Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Generative AI solutions in the finance industry address key challenges like regulatory compliance, anti-money laundering, personalized customer support, and risk management scenarios. It facilitates better customer interactions, decision-making and offers personalized investment strategies. Automated report generation, chatbots, and virtual assistants powered by generative AI save the time and cost associated with the process and improve customer satisfaction. For example, US-based startup Rogo facilitates investment banking solutions by automating core workflows.

As the applications of generative AI in the fintech industry continue to evolve, stakeholders must integrate these emerging innovations into their operations to optimize research capabilities, enhance data-driven decision-making, and address the increasing demand for better customer solutions.

Why should you read this report?

- Gain in-depth insights into the top 9 use cases of generative AI in finance

- Learn about two practical use cases for each use case

- Meet 9 innovative startups advancing these applications

Key Takeaways

- Fraud Detection and Risk Assessment

- Use Cases:

- Identity Verification and Authentication

- Synthetic Fraud Scenarios

- Startup to Watch: Greenlite

- Use Cases:

- Personalized Financial Advice

- Use Cases:

- Tailored Investment Recommendations

- Budgeting and Spending Insights

- Startup to Watch: FinqUP

- Use Cases:

- Asset Management and Portfolio Optimization

- Use Cases:

- Investing Strategy Optimization

- Custom Financial Product Information

- Startup to Watch: Rogo

- Use Cases:

- Customer Service Automation

- Use Cases:

- Automated Customer Support

- Personalized Responses

- Startup to Watch: GreyLabs AI

- Use Cases:

- Risk Management and Credit Scoring

- Use Cases:

- Synthetic Data Generation

- Personalized Credit Offers

- Startup to Watch: Crediflow AI

- Use Cases:

- Financial Document Analysis

- Use Cases:

- Automated Report Generation

- Sentiment Analysis

- Startup to Watch: CXsphere

- Use Cases:

- Regulatory Compliance and Reporting

- Use Cases:

- Automated Regulatory Reporting

- Compliance Training and Education

- Startup to Watch: Kodex AI

- Use Cases:

- Marketing and Lead Generation

- Use Cases:

- Chatbots and Virtual Assistants

- Customer Segmentation and Targeting

- Startup to Watch: Vodex.ai

- Use Cases:

- Financial Forecasting

- Use Cases:

- Macroeconomic Forecasting

- Market Trend Prediction

- Startup to Watch: Cloud FO

- Use Cases:

- Fraud Detection and Risk Assessment

FAQs: Applications of Generative AI in Finance

1. How can generative AI be used in finance?

Generative AI plays a crucial role in financial data analysis, scenario simulation, and predictive modeling. It assists in generating synthetic data, which is especially useful for training algorithms in sensitive areas like fraud detection, without compromising real customer data.

Additionally, generative AI supports automated report writing by generating financial summaries and analyses, enabling analysts to focus on strategic tasks. By enhancing predictive models, generative AI also helps banks and financial institutions foresee potential market shifts and customer needs, aiding decision-making and competitive positioning.

2. What are the applications of artificial intelligence in finance?

Artificial intelligence transforms finance through risk assessment, customer service, and regulatory compliance. AI-driven models analyze vast datasets to detect fraud patterns and assess creditworthiness with increased accuracy and speed. Chatbots and virtual assistants provide customer support, handling routine inquiries and allowing human agents to address more complex issues.

Moreover, AI automates compliance processes, ensuring that financial institutions adhere to regulations by identifying anomalies and generating compliance reports. In asset management, AI algorithms facilitate high-frequency trading by analyzing market trends and executing trades within milliseconds.

3. What are the challenges of AI in fintech?

AI in fintech faces challenges related to data privacy, regulatory compliance, and ethical considerations. Ensuring data privacy remains paramount, as financial institutions must protect sensitive customer information when leveraging AI technologies. Regulatory constraints demand that AI models operate transparently and fairly, posing a challenge as advanced AI models can sometimes lack explainability.

Additionally, ethical issues arise around potential biases in AI algorithms, which might inadvertently lead to discrimination in areas like lending and credit scoring. Addressing these challenges requires rigorous testing, transparent AI governance, and collaboration with regulators to align technological advancement with regulatory frameworks.

