Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into FinTech. This time, you get to discover 5 hand-picked AI startups impacting FinTech companies.

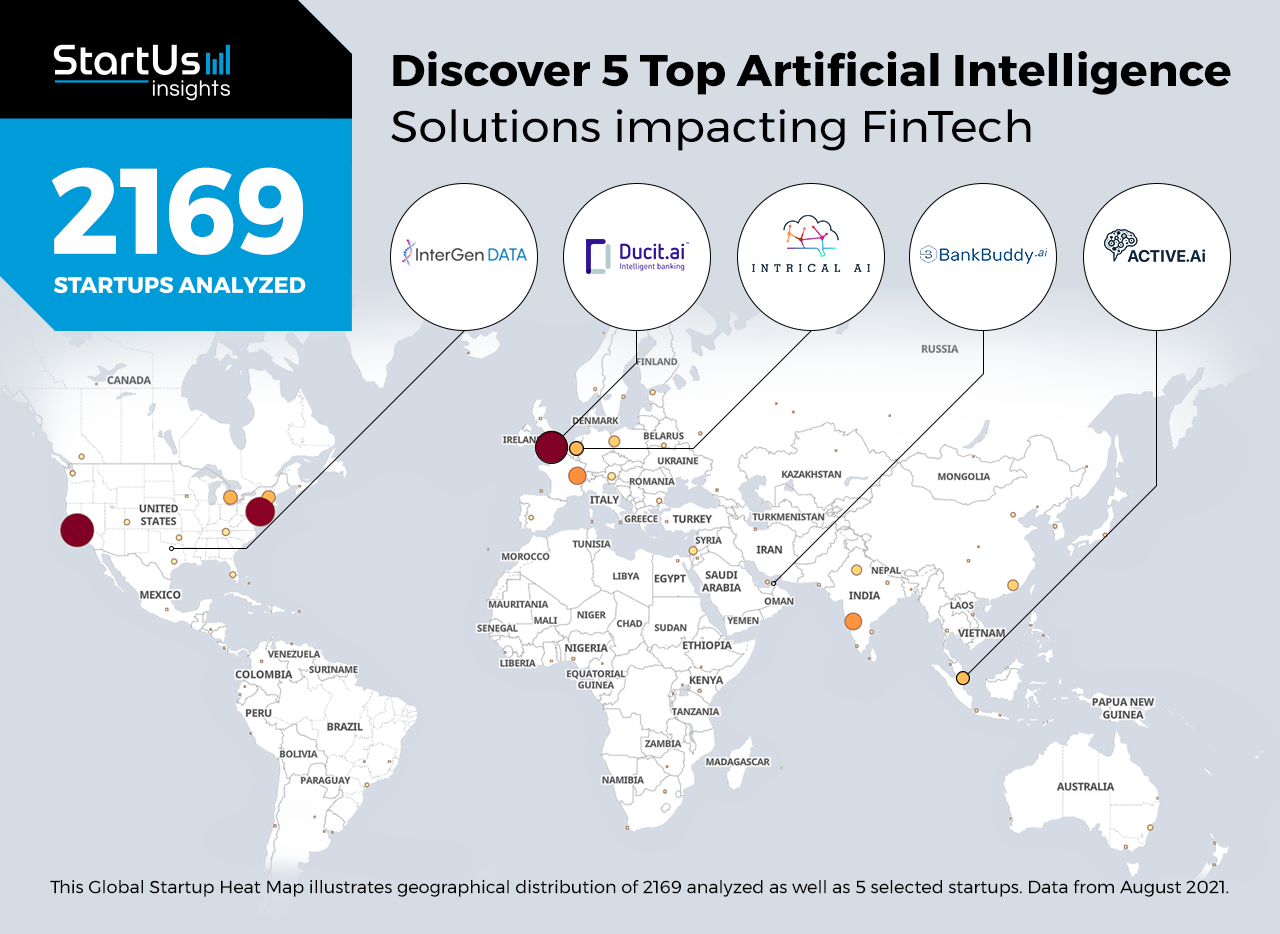

Global Startup Heat Map highlights 5 Top Artificial Intelligence Startups impacting FinTech out of 2.169

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2.093.000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 2.169 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 2.164 AI solutions for FinTechs, get in touch.

