Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

In this 2024 Fleet Management Report, we examine the trends and analytics reshaping logistics and transportation. This includes technologies like autonomous driving, sustainable mobility, and route optimization. The report also looks at the industry growth and rising investments in efficiency and sustainability. Read more to explore how fleet operators manage the intricacies of regulatory changes and incorporate innovative solutions to stay competitive.

This report was last updated in July 2024.

This fleet management industry report serves as a reference for stakeholders, investors, policymakers, and economic analysts providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Fleet Management Report 2024

- Executive Summary

- Introduction to the Fleet Management Report 2024

- What data is used in this Fleet Management Report?

- Snapshot of the Global Fleet Management Industry

- Funding Landscape in the Fleet Management Industry

- Who is Investing in Fleet Management?

- Emerging Trends in the Fleet Management Industry

- 5 Fleet Management Startups impacting the Industry

Executive Summary: Fleet Management Industry Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 2000+ fleet management startups developing innovative solutions to present five examples from emerging fleet management industry trends.

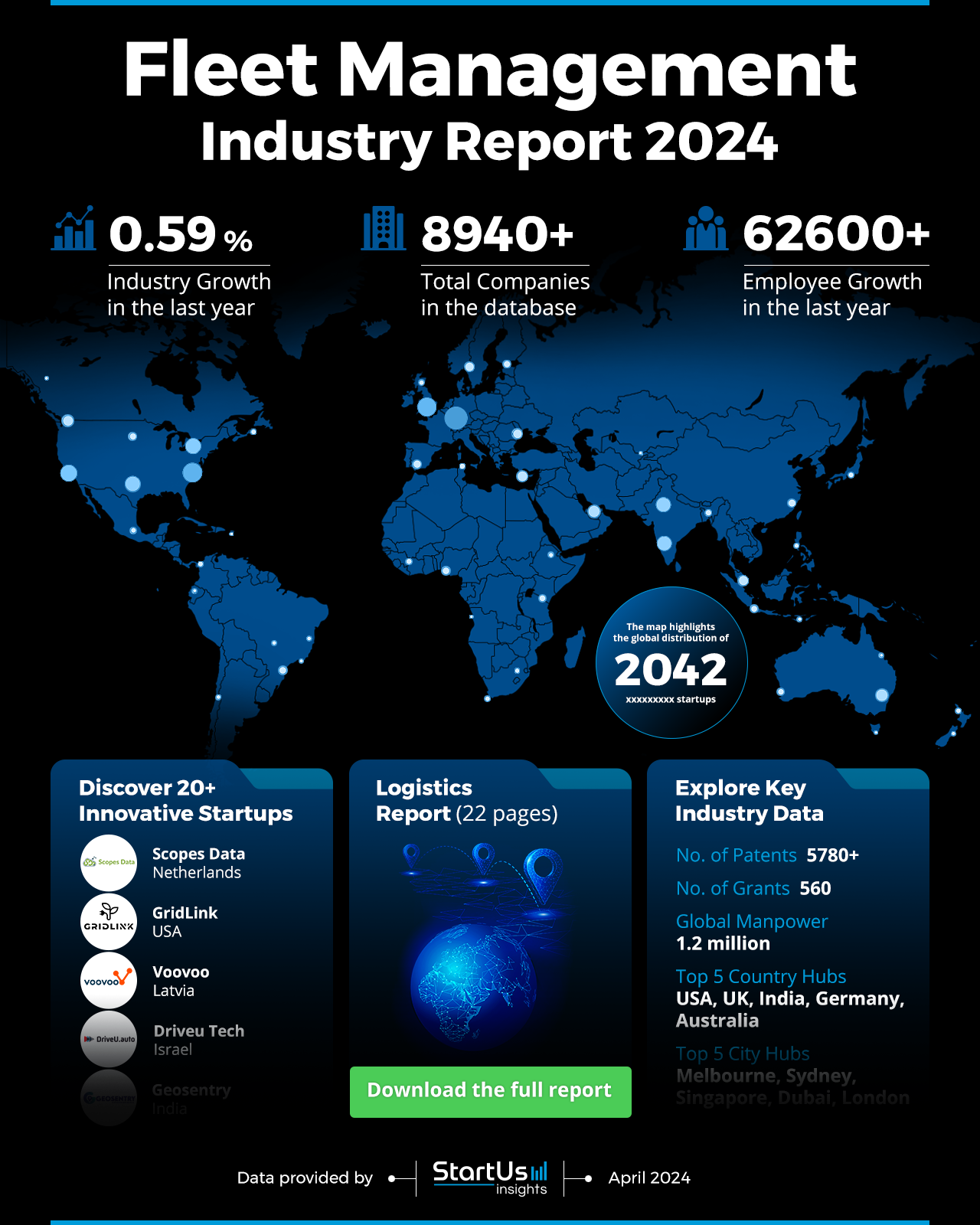

- Industry Growth Overview: With over 8900 companies, the fleet management industry remains a huge global sector despite the minor growth increase of 0.59% in 2023.

- Manpower & Employment Growth: The industry employs more than 1.2 million employees worldwide, with an annual increase of more than 62000 new hires.

- Patents & Grants: With over 5780 patents and 560 grants, innovation is increasingly visible in this sector.

- Global Footprint: The USA, UK, India, Germany, and Australia lead as top country hubs, while cities from Melbourne, Sydney, Singapore, Dubai, and London rank as top city hubs.

- Investment Landscape: Over 980 companies closed 2480 funding rounds, with an average investment value of USD 57.2 million each round.

- Top Investors: Major investors include BDT & MSD Partners (440 million), Warburg Pincus (400 million), Lloyds Banking (357 million), SoftBank Vision Fund (344.5 million), and more, have collectively invested over 2 billion.

- Startup Ecosystem: Notable startups in the field include Scopes Data (fleet emissions management platform), GridLink (charging management software), Voovoo (co-pilot technology), DriveU Tech (teleoperation connectivity platform), and Geosentry (AI-powered GPS tracking solutions).

- Recommendations for Stakeholders: Emphasize investment in technology and human capital to utilize AI, IoT, and big data for efficiency, safety, and sustainability.

Explore the Data-driven Fleet Management Outlook for 2024

