Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked cybersecurity solutions.

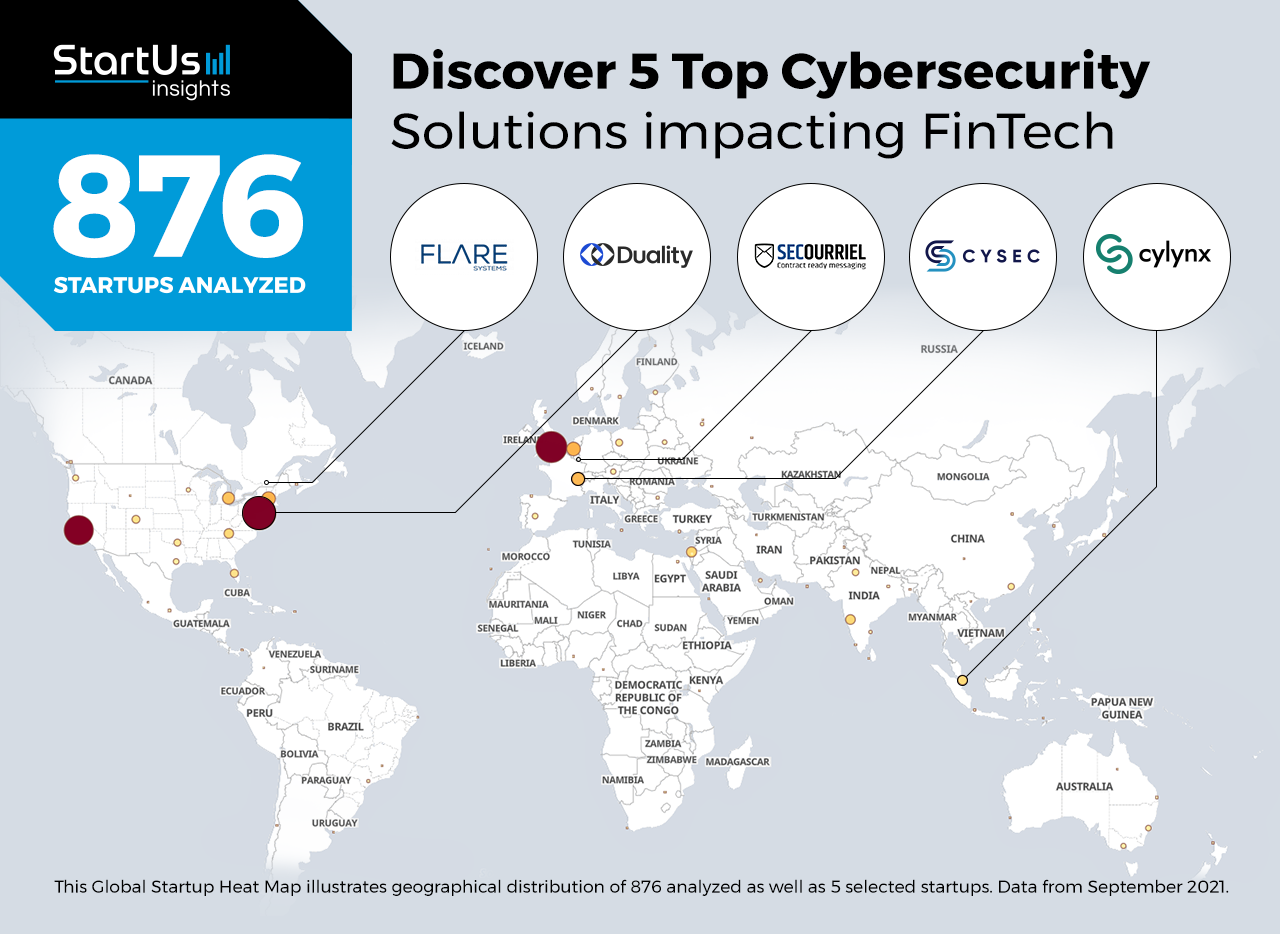

Global Startup Heat Map highlights 5 Top Cybersecurity Solutions impacting Financial Services out of 876

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 876 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 cybersecurity solutions that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 871 cybersecurity solutions for FinTech, get in touch.

