Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

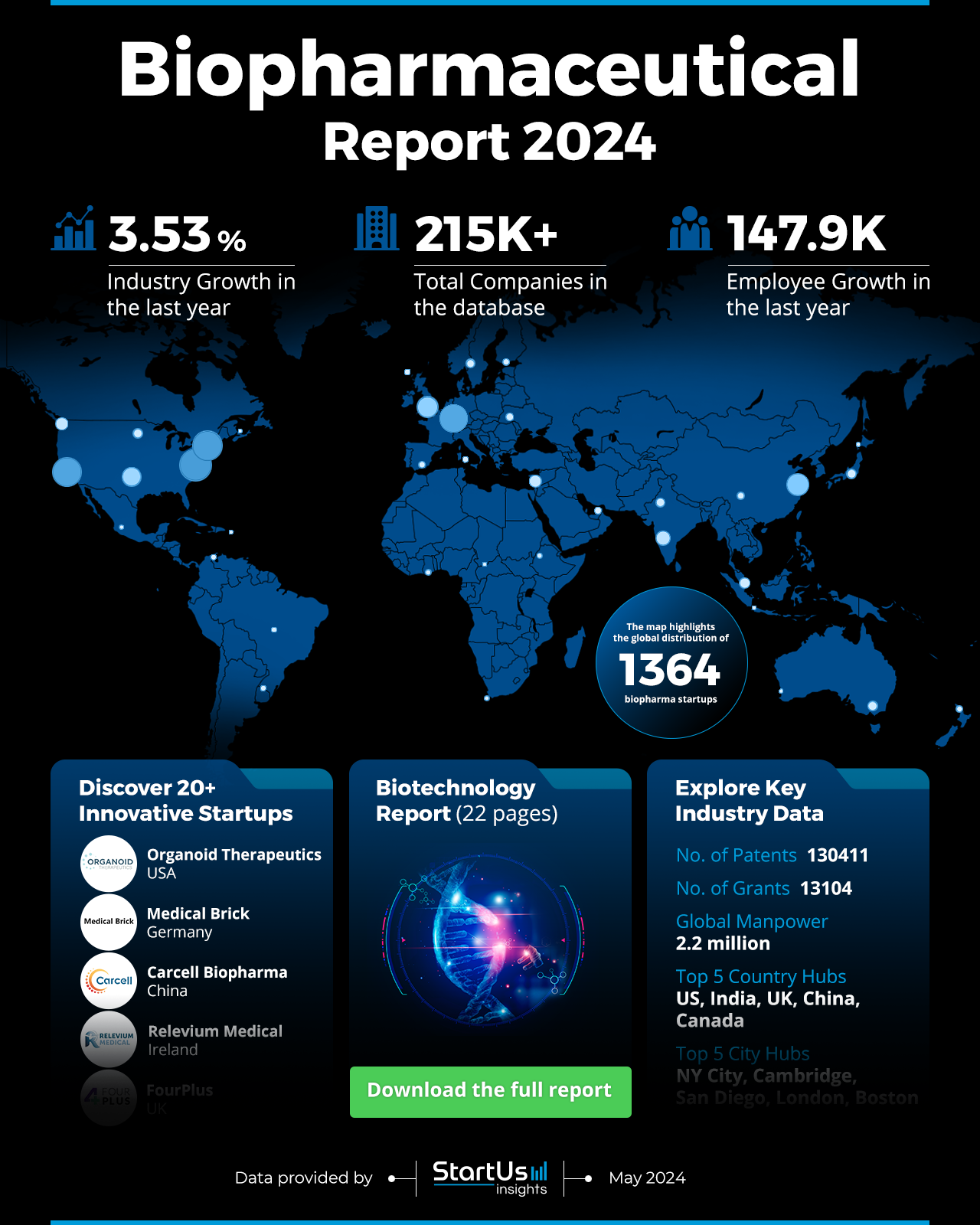

The 2024 Biopharmaceutical Report presents an overview of the key statistics underlying the sector’s current situation. It outlines important trends, growth indicators, and investment behaviors, offering a glimpse into the industry’s evolving landscape. The report centers on developments in gene therapy, synthetic biology, and drug discovery, studying the efforts of notable companies and investors driving progress. It further investigates the growth of the sector’s workforce and funding activities, highlighting the substantial financial and intellectual resources supporting the advancement of biopharma.

This report was last updated in July 2024.

This biopharma report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Biopharmaceutical Report 2024

- Executive Summary

- Introduction to the Biopharmaceutical Report 2024

- What data is used in this Biopharmaceutical Report?

