Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

We’ve published a brand-new, data-rich report on the Latest Banking Industry Trends.

Read the Updated 2025 Banking Industry Trend Report!

Technology in banking drives advancements in security, operational efficiency, and customer experience. Artificial intelligence (AI)-powered anti-money laundering (AML) and know-your-customer (KYC) solutions accelerate and enhance customer profile screening accuracy. Blockchain-enabled smart contracts further streamline financial transactions and improve transparency. This article examines the top 10 banking trends, including open banking, personalized services, the banking of things, and quantum computing. Each trend significantly influences business operations, shaping the future of the banking industry.

This article was last updated in August 2024.

Innovation Map outlines the Top 10 Banking Industry Trends & 20 Promising Startups

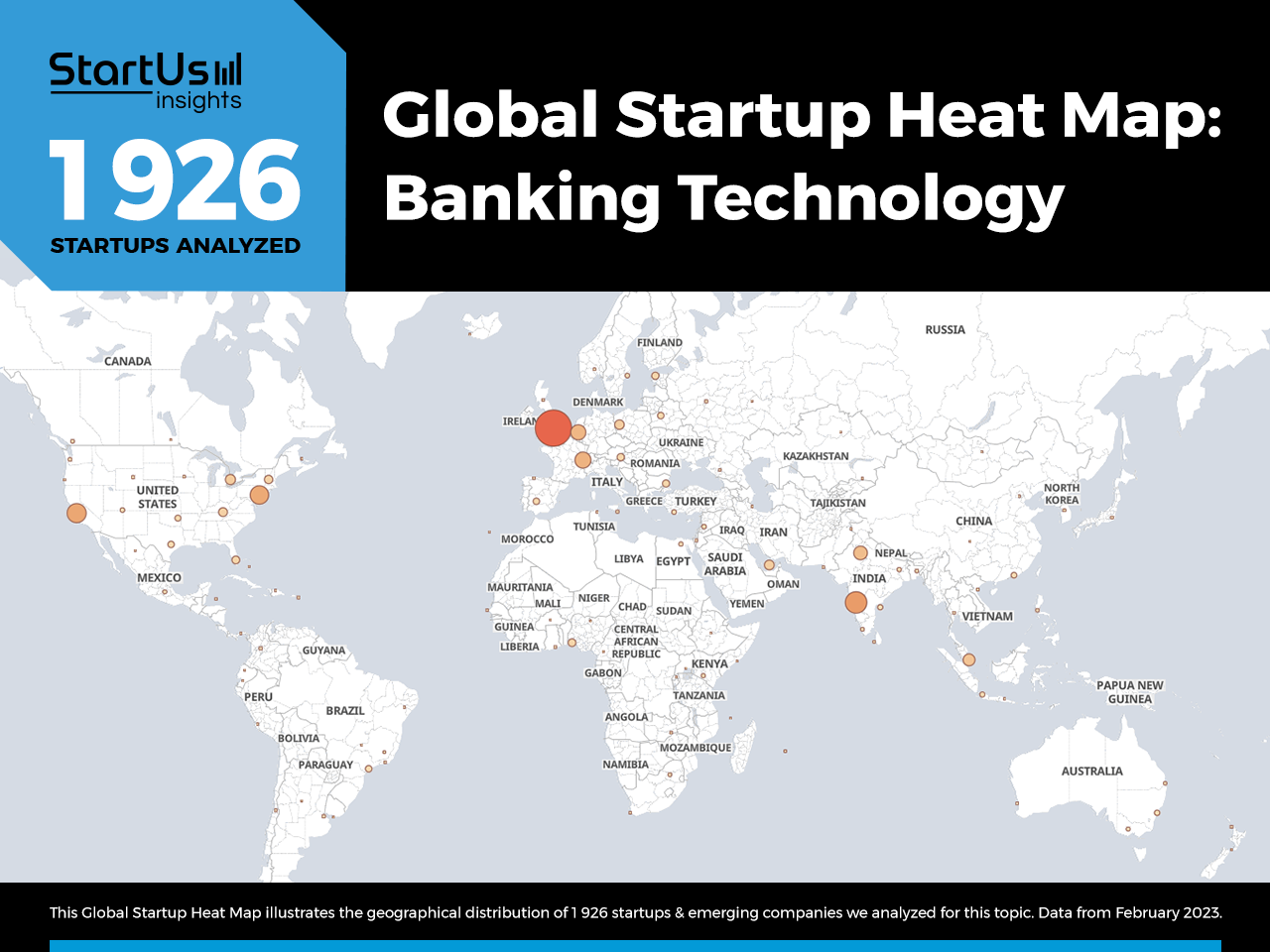

For this in-depth research on the Top Banking Technology Trends & Startups, we analyzed a sample of 1926 global startups & scaleups. This data-driven research provides innovation intelligence that helps you improve strategic decision-making by giving you an overview of emerging technologies in the banking industry. In the Banking Technology Innovation Map, you get a comprehensive overview of the innovation trends & startups that impact your company.

10 Emerging Banking Trends in 2025

- Artificial Intelligence

- Open Banking

- Hyper-Personalized Banking

- Blockchain

- Banking of Things

- Cybersecurity

- Immersive Technologies

- Banking Process Automation

- Neobanking

- Quantum Computing

Want to explore all banking innovations & trends?

These insights are derived by working with our Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 4.7M+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to identify relevant technologies and industry trends quickly & exhaustively.

Tree Map reveals the Impact of the Top 10 Banking Trends in 2025

Based on the Banking Innovation Map, the Tree Map below illustrates the impact of the Top 10 Bank Trends in 2025. AI allows banks to automate customer interactions using chatbots and virtual assistants. Open banking and hyper-personalized banking deliver unique customer experiences. Additionally, blockchain enhances the integrity of financial systems, whereas the Internet of Things (IoT) enables real-time response to financial transactions.

Cybersecurity solutions further protect banking systems from malicious hacks, viruses, data thefts, and unauthorized access. Besides, immersive technologies bring banks into the metaverse and improve customer engagement. Startups also offer robotic process automation (RPA) platforms that streamline banking processes. Lastly, neobanks offer digital, mobile-first financial services while quantum computing strengthens cybersecurity and forecasting accuracy.

