Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

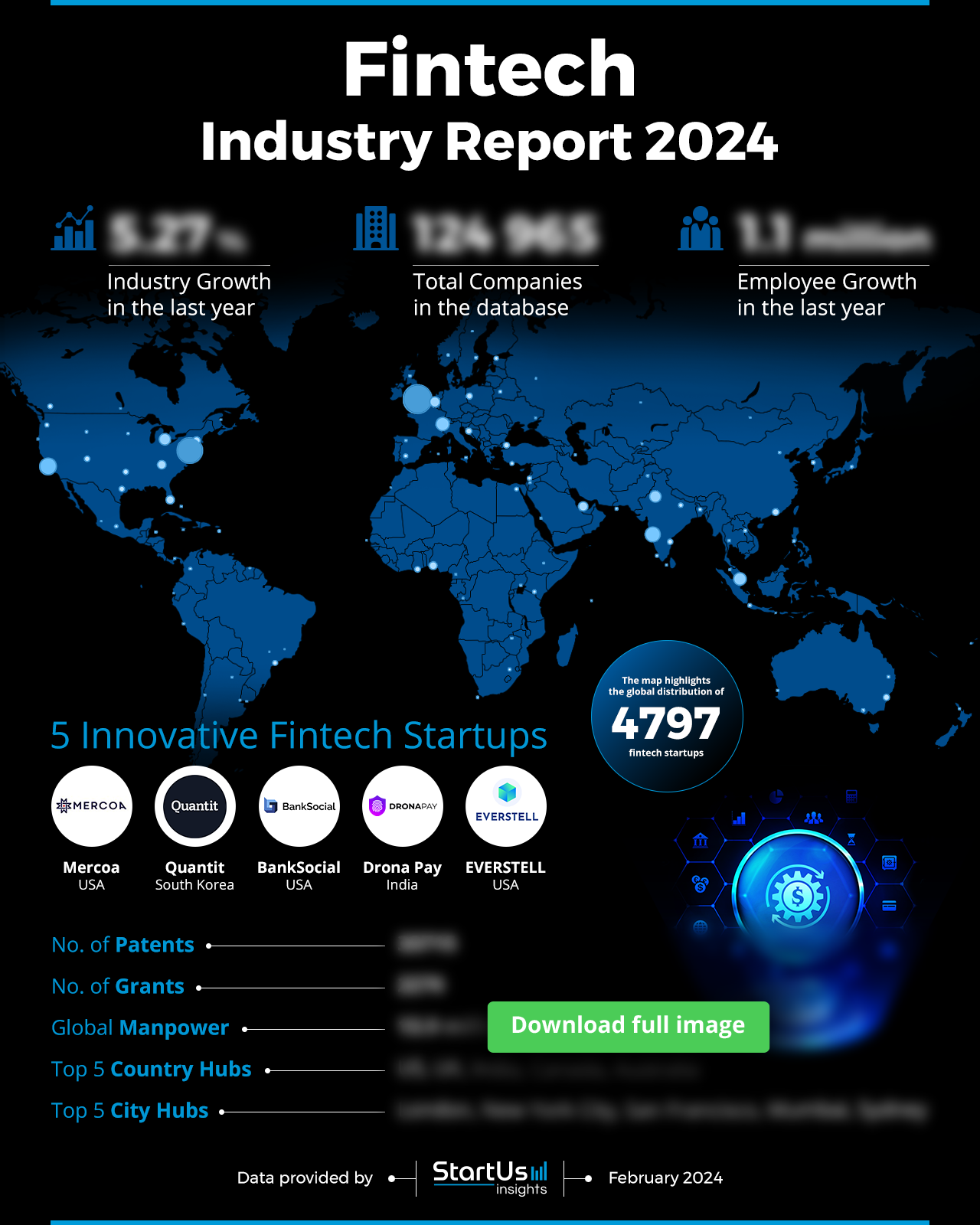

This Fintech Industry Report presents the latest advancements in financial technology, showcasing a year of steady growth and innovation. This report explores the key trends, investment patterns, and the surge in global fintech manpower. With AI integration and more financial inclusion solutions, the industry is expanding its focus on digitalization to reshape financial systems and services.

This report was last updated in July 2024.

The 2024 fintech report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Fintech Industry Report 2024

- Executive Summary

- Introduction to the Fintech Industry Report 2024

- What data is used in this Fintech Industry Report?

