EV Outlook 2025 examines how technologies like advanced battery technology, expanded charging infrastructure, and vehicle-to-grid (V2G) integration improve the global shift toward electric mobility. Further, developments in solid-state and lithium-metal batteries, ultra-fast charging networks, and grid-interactive vehicles reshape transportation and energy systems.

This electric vehicle market outlook provides a focused analysis of market changes, infrastructure scale-up, and technological convergence. It offers critical insights to mobility leaders, energy planners, and strategic investors shaping the future of electrification.

Executive Summary: Electric Vehicle Outlook 2025

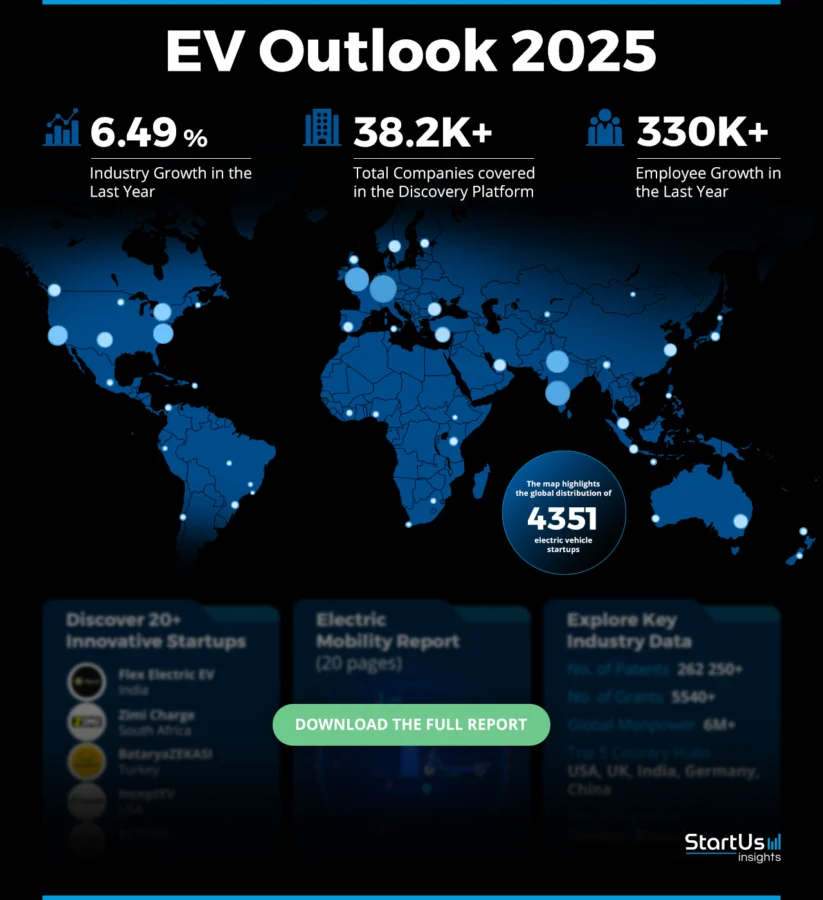

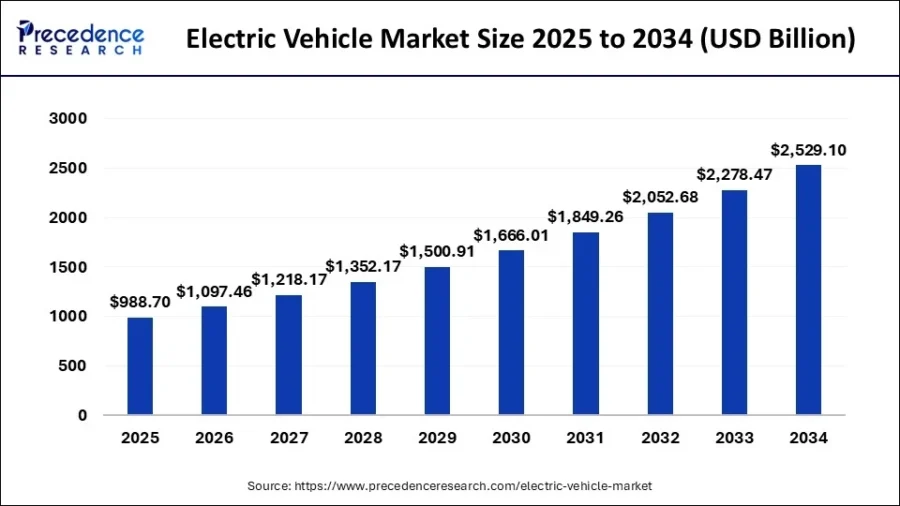

- Industry Growth Overview: The electric vehicle market size is predicted to increase from USD 988.70 billion in 2025 to approximately USD 2.52 trillion by 2034 with a compound annual growth rate (CAGR) of 11%. On a granular level, the EV market experienced a growth rate of 6.49% over the past year, as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: The electric vehicle market employs over 6 million individuals globally, with an increase of 330K+ new jobs added in the last year.

- Patents & Grants: The electric vehicle industry holds over 262 250 patents and 5540 grants. The patent growth rate is 9.07% yearly, with China and the US leading the patent issuance.

- Global Footprint: Key hubs for electric vehicles include the US, the UK, India, Germany, and China, showcasing a diverse global infrastructure supporting market growth. Major city hubs include London, Bangalore, Shenzhen, Sydney, and New York City.

- Investment Landscape: The average investment value per funding round exceeds USD 86.5 million, with over 17 190 funding rounds closed. More than 13K investors are actively engaged in the electric vehicle market.

- Top Investors: Major investors, including the European Investment Bank (EIB), US Department of Energy, Tencent, and Agricultural Bank of China, are collectively investing over USD 45.1 billion across companies.