Global Startup Heat Map covers 1926 Banking Technology Startups & Scaleups

The Global Startup Heat Map below highlights the global distribution of the 1926 exemplary startups & scaleups that we analyzed for this research. Created through the StartUs Insights Discovery Platform, the Heat Map reveals high startup activity in the UK, followed by India and the US. Below, you get to meet 20 out of these 1926 promising startups & scaleups as well as the solutions they develop. These banking technology startups are hand-picked based on criteria such as founding year, location, funding raised, & more. Depending on your specific needs, your top picks might look entirely different.

Top 10 Banking Innovations & Trends in 2025

1. Artificial Intelligence

AI banking provides high-quality banking services to customers and saves operating costs. AI-powered tools, such as virtual assistants and chatbots, automate customer service interactions. Additionally, they provide customers with account information and resolve account-related queries. AI-based biometrics detect fraud and improve security, as well as enhance AML applications and KYC checks.

Further, machine learning (ML) algorithms power alternate credit score modeling that aids banks in making better lending decisions. Computer vision-enabled tools also simplify document analysis, which assists banks in customer onboarding and compliance management. Moreover, AI analyzes massive financial datasets to improve risk assessment and financial forecasting, improving investing decisions.

Capton offers a Non-performing Loans (NPL) Warning System

US-based startup Capton develops NPL EWS, an early NPL warning system. It is an enterprise software application that allows banks to predict NPLs with high accuracy. For this, the software combines AI, machine learning, and behavior analytics on banking and dynamic external data.

Additionally, the system provides banks with global, regional, and branch-level NPL insights. As a result, the software enables banks to make faster loan decisions while reducing risks and increasing profitability.

Neocova simplifies Transaction Data Analysis

Neocova is a US-based startup that facilitates transaction data analysis. The startup’s AI and cloud-based platform streamlines customer data management. Moreover, it allows banks to better match customers with specific financial products, enabling highly-targeted cross-selling and driving revenue.

2. Open Banking

Open banking connects non-banking financial companies (NBFCs) and banks to provide customers with custom and more accessible financial services. Banking application programming interfaces (APIs) enable third-party developers to securely access customer financial data without compromising data compliance. Open banking also includes account aggregators that allow customers to manage all their banking accounts through a single platform.