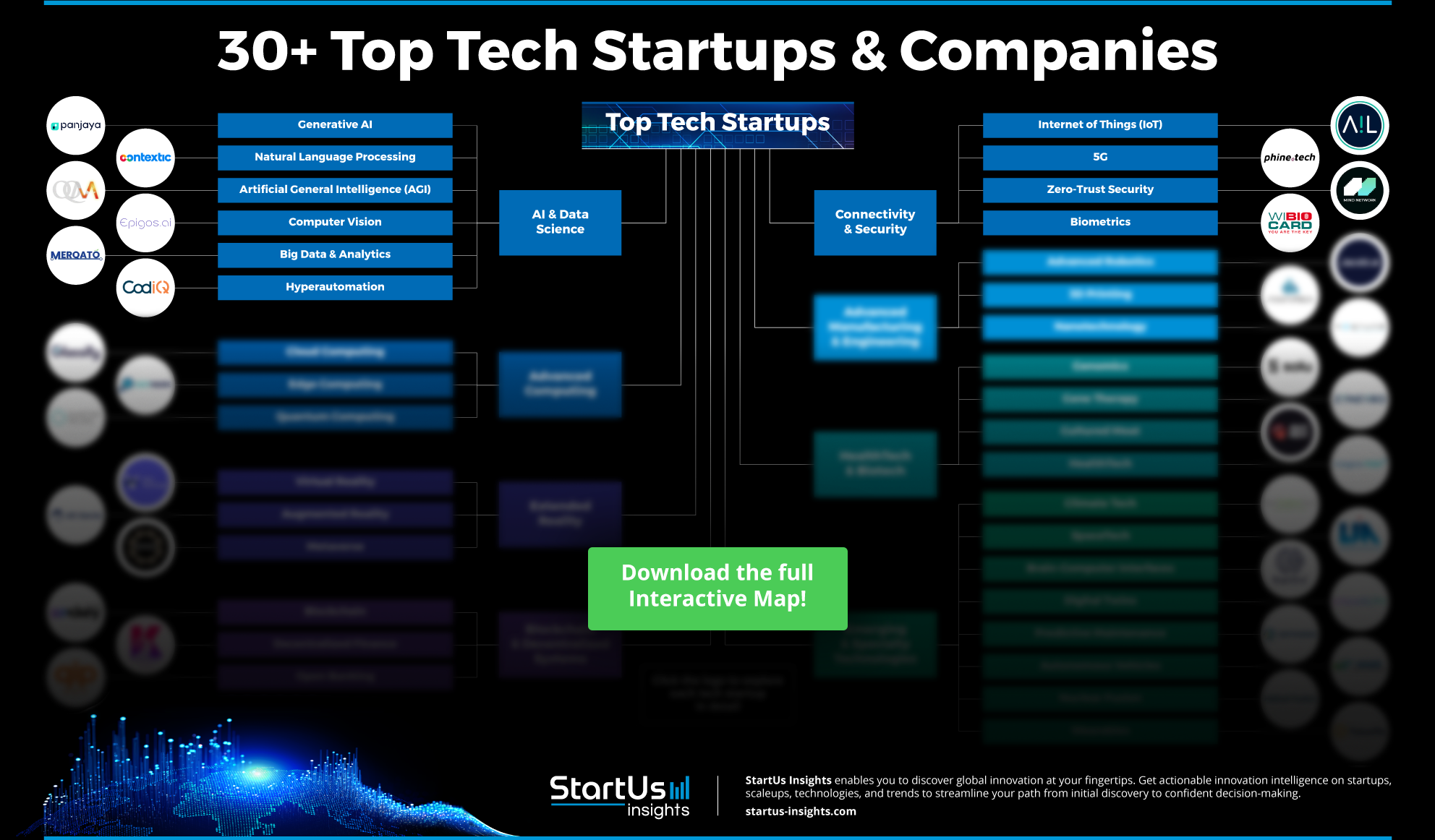

Where We Get Our Data From

StartUs Insights gathers data through its exhaustive Discovery Platform, covering information on 4.7+ million startups, scaleups, and tech companies globally, alongside 20K+ emerging technologies and trends. The Discovery Platform accelerates startup and technology scouting, trend intelligence, and patent searches, offering thorough insights into technological advancements.

By leveraging the trend intelligence feature for this report, we identified emerging technologies within specific industries. This process allows us to uncover patterns and trends, and pinpoint relevant use cases and the startups creating solutions for each scenario. Additional capabilities and information can be found at StartUs Insights Discovery Platform.

Top 9 Applications of Generative AI in Finance [2025 & Beyond]

1. Fraud Detection and Risk Assessment

Generative AI identifies potential threats by leveraging machine learning algorithms and natural language processing. It analyzes financial data in real-time and detects patterns that indicate fraud activities. In the process of identity verification and authentication, AI automates the time-consuming procedures by introducing optical character recognition (OCR) and biometric services. This includes face recognition which minimizes processing time for new user onboarding.