- Snapshot of the Global Fintech Industry

- Funding Landscape in the Fintech Industry

- Who is Investing in the Fintech Industry?

- Emerging Trends in the Fintech Industry

- 5 Fintech Startups impacting the Industry

Executive Summary: Fintech Industry Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 4000+ fintech startups developing innovative solutions to present five examples from emerging fintech industry trends.

- Industry Growth Overview: The fintech outlook shows a 5.27% growth with over 124000 companies listed.

- Manpower & Employment Growth: An addition of 1 million employees in the last year is observed, reaching a total manpower of 13.9 million in the fintech industry.

- Patents & Grants: The industry boasts 33700+ patents and has received 2276 grants, emphasizing a strong innovation culture.

- Global Footprint: Key financial hubs include the US, UK, India, Canada, and Australia. The industry exhibits significant international influence as well with top city hubs in London, New York City, San Francisco, Mumbai, and Sydney.

- Investment Landscape: The fintech industry features an average investment value of USD 47 million and more than 71000 funding rounds.

- Top Investors: Prominent investors have contributed over USD 45.5 billion to the industry. Some of the top investors include Tiger Global Management, Goldman Sachs, and SoftBank Vision Fund.

- Startup Ecosystem: Highlights include Meroca (Accounts Payable API), Quantit (AI-based Programmable Investment), BankSocial (Crypto Exchange), Drona Pay (Real-time Fraud Detection), and EVERSTELL (Profitability Management).

- Recommendations for Stakeholders: Invest in emerging fintech areas such as decentralized finance (DeFi), AI, predictive analytics, and more to capitalize on the sector’s expansive potential. Identify and track startups developing advanced financial technologies to gain a competitive advantage.

Explore the Data-driven Fintech Industry Report for 2024

The Fintech Industry Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The report indicates a robust growth trajectory in the sector, with a 5.27% increase in industry growth over the past year. A total of 124000+ companies have been cataloged in the database, signaling a thriving ecosystem.

The heatmap highlights the global distribution of 4700+ fintech startups. Fintech’s global manpower stands at 13.9 million, further indicative of the industry’s massive scale. The industry’s workforce expanded by 1.1 million employees, reflecting the sector’s escalating influence on global employment trends.

What data is used to create this fintech report?

Based on the data provided by our Discovery Platform, we observe that the Fintech industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The fintech industry is growing with over 130000 publications in the last year. This showcases its prominence in news coverage.

- Funding Rounds: We have data on over 71000 funding rounds in our database, reflecting the industry’s robust financial engagement.

- Manpower: It employs more than 13 million workers globally, and added over 1 million new employees in the last year. It showcases the vast workforce of fintech.

- Patents: Fintech innovation is evident with more than 33000 patents.

- Grants: The industry has secured over 2270 grants, indicating significant research and development support.

A Snapshot of the Global Fintech Industry

The fintech sector is exhibiting formidable growth in human capital and investment, a clear indicator of its increasing influence on the global economic landscape. With a massive manpower of 13.9 million, the industry also demonstrates dynamic expansion, having added 1 million+ new employees over the past year. This rapid employee growth underscores the sector’s capacity for innovation and its substantial role in job creation.

Explore the Funding Landscape of the Fintech Industry

Financially, the average investment value per funding round stands at USD 47 million, reflecting investor confidence and the high potential returns that fintech companies promise.

Fintech has more than 15000 investors, contributing to over 71000 funding rounds. These investors have diversified their investments, with more than 24000 companies receiving investments. It suggests a healthy spread of innovation across the fintech landscape.

Who is Investing in Fintech?

The fintech sector has witnessed an infusion of capital, with the top investors injecting over USD 45.5 billion, underscoring their confidence in the industry’s growth potential.

- Tiger Global Management leads with investments of USD 7.1 billion across 101 companies.

- Goldman Sachs closely follows with investments totaling USD 7 billion across 70 companies. This demonstrates its strategic commitment to fintech.

- SoftBank Vision Fund has targeted 32 companies with an investment sum of USD 6.4 billion.

- Tencent’s USD 4.1 billion investment across 47 companies signifies its aggressive positioning in the fintech domain.

- Insight Partners has bolstered 58 companies with USD 3.8 billion, showcasing its role as a key player in the sector’s expansion.

