Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The 2025 Cleantech Report examines the sector’s current state and covers growth trends, employment shifts, patent activity, innovation hubs, and investment patterns.

S&P Global Commodity Insights projects that cleantech energy supply investments, including renewable power generation, green hydrogen production, and carbon capture and storage (CCS) will total USD 670 billion in 2025.

The report identifies key markets, technological advancements, leading investors, and emerging startups shaping clean technology. These insights enable industry leaders, policymakers, and stakeholders to make informed decisions and adapt to the evolving cleantech landscape.

Executive Summary: Cleantech Market Outlook 2025

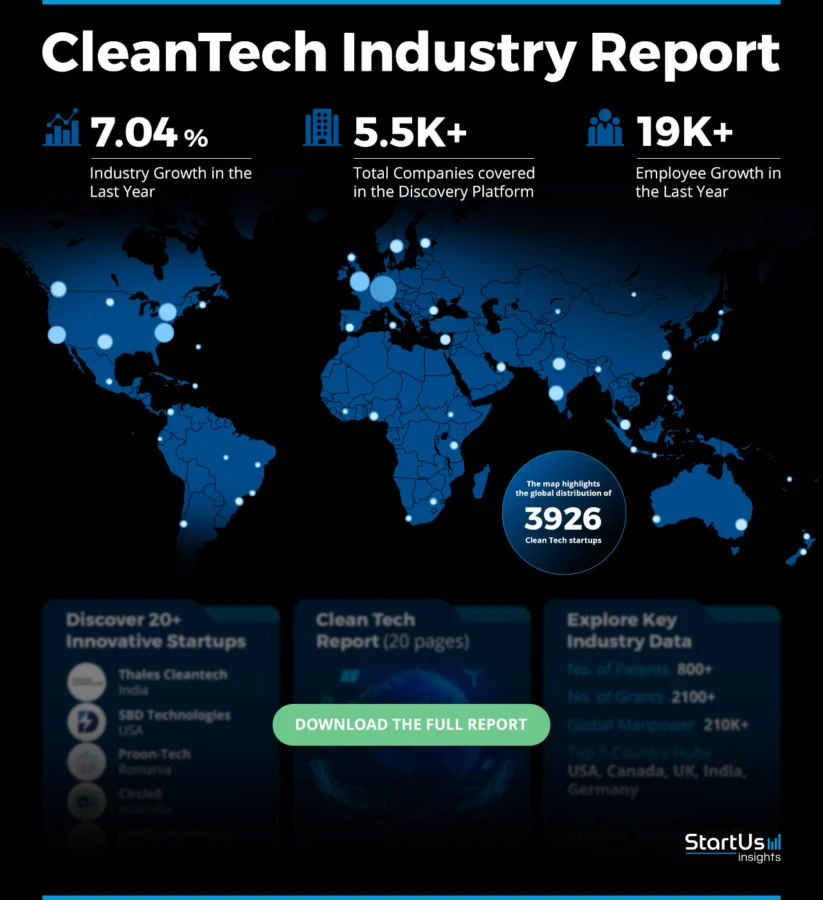

- Industry Growth Overview: The cleantech market expanded by 7.04% over the past year, with over 5500 companies tracked and more than 3900 startups currently operating worldwide. The global clean technology market is projected to grow at a compound annual growth rate (CAGR) of 12.7% from 2025 to 2030.

- Manpower & Employment Growth: The sector employs more than 210 000 professionals globally. Over 19 000 new employees joined in the past year.

- Patents & Grants: Cleantech companies filed more than 800 patents and secured over 2100 grants. Also, the patent applications increased by 17.15% year-over-year, with China and the US leading submissions.

- Global Footprint: Key country hubs for the industry include the USA, Canada, the UK, India, and Germany. Major city hubs include London, Toronto, New York City, Singapore, and San Francisco.

- Investment Landscape: The sector recorded over 4200 funding rounds, with an average investment of USD 26.3 million. More than 3500 investors supported over 1100 companies. It demonstrates diverse capital inflows.

- Top Investors: UBS, BNP Paribas, and the European Investment Bank rank among the leading investors. Their combined investment exceeds USD 2 billion across cleantech ventures.

- Startup Ecosystem: Notable startups include Thales Cleantech (Atmospheric Moisture Extraction), SBD Technologies (EV Fleet Charging), Proon-Tech (Reforestation & Tree Management), Circle8 (Plastic Waste Collection), and pH7 Technologies (Sustainable Metal Extraction).

Methodology: How we created this Cleantech Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 7 million global companies, 20K+ technologies and trends as well as 150M patents, news articles and market reports. This data includes detailed firmographic insights into approximately 7 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of cleantech over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working in the sector

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within cleantech

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the cleantech market.