It eliminates paperwork and physical visits and verifies new customer identity through video calls and selfies from trusted sources. In synthetic fraud scenarios, generative AI identifies critical features for payment fraud, account age, and modification in account information. It improves synthetic fraud detection through the continuous training of machine learning models which flags high-risk transactions and informs security breaches.

Diver Deeper:

- Noteworthy Example: Mastercard uses generative AI and graph technology to predict fraud activities of digital cards by focusing on the relationship between data points and tracks leaked cards in the network.

- Financial Landscape: Generative AI-based fraud detection and risk assessment startups in the finance industry receive an average of USD 17.1 million in funding.

Startup to Watch: Greenlite

US-based startup Greenlite uses generative AI to automate financial compliance workflows for banks, investment firms, and credit unions. It enhances anti-money laundering (AML) investigations by automating data collection, transaction analysis, and document reviews. It facilitates risky customer analysis by reviewing customer documentation, financial statements, and web presence. Greenlite’s technology adapts to evolving regulatory requirements and emerging fraud patterns and ensures that financial institutions stay ahead of potential threats.

2. Personalized Financial Advice

By analyzing vast amounts of financial data such as transaction histories, market trends, and individual client profiles, AI-powered systems generate customized financial plans and investment strategies for individuals. Generative AI enhances dynamic portfolio allocations which include information from investors, current assets and equity funds. This process increases customer satisfaction and loyalty by offering tailored investment recommendations for customers. These parameters are generated by tracking spending habits, income streams, and a comprehensive view of an individual’s financial activities.

Generative AI solutions enable the creation of personalized budgets to meet individual needs and goals. AI-driven assistants offer personalized financial advice on budgeting, investment decisions, and strategies. It continuously learns from interactions and financial outcomes to improve recommendations over time.

Diver Deeper:

- Noteworthy Example: Global predictions has launched personalized financial advisor called portfolio pilot which generates investment recommendations based on individual’s portfolio and improves wealth management strategy .

- Financial Landscape: Generative AI startups providing personalized financial advice receive an average of USD 15.4 million in funding.

Startup to Watch: FinqUP

Macedonian startup FinqUP offers financial advice through generative AI advisors. The company’s product FinqUP VISTA allows the deployment of generative AI avatars that offer financial advice through video, voice, and text. Also, it ensures quick customer onboarding by using EIDAS 2.0 KYC & AML technology. Another product FinqUp Charm uses machine learning to analyze data and make relevant financial recommendations for the customers. The company offers digitalization services like customer onboarding, portfolio simulations, and customer engagement through its application.

3. Asset Management and Portfolio Optimization

Generative AI leverages large language models and predictive analytics to process data related to asset allocation and portfolio optimization. Based on the historical performance data, investor preferences, and market conditions, it generates optimized asset allocation and monitors the potential impact of their portfolios.

AI-driven strategies adapt to market conditions and allow financial institutions to offer individual strategies for investments which improves client satisfaction. It enables custom financial products by simulating various financial scenarios to understand the results of their choices. It generates reports, summaries, and explanations about financial products that satisfy individual financial goals.

Diver Deeper:

- Noteworthy Example: Broadridge combines several asset servicing functions into a single, multi-currency platform across capital markets. This approach streamlines the maintenance of financial assets, accurate transaction processing, and compliance with regulations.

- Financial Landscape: Generative AI based asset management and portfolio optimization startups receive an average of USD 10.8 million in funding.

Startup to Watch: Rogo

US-based startup Rogo develops an AI-powered analytics platform for investment banks and private equity investors. The company’s platform utilizes generative AI to analyze vast amounts of financial data, market trends, and company information. Using this data, Rogo’s platform generates insights and automates core workflows which enables financial professionals to make investment decisions. It creates market reports, specialized workflows, and document summaries by analyzing internal data and an extensive library of quality sources. It handles sensitive financial information and provides customizable features tailored to each firm’s specific needs. Rogo’s AI assistants streamline due diligence processes, enhance deal sourcing capabilities, and optimize asset management strategies.

4. Customer Service Automation

Generative AI supports customer service automation through machine learning algorithms to provide personalized and round-the-clock support. AI-powered chatbots and virtual assistants handle a range of customer queries with human-like understanding and responsiveness. They handle regular tasks from customers like transaction histories, balance inquiries, and basic financial advice.

By analyzing vast amounts of customer data, social media activity and demographic information generative AI solutions enhance the customer experience to cater it to individuals. This real-time adaptation contributes to an improved customer experience and reduced response times. AI-powered chatbots communicate fluently in multiple languages which breaks down language barriers and makes financial services more accessible to a diverse customer base.