- Startup Ecosystem: Five innovative startups, Flex Electric EV (last-mile delivery and fleet management platform), Zimi Charge (EV charging and energy management platform), Inspiration Mobility (EV fleet management platform), EVion (multi-tenancy and commercial EV solutions), and YOTO (app-based scooter rentals), showcase the electric vehicle market’s global reach and entrepreneurial spirit.

Methodology: How we created this Electric Vehicle Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles, and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of electric vehicles over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within electric vehicles

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of electric vehicles.

What Data is used to create this Electric Vehicle Market Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the electric vehicle market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: The electric vehicle topic has been featured in over 43 890 publications in the last year, which showcase major media attention.

- Funding Rounds: More than 17 190 funding rounds have been recorded in our database for this sector.

- Manpower: The global workforce in electric vehicles exceeds 6 million, with an additional 330K+ employees added in the past year alone.

- Patents: The electric vehicle sector holds more than 262 250 patents.

- Grants: Over 5540 grants have been awarded to companies within the electric vehicle market.

- Yearly Global Search Growth: The electric vehicle market has experienced a yearly global search growth of 29.46%.

Explore the Data-driven EV Market Outlook for 2025

According to Precedence Research, the global electric vehicle market is predicted to increase from USD 988.70 billion in 2025 to approximately USD 2.52 trillion by 2034, expanding at a CAGR of 11% from 2025 to 2034.

Credit: Precedence Research

Data from the Discovery Platform highlights the key metrics that show the sector’s growth and innovation. Our database features 4350+ startups and over 38 200 companies, which reflect the market’s vast scope with an annual growth of 6.49%. It also highlights over 262 250 patents and 5540 grants.

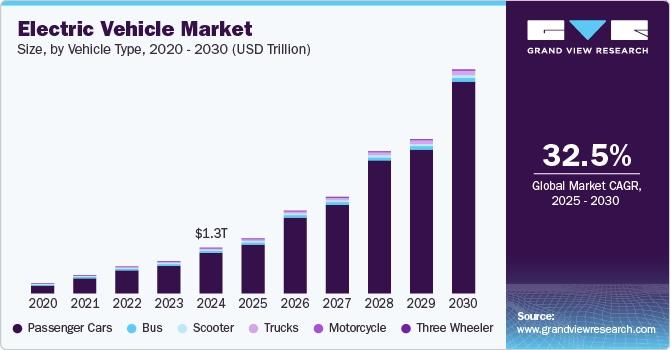

Another resource suggests that the global electric vehicle market size was estimated at USD 1.33 trillion in 2024 and is projected to grow at a CAGR of 32.5% from 2025 to 2030.