What Data is used to create this Cleantech Market Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the cleantech market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: The cleantech industry was covered in over 4400 news publications last year. This is a reflection of growing media interest in sustainable technologies and climate solutions.

- Funding Rounds: Our database recorded investors participating in more than 4200 funding rounds. It demonstrates engagement across early-stage and growth-stage cleantech companies.

- Manpower: The workforce exceeds 210 000 professionals, with 19 000 new employees joining last year. This growth indicates steady job creation and talent absorption.

- Patents: Companies in the sector hold over 800 patents, which highlights ongoing technological advancements and efforts to protect cleantech innovations.

- Grants: More than 2100 grants have been awarded to cleantech companies. It aligns with public funding priorities and environmental policy initiatives.

- Yearly Global Search Growth: There has been an increase in global search interest in cleantech by 9.38% over the past year. This shows rising consumer awareness and curiosity among stakeholders.

Explore the Data-driven Cleantech Market Report for 2025

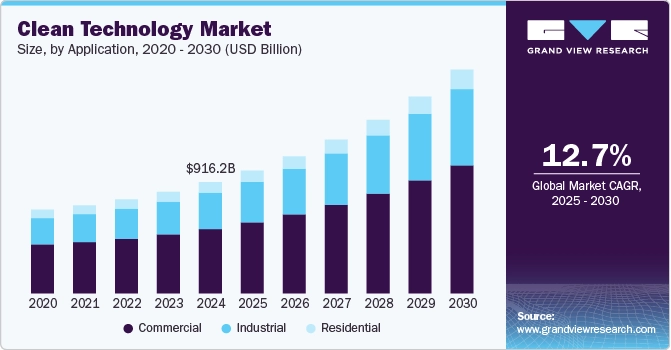

The global clean technology market reached USD 916.20 billion in 2024 and is projected to grow at a CAGR of 12.7% from 2025 to 2030. This expansion reflects efforts to address climate change, limit environmental damage, and shift to sustainable energy sources.

Credit: Grand View Research

The annual cleantech investments will surpass USD 1 trillion by 2030. This will be driven by advancements in battery storage and electrolysis technologies.

Our database monitors more than 3900 cleantech startups and 5500 companies. It shows a 7.04% annual growth rate across the industry.

Further, patent filings surpassed 800, while grants exceeded 2100. There is ongoing support from both the public and private sectors for sustainability and energy transformation.

The industry employed 210 000 professionals and added 19 000 new hires in the past year. It demonstrates consistent workforce expansion and rising demand.

Major country hubs include the USA, Canada, the UK, India, and Germany. Leading city hubs are London, Toronto, New York City, Singapore, and San Francisco.

Moreover, Estonia invests the most per capita in cleantech within the European Union. It exceeds the USA and larger European Union (EU) economies such as Germany and France. Meanwhile, India directs USD 4.3 billion into solar and green hydrogen initiatives through its 2023–24 budget.

A Snapshot of the Global Cleantech Market

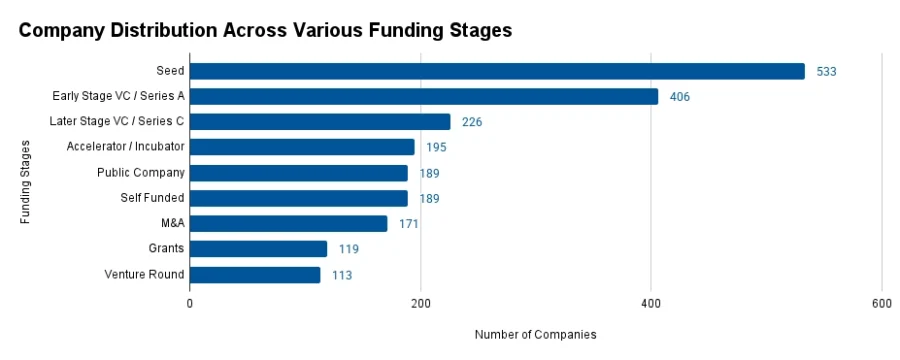

The cleantech sector expanded by 7.04% over the past year, and it is supported by more than 3900 startups in global markets. Among them, over 400 are early-stage ventures, which reflects steady entrepreneurial activity. Additionally, 170+ mergers and acquisitions indicate ongoing consolidation and strategic shifts.

Innovation in cleantech continues to advance, with more than 800 patents filed by over 760 applicants. Patent filings increased at an annual rate of 17.15%. This is driven primarily by contributions from China, which accounted for over 680 patents. The USA followed with more than 25. This trend underscores rising competition in cleantech research and development among global technology leaders.

Besides, a joint report by the European Investment Bank (EIB) and the European Patent Office (EPO) states that the European Union develops 22% of the world’s clean and sustainable technologies. EU cleantech innovation prioritizes low-carbon energy, clean mobility, and plastic alternatives.

