Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover five hand-picked billing solutions impacting FinTech.

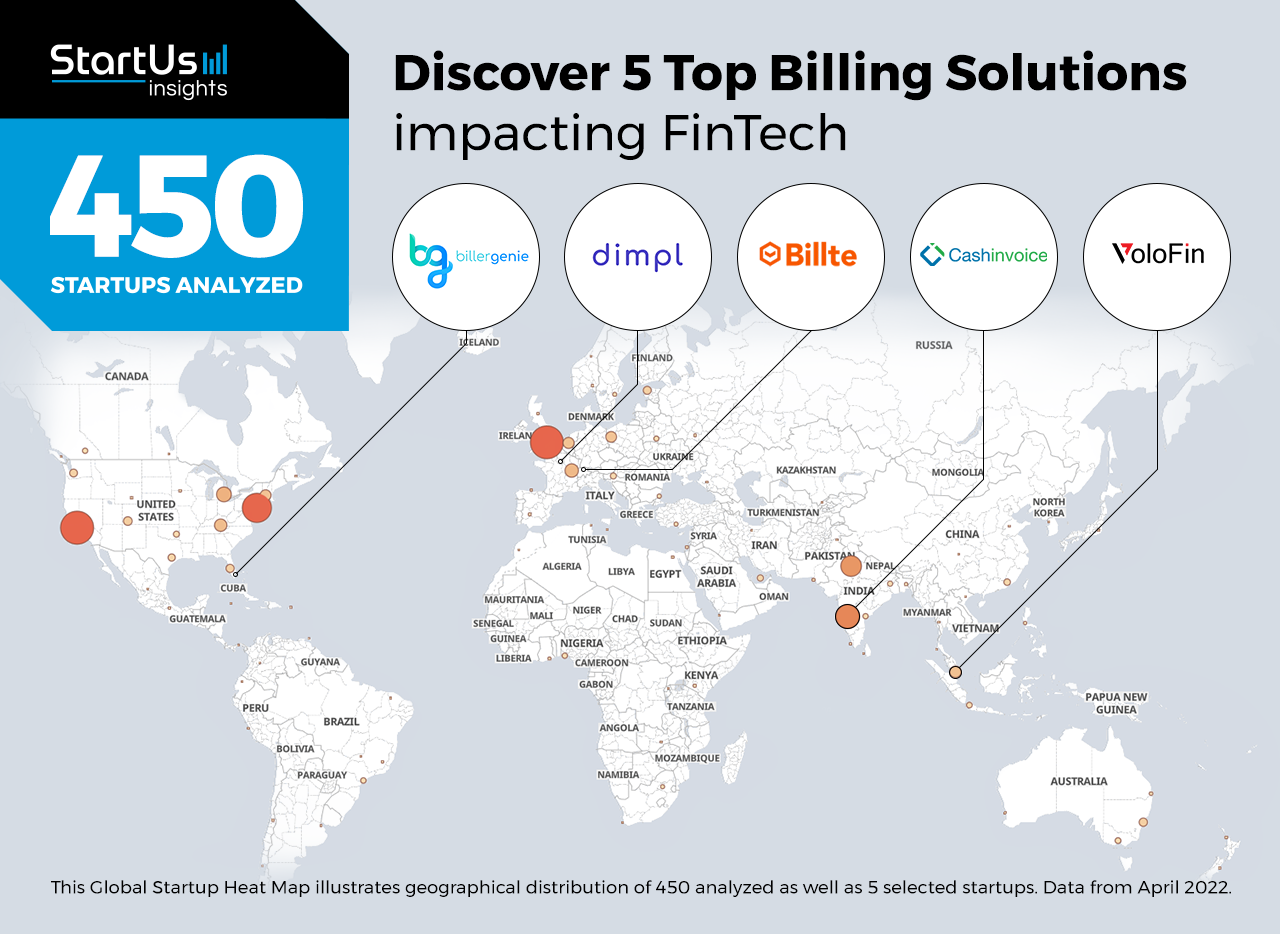

Out of 450, the Global Startup Heat Map highlights 5 Top Billing Solutions impacting FinTech

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 450 exemplary startups & scaleups we analyzed for this research. Further, it highlights five FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 455 billing solutions for FinTech companies, get in touch with us.

Biller Genie builds an Invoice Messenger Platform

Founding Year: 2018

Location: Miami, US

Funding: USD 3,5 M

Partner with Biller Genie for Zero-Cost Invoice Processing

Biller Genie is a US-based startup that provides an invoice messenger platform. It automatically sends invoices and reminders to customers with gentle prompts and progresses to more serious warnings beyond the due date. On receiving the payments, it sends invoices to the customers with a paid stamp. The software also features a customer portal, auto-pay systems, and integrated payments. These features enable small and medium-sized businesses (SMBs) to automate accounting while reducing cost and manual repetitive tasks.

VoloFin enables Blockchain-based Invoice Financing

Founding Year: 2020

Location: Singapore

Funding: USD 20 M

Innovate with VoloFin for Supply Chain Financing

Singaporean startup VoloFin offers blockchain-based invoice financing. Invoice financing is a way for businesses to borrow money against the amounts due from customers. SMBs submit a funding request against invoices on VolFin’s blockchain-protected platform. VolFin predicts the buyer risk while conducting an automated risk assessment and provides advances against these invoices with minimum interest. VolFin’s product, in turn, augments the current banking lines or replaces them entirely while exporting businesses utilize this solution for collateral-free financing.

Dimpl offers Invoice Insurance

Founding Year: 2018

Location: Paris, France

Funding: USD 4,7 M USD

Use this solution for Debt Risk Assessment

Dimpl is a French startup that offers an invoice insurance platform. It allows businesses to add invoices and insures them after checking the eligibility. At maturity, 90% of the invoice amount is paid to these businesses with the remaining 10% paid when the customer pays. This allows businesses to insure against late payments and non-payments as well as enables debt risk assessment for credit companies.

Cashinvoice provides an Early Payment Platform

Founding Year: 2018

Location: Mumbai, India

Funding: USD 1 M

Reach out to Cashinvoice for Automated Payment Workflows

Indian startup Cashinvoice provides PayEarly, an early payment platform that integrates with existing enterprise systems. It provides customized options for sellers to receive payments on invoices, offering cash discounts for early payments. PayEarly also allows sellers to access on-demand capital from suppliers through improved supplier relationships and favorable procurement terms. Additionally, the platform settles the payment between parties without any manual intervention. Supply chain stakeholders leverage this solution for strengthening trade relations and streamlining invoice settlement.

Billte offers an Invoice Management Platform

Founding Year: 2017

Location: Adliswil, Switzerland

Funding: USD 800 000

Partner with Billte for Consolidated Payment Channels

Billte is a Swiss startup that offers an invoice management platform to digitize billing processes. It converts unstructured invoices into e-bills and QR-coded bills. The platform then delivers invoices through multiple channels, such as SMS and email, as well as sends automatic reminders and generates real-time reports. Moreover, it tracks partial payments in different currencies, further improving efficiency and liquidity for SMBs.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on incentivization, risk management, robotic process automation (RPA), and blockchain. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore financial technologies in more detail, simply let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.