The Drug Discovery Market Report 2025 presents firmographic, innovation, and investment data across the sector. It tracks company activity in key biotech hubs, lists workforce and patent growth, and reviews funding patterns shaping new research. The report also highlights major investors and acquirers influencing the sector’s direction.

This drug discovery outlook also features rising focus areas such as AI-driven discovery, stem cell models, and 3D tissue platforms. These data points offer industry leaders, executives, and corporates insights to inform decision-making.

Executive Summary: Drug Discovery Market Report 2025

- Industry Growth Overview: The global drug discovery industry was valued at approximately USD 106.70 billion in 2025. It shows a 9.46% annual growth rate with advances in genomics, proteomics, and biopharmaceutical development.

- Manpower & Employment Growth: The sector employs over 314 300 professionals globally, with more than 30 600 new jobs added in the last year.

- Patents & Grants: In the last year, over 1790 applicants filed more than 1980 patents and secured 4840 grants.

- Global Footprint: The drug discovery sector includes 5370 companies with 990+ startups. The leading country hubs are the USA, the UK, India, China, and Japan, and major city hubs include San Diego, Cambridge, London, New York City, and San Francisco.

- Investment Landscape: Over 9550 funding rounds closed with an average of USD 34 million per round. More than 7600 investors invested in over 2220 companies.

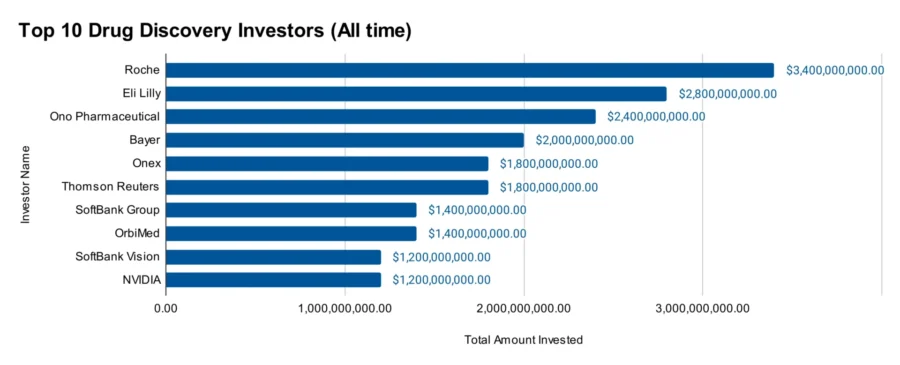

- Top Investors: Strategic investors collectively committed over USD 19.4 billion. Some of the top investors include Roche (USD 3.4 billion), Eli Lilly (USD 2.8 billion), Ono Pharmaceutical (USD 2.4 billion), Bayer (USD 2 billion), and Onex (USD 1.8 billion).

- Startup Ecosystem: Five innovative startups in this sector are InVirtuoLabs (AI molecular simulation), BrainStorm Therapeutics (induced pluripotent stem cells (iPSC) neurotherapeutics platform), ArtifiCell (human tissue analysis system), RIANA Therapeutics (phenotypic screening system), and V4CURE (venom-based cardio-renal therapeutics).

Methodology: How We Created This Drug Discovery Report

This drug discovery industry report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this drug discovery market outlook, we focused on the evolution of drug discoveries over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within drug discovery

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the drug discovery market.

What Data is Used to Create This Drug Discovery Market Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the drug discovery market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: More than 44 540 publications related to drug discovery and advancements appeared over the last year.

- Funding Rounds: Our database tracks 9550 funding rounds within the market that reflect investor confidence and sustained capital flow into research and development.

- Manpower: More than 314 300 professionals employed globally, and over 30 600 new jobs added in the last year alone.

- Patents: The market registered 1980+ patents, which showcase the rate of innovation and focus on proprietary breakthroughs.

- Grants: With 4840 grants awarded, the drug discovery space demonstrates exceptional competitiveness in securing research funding.

- Yearly Global Search Growth: The sector experienced a 3.88% increase in global search interest over the last year.

