In addition, the industry encompasses over 16180 companies that highlight its global presence.

Explore the Funding Landscape of the Diabetes Industry

Investment activity in this sector stands with an average investment value of USD 27 million per funding round. More than 1500 investors actively participated in this industry and showcased the broad investment community. This level of involvement resulted in over 4770 funding rounds closed. The number underscores the continuous flow of capital and support for innovation and growth.

Additionally, the number of companies that secured investments exceeds 1880 and reflects the distribution of financial resources and the diverse opportunities within the industry.

Who is Investing in Diabetes Care Solutions?

The combined value contributed by the top investors in the industry exceeds USD 614 million. Below are some of the top investors, their financial contributions, and the number of companies they backed:

- Techstars allocated USD 980 thousand to 10 companies.

- Deerfield committed about USD 406 million to 6 companies.

- Y Combinator channeled USD 1.7 million into 6 companies.

- Hercules Capital provided USD 179 million to 5 companies.

- Almi Invest contributed USD 4 million to 5 companies.

- Khosla Ventures backed 5 companies with a total contribution of USD 22 million.

- and more. Contact us to explore all investment data in the diabetes industry.

These top investors provided the capital to fuel innovation, expansion, and development.

Access Top Diabetes Innovations & Trends with the Discovery Platform

Cell Therapy grows with a total of 3589 identified companies. This area employs approximately 259K people, and it added 21K new employees in the last year alone. The annual trend growth rate for cell therapy stands at 7.69%. This trend’s expansion is driven by advancements in medical research and increasing applications of cell-based treatments in various medical fields.

The Remote Patient Monitoring segment comprises 2022 companies and employs around 177K people. Adding 16K new employees in the last year, the sector experienced an annual trend growth rate increase of 22.92%. The substantial number of companies and employees indicates that remote patient monitoring remains a critical component of healthcare and enables continuous care and data collection for patients outside traditional clinical settings.

Continuous Glucose Monitoring (CGM) encompasses about 556 companies and a workforce of 56K employees. The sector saw an addition of 3700 new employees in the past year, reflecting growing interest and investment. The annual trend growth rate for CGM is 13.43%. The high growth rate and expanding workforce underscore the importance and potential of CGM in improving diabetic care and patient outcomes.

5 Top Examples from 2000+ Innovative Global Diabetes Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a platform demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Diabeasy develops Patient Management & Audit Software

Australian startup Diabeasy develops single-entry type 1 diabetes patient management and audit software. The software facilitates consultations and captures recommended data. It customizes management tools like insulin pumps and multiple daily injections for optimal use. Further, it generates consultation summaries for patients, medical records, and referring doctors. The software integrates anonymized clinic data into external databases. In addition, it identifies glycemic patterns and diabetes management goals.

Fada Medical builds Drug Diffusion Technology

UK-based startup Fada Medical builds a drug diffusion technology to improve insulin pump use for people with type 1 diabetes. The technology increases the wear time and performance of insulin pump cannulas. It addresses the unreliability of infusion sets and reduces interruptions to insulin therapy. Moreover, it mitigates the environmental impact and excessive healthcare spending caused by failed cannulas. Also, it prevents early infusion set failure and cannula occlusion to make insulin therapy easier.

Exostatics Pharmaceuticals offers Extracellular Vesicles Capture Technology

Spanish startup Exostatics Pharmaceuticals makes an exosome capture technology for diagnostic and therapeutic applications. It captures circulating microvesicles and exosomes through a binding process. Also, it detects biomarkers like podocalyxin and CD41 from exosomes in diabetic nephropathy and diabetes patients. This technology supports at-home diagnostics by identifying exosomes in biological samples. Also, it aids blood purification and provides therapeutic applications due to its role in intercellular communication.

Procyon Technologies makes Biocompatible Synthetic Membrane Chambers

US-based startup Procyon Technologies develops cellular therapies and drug delivery through oxygen-enabled implantable medical devices for diabetes. These devices feature implantable chambers made from biocompatible synthetic membranes to protect allogeneic cells from immune rejection. Moreover, they enhance cellular viability and function by delivering oxygen and supporting therapeutic product secretion. Additionally, the devices hold sensors or function as subcutaneous drug delivery systems.

OneTwo Analytics provides AI-based Diabetes Management

Swedish startup OneTwo Analytics offers AI/ML-based data management to enhance diabetes care. The startup’s app for type 1 or type 2 diabetes uses continuous glucose monitor (CGM) sensors and offers automatic and personalized assistance. Its INSIGHTS report analyzes glucose levels and interprets metrics for patient consultations and treatment decisions. It includes analyses of time in range, fluctuations, high and low values, and meal impact. The PRIO feature assists in scheduling appointments based on patients’ unique needs and analyzes CGM data to recommend visit types and lengths. This feature optimizes resource allocation, reduces waiting times, and standardizes workflows.

Gain Comprehensive Insights into Global Diabetes Trends, Startups & Technologies

The 2024 report on diabetes care underscores a sector driven by innovations and evolving patient needs. Advances in insulin delivery, diagnostic technologies, exosome research, and other such areas enhance patient outcomes and treatment efficacy. This report highlights the importance of continued investment in research and development to address unmet needs and improve the reliability of diabetes management tools. Get in touch to explore all 2076 startups and scaleups, as well as all industry trends impacting global diabetes companies.