APIs from banks also allow NBFCs to integrate banking functionality into their apps and services. This embedded banking enables NBFCs to verify customer information automatically, reducing the need for manual verification and accelerating customer verification. Moreover, open banking enables banking-as-a-service (BaaS) that allows banks to reach new customers through third parties and increase their revenue.

BirAPI builds Technical API Infrastructure

Turkish startup BirAPI makes solutions for banks to meet Payment Services Directive 2 (PSD2) and open banking requirements. They establish and secure interoperability channels between banks and consumers.

For example, the startup’s solution, Consent Management, takes into consideration PSD2 compatibility requirements and provides banks with tools to improve compliance management. Additionally, it offers developer portals, API gateways, and dashboard solutions for PSD2 compliance management.

FinanceKey simplifies Treasury Management

Finnish startup FinanceKey automates and centralizes treasury operations management. The startup’s software provides a dynamic dashboard for liquidity, payments, and compliance management. It delivers self-service reporting and real-time visibility into banking data, automating payment and treasury workflows.

Further, the software’s multi-bank connectivity allows banks to improve cost-effectiveness and enhance security.

3. Hyper-Personalized Banking

Providing a personalized banking experience improves customer retention. That is why banks now leverage various strategies and technologies, such as buy now pay later (BNPL), omnichannel banking, and financial advisory tools, to tailor their offerings. For instance, omnichannel banking provides a unified, customer-centric view of their financial information while allowing them to interact with banks via multiple channels.

Additionally, wealth management and financial advisory tools provide customized advice and investment guides, improving investor and customer satisfaction. Banks thus leverage AI and machine learning to provide such real-time personalized financial recommendations.

OneBanc Technologies specializes in Personalized Digital Banking

Indian startup OneBanc Technologies offers personalized digital banking. The startup’s AI-enabled digital platform acts as an interface between customers and banks. It captures and analyzes customer activity data for providing hyper-personalized banking experiences.

Further, the platform features contactless banking, automated tax benefits, and cash back on card purchases. Through personalized digital banking, the startup tailors customers’ financial needs to fit their lifestyles.

Genify simplifies Personal Finance Management

Genify, a UAE-based startup, provides AI Personal Financial Manager API, an application programming interface. The startup’s machine learning models and intelligent rule-based system power its API to provide insights into spending and budgeting. This allows banks to deliver customized financial guidance.

The startup’s automatic budgeting system calculates personalized monthly budgets at an individual level. Banks use the startup’s software dashboard, Genify Dashboard, to customize API and monitor customer engagement. With the startup’s API, banks cater to their customers’ specific needs and provide personalized financial management services.

4. Blockchain Banking

Blockchain provides tamper-proof records of all financial transactions and improves transactional transparency and security. Further, it improves trade efficiency through transaction automation as well as streamlines manual and paper-based operations. Smart contracts automate financial transactions and improve the performance of financial contracts.

Smart contracts also eliminate the need for intermediaries and enable peer-to-peer (P2P) payments. This greatly enhances the speed and efficiency of transactions, especially cross-border payments. Moreover, decentralized finance (DeFi) leverages blockchain to make financial services more accessible while lowering transaction fees.

BankSocial provides Decentralized Finance

BankSocial is a US-based startup that advances decentralized finance. The company offers a range of financial solutions, including a self-custody crypto exchange, streamlined user verification, and asset-backed lending. Its platform also uses blockchain to ensure secure, transparent, and instant financial transactions. This enables credit unions to provide tailored products and services. By offering decentralized financial services, BankSocial allows credit unions to enhance customer experience.

SQ Solutions facilitates Decentralized Investment Banking

SQ Solutions is a German startup that makes QWICSChain, a smart, distributed asset exchange and trading platform. It uses blockchain and smart contracts to improve settlement processes for banks. The startup’s platform integrates into existing banking platforms to enable secure investment banking.

Additionally, the P2P distributed ledger allows users to exchange and trade digital assets in near real-time. Lastly, the platform features a built-in cryptocurrency to simplify payment execution.

5. Banking of Things

The banking industry is adopting IoT for efficient data collection. This automates data acquisition for streamlining banking processes, such as KYC and lending, to enable real-time event response. For example, IoT-enabled smart automated teller machines (ATMs) send alerts for low cash levels and malfunctions, ensuring timely maintenance.