Explore the Funding Landscape of the Cleantech Market

The investments in the cleantech market remain steady. It is an average of USD 26.3 million per round. Further, more than 3500 investors have participated in over 4200 funding rounds across different company stages.

Investment has reached over 1100 companies, which reflects broad capital distribution within the ecosystem. The sector’s appeal aligns with environmental priorities and energy transition strategies.

Who is Investing in the Cleantech Market?

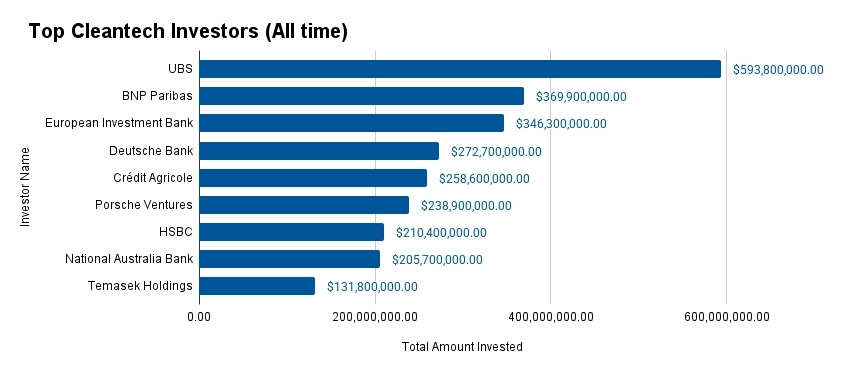

The top investors in the cleantech industry have contributed more than USD 2 billion. They provide institutional support for sustainable innovation and climate-focused ventures.

- UBS invested USD 593.8 million across 2 companies. Also, it signed a 10-year agreement with Climeworks, a Swiss direct air capture company, to advance carbon removal solutions as part of its net-zero commitment.

- BNP Paribas supported 6 companies with a total investment of USD 369.9 million.

- The European Investment Bank contributed USD 346.3 million to 10 companies.

- Deutsche Bank invested USD 272.7 million across 2 companies.

- Crédit Agricole deployed USD 258.6 million into 2 companies.

- Porsche Ventures backed 2 companies with USD 238.9 million.

- HSBC invested USD 210.4 million in 4 companies.

- National Australia Bank funded 3 companies with USD 205.7 million.

- Temasek Holdings invested USD 131.8 million across 4 companies.

Top Cleantech Innovations & Trends

Discover the emerging trends in the cleantech market along with their firmographic details:

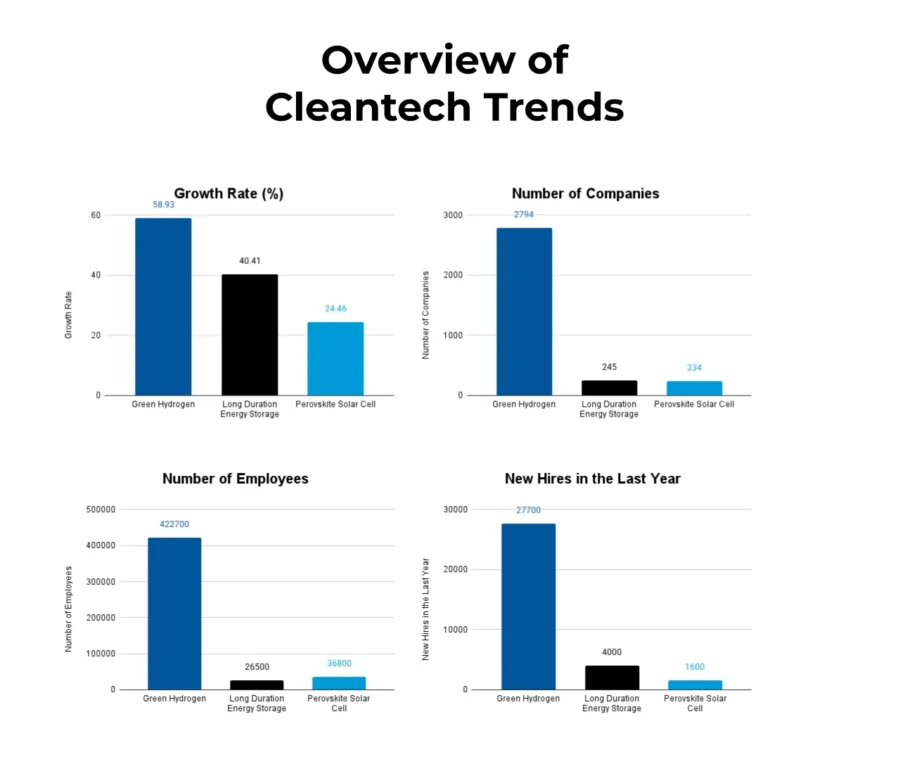

- Green Hydrogen is expanding as heavy industries, power generation, and mobility are adopting it as a decarbonization tool. More than 2700 companies working on green hydrogen are identified worldwide. These firms employ over 422 700 people, including 27 700 new hires last year. The sector is growing at an annual rate of 58.93% and reflects increased investments in clean fuel alternatives.

