Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked FinTech startups building voice-activated solutions.

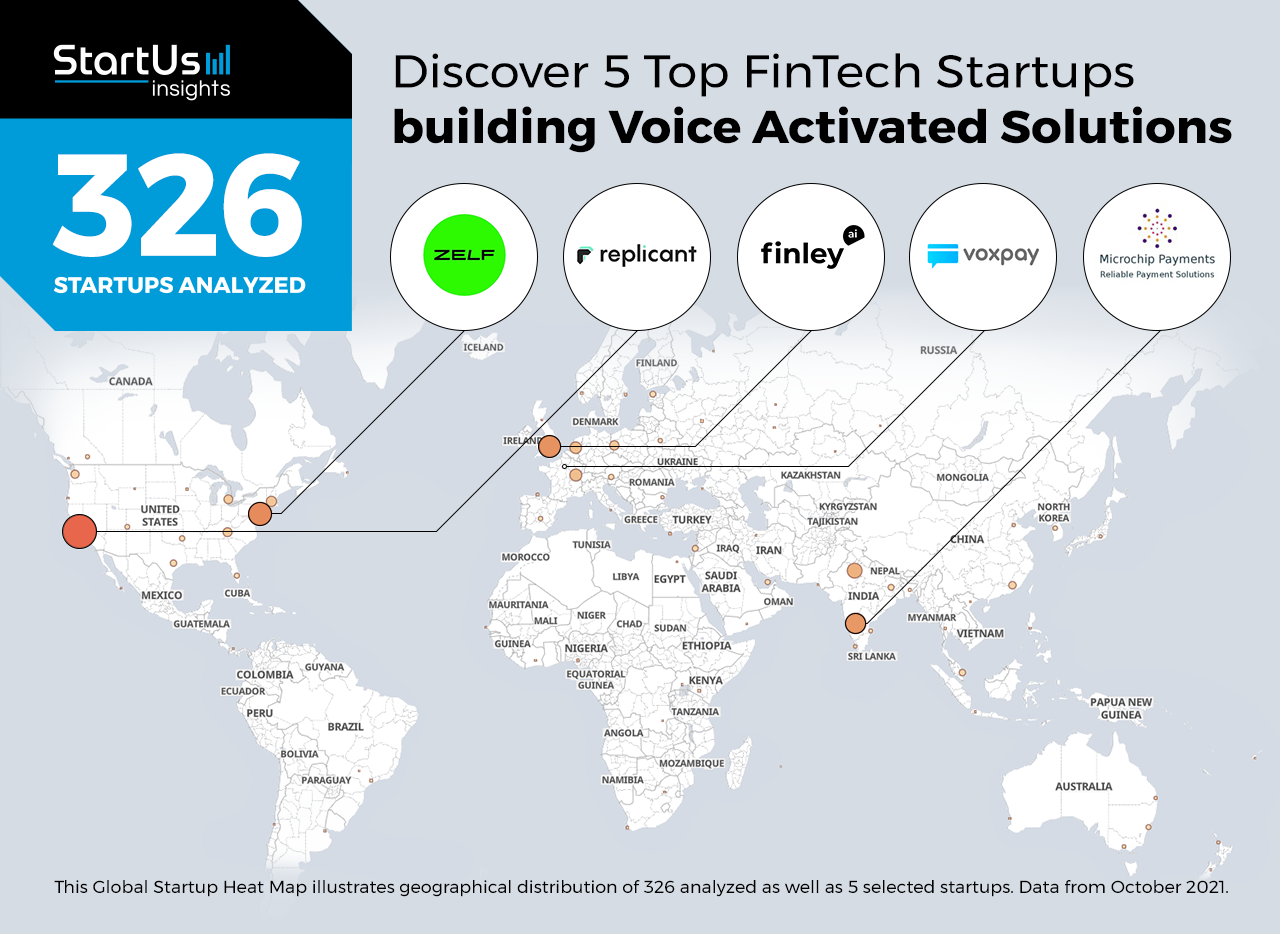

Out of 326, the Global Startup Heat Map highlights 5 Top FinTech Startups building Voice Activated Solutions

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 326 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 321 voice-activated solutions, get in touch.

