The Energy Storage Market Report 2025 presents a detailed overview of firmographic trends, innovation intensity, and funding activity of the global energy storage sector. It tracks growth across emerging hubs, maps workforce development, and analyzes patent and grant momentum. Also, the report outlines investor commitments and corporate strategies that expand the market.

Further, the energy storage industry report explores high-impact subfields such as virtual power plants (VPPs), flow batteries, and hydrogen storage by offering insights into their evolving roles in the transition to clean energy. Together, these indicators offer industry leaders, strategists, and policymakers a clear view of the market’s trajectory and the key forces shaping its progress.

Executive Summary: Energy Storage Industry Outlook 2025

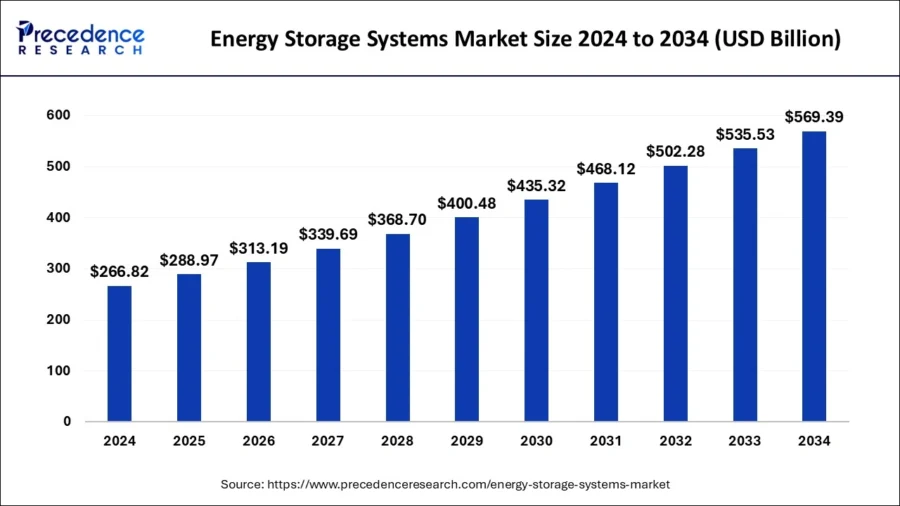

- Industry Growth Overview: The global energy storage systems market is projected to reach USD 288.97 billion in 2025, reflecting the sector’s steady expansion and a consistent annual growth rate of 5.69%

- Manpower & Employment Growth: The industry employs over 2.8 million professionals worldwide, adding nearly 195 900 new jobs in the last year.

- Patents & Grants: Over 181 000 applicants filed more than 980 000 patents. Additionally, the sector received 5210+ grants globally. The sector’s patent portfolio is growing at a 6.05% annual rate. China and the USA lead global patent activity by filing more than 304 000 and 189 900 patents respectively.

- Global Footprint: The leading country hubs include the USA, the UK, China, Germany, and Australia. The city-level innovation concentrates in Shenzhen, London, Melbourne, Sydney, and New York City.

- Investment Landscape: The sector closed over 10 280 funding rounds to date, supported by 8100+ investors. The average deal size stands at USD 92.1 million according to our data.

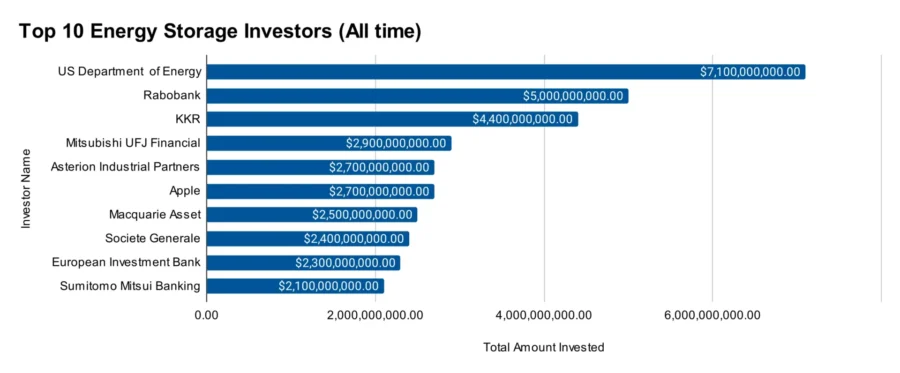

- Top Investors: Leading investors include the US Department of Energy, Rabobank, KKR, Mitsubishi UFJ Financial, and Asterion Industrial Partners. Collectively, these investors contributed over USD 34 billion.

- Startup Ecosystem: Five innovative startups in this sector are EPYR (renewable thermal storage), Emtel Energy USA (graphene-based electrostatic storage), Eleven Energy (sodium battery systems), FPR Energy (concentrated solar thermal technology), and FeX Energy (iron-based energy storage).