- Long Duration Energy Storage is shaping the cleantech landscape by improving grid reliability and supporting renewable integration. The segment includes 245 companies with a workforce of 26 500. The companies added 4000 employees last year. The annual growth rate of 40.41% highlights interest in technologies such as flow batteries, thermal storage, and gravity-based systems.

- Perovskite Solar Cells represent a promising frontier in photovoltaic innovation. This domain comprises 234 companies with 36 800 employees, including 1600 new positions added last year. The sector is growing at an annual rate of 24.46%, as perovskite materials continue to attract R&D funding due to their potential for low-cost, high-efficiency solar cells.

5 Top Examples from 3900+ Innovative Cleantech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Thales Cleantech designs Atmospheric Moisture Extraction (AME) Technologies

Indian startup Thales Cleantech develops atmospheric moisture extraction systems that produce potable water using renewable energy. Its patented process mimics natural rainfall by drawing humid air into a supercooled chamber. Here, condensation occurs through heat exchange without refrigerant gases.

The systems improve energy efficiency compared to conventional methods and operate without grid electricity to lower costs. They reduce the price of producing one liter of water by using freely available raw materials and eliminating chemical filtration or groundwater extraction.

Further, the startup integrates real-time monitoring through a proprietary app that tracks water from generation to delivery for enhancing transparency. Its sterile on-site packaging ensures water security during dry periods and provides a reliable, low-emission alternative for sustainable supply.

SBD Technologies advances Electric Vehicle (EV) Fleet Charging

US-based startup SBD Technologies develops AI-powered software to improve EV fleet operations in home, depot, and public charging environments.

Its platform includes FleetHome, which automates home charging reimbursements by paying utilities directly and using vehicle data for accuracy. FleetCharge consolidates energy usage and billing across all charging locations into a single dashboard.

Further, FleetAssist simplifies fleet management with natural language processing. It allows users to issue commands in plain English. Additionally, FleetGrid connects vehicles to the power grid, which enables energy return during peak demand and optimizes charging schedules based on real-time electricity prices.

Proon-Tech enables Reforestation & Tree Management

Romanian startup Proon-Tech creates AI-driven reforestation systems that automate tree cultivation from seed to maturity. Its technology integrates 3D-bioprinted seed pods, called Scion, with autonomous ground vehicles and drones for precise planting in remote or disaster-affected areas.

Scion pods contain seedlings and macronutrients, and they are germinated in controlled environments using the Bloom automated nursery. This system simulates various ecological conditions to improve survival rates.

Moreover, its Proon.ing app offers real-time visual guidance and species-specific pruning protocols to improve productivity and data accuracy in forestry and orchard management.

Circle8 facilitates Plastic Waste Collection

Australian startup Circle8 makes AI-driven waste management systems that turn plastic disposal into a structured, data-focused process.

Also, its smart lids authenticate plastic waste at disposal and send real-time data to the C8 software platform. It tracks collection metrics and provides insights for sustainability planning.

Further, the startup’s mobile app improves consumer participation, supports deposit return programs, and promotes stakeholder engagement through clear reporting. Its retrofittable hardware installs with minimal disruption and allows municipalities and private enterprises to scale efficiently.

pH7 Technologies enables Sustainable Metal Extraction

Canadian startup pH7 Technologies creates a closed-loop organo-electrochemical heap leaching system for extracting copper and gold from oxide, transition, and sulfide ores.

Its electrochemical module integrates into existing heap leach flowsheets to generate in-situ oxidizers that break metal-sulfur bonds and remove passivation layers. Organic ligands in the lixiviant bind with oxidized metals, which are recovered through solvent extraction, ion exchange, or electrowinning.

This process eliminates the need for mills, concentrators, and smelters, which enables copper cathode and gold doré production directly at the mine site. The system reduces greenhouse gas emissions, cuts water consumption by half, and eliminates tailings disposal.

Further, pH7 Technologies offsets energy use with on-site green hydrogen generation to lower transport-related emissions. Its modular design increases heap recovery rates from refractory ores and preg-robbing mineral zones without altering existing infrastructure.

Gain Comprehensive Insights into Cleantech Trends, Startups, and Technologies

The Cleantech industry will continue expanding in 2025 as it is supported by favorable policies, investor interest, and growing demand for sustainable energy solutions. Emerging trends such as carbon capture, circular economy platforms, and climate-focused AI will drive the next wave of innovation.

Get in touch to explore 3900+ startups and scaleups, as well as all market trends impacting cleantech companies.