Diver Deeper:

- Noteworthy Example: Bank of America’s virtual assistant, Erica deals with client requests and demonstrates the usage of chatbots to reduce the workload of human agents.

- Financial Landscape: Generative AI startups providing customer service automation in the fintech industry receive an average funding of USD 31.5 million.

Startup to Watch: GreyLabs AI

Indian startup GreyLabs AI develops a call center speech analytics solution for banks, insurance companies and financial institutions. The company uses generative AI to analyze customer conversations and derive insights. It automates the summary of customer interactions and ensures that important information is captured for reference and analysis. The solution helps to improve call agent’s performance by offering insights and feedback of each call. By uncovering trends, sentiments of customer interactions, it identifies lead generation opportunities and improves customer satisfaction.

5. Risk Management and Credit Scoring

By utilizing AI algorithms and machine learning techniques, financial institutions process large amounts of structured and unstructured data to generate more accurate risk assessments and credit scores. Generative AI enables dynamic predictive modeling that predicts potential risks. These models forecast market fluctuations, credit risks, and cybersecurity threats through predictive threat detection and automated response mechanisms.

Synthetic Data Generation (SDG) addresses challenges of credit scoring like data privacy, scarcity, and quality by creating artificial datasets that have patterns of real-world data without any sensitive information. Personalized credit offers generate credit products by analyzing customer data and market trends that align with individual customer needs and risk profiles. By automating time-consuming processes of risk assessment, financial institutions optimize turnaround times for loan approvals and other financial decisions which enhances the overall customer experience.

Diver Deeper:

- Noteworthy Example: SPIN analytics automates the credit risk modeling process through its product, RISKROBOT which performs data cleaning and time-consuming tasks and reduces the lead time to market.

- Financial Landscape: Generative AI startups that perform risk management and credit scoring in the fintech industry receive an average funding of USD 19.8 million.

Startup to Watch: Crediflow AI

UK-based startup Crediflow AI develops an AI-powered credit analysis platform for banks and lenders. The company’s generative AI solution turns financial statements into credit memos for review and discussion. The platform performs financial analysis, trends analysis, and ratio analysis for decision making which saves hours on time-consuming tasks. The platform supports integration with other CRMs, credit bureaus, and loan software to automate the credit assessment process. It turns unstructured data from sources like Know Your Business (KYB) screening to structured data that enhances operational efficiency and consistency in risk management.

6. Financial Document Analysis

Generative AI extracts data from a wide range of financial documents and automates data extraction and summarization. This approach reduces the time and effort required for manual analysis and allows financial professionals to make better decisions. Generative AI performs cross-document analysis which monitors information from multiple sources and identifies patterns in the documents for preparing financial documents.

Automated report generation allows structured, informative financial reports which include income statements, and cash flow statements in a consistent manner. It ensures the timely delivery of reports and reduces the time and effort for manual preparation. Generative AI provides sentiment analysis by viewing financial news, and social media posts to provide insights into market trends and investor sentiment.

Diver Deeper:

- Noteworthy Example: Perfios automates the process of financial statement analysis, data extraction, and credit decisions. It does it through the financial statement analyzer (FSA) tool which boosts productivity and performs the operation of analysis and reporting

- Financial Landscape: Generative AI startups that provide financial statement analysis solutions in the finance industry receive an average funding of USD 60 million.

Startup to Watch: CXsphere

Canadian startup CXsphere provides a conversational automation and intelligence platform that automates data extraction and document analysis for banks and financial institutions. The company’s product CXAUTOMATE leverages generative AI to automate customer experience with services like voice automation, email automation, and chatbots. Another product CXENGAGE accelerates lead generation through customer insights and deep segmentation. Further, the company’s product CXINSIGHT delivers real-time predictive data intelligence and offers an insightful view of customer behavior. The platform is intended to enable brand owners to engage with their customers in a more personalized manner

7. Regulatory Compliance and Reporting

Integration of generative AI models into the regulatory compliance systems automates the creation of policy documents, compliance reports, and data interpretation. It identifies key compliance areas, extracts relevant obligations, and enables regulatory teams to stay updated with current regulations across jurisdictions. It creates compliance training content based on employee roles and ensures awareness about regulatory standards across the organization. The technology performs real-time monitoring, detects patterns and anomalies in transactions, and improves risk scoring. It offers data-driven insights, reduces compliance management costs and provides flexible compliance practices.

Diver Deeper:

- Noteworthy Example: Fenergo offers real-time KYC and transaction compliance products which automate regulatory compliance and provide continuous transaction monitoring throughout the client’s lifecyle.

- Financial Landscape: Generative AI startups that offer regulatory compliance and reporting solutions in the fintech industry receive an average funding of USD 23.6 million.