Methodology: How We Created This Energy Storage Market Report

This energy storage report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this energy storage outlook, we focused on the evolution of energy storage over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within energy storage

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the energy storage market.

What Data is Used to Create This Energy Storage Market Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the energy storage market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: The energy storage industry generated over 27 000 publications in the last year.

- Funding Rounds: Our database recorded more than 10 280 funding rounds.

- Manpower: The sector employs over 2.8 million professionals and added nearly 195 900 new jobs in just the last year.

- Patents: More than 980 000 patents are filed this year.

- Grants: It secured 5 210+ grants showcasing its support from government and institutional bodies.

- Yearly Global Search Growth: Global interest in the field increases with a yearly growth rate of 20.56%.

Explore the Data-driven Energy Storage Market Report for 2025

The global energy storage systems market is projected to reach USD 288.97 billion in 2025, reflecting the sector’s steady expansion and a consistent annual growth rate of 5.69%

The energy storage market report uses data from the Discovery Platform and encapsulates the key metrics that underlie the sector’s dynamic growth and innovation. The energy storage heatmap captures 2250+ startups operating out of a total 19 830+ companies. Over the past year, the industry grew by 5.69% with an increase in talent and investment.

Credit: Precedence Research

Further, the companies in the energy storage sector filed for 980 000+ patents and received 5218 grants for research, development, and commercialization. The sector employs 2.8 million professionals worldwide, with 195 900 new jobs added in the last year alone.

Geographically, the top five country hubs are the USA, the UK, China, Germany, and Australia. At the city level, innovation clusters around Shenzhen, London, Melbourne, Sydney, and New York City reflect both established powerhouses and rising players in the energy storage race.

A Snapshot of the Global Energy Storage Market

The energy storage industry recorded an annual growth rate of 5.69% with sustained market momentum of innovation, global demand, and clean energy policies.

The market is valued at USD 288.97 billion in 2025 and is projected to reach USD 569.39 billion by 2034 with a 7.87% compound annual growth rate (CAGR) for 2025–2034.

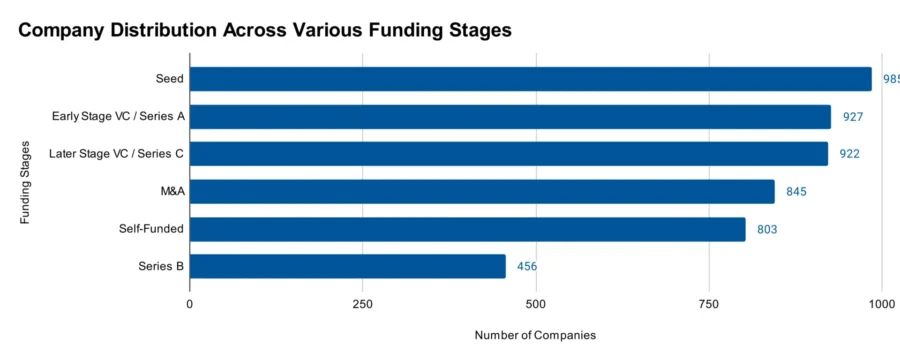

The presence of 2250+ active startups underscores the sector’s momentum and entrepreneurial activity. Moreover, the sector holds 920+ early-stage startups with 840+ companies that underwent mergers and acquisitions (M&A).

Explore the Funding Landscape of the Energy Storage Market

The energy storage sector scales technologically and attracts decent investment activity. It undergoes an average investment value of USD 92.1 million per round.

Over 10 280 funding rounds are closed to date, which indicates a consistently active funding pipeline. This capital flowed into more than 2870 companies with a mix of technologies, business models, and regional markets.

Over 8100 investors backed energy storage ventures, ranging from venture capital firms and private equity players to government funds and strategic corporate investors.

Who is Investing in the Energy Storage Market?

The top investors in the energy storage industry have collectively contributed more than USD 34.1 billion to the sector. Here’s a breakdown of the leading contributors:

- The US Department of Energy has invested USD 7.1 billion across 21 companies

- Rabobank has supported 268 companies with USD 5 billion, supporting the expansion of large-scale energy storage like 420 MWh.

- KKR has deployed USD 4.4 billion into 11 companies.

- Mitsubishi UFJ Financial has backed 23 companies with USD 2.9 billion.

- Asterion Industrial Partners has invested USD 2.7 billion in about 2 companies. Also, they acquired a major stake in Revalue Energies for the development of 2.7 GW portfolio,

- Apple has invested USD 2.7 billion in at least one company.

- Macquarie Asset has funded 5 companies with USD 2.5 billion. They purchased a stake in D.E. Shaw Renewable Investments (DESRI) for up to USD 1.73 billion.

- Societe Generale has invested USD 2.4 billion across 20 companies.