Credit: Grand View Research

Additionally, with a global workforce exceeding 6 million and 330K new employees added last year, the electric vehicle market’s talent is significant. Major hubs include the US, the UK, India, Germany, and China, while cities like London, Bangalore, Shenzhen, Sydney, and New York City stand out as vibrant epicenters of electric vehicle activity.

A Snapshot of the Global Electric Vehicle Market

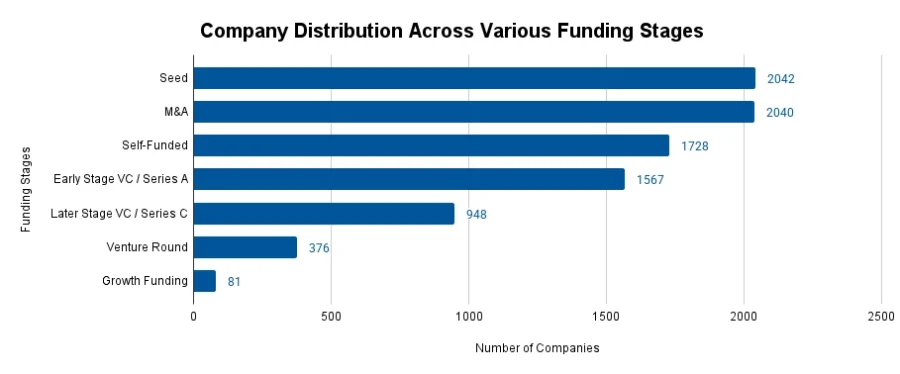

Over the past year, the electric vehicle market has been evolving at a 6.49% annual growth rate, driven by early-stage innovation and patent activity. It includes 1560 early-stage startups and more than 2040 mergers and acquisitions (M&A) deals.

Patent filings exceed 262 250 globally, with 54 030+ applicants, although yearly growth in filings remains at 9.07%. Further, China and the US lead the innovation front, issuing 79 340+ and 54 560+ patents, respectively.

Explore the Funding Landscape of the EV Market

With over 13K investors backing more than 5040 companies across 17 190+ funding rounds, the EV sector demonstrates decent financial momentum. The average investment exceeds USD 86.5 million per round.

This surge in capital aligns with a broader ecosystem of 1560+ early-stage startups and 2040 M&A activities. As funding improves and global patent activity surpasses 54 030 filings, the electric vehicle space is positioned for innovation-led growth.

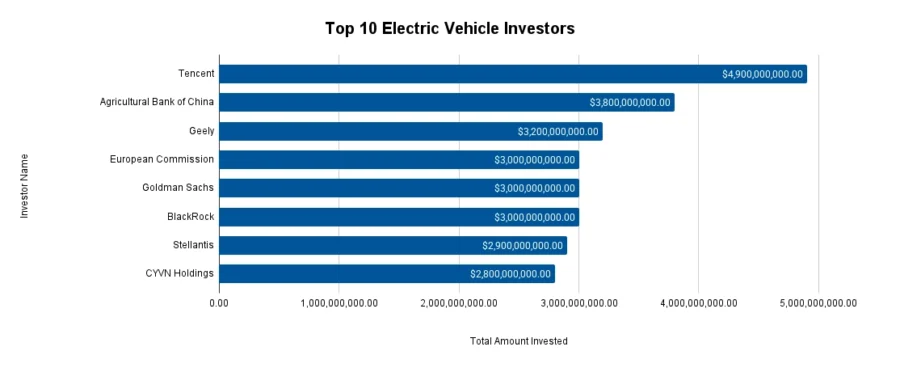

Who is Investing in the Electric Vehicle Market?