Also, IoT-enabled digital wallets integrated into mobile phones and smartwatches enable customers to make purchases. Since connected devices deliver customer-specific data in real-time, IoT in banking aids fraud detection and, in turn, mitigates loss.

SensePass provides Secure IOT Payments

SensePass is an Israeli startup that streamlines digital payments to improve customer experiences. The startup’s omnichannel payments network operates around different digital wallets. It offers payment gateway software, SensePay, and an IoT-enabled device, SensePass.

Customers use the device to make contactless payments. The software’s dashboard also provides information on digital payments across various touchpoints, including terminals and QR stickers. Using the startup’s system, banks are able to better manage payment activities.

IndyKite aids Customer Onboarding

US-based startup IndyKite develops a decentralized identity platform based on a model handling various identities, including device or non-human entities. It is built for open banking and utilizes a knowledge graph to connect entities and their relationships in a real-world network.

Devices and non-human entities learn access controls directly from the network without human intervention. This enhances security and streamlines identity management for banks. Hence, by leveraging IoT, the startup provides digital identity solutions for customer onboarding.

Find out how 10 emerging technologies shape your industry!

6. Cybersecurity

The banking industry handles massive amounts of sensitive customer and transactional data. This makes its IT infrastructure a popular target for cybercriminals. To tackle this, startups provide security protocols and data compliance management tailored for banking systems. Such cybersecurity solutions enable banks to safeguard sensitive data.

Data encryption tools further extend this, reducing the risks of data leaks. AI-powered fraud detection identifies and prevents suspicious activities such as identity theft and phishing scams. Banks also leverage anti-hacking software to protect networks from unauthorized access. These features help banks in improving threat detection and response.

Airome Technologies improves Banking Fraud Prevention

Singaporean startup Airome Technologies aids banking fraud prevention. The startup’s Fraud Hunting Platform is a client-side fraud and attack prevention system and PayConfirm is a mobile transaction authentication signature platform. Banks integrate them into mobile banking apps to simplify transaction authorization through smartphones.

This makes transaction processes secure and cost-effective for banks. Further, these platforms detect signs of fraud in real-time and identify attempts to steal or use compromised credentials, banking Trojans, and web injections. This results in added security for banks and their customers.

Finosec simplifies Cybersecurity Governance

US-based startup Finosec provides Governance Automation, a cybersecurity governance platform. It applies a five-step process that includes system map documentation, gap analysis, governance automation, user access control, and cybersecurity maturity tracking. This allows banks to enhance the efficiency and effectiveness of cybersecurity programs.

Additionally, it offers various features such as automated risk assessment, policy drafts and approvals, board reporting and training, program tracking, and audit reporting. These features create a more secure financial environment while providing a detailed view of the system. This allows banks to identify and address potential vulnerabilities.

7. Immersive Technologies

Immersive technologies deliver personalized and interactive customer experience. Augmented reality (AR) and virtual reality (VR) optimize the interactions between banks and customers. VR allows banks to train employees on various banking procedures, products, and regulations in interactive environments. For instance, these technologies power virtual showrooms, where customers explore vehicles in a virtual environment and banks streamline the loan application process.

Moreover, metaverse banks allow customers to interact with banks in virtual environments. By leveraging immersive technologies, banks thus ensure a more engaging customer experience to increase customer satisfaction and loyalty.

Runvido offers AR-powered Customer Interactions

Polish startup Runvido develops an AR-based solution for banks to interact with customers. The startup’s application allows banks to animate static images, such as the image on credit cards, using smartphones. It also detects the user’s phone language and displays content accordingly.

The app delivers interactive content depending on user location and provides customer involvement insights to banks. Banks use the startup’s application for engaging customers with interactive content and improving their marketing efforts.

Invinciblemeta provides Banking Metaverse

Invinciblemeta builds a banking metaverse. The company’s VR platform enables users to navigate a virtual bank environment, interact with their accounts, and perform transactions in an immersive setting. Its key features include real-time virtual assistance, interactive 3D environments for personalized banking services, and secure transactions through advanced encryption. By providing an engaging banking experience, Invinciblemeta enhances user convenience and accessibility.

8. Banking Process Automation

Banks automate repetitive and time-consuming tasks through the use of software robots. They provide a competitive advantage to banks as their employees are able to focus on more critical tasks. Further, RPA-based accounts payable solutions automate tasks like invoice processing, payment approvals, and reconciliation. Banking process automation (BPA) also involves automating mortgage processing, including evaluating and disbursing loans to customers.