BankBuddy advances Personalized Digital Banking

Today, fewer people visit a bank for money transfers or other services. Therefore, FinTech startups are deploying AI, robotic process automation (RPA), and blockchain to enable the transition to digital banking. This allows consumers to send or receive money and keep a tap on their account balance and transaction history in a few clicks. Facilities such as mobile banking make the process even faster and more interactive.

UAE-based startup BankBuddy enables financial institutions to deliver personalized digital banking to their customers. The startup uses a domain-specific natural language processing (NLP) engine to analyze variations of multilingual speech, capture context, and respond in a human-like manner. The solution also provides human-centric banking recommendations as well as voice banking across channels like smart speakers and internet of things (IoT) devices. Additionally, it simplifies onboarding new customers with eKYC, liveness detection, speech verification, and face recognition.

Active.Ai develops a Banking-as-a-Service Platform

Traditionally, banks interact with their customers in person and there are only a limited number of staff to answer their questions or resolve their problems. While basic mobile banking services solve the issue to an extent, they do not offer granular personalization. As a result, the FinTech industry is developing solutions to improve customer engagement. Virtual assistants, for instance, are not only useful for executing banking transactions but also reply to customer queries very quickly. This is why startups are offering conversational chatbots that improve customer satisfaction and lower customer service costs.

Active.Ai is a Singaporean startup that provides AI-powered virtual chatbots for digital financial services. The startup’s conversational AI banking-as-a-service platform, One.Active, lets credit unions and banks deploy the virtual assistant on multiple voice-based and text channels. Additionally, the customer service automation platform, Trinity.Ai, handles customer queries without any human intervention. It applies deep learning algorithms to comprehend customer queries and instantly respond with the appropriate details.

Ducit.ai enables Credit Risk & Fraud Detection

The banking and payments industries heavily rely on legacy fraud detection platforms. However, these are insufficient to prevent newer mechanisms of banking fraud. Additionally, accurate credit risk assessment is important for lenders and identifies the severity of the default risk. Startups are utilizing NLP and machine learning (ML) to assess credit risk using multiple sources of information.

British startup Ducit.ai builds an open banking platform. The platform uses proprietary taxonomy, NLP, and ML models to classify banking transactional data and provide behavioral insights. The startup utilizes unsupervised and supervised machine learning to detect anomalies from both previously unseen data and existing data, respectively. This improves credit risk assessment, debt advice and collections operations, customer experience, and fraud detection for lenders.

InterGen Data evaluates Consumer Transactions

Life events such as divorce, retirement, and terminal illness often disrupt the financial plans of consumers. For instance, a consumer might have to break a fixed deposit or take a medical loan for their treatment. This, in turn, affects the banks as these unexpected withdrawals put banks’ liquidity coverage and net stable funding ratios at risk. Therefore, startups are offering AI solutions to predict these events, allowing financial institutions to evaluate consumer transactions. Unlike a rules-based system, these predictions incorporate each data attribute and measure the entire data group to formulate objective opinions of the appropriateness of transactions.

US-based startup InterGen Data offers Risk Uncovered Through Heuristics – RUTH, a predictive AI platform that enables compliance and risk professionals to assess actual and potential financial risks. It collects the know your customer (KYC) and transaction data and measures it against the regulatory requirements to issue KYC scores. It then screens consumers for applicable life stages and life events. This enables financial institutions to measure the appropriateness of consumer transactions.

Intrical AI simplifies Corporate Finance

Corporate finance companies, venture capitals, and private equities require up-to-date market data and company profiles to evaluate their position in the market, measure competitiveness, and make investment decisions. Typically, the due diligence process consumes several man-hours and is expensive to complete thoroughly. To simplify corporate finance evaluation and management processes, FinTech startups develop AI-based search engines for data collection and analysis.

Intrical AI is a Dutch startup that simplifies financial data search. The startup’s AI-based search engine filters the most relevant news based on the user’s request and context and identifies money-making opportunities from tons of financial data. It offers market and company profiles for banks and corporate finance companies, enabling faster and data-driven decision-making.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on credit assessment and fraud detection as well as personalized digital banking and banking-as-a-service solutions. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.

![Discover the Top 10 FinTech Trends & Innovations [2025-2026]](https://www.startus-insights.com/wp-content/uploads/2025/06/FinTech-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)