Explore the Data-driven Drug Discovery Industry Report for 2025

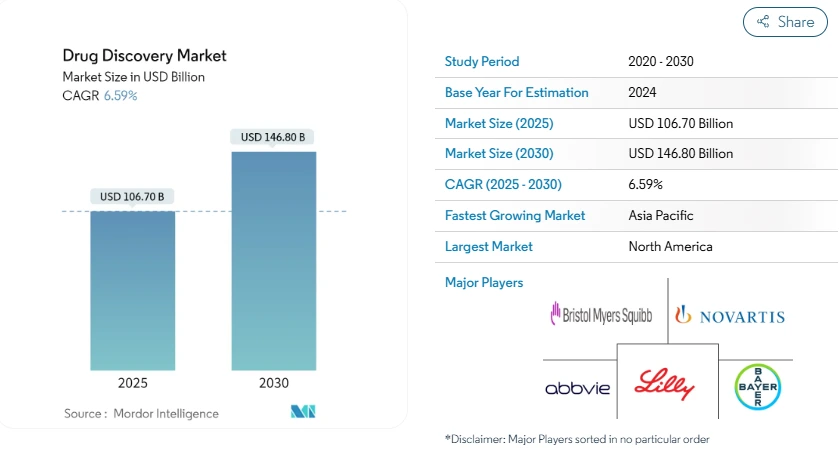

The drug discovery industry outlook is projected to grow from USD 106.70 billion in 2025 to USD 146.80 billion by 2030. This reflects a CAGR of 6.59% over the forecast period. This expansion highlights the sector’s long-term potential with innovation and rising global demand for therapeutics.

Credit: Mordor Intelligence

The drug discovery market is projected to grow from USD 106.70 billion in 2025 to USD 146.80 billion by 2030. This reflects a CAGR of 6.59% over the forecast period. This expansion highlights the sector’s long-term potential with innovation and rising global demand for therapeutics.

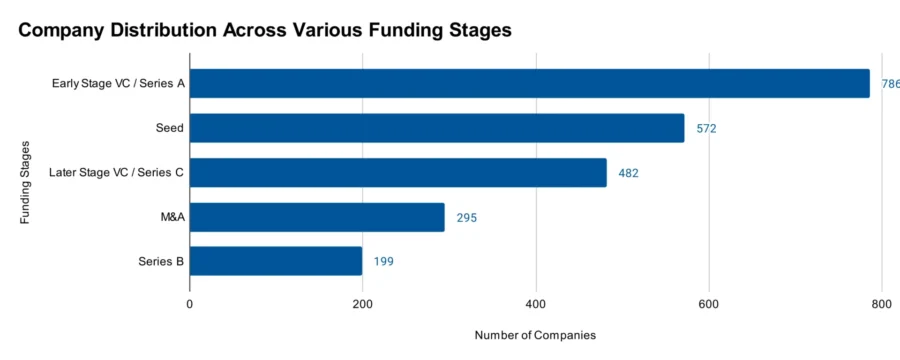

In addition, 290+ companies underwent mergers and acquisitions (M&A) that signify strategic realignments and increased deal activity within the biotech space. It attracted large investments, with IPO valuations averaging USD 1.2 billion and late-stage funding rounds around USD 100 million.

In the drug discovery sector, 1790+ applicants filed for 1980+ patents in the last year. While the yearly patent growth stands at 2.14%, the steady issuance of new patents shows the sector’s technological advancements. The USA and Canada lead the way as top jurisdictions for patent filings, reflecting innovation support systems in these countries.

A Snapshot of the Global Drug Discovery Market

The drug discovery sector recorded a 9.46% annual growth. Out of 5370 companies in our database, 990+ are classified as startups, with 780+ operating at early-stage levels. This highlights the sector’s pipeline of new entrants that include therapeutic platforms, AI-based screening tools, and next-generation delivery systems.

Explore the Funding Landscape of the Drug Discovery Market

The drug discovery sector attracts an average investment value of USD 34 million per round. To date, the market has closed over 9551 funding rounds, backed by a diverse base of more than 7600 investors. These investments are distributed across over 2220 companies.

Who is Investing in the Drug Discovery Market?

The top investors in the drug discovery sector collectively committed over USD 19.4 billion. This reflects sustained confidence in the sector’s commercial viability and long-term growth potential.

- Roche has contributed USD 3.4 billion among 7 companies. Also, it plans to invest USD 50 billion in pharmaceutical and diagnostic operations in the USA.

- Eli Lilly has invested in 23 companies, totaling USD 2.8 billion. Eli Lilly expanded its collaboration with Purdue University and committed up to USD 250 million over eight years.

- Ono Pharmaceutical has channeled USD 2.4 billion into just 2 companies. Ono acquired USA-based Deciphera Pharmaceuticals for USD 2.4 billion to expand its oncology portfolio and strengthen its presence in the USA and Europe.

- Bayer has invested USD 2 billion across 5 companies. Bayer also partners with NextRNA Therapeutics to develop small-molecule lncRNA-targeting cancer drugs, committing up to USD 547 million in upfront and milestone payments.

- Onex has invested USD 1.8 billion in at least 1 company. Onex Partners acquired Accredited, a global P&C program manager.