The Fleet Management Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The global heatmap shows the concentration and distribution of startup businesses worldwide. Important hotspots include the top country hubs, the United States, the United Kingdom, India, Germany, and Australia. These countries offer startup ecosystems that promote economic expansion and innovation. The heatmap also illustrates entrepreneurship’s global reach by showing the activity level within these hotspots. Melbourne, Sydney, Singapore, Dubai, and London are the five most active city hubs for fleet management.

Our database covers over 8940 companies. Of these, 2042 startups in this ecosystem represent the industry’s growth, which increased by 0.59% in the past year. Further, the industry filed more than 5780 patents, along with 560 grants given out. The number of workers in the sector surpassed 1.2 million, with the addition of 62600 personnel in the last year.

What data is used to create this fleet management report?

Based on the data provided by our Discovery Platform, we observe that the fleet management industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: This past year, the fleet management sector was featured in over 3990+ publications and news stories.

- Funding Rounds: The industry completed more than 2480 funding rounds, according to our database.

- Manpower: The industry employs over 1.2 million people, with over 62600 new hires in the past year alone.

- Patents: The Fleet Management sector filed for more than 5780 patents.

- Grants: The sector received about 560 grants.

- Global Search Growth: The industry saw an annual increase of 10.5% in worldwide search interest.

- and more. Book a demo to explore all data points used to create this fleet management report.

A Snapshot of the Global Fleet Management Industry

The fleet management industry report highlights the growth and investments within the sector. A workforce of 1.2 million individuals drives its productivity. The past year alone has welcomed about 62000 new employees.

With over 8940 companies contributing to its ecosystem, the industry showcases a growing capacity for innovation.

Explore the Funding Landscape of the Fleet Management Industry

Regarding investment dynamics, each funding round’s average investment value stands at USD 57.2 million. Over 1000 investors support growth and innovation in over 9840 companies. With the closure of more than 2480 funding rounds, these investors provided resources to over 980 companies.

Who is Investing in Fleet Management?

Leading the charge in the investment sphere, top investors contributed over USD 2.7 billion to the industry. This demonstrates their dedication and growth potential.

- BDT & MSD Partners made an investment of USD 440 million in a single company.

- Warburg Pincus invested USD 400 million in two companies to diversify their impact and leverage high-value opportunities.

- Lloyds Banking invested USD 357 million in one company, showcasing a targeted investment strategy.