Banks use RPA to process credit cards to identify fraud and detect suspicious transactions. This reduces application processing times while improving compliance and security. Moreover, RPA streamlines data collection and improves data-driven decision-making.

Flobotics provides Banking Software Bots

Flobotics is a US-based startup that provides software bots for banks to automate operations. They automate tasks such as mortgage lending, loan initiation, document processing, transaction monitoring, financial comparisons, and quality control. The bots assist banks in building an RPA system that reduces human errors and improves operational accuracy.

Moreover, this results in smoother workloads, higher team satisfaction, and better client service. The startup’s RPA solution enables banks to interconnect their systems and decrease operational costs.

Numeral optimizes Payment Management for Agency Banking

Numeral is a French startup that provides a payments management solution for agency banking. It allows banks to control outgoing and incoming Bacs and Faster Payment System (FPS) payment flows. It also collects payment reports to automate Bacs and FPS payment operations and reconciliations.

Further, the solution supports interbank payments and programmatic treasury management. It thus enables banks to centralize payments management while extending their service through agency banking and avoiding expensive in-house software development.

9. Neobanking

Neobanking enables a digital-only presence for banks, minimizing capital and operating expenses. It offers a seamless and integrated banking experience to customers through cloud computing, open API, and more. Additionally, neobanks support a range of services from automated reconciliation and payroll management to integrated workflow management.

Digital-only banks ensure customer convenience by enabling them to access services on-demand and across platforms. Neobanks also feature lower fees as they require less capital and operational expenses compared to traditional banks.

Finture provides a Buy Now Pay Later (BNPL) Financing Aggregator Platform

Finture is an Indonesian startup that offers Yup, a financial aggregator. It links customers with pay-later products from licensed financial service providers. The platform also partners with these institutions to offer loan limits on card payments.

It delivers various services, such as loan approval and late payment penalties, through its financing partners. The startup thus enables banks to offer a wide range of payment options as well as credit products and services to customers.

Techno Tara builds a Hybrid Neobank

Techno Tara is an Indian startup that develops Genie Moneyy, a hybrid neobank. The startup’s smartphone app allows customers to create bank accounts. It integrates the services of conventional banks like accounts, deposits, credit cards, loans, insurance, investments, and more.

The startup thus bridges the gap between conventional and novel banking systems to make the transition to digital platforms smoother, improving financial inclusion.

10. Quantum Computing

With traditional computing, processing huge amounts of data is resource and time-intensive. Quantum computing solves this problem by offering faster, more efficient, and more secure computing. It assists banks in optimizing their portfolios and making accurate financial predictions.

Startups are thus developing cost-effective quantum computers. They assist banks in derivative pricing and improving their cybersecurity programs.

Qaisec employs Quantum Encryption

Bulgarian startup Qaisec delivers quantum encryption solutions for banks, such as the quantum encrypted blockchain (QEB). The startup conducts thorough security assessments of banks’ digital networks and databases. It then formulates a solution that protects them against quantum security threats.

This enables banks to maintain system integrity and ensure protection against quantum decryption attacks and make their infrastructure quantum-proof.

Quantum Mads offers Quantum Software as a Service (QSaaS)

Spanish startup Quantum Mads offers its hybrid QSaaS tool for the financial sector. It combines quantum optimization, simulation, and machine learning to assist banks with a variety of applications. They include portfolio allocation, index tracking, fraud detection, pricing derivatives, and synthetic markets.

The startup’s solution, Q-Allocate, uses advanced algorithms to optimize investment portfolios. This results in portfolios that are better optimized for return-to-volatility, leading to substantial improvements in investment values.

Discover all the Latest Trends in Banking Technology

The trends discussed above, like open banking and AI, along with big data and analytics are increasing operational efficiency in the banking industry. These technologies mitigate security breaches, improve customer satisfaction, and enhance regulatory compliance. Banks are also implementing cloud banking to improve operational speed and enhance data security

The Banking Technology Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Among others, open, sustainable, and decentralized banking will transform the sector as we know it today. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage. Get in touch to easily & exhaustively scout startups, technologies & trends that matter to you!

WATCH THE VIDEO VERSION

WATCH THE VIDEO VERSION