- Thomson Reuters has contributed USD 1.8 billion to at least 1 company. Thomson Reuters announced that it will invest USD 8 billion in AI over the coming years.

- SoftBank Group has funded 2 companies with a total investment of USD 1.4 billion. SoftBank agrees to invest up to USD 40 billion in OpenAI, valuing it at USD 300 billion.

- OrbiMed has backed 40 companies with USD 1.4 billion. Moreover, OrbiMed led a USD 35 million financing round for vVARDIS, a Swiss dental company.

- SoftBank Vision has invested USD 1.2 billion across 10 companies. SoftBank Group and Arm also contributed USD 15.5 million to fund AI research at Carnegie Mellon and Keio University.

- NVIDIA has invested USD 1.2 billion across 7 companies. HUMAIN, an AI unit of Saudi Arabia’s PIF, partners with NVIDIA to receive hundreds of thousands of GPUs over five years.

Top Drug Discovery Innovations & Trends

Discover the emerging trends in the drug discovery market along with their firmographic details:

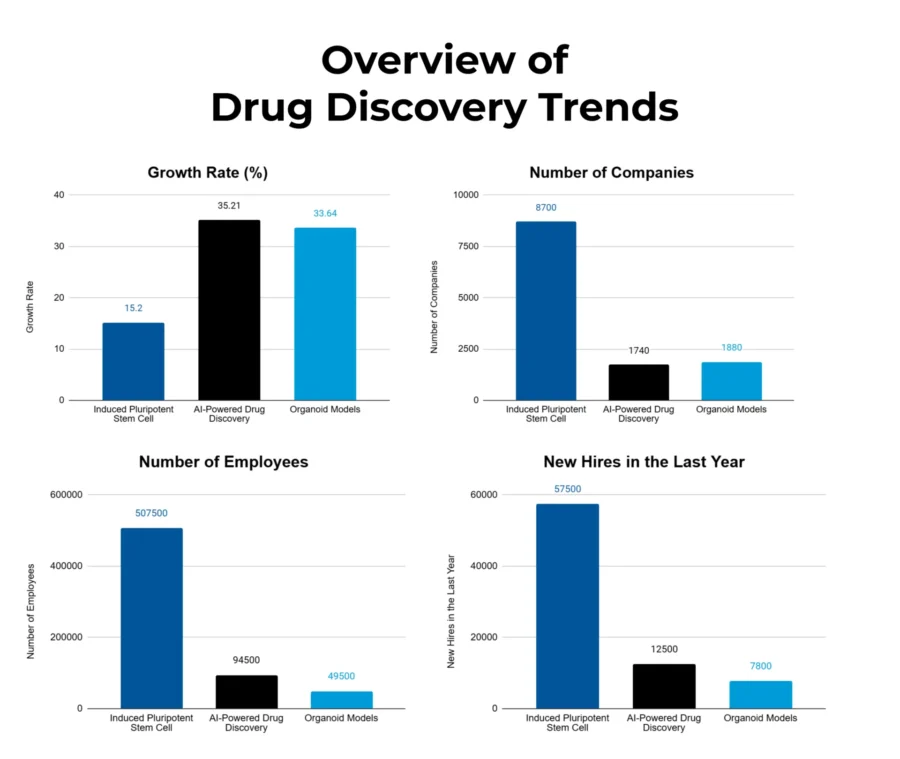

- Induced Pluripotent Stem Cells: Represented by 430+ companies and employing 19 500 people, the iPSC sector grows at a steady 6.30% annual rate. With 2200 new jobs created in the last year, iPSC-based approaches are gaining traction for disease modeling, regenerative medicine, and personalized drug screening.

- AI-Powered Drug Discovery: With 760+ companies and a workforce of 25 000, AI-Powered drug discovery modernizes drug development. The sector added 4400 new employees in the past year alone and grew 42.39% annually. It leverages machine learning (ML), generative models, and predictive algorithms to reduce discovery timelines and optimize molecule selection with speed and accuracy.

- Organoid Models: Although smaller in scale with 60 companies and 1300 employees, the organoid sector grows at a 30.26% annual growth rate. These 3D cellular models showcase the study of disease progression and drug response, particularly in oncology and neurology. With 210+ new hires in the past year, the field moves from niche to necessity in high-precision preclinical testing.

5 Top Examples from 990+ Innovative Drug Discovery Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

InVirtuoLabs offers AI-Powered Drug Discovery

Swiss startup InVirtuoLabs develops an AI platform to optimize the drug discovery process. The platform serves as the coordinating layer that brings the 3 engines, InVirtuoMOL, InVirtuoGEN, and InVirtuoSIM, together.