- SoftBank Vision Fund demonstrates its keen eye for potential, spreading USD 344.5 million across three companies, balancing risk and reward.

- Solera Holdings invested USD 342.7 million in six companies, demonstrating a broad approach to fostering growth.

- G2 Venture Partners invested USD 282 million in two companies.

- Continental focused its funding on one company, infusing USD 280 million.

- Banco Bradesco rounds out the list with a sizable investment of USD 270 million in one company.

Gain Access to Top Fleet Management Innovations & Industry Trends with the Discovery Platform

Here are a few growing trends in the fleet management industry along with firmographic insights:

- Route optimization in the fleet management industry involves about 1168 companies. The workforce driving this trend amounts to over 80300 employees, augmented by 6100 fresh talents in the last year alone. It also has an annual growth rate of 7.66%. This surge indicates the demand for efficient logistics and the role of route optimization in time and resource management.

- Computer vision stands out as a rapidly ascending trend. 17600+ companies leverage this technology while employing 947700 professionals. These companies also welcomed 87500 newcomers over the past year mirroring an annual growth rate of 6.15%. This uptick underscores the integration of computer vision across diverse industries, from autonomous vehicles to quality control.

- Edge computing spans across 45548 companies. The sector’s current workforce includes 4 million people with an addition of 301600 new employees in the previous year. This demonstrates edge computing’s 2.59% growth rate annually. Further, it reflects a seismic shift towards decentralized computing, enabling faster processing and responsiveness.

5 Top Examples from 2000+ Innovative Fleet Management Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Scopes Data provides Fleet Emissions Management Platform

Dutch startup Scopes Data offers a fleet emissions management platform. The platform categorizes the fleet’s greenhouse gas emissions and consolidates data trends such as mileage, fuel or electricity consumption, compliance score, and more. With Scopes Data’s platform, organizations better manage fleet emissions and implement reduction initiatives.

GridLink offers Charging Management Software

US-based startup GridLink develops charging management software for electric vehicle fleets. The software features remote command and control over the charging process as well as integrates renewable energy. This software also provides predictive maintenance insights, weather-informed charging, emissions tracking, alert monitoring, and performance analysis to optimize charging schedules and reduce costs. Use cases of GridLink include commercial EV fleets, Auto OEMs, EV bus fleets, and utilities.

Voovoo develops Co-Pilot Technology

Latvia-based startup Voovoo develops co-pilot technology to enhance fleet safety. This technology prevents speeding and aggressive driving through real-time monitoring and control. It also integrates with existing GPS trackers to support current infrastructure without capital-intensive retrofits. Further, Voovoo’s system features geofencing and a remote immobilizer that turns off all car electronics and activates only until the driver stops the car to increase car safety. Thus, fleet owners and management companies benefit from automated safety, enhanced efficiency, and reduced environmental footprint.

DriveU Tech enhances Teleoperation Connectivity

DriveU Tech is an Israeli startup that equips robots and autonomous vehicles with an advanced teleoperation connectivity platform for low-latency communication. It offers connectivity solutions tailored for both low-impact robots and high-demand vehicle teleoperation. The platform supports diverse robotic operations and caters to autonomous trucks, shuttles, robotaxis, and heavy machinery. The platform also features cellular bonding and dynamic video encoding to tackle varying network conditions and ensure uninterrupted service while enabling the safe operation of autonomous vehicles.

Geosentry provides AI-Powered GPS-Tracking

Indian startup Geosentry offers AI-powered GPS tracking solutions built on the Google Cloud Platform. The company provides software development kits (SDK) and application programming interface (API) services for optimal routing, geofencing, and GPS tracking, tailored for asset, vehicle, and personnel management. Its platform enhances operational efficiency through real-time insights and security improvements. Geosentry also utilizes AI to deliver predictive analytics, behavior analysis, and safety alerts. Thus, the company assists in analyzing, planning, and optimizing fleet routes to reduce time and costs.

Gain Comprehensive Insights into Fleet Management Trends, Startups, or Technologies

The 2024 Fleet Management report shows how technological innovation drives the logistics sector forward. The industry shows a strong growth trajectory, with adaptive strategies poised to tackle future challenges. These include adapting to rapid technology changes, managing increasing data volumes, ensuring cybersecurity, and integrating new technologies with existing systems. Get in touch to explore all 2000+ startups and scaleups, as well as all industry trends impacting fleet management companies.