The combined investment value of the top investors in the electric vehicle market exceeds USD 45.1 billion. Here is a breakdown of their contributions:

- European Investment Bank (EIB) has invested USD 10.2 billion in 32 companies.

- US Department of Energy has committed USD 8.3 billion to 20 companies.

- Tencent has backed 7 companies with USD 4.9 billion.

- Agricultural Bank of China has invested USD 3.8 billion in 5 companies.

- Geely has invested USD 3.2 billion in 15 companies. Geely Auto plans to take its EV unit Zeekr private by offering USD 25.66 per share, valuing the company at around USD 6.5 billion.

- European Commission has committed USD 3 billion to 6 companies.

- Goldman Sachs has invested USD 3 billion in 15 companies.

- BlackRock has invested USD 3 billion in 18 companies.

- Stellantis has invested USD 2.9 billion in 7 companies. It also partnered with Swedish firm Luvly to produce flat-packed electric vehicles.

- CYVN Holdings has committed USD 2.8 billion to 2 companies. The company also acquired McLaren Automotive from Mumtalakat for EUR 1.2 billion, gaining full control of the car unit and a minority stake in McLaren Group.

Top Electric Vehicle Innovations & Trends

Discover the emerging trends in the electric vehicle market along with their firmographic details:

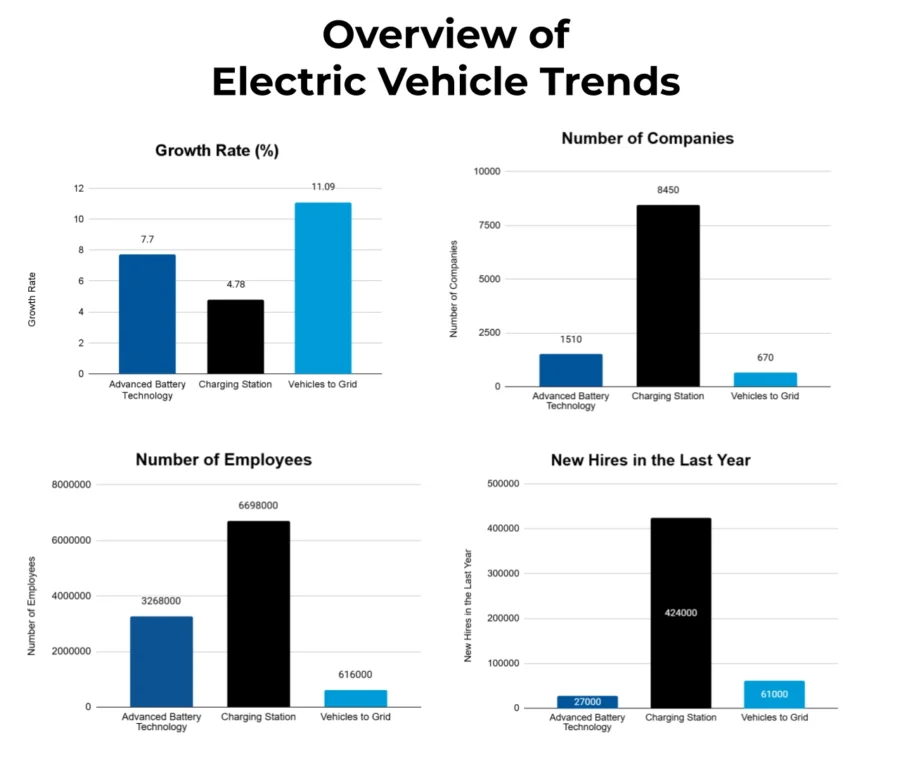

- Advanced Battery Technology leads the push toward high-performance electric vehicles, with over 1510 companies employing approximately 326 800 professionals worldwide. Growing at an annual rate of 7.7%, the domain enables longer-range EVs and supports innovations in solid-state and lithium-ion battery chemistries. In the past year, the domain added 27K new roles, signaling continued investment in battery efficiency, energy density, and lifecycle improvements.

