Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

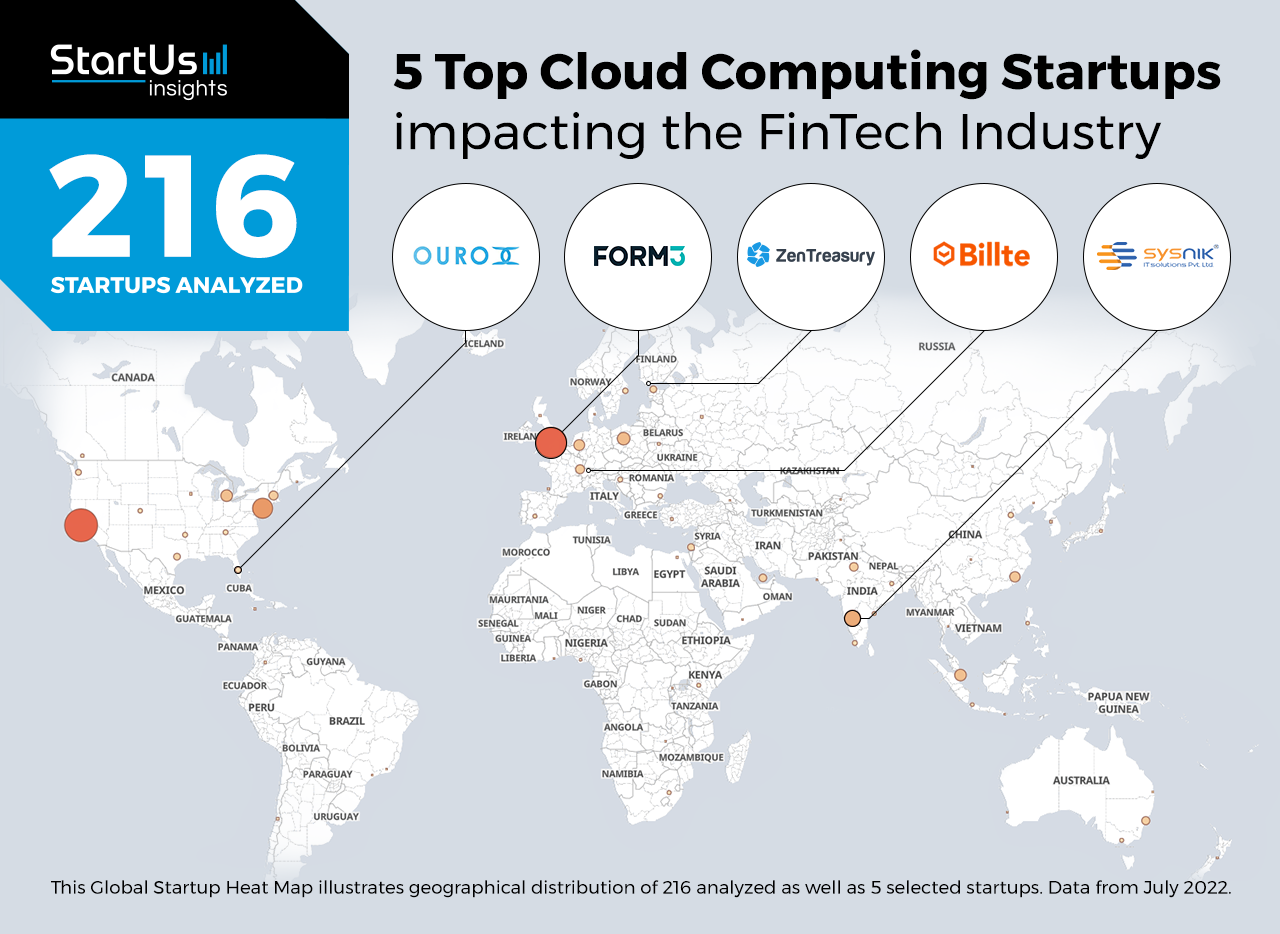

Out of 216, the Global Startup Heat Map highlights 5 Top Cloud Computing Startups impacting the FinTech Industry

Startups such as the examples highlighted in this report focus on treasury management, cryptocurrency, artificial intelligence (AI), and robotic process automation (RPA). While all of these technologies play a significant role in advancing FinTech, they only represent the tip of the iceberg. This time, you get to discover five hand-picked cloud computing startups impacting the FinTech industry.

The Global Startup Heat Map below reveals the geographical distribution of 216 exemplary startups & scaleups we analyzed for this research. Further, it highlights five FinTech startups that we hand-picked based on scouting criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 211 cloud computing solutions for FinTech, get in touch with us.

Billte simplifies Invoice Management

Founding Year: 2017

Location: Adliswil, Switzerland

Partner with Billte for Digital Billing

Billte is a Swiss startup that offers an invoice management platform to digitize billing processes. It converts unstructured invoices into e-bills and QR-coded bills. The platform then delivers invoices through multiple channels, such as SMS and email, as well as sends automatic reminders and generates real-time reports. Moreover, it tracks partial payments in different currencies, improving efficiency and liquidity for small and medium enterprises (SMEs).

ZenTreasury aids Treasury Management

Founding Year: 2016

Location: Espoo, Finland

Collaborate with ZenTreasury for Transaction Audits

ZenTreasury is a Finnish startup that develops a cloud platform for treasury management. It provides accounting methods depending on contract type, portfolio, and counterparty. The platform offers a simplified audit process, and its audit trail logs all transactions with dates and time stamps. Further, it enables businesses to manage transactions in foreign currencies.

Form3 provides Cloud-native Payments

Founding Year: 2016

Location: London, UK

Reach out to FORM3 for Payments-as-a-Service (PaaS)

Form3 is a UK-based startup that makes payment platforms. Its end-to-end managed payments service for banks and regulated fintechs delivers entire payment processing, clearing, and settlement through an application programming interface (API). The cloud platform removes the burden of maintaining back-office payments infrastructure, compliance, and security as well as shields customers from regulatory changes.

OuroX facilitates Digital Asset Exchange

Founding Year: 2018

Location: Doral, US

Use OuroX’s solution for Crypto Exchange

OuroX is a US-based startup that advances financial inclusion and economic growth by using AI, blockchain, machine learning, and cloud computing. It develops a digital asset exchange platform that offers crypto-to-crypto, crypto-to-fiat, and fiat-to-crypto exchange services. Additionally, its mobile-based cryptocurrency payment wallet allows users to store, send and receive cryptocurrency. Moreover, it facilitates cross-border remittances at lower charges.

Sysnik advances Cloud-enabled Banking

Founding Year: 2016

Location: Pune, India

Engage with Sysnik for Financial Process Automation

Sysnik is an Indian startup that automates processes in the banking and financial services sector. The startup’s cloud-enabled product, SYS-CORE, offers the flexibility for banks to self-manage changes in customer composition, competitive landscape, or regulatory guidelines. Further, its modules, workflows, and reports enhance customer experience, improve efficiency, reduce risks, and improve outcomes through assisted processes.

Where is this Data from & how to Discover More FinTech Startups?

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. The insights of this data-driven analysis are derived from our Big Data & AI-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & lets you scout relevant startups within a specific field in just a few clicks. To explore financial technologies in more detail, let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.