- General Atlantic has also invested USD 3.8 billion in 32 companies.

- GIC’s investment has funneled USD 3.6 billion into 35 companies, securing its spot as a significant investor.

- DST Global has concentrated USD 3.4 billion into 19 companies, betting on high-impact fintech ventures.

- Warburg Pincus has allocated USD 3.3 billion to 27 companies, investing with a focus on long-term growth.

- International Finance Corporation has extended its financial support to 50 companies with an investment of USD 3 billion.

Explore Firmographic Data for All Fintech Trends

- AI in Finance enhances decision-making, risk assessment, and customer service. Its annual growth rate is a remarkable 71.21%. This trend involves 937 companies, which collectively employ 53.5K individuals. It has experienced a surge in its workforce with 6.5K new employees in the last year alone.

- Tokenized Security is revolutionizing asset trading and ownership. This trend boasts an annual growth rate of 28.27%. A total of 219 companies are spearheading this digital transformation, employing 3.7K individuals. Moreover, it has seen an influx of over 900 new employees in the past year.

- Financial Inclusion shows an above-average annual trend growth rate of 12.93%. This is a key emerging fintech trend that also has social impacts. 387 companies are dedicated to making financial services accessible to the broader population. These companies employ 843K+ people, with 71K+ joining in the last year.

As the fintech sector evolves, technological advancements will broaden the horizon for financial accessibility, shaping future economic interactions.

5 Top Examples from 4700+ Innovative Fintech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Mercoa offers an Accounts Payable API

US-based startup Mercoa integrates accounts payable solutions for B2B platforms through a single API. It offers automation tools for its customers to manage bills and invoices effectively within their products. The startup’s platform includes an email inbox, invoice OCR, and approval workflows to streamline the accounts payable process.

With Mercoa, developers utilize React Components, Hosted iFrames, and REST APIs for flexible integration. Further, the startup’s SDKs support various programming languages, ensuring a developer-friendly experience for implementing its AP automation solutions.

Quantit creates a Real-time Asset Management Framework

South Korean startup Quantit develops FINTER, a programmable investment platform that offers data collection, structuring, and API services for financial markets. It also features QUANDA, an API that delivers processed financial data in real-time. Additionally, it offers an early warning system for crisis alerts.

The startup’s platform also provides diverse global asset allocation strategies and market anomaly models tailored to various market conditions. Further, Quantit’s trading solutions include an order management system for real-time trade oversight and an execution management system that optimizes order execution using AI.

BankSocial enables B2B Crypto Exchange

US-based startup BankSocial develops a blockchain-based financial ecosystem. It offers a crypto exchange for businesses, integrating centralized and decentralized elements. This exchange promotes autonomy, enabling users to maintain control over their digital assets.

The startup’s ecosystem allows cross-border transactions, payments, and transfers — all within the same network. Further, BankSocial ensures security and adheres to PCI/DSS and AML/BSA compliance, using SSL for transactions. This allows businesses to receive and provide financial services worldwide.

Drona Pay supports Real-time Fraud Detection

Indian startup Drona Pay specializes in real-time fraud prevention and risk management for the digital banking sector. It offers solutions such as transaction monitoring, behavior analysis through biometrics, and anti-money laundering measures.

The platform uses machine learning and alternate data to reduce delinquency and bust-offs effectively. The startup’s AI-based systems also manage order risks and optimize trade executions. Drona Pay secures transactions, authenticates users, and provides early warnings for potential scams.

EVERSTELL provides FinTech Analytics

US-based startup EVERSTELL develops a cloud-based profitability management platform that integrates advanced financial practices for cost and profit analysis. The software analyzes multi-dimensional cost attribution, which is customized to the company’s unique operations.

The platform integrates within existing financial planning and analysis processes. It simplifies profitability management, performance reporting, scenario analysis, budgeting, and forecasting. EVERSTELL also provides ROI measurement and cost accountability, addressing asset managers’ challenges with fee compression and declining margins.

Gain Comprehensive Insights into Fintech Trends, Startups, or Technologies

The fintech report highlights a sector transforming with advancements in AI, tokenization, financial inclusion, and more. These financing solutions improve back-office processes, provide access to working capital, and support growing business needs. Get in touch to explore all 4700+ startups and scaleups, as well as all industry data and trends impacting fintech companies.