- The European Investment Bank has allocated USD 2.3 billion to 20 companies, promoting green transition across Europe. They issued two green loans to Iberdrola totaling about USD 120 million for energy-storage infrastructure in Spain.

- Sumitomo Mitsui Banking has supported 20 companies with USD 2.1 billion.

Top Energy Storage Innovations & Trends

Discover the emerging trends in the energy storage market along with their firmographic details:

- Virtual Power Plants: Manage, coordinate, and monetize distributed energy resources (DERs). More than 562 companies actively engage in this space. It employs 72 500 people, with 7300 new jobs added just in the past year. The domain showcases an annual growth rate of 25.45% with the integration of renewables and the need for decentralized energy reliability.

- Hydrogen Storage: Hydrogen generates strategic interest as a long-duration, zero-emission storage option. Despite a slight decline of 0.21% in its overall growth rate, the field highlights decent company participation and hiring. Over 950 companies are currently involved in hydrogen storage initiatives. Additionally, the sector supports 58 700 employees, with 6800 added in the last year.

- Flow Batteries: Flow batteries offer an alternative to lithium-ion storage for grid-scale applications that feature safety and long cycle life. It grows at an annual rate of 19.97%. About 290+ companies develop or deploy flow battery technologies. The sector employs 13 500 professionals, with 1300 new hires in the past year.

5 Top Examples from 2250+ Innovative Energy Storage Startups

The five innovative startups showcased below were picked based on data, including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

EPYR provides a Renewable Thermal Energy Storage

French startup EPYR develops thermal energy storage systems that convert surplus renewable electricity into high-temperature heat. Its technology captures low-cost renewable electricity, stores it as heat, and provides high-temperature energy when needed.

Further, the stored energy is retained in specialized bricks with minimal thermal loss and later delivered on demand to industrial facilities through a containerized system. This technology offers zero-emission operation, cost parity with fossil fuels, and plug-and-play installation to decarbonize heat production.

Emtel Energy USA offers a Graphene-Based Electrostatic Storage

USA-based startup Emtel Energy USA develops an electrostatic long-duration energy storage (ELDES) system that offers an alternative to lithium-based batteries. Its solid-state supercapacitor technology stores electricity electrostatically to provide high power density and long cycle life.

The startup’s container, ENPACK, features graphene-based supercapacitor units for applications including electric vehicle (EV) charging, microgrids, and off-grid backup systems.

Further, the integrated ENSERVER control unit manages performance, monitors system health in real-time, and allocates power across connected loads. The containers enable peak shaving, grid offset, and resilient microgrid operations for long-duration energy storage.

Eleven Energy makes a Sodium Battery System

UK-based startup Eleven Energy develops sodium battery systems to store power from solar panels. The core battery pack offers 4.5 kWh of storage, expandable to over 33 kWh to power in extreme temperatures ranging from -20°C to 55°C.

The systems include a 6 kW hybrid inverter and an energy management system to schedule charging based on electricity tariffs and solar forecasts. Also, they control connected devices like EV chargers and heat pumps and support real-time data access with remote configuration. These systems reduce costs while supporting the clean energy transition.

FPR Energy builds a Concentrated Solar Thermal (CST) Technology

Australian startup FPR Energy builds a particle-based concentrated solar thermal technology to offer zero-emission, continuous heat and power for industrial applications. The technology uses heliostats to focus sunlight onto a central receiver, where inert ceramic particles absorb heat at temperatures proven at 850°C and scalable up to 1200°C.

These heated particles are stored in insulated silos and later transferred through heat exchangers to supply on-demand thermal energy for industrial processes or to generate electricity via steam turbines.

Next, the particles are then cooled and recirculated to enable a closed-loop energy cycle with minimal losses. Thus, the technology supports bulk energy storage, simplifies materials handling, and eliminates reliance on hazardous substances.

FeX Energy offers an Iron-based Energy Storage

Canadian startup FeX Energy provides iron-based energy storage systems powered by a proprietary iron arc reactor. This reactor stores surplus electricity by heating iron. Then, it releases that stored energy as high-temperature heat.

The iron system undergoes a natural and controlled reaction with air due to its non-toxic, non-volatile, and corrosion-free properties. With a modular design, the system meets industrial and grid-level thermal demands.

Gain Comprehensive Insights into Energy Storage Trends, Startups, and Technologies

The Energy Storage Market Report 2025 shows the innovation signals, global investor confidence, and expanding commercialization pathways. As the industry matures, it benefits from technology diversification, workforce scale-up, and regional policy support. With next-generation solutions gaining traction like long-duration systems and decentralized architectures, energy storage is emerging as a critical enabler of resilient, low-carbon energy systems worldwide.

Get in touch to explore 2250+ startups and scaleups, as well as all market trends impacting 19 350+ energy storage companies.