- Snapshot of the Global Biopharmaceutical Industry

- Funding Landscape in the Biopharmaceutical Industry

- Who is Investing in Biopharmaceuticals?

- Emerging Trends in the Biopharmaceutical Industry

- 5 Biopharmaceutical Startups Impacting the Industry

Executive Summary: Biopharmaceutical Industry Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 1300+ biopharmaceutical startups developing innovative solutions to present five examples from emerging biopharmaceutical industry trends.

- Industry Growth Overview: The biopharma industry saw a growth rate of 3.53% in the last year, showing positive momentum and a changing landscape with over 215000 companies

- Manpower & Employment Growth: The industry employs 2.2 million people, with an increase of 147900 new employees in the past year, indicating strong workforce growth.

- Patents & Grants: There are 130000+ patents and 13100+ grants, showing considerable innovation and solid support for research and development projects.

- Global Footprint: The top five country hubs are the United States, India, the United Kingdom, China, and Canada. Key city hubs include New York City, Cambridge, San Diego, London, and Boston.

- Investment Landscape: The industry has closed over 20700 funding rounds with an average investment value of USD 44.5 million per round. Over 4400 investors are actively participating, supporting more than 7100 companies.

- Top Investors: RA Capital Management, Arch Venture Partners, OrbiMed, and more have collectively invested more than USD 24 billion.

- Startup Ecosystem: Highlights include startups such as Organoid Therapeutics (Lab-Grown Artificial Organ), Medical Brick (AI-assisted Analytics), Carcell Biopharma (Cell & Gene Therapies Development), Relevium Medical (Chronic Pain Hydrogel Treatments), FourPlus (Immersive Training)

- Recommendations for Stakeholders: Increase investment in growing areas like synthetic biology and gene therapy. Prioritize workforce development to manage emerging industry trends better. Encourage innovation through strategic partnerships and funding.

Explore the Data-driven Biopharmaceutical Report for 2024

The biopharmaceutical report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Our database includes 1364 startups and 215000+ companies, indicating a diverse industry. The industry saw a growth of 3.53% in the last year, showing positive development. The sector has also received 130K+ patents and 13K+ grants, underlining its innovation and backing for new projects.

The total manpower in the sector is 2.2 million, with an increase of 147900 employees in the last year, pointing to strong workforce growth. The five leading country hubs—United States, India, United Kingdom, China, and Canada—illustrate the broad geographical spread of industry activity. Major city hubs include New York City, Cambridge, San Diego, London, and Boston, becoming important urban centers for innovation and growth.

What data is used to create this biopharmaceutical report?

Based on the data provided by our Discovery Platform, we observe that the biopharmaceutical industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The news coverage and publications total 19000 in the last year, indicating its visibility and research output.

- Funding Rounds: Our database includes more than 20700 funding rounds, demonstrating the industry’s financial support and investment activity.

- Manpower: The industry employs over 2 million workers, with an addition of more than 147000 new employees in the past year.

- Patents: Biopharma has over 130000 patents, showing its innovative efforts and technological progress.

- Grants: There are 13104 grants, showing solid support for research and development projects.

- Yearly Global Search Growth: The industry’s yearly global search growth is 2.43%, showing a rise in public and professional interest.

A Snapshot of the Global Biopharmaceutical Industry

The biopharma industry data shows growth and investment. With a workforce of 2.2 million, the industry added 147900 employees in the last year, indicating manpower growth. The industry includes over 215000 companies, showing its broad and diverse ecosystem.

Explore the Funding Landscape of the Biopharmaceutical Industry

Investment activity in the biopharma sector is strong, with an average investment value of USD 44.5 million per round. The industry has closed over 20700 funding rounds, indicating financial engagement.

Over 4400 investors are involved in the sector, supporting more than 7100 companies. This network of investors and funded companies highlights the biopharma industry’s active investment landscape.

Who is Investing in Biopharmaceuticals?

Leading investors in the biopharma industry have together invested more than USD 24 billion, indicating the sector’s financial support. Here are some investors and their contributions:

- RA Capital Management has invested USD 5.1 billion in 68 companies, showing a commitment to advancing biopharma innovations.

- ARCH Venture Partners has invested USD 3.2 billion in 44 companies, highlighting its role in funding early-stage biotech ventures.

- OrbiMed has invested USD 2.8 billion in 66 companies, indicating its engagement and support in the biopharma sector.

- Novartis Venture has invested USD 2.4 billion in 23 companies, strategically investing in promising biopharma firms.

- Ardian has invested USD 2.3 billion in 2 companies, reflecting high-value investments in targeted ventures.