InVirtuoGEN initiates the process by generating drug-like molecules for specific therapeutic targets using generative AI. These candidate compounds undergo evaluation by InVirtuoMOL. It is an ML engine that leverages multimodal and active learning to predict essential molecular properties like solubility and toxicity.

Further, the simulation module, InVirtuoSIM, analyzes the candidates’ molecular interactions at the atomic level. It provides high-resolution insights and refines predictions. Together, these components form a unified platform that improves candidate selection, reduces risk, and shortens the drug development timeline.

BrainStorm Therapeutics provides iPSC Neurotherapeutics

USA-based startup BrainStorm Therapeutics builds a discovery platform that integrates patient-derived iPSC organoids, biomarker-based screening, and AI-powered analytics for the central nervous system (CNS).

It uses human iPSC-derived models of brain disease to capture disease pathophysiology in a high-throughput format by enabling both phenotypic and target-based screening.

Moreover, the platform’s screening de-risks target selection by validating hits across multiple biological endpoints. Also, it leverages genetic entry points to address familial and sporadic forms of neurological disorders.

This way, the platform identifies, halts, prevents, or reverses compounds that intervene in molecular pathways linked to synaptic dysfunction and neurodegeneration.

ArtifiCell simplifies Functional Human Tissue Analysis

German startup ArtifiCell offers a platform for cultivating and analyzing functional human 3D tissues to improve the predictive accuracy of drug development. The startup’s microplate system allows cardiac and skeletal tissues to grow directly on a thin glass slide.

This enables real-time, high-resolution imaging of structural and functional properties like contraction force, tissue tension, and beating frequency without removing the tissue from its environment.

In addition, the startup’s T-Stim device provides electrical stimulation to cultured tissues using customizable pulse sequences to simulate physiological conditions.

In this way, ArtifiCell enables faster, cost-efficient analysis of drug efficacy and toxicity in human-relevant models while reducing reliance on animal testing and traditional 2D cultures.

RIANA Therapeutics builds a Phenotypic Screening System

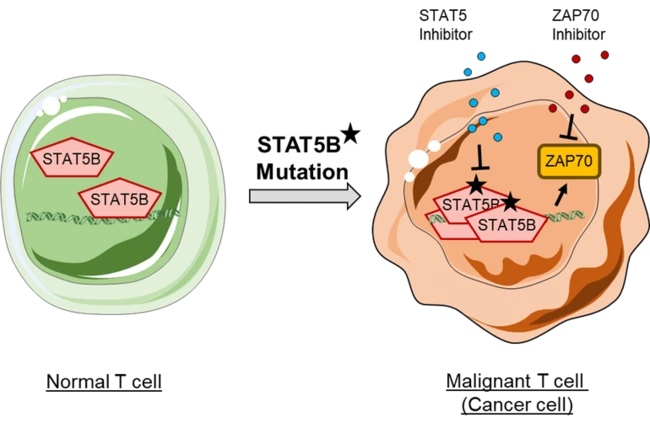

Austrian startup RIANA Therapeutics develops targeted cancer therapies using a proprietary phenotypic drug discovery platform. The startup’s cell-based screening system identifies inhibitors that selectively interfere with disease-driving protein conformations, like the oligomerization of STAT5 B, without affecting their essential physiological forms.

This approach addresses previously undruggable cancer targets, especially in hematopoietic malignancies like T-cell acute lymphoblastic leukemia, by focusing on conformationally specific protein-protein interactions (PPIs).

Thus, RIANA Therapeutics develops effective and precise anti-cancer therapies that minimize off-target effects.

V4CURE develops Venom-based Cardio-Renal Therapeutics

French startup V4Cure makes venom-derived therapeutics for cardio-renal diseases. V4C-232 is a synthetic molecule based on a peptide from the green mamba’s venom that assists in targeting conditions such as refractory ascites in liver cirrhosis and polycystic kidney disease.

Simultaneously, the startup explores the molecule for rare genetic kidney disorders like autosomal dominant polycystic kidney disease (ADPKD) and autosomal recessive polycystic kidney disease (ARPKD), which have limited treatment options.

Gain Comprehensive Insights into Drug Discovery Trends, Startups, and Technologies

The Drug Discovery Market Report 2025 shows the transition of traditional methods toward faster, modular, and data-driven approaches. As the field advances, it gains momentum from cross-disciplinary innovation, growing investor interest, and a focus on disease relevance from early research stages. With rising clinical precision and expanding startup activity, the industry moves steadily toward more effective, targeted, and scalable solutions for global health challenges.

Get in touch to explore 990+ drug discovery startups and scaleups, as well as all market trends impacting 5300+ companies.