- Charging Station Infrastructure anchors the EV ecosystem, represented by more than 8450 companies and a global workforce of nearly 669 800 professionals. With an annual growth rate of 4.78%, this domain supports scalable deployment of fast chargers, grid-connected solutions, and smart charging platforms. The domain welcomed 42 400 new employees last year, underscoring strong momentum in expanding public and private charging networks.

- Vehicles to Grid is an emerging trend reshaping energy and mobility convergence, with over 670 companies employing 61 600 people worldwide. With an annual growth rate of 11.09%, V2G technologies improve grid flexibility and enable cleaner energy transitions. The addition of 6100 new jobs in the last year reflects growing interest in bi-directional power flow that allows EVs to serve as distributed energy resources (DERs).

5 Top Examples from 4350+ Innovative EV Startups

The five innovative startups showcased below were picked based on data, including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Flex Electric EV builds a Last-mile Delivery and Fleet Management Platform

Indian startup Flex Electric EV offers a fully electric fleet and fleet management platform for last-mile logistics. Its range of electric vehicles includes compact scooters and delivery vans for diverse urban delivery needs.

Additionally, the platform electrifies operations, tracks orders in real time, and lowers the cost per kilometer. The startup also provides leasing options, zero-emission vehicles, and fleet management to ensure reliable and efficient operations.

Zimi Charge offers an EV Charging and Energy Management Platform

South African startup Zimi Charge provides an electric vehicle charging and energy management platform. It operates a network of alternating current (AC) and direct current (DC) charging stations. These stations connect to a centralized platform for real-time monitoring, load balancing, and remote diagnostics across fleet and public charging sites.

Additionally, the startup supports all EV models with chargers that feature 4G connectivity for autonomous operation. Its software suite further tracks energy use, generates carbon reports, and manages payment reconciliation. Zimi also integrates solar and battery storage systems to minimize grid dependence and runs V2G pilots that allow EVs to feed power back into facilities or the grid during peak demand.

BataryaZEKASI simplifies Battery Health Monitoring

Turkish startup BataryaZEKASI develops an AI-powered cloud platform that monitors and diagnoses EV battery health. It collects real-time data from EV batteries and uses AI algorithms to assess battery capacity, predict potential failures, and detect when batteries near the critical 80% health threshold.

Additionally, the platform alerts EV manufacturers and fleet operators in time for preventive maintenance to reduce battery-related costs. It also combines continuous battery diagnostics with cloud-based analytics to support data-driven decisions and extend battery life. This improves operational efficiency and reliability of electric vehicle fleets.

InceptEV advances Fleet Operations Planning and Optimization

US-based startup InceptEV builds a simulation-first EV data platform for fleet planning and optimization. It assesses performance before acquisition and forecasts operational needs. This avoids unnecessary upgrades, cuts costs, and streamlines electric fleet deployment.

BaTTeRi specializes in a Mobile Charging Robot

Israeli startup BaTTeRi offers a mobile EV Charging as a Service (CaaS) solution using its proprietary robot, Thomas. The robot provides rapid DC charging to electric vehicles via wired or wireless connection. It navigates independently to each parking spot and uses an onboard battery to charge during off-peak hours and reduce energy costs.

Additionally, the startup’s companion app manages AI-driven scheduling and control to optimize deployment and usage across sites. It converts any parking area into a functional charging network for operators to offer scalable and profitable EV services from day one.

Gain Comprehensive Insights into EV Trends, Startups, and Technologies

In 2025, the EV outlook shows a rapidly evolving electric-mobility landscape as next-gen battery chemistries, ultra-fast charging corridors, and V2G connectivity reshape how people and goods move. Solid-state energy storage, AI-driven energy orchestration, and circular battery-recycling systems drive the next chapter of sustainable transport. Policymakers tighten emission mandates and fleets shift to zero-tailpipe operations for positioning electric vehicles at the core of global mobility and power-grid resilience.

Get in touch to explore 4350+ startups and scaleups, as well as all market trends impacting electric vehicle companies.