Secourriel provides Encrypted Communication

The COVID-19 pandemic is forcing banks and non-banking financial companies (NBFC) to move more of their operations into online channels. These include customer service, verification, and onboarding that traditionally needs customer-employee interaction. Even though it improves customer and employee convenience, there are higher chances of data breach and loss. To tackle this, startups develop cybersecurity solutions that encrypt sensitive information, providing data security for financial firms. Such solutions reduce data leaks while using remote communication channels to share sensitive information such as credit card details and personal information.

Secourriel is a Luxembourg-based startup that offers encrypted communication for the financial industry. The startup integrates end-to-end encryption into existing communication tools to secure emails along with document storage and sharing using REGIMAIL & REGIBOX. In addition, REGIGATE, a gateway encryption solution, adds a bank-grade security level without desktop software. These solutions enable audit trail and evidence of reading, further strengthening General Data Protection Regulation (GDPR)-compliance for financial services.

CYSEC offers Confidential Cloud Computing

Financial firms rely on cloud-based services for device- and location-agnostic operations management. However, most firms employ externally managed services for cloud-service development and maintenance, including access control and data security – increasing cybersecurity risks. This is because using in-house teams for cloud service development increases operational and capital costs. Therefore, startups offer security systems for financial companies that are integrable with third-party cloud systems to protect remotely stored data against malicious attacks and cybersecurity risks.

Swiss startup CYSEC enables confidential cloud computing. CYSEC ARCA, the startup’s operating system (OS) for container environments, protects data-in-use via secure code execution. Besides, it uses a full-stack approach, thus protecting sensitive information throughout its lifecycle from hardware, to the kernel, to application. CYSEC ARCA further enables key management and encryption as well as features full-disk encryption that allows financial firms to ensure the safety of their digital assets as well as customer and business data.

Duality Technologies develops a Privacy-Preserving Collaboration Platform

In today’s banking, banks monitor customer interactions from onboarding to account closure. Additionally, mobile banking, credit card transactions, and eCommerce activities provide insights into customer behavior and impact their customer lifetime value (CLV). However, storage of such sensitive information needs a robust security system, which otherwise leads to data leaks and an increase in legal costs. To this end, startups provide secure communication solutions for banks and NBFCs that enable risk-free customer-employee collaboration.

Duality Technologies is a US-based startup that develops Duality SecurePlus, a privacy-preserving collaboration platform. The startup’s privacy-enhancing technology (PET) uses encrypted artificial intelligence (AI) models to work on encrypted data and generate query outputs. Since the original data is not decrypted, malicious attackers are unable to gather sensitive information. Thus, Duality SecurePlus allows financial institutions to securely collaborate across institutions and business lines while minimizing cybersecurity risks. Besides, it enables financial crime, risk, and compliance teams to track and monitor customer activities such as know-your-customer (KYC) and cash transactions with regulatory compliances.

Flare Systems facilitates Financial Fraud Prevention

Financial companies collect massive amounts of customer data, including sensitive personal and credit card details. Therefore, customers expect organizations to keep this data safe and away from malicious hackers, which is why financial firms use cybersecurity solutions. However, most data leaks from banks and NBFCs are an inside job that happens purposefully or through social engineering victims. This is why startups develop employee-side cybersecurity solutions.

Canadian startup Flare Systems develops Firework, a financial fraud prevention platform. Firework monitors the dark, deep, and clear web activities as well as the employees’ digital footprint to detect threats and technical leakages proactively. In addition, it provides a directory of financial fraud victims based on the leaks, allowing users to check whether their customers are fraud victims or not. This enables financial institutions to identify fraudsters impersonating victims and reduce fraud losses as well as to detect suspicious activities among employees.

Cylynx enables Pre-Transaction Monitoring

Conventional payment gateways use two-way authentication using dynamic and unique passwords to verify a transaction. Even with this, malicious attackers and fraudsters use social engineering and man-in-the-middle attacks to make unauthorized transactions. To tackle this, startups offer transaction monitoring and tracking solutions that allow financial firms to monitor suspicious transactions and trace them back to the fraudster.

Singaporean startup Cylynx enables pre-transaction monitoring that flags suspicious transactions. The startup integrates its solution with the firm’s payment gateway where their machine learning engine applies behavioral and sentimental analysis to customer databases. Based on its outcome, Cylynx’s real-time transaction monitoring system approves or rejects it, upon which it goes for internal review. Thus, it uncovers hidden risks and maintains a compliance trail, allowing issuers to reduce false positives and improve customer experience. Cylynx also offers forensics to trace blockchain transactions.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on biometrics, blockchain, automation as well as cryptocurrencies. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.