Startup to Watch: Kodex AI

German startup Kodex AI offers a regulatory compliance platform for addressing risk for financial services, workflow automation, and regulatory alerts. The company’s solution leverages artificial intelligence and natural language processing to automate compliance processes by monitoring global regulatory landscapes and identifying new policies. The platform offers multimodal capabilities and generates regulatory documents in any format to connect various information and data types. The company’s solution compares the client’s internal policies with the latest regulatory reports to identify compliance gaps and tries to resolve them.

8. Marketing and Lead Generation

By utilizing natural language processing and machine learning algorithms, financial institutions offer targeted marketing campaigns and identify potential leads with high accuracy. Generative AI produces tailored marketing materials, from email campaigns to social media posts which aim at specific customer segments.

Chatbots and virtual assistants engage in natural conversations and qualify leads through follow-ups and appointment bookings. They reduce the workload on human staff and maintain high levels of customer satisfaction. Generative AI improves customer segmentation and targeting by creating customer profiles and extracting data from various sources. It analyzes customer data, engagement metrics, and behavior patterns to prioritize leads which provides increased conversion rates and efficiency.

Diver Deeper:

- Noteworthy Example: Webfx provides lead generation services for fintech companies. Using data-driven strategies and a proprietary tool, MarketingCloudFX qualifies the leads that fits the client’s goals

- Financial Landscape: Generative AI startups that work on marketing and lead generation solutions receive an average funding of USD 29 million.

Startup to Watch: Vodex.ai

Indian startup Vodex.ai delivers generative AI-powered voice bot calls that are powered by website visitors for lead generation. It ensures that only qualified prospects are made in connection with the client and the outbound calls are made in human-like voice. Vodex.ai integrates into existing CRMs and offers engaging multilingual interactions which simplifies outreach efforts. The solutions eliminate waiting times, human error and increase the volume of customer interactions.

9. Financial Forecasting

Generative AI algorithms scan and analyze large volumes of historical data to identify complex patterns and relationships that improve asset prices and predictive modeling. It enhances time series analysis by modeling temporal dependencies and forecasts stock price, market demand, and economic indicators which leads to improved decision-making.

By recognizing trends that are not common through traditional analytical methods, generative AI improves the accuracy of forecasting. Also, it simulates various financial scenarios based on different inputs and assumptions which allows financial analysts to evaluate how different economic variables impact forecast. By this approach, financial forecasting powered by generative AI enables better risk assessment and management.

Diver Deeper:

- Noteworthy Example: FIS launches an innovative fintech platform, Atelio which offers a broad suite of financial service capabilities and financial forecasting. It provides the building blocks to embed their offerings into the client’s workflow.

- Financial Landscape: Generative AI startups that provide financial forecasting solutions receive an average funding of USD 8.7 million.

Startup to Watch: Cloud FO

UK-based startup CloudFO delivers an intelligent software solution using generative AI to perform complex analysis and forecast business metrics in seconds. The solution uses the cloud platform to visualize the income, expenses, and business performance. The cloud platform offers tools such as scenario planning, forecasting, and budgeting that enable businesses to acquire comprehensive insights into their financial health. By utilizing machine-learning techniques, the solution keeps the bank transactions of the client in a secure infrastructure and minimizes data sharing with commercial partners.

Don’t Miss Out on the Latest Generative AI-led FinTech Innovations

Top investors like Techstars, Y Combinator, Khosla Ventures, Nyca Partners, and 100X.VC support startups focusing on generative AI applications in the fintech industry. This funding majorly spans seed, early-stage VC/Series A, Accelerator/Incubator, Pre-Seed, and Angel rounds. The average funding per round stands at USD 21.3 million, which supports early-stage startups developing generative AI-led fintech solutions.

Ready to leverage the latest healthcare technologies shaping the future? With StartUs Insights, you gain quick and easy access to over 4.7 million startups, scaleups, and tech companies, along with 20K+ emerging technologies and trends. Our AI-powered search and real-time database provide exclusive solutions that set you apart from the competition.

Industry giants like Samsung, Nestlé, and Magna trust our innovation intelligence tools to lead trends, optimize operations, and uncover new market opportunities. Dóra Avar, Innovation Consultant at OTP Group says “StartUs Insights enables us to discover new partners for PoCs, scale our outreach, and further strengthens OTP’s position as a leading innovation player globally.”

Like them, you can also benefit from our unmatched data, comprehensive industry views, and reliable insights to drive strategic decision-making. Get in touch to learn how our tailored discovery options can accelerate your innovation journey.

Discover All Generative AI-led Financial Technologies & Startups!