- Advent International has invested USD 2 billion in 3 companies, showing its focused investment strategy in the industry.

- SoftBank Vision Fund has invested USD 2 billion in 11 companies, indicating its interest in scaling biopharma innovations.

- Grifols has invested USD 1.8 billion in 4 companies, pointing to its strategic investments in biopharma.

- Bain Capital Life Sciences has invested USD 1.7 billion in 14 companies, showing its commitment to advancing life sciences.

- Redmile Group has invested USD 1.7 billion in 21 companies, indicating its active investment presence in the biopharma sector.

Access Top Biopharmaceutical Innovations & Industry Trends with the Discovery Platform

Biopharmaceutical industry trends are changing drug development and disease management. Here’s a closer look at a few trends with firmographic insights:

- Gene therapy is a trend in the biopharma industry, with 2508 companies identified in this area. These companies employ more than 341700 individuals, with 23800 new employees added last year. The annual trend growth rate for gene therapy is 0.16%, showing steady expansion.

- Synthetic biology is growing in the industry, with 1215 companies identified in this field. These companies employ 49000 people, adding 6700 new employees in the past year. The annual trend growth rate is 9.27%, indicating advancements and interest in this field.

- Drug discovery and development is a key trend in the biopharma industry, with 1289 companies dedicated to this area. These companies employ 82000 individuals, with 9800 new employees joining last year. The annual trend growth rate of 4.98% points to the ongoing expansion of this sector.

5 Top Examples from 1300+ Innovative Biopharmaceutical Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Organoid Technologies creates Lab-Grown Artificial Organ

US-based startup Organoid Therapeutics develops organoid-based technologies to correct hormone deficiencies in patients. In addition, it streamlines drug discovery and toxicology testing in labs. The startup is working on pancreatic organoid technology that eliminates the need for diabetes patients to regulate their blood sugar levels with exogenous insulin injections. Organoid Therapeutics specializes in tissue engineering, regenerative medicine, and genetic engineering for the development and clinical application of fully compatible artificial organs. The technologies include implantable hardware, biomaterial-synthetic biohybrid medical devices, biomimetic tissue interfaces, and CRISPR-Cas9 gene editing strategies.

Medical Brick offers AI-assisted Analytics

German startup Medical Brick provides AI-assisted analytics for biomedical and pharmaceutical solutions. It offers a variety of AI models tailored to individual requirements. It provides faster results and a more efficient selection of suitable compounds than conventional methods. The platform uses deep learning to automatically detect and classify infections, thus phenotyping agents applied to diseases. This approach shortens drug development time in the early discovery phase, while simultaneously increasing the number of drug candidates.

Carcell accelerates Cell & Gene Therapies Development

Chinese startup Carcell Biopharma offers drug delivery platform technologies, including proprietary red cell therapy and licensable lipid nanoparticles (LNPs). The Powertrain platform accelerates cell and gene therapy development. This platform supports multiple technology platforms, each with R&D independence and potential cross-platform synergies. The Exogenously-Engineered Erythrocyte (E3) platform generates engineered red blood cells efficiently. These cells have the potential to treat solid tumors and autoimmune diseases. Further, Carcell Biopharma develops proprietary Versatile Lipid Nanoparticles to deliver nucleic acids for various applications.

Relevium Medical develops Chronic Pain Hydrogel Treatments

Irish startup Relevium Medical develops peptide-based therapeutics for chronic conditions. It integrates natural biopolymers with pharmacologically active agents. This approach tailors treatments to different chronic pain conditions and also results in a range of novel platform hydrogel products. A few of them in their pipeline include RM-010, an injectable hydrogel treatment for osteoarthritis, RM-020, a gel for interstitial cystitis, and more.

FourPlus facilitates Immersive Training

UK-based startup FourPlus offers immersive experiences for the biopharmaceutical and life sciences sectors. Its technology includes virtual reality experiences for workforce management, 3D asset visualization, facility visualization, and laboratory training. Its product Accelerate guides users through a virtual GMP facility. It instructs on navigating the production module and carrying out essential procedures like gowning and cleaning. This equips users to operate in real-world medicine manufacturing environments.

Looking for Comprehensive Insights into Biopharmaceutical Trends, Startups, or Technologies?

The 2024 Biopharmaceutical Report highlights a sector poised for continued growth and innovation. Emerging trends like gene therapy, synthetic biology, and advanced drug discovery will drive future developments. As investment and research efforts intensify, the industry will likely see transformative advancements, enhancing global healthcare outcomes. Get in touch to explore all 1300+ startups and scaleups, as well as all industry trends impacting biopharmaceutical companies.