Finley AI provides AI-based Voice Assistants

Founding Year: 2019

Location: London, UK

Partner for: Financial Knowledge and Wellbeing

Finley AI is a British startup that offers artificial intelligence (AI)-powered voice assistants for financial and pension planning. Without guidance or expert advice, many individuals are unprepared for life’s important financial choices like family planning and retirement. The Finley AI answers such questions and explains everything from budget planning to the ways one can plan for their future by providing money-saving tips. In addition, it uses sophisticated natural language and is designed to speak to a user just like they would consult with a financial expert. Hence, Finley AI understands dialogues within a normal and natural conversation. The startup further provides conversational AI-based voice and chat assistants for financial services and wealth management firms for engagement, marketing, and acquisition.

Microchip Payments enables Voice-based Payments

Founding Year: 2017

Location: Bangalore, India

Funding: USD 31 000

Partner for: Voice Payments

Microchip Payments is an Indian startup that develops Voice Pay, a platform that enables digital payments over voice networks. With the emergence of cashless economies, people often face challenges while making transactions due to connectivity issues or internet outages in remote places and crowded places. VoicePay is an end-to-end platform that provides seamless payment experiences to non-tech-savvy users even if connectivity issues arise due to network congestion. In addition, the startup’s software development kit can be integrated with any bank, payment, or financial service app to execute transactions without using data or the internet.

Replicant facilitates Customer Service Automation

Founding Year: 2017

Location: San Francisco, US

Funding: USD 35 M

Partner for: Customer Assistance, Customer Service Automation

US-based startup Replicant provides an AI voice technology that resolves issues over the phone. Replicant’s solution automates customer service without losing the human touch. However, if Replicant’s Thinking Machine detects a highly emotional or urgent customer issue, it passes the customer to a live agent. Whenever consumer behavior shifts due to economic changes, the customer service capacity for banks needs to adapt as well. For example, a surge in refinancing due to low-interest rates or a flood of account activity because of stimulus checks. The Replicant’s voice AI scales to the contact center capacity quickly, efficiently, and securely. With the startup’s solution, agents do not have to complete repetitive transactions or spend more time and effort on building relationships with clients or partners. Besides, it improves customer experience and reduces customer handling costs.

Voxpay provides Secure Remote Payments

Founding Year: 2017

Location: Paris, France

Partner for: Secure Remote Payments

Voxpay is a French startup that offers a unique and seamless omnichannel solution for securing remote payments. In particular, it is a confidential Payment Card Industry Data Security Standard (PCI-DSS) certified voice channel payment product. The solution enables cashing a credit card transaction during a phone conversation without asking the bank card number. At the time of payment, the agent redirects the consumer to a secure interactive voice response (IVR) server. The consumer is then guided by an automatic call machine for the payment procedure. This allows call centers, debt recovery agencies, eCommerce companies, and accountancy departments to simplify cash collection and billing processes.

Zelf develops a Voice-Controlled Neobank

Founding Year: 2017

Location: New York City, US

Funding: USD 2 M

Partner for: Voice-Activated Neobank

US-based startup Zelf develops a messenger-based bank. Once a user signs up, it takes less than 30 seconds to receive a virtual Mastercard. The customer has full control over sending and receiving money using voice through the messaging platform of their choice once they receive the card. The supported messenger apps include Facebook Messenger, WhatsApp, Telegram, and Viber. To achieve this, the startup uses an AI-powered voice control solution. Additionally, the startup sends SMS with a unique code to confirm each and every transaction as well as provides an option to set limits to the size of transactions for additional security.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on cybersecurity, open finance, and neobanking. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.