Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The alcoholic beverage industry is undergoing a strategic evolution as businesses are shifting market dynamics around quality, experience, and sustainability. Major alcohol trends, such as premiumization, immersive alcohol experiences, cannabis-infused beverages, and farm-to-glass brewing, are improving production models, brand positioning, and value chain integration.

These developments enable producers to differentiate offerings, increase margins, and build stronger engagement across niche and mainstream markets. Reflecting this momentum, the global alcoholic beverages market is projected to reach USD 2.88 trillion by 2033, growing at a compound annual growth rate (CAGR) of 5.02% from 2025 onwards.

What are the Top 10 Alcohol Trends & Innovations in 2025?

- Premiumization

- AI-enhanced Brewing

- Low Alcohol by Volume (ABV) Drinks

- Functional Alcoholic Beverages

- Immersive Alcohol Experiences

- Blockchain Authentication

- Ready-to-Drink (RTD) Cocktails

- Cannabis-Infused Drinks

- Farm-to-Glass Brewing

- Experimental Flavors and Ingredients

Methodology: How We Created the Alcohol Industry Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 7M+ global startups, 20K technologies & trends plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the alcohol industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the alcohol industry innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 10 Alcohol Industry Trends & 20 Promising Startups

For this in-depth research on the Top Liquor Trends & Startups, we analyzed a sample of 6722 global startups & scaleups. The Alcohol Industry Innovation Map, created from this data-driven research, helps you improve strategic decision-making by giving you a comprehensive overview of the liquor industry trends & startups that impact your company.

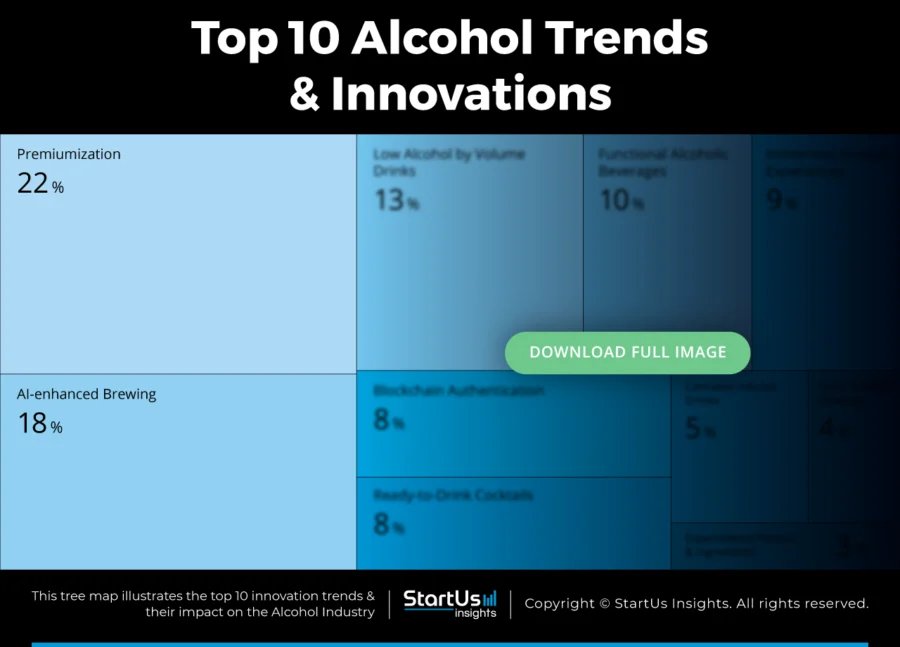

Tree Map reveals the Impact of the Top 10 Trends in the Alcohol Industry

The Alcohol Industry Tree Map highlights the Top 10 Alcohol Trends shaping 2025. These include premiumization, AI-enhanced brewing, low ABV drinks, and functional alcoholic beverages. The industry also focuses on blockchain, cannabis-infused drinks, farm-to-glass brewing, RTD cocktails, immersive alcohol experiences, and more. These trends reflect how the industry responds to changing consumer preferences while using innovation to redefine alcohol production, consumption, and experiences.

Global Startup Heat Map covers 6722 Alcohol Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 6722 exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the US and the UK, followed by India and France. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Alcohol Industry Innovations & Trends?

Top 10 Emerging Alcohol Trends [2025 and Beyond]

1. Premiumization

Consumers now prioritize quality over quantity and prefer more premium options. CGA reports that 54% of 18–34-year-olds prefer premium drinks, compared to 35% of those over 55. Similarly, a Bacardi survey found that 41% of US consumers aged 21–44 plan to seek more premium spirits.

Moreover, economic growth, especially in emerging markets like India, increases disposable income. This financial uplift encourages consumers to explore premium alcoholic options.

Research and Markets forecasts that the alcoholic beverages market will rise from USD 1.85 trillion in 2024 to USD 2.88 trillion by 2033, growing at a CAGR of 5.02%.

Health-conscious consumers also drive demand for premium low and no-alcohol beverages. Baileys addresses this demand by launching non-dairy liqueurs that use oat milk.

Solutions like high-quality ready-to-drink cocktails further serve consumers who want convenience without sacrificing taste. For example, Absolut partnered with Ocean Spray to launch premium RTD cocktails that blend quality spirits with natural mixers.

Additionally, companies use artificial intelligence (AI) to analyze consumer preferences and deliver personalized recommendations. This improves customer experience and increases sales by matching products with individual tastes. For instance, Diageo’s FlavorPrint AI platform profiles consumers and suggests whisky options that suit their preferences.

Online sales platforms expand brand reach by enabling direct consumer access and offering convenient, personalized shopping experiences. ReserveBar sells premium spirits, wines, and champagnes through its online marketplace. It also partners with celebrities like Bruno Mars and Ryan Reynolds to offer exclusive, high-end products. These collaborations result in premium pricing and heightened demand for premium alcoholic beverages.

Eltom Distillery manufactures Premium Spirits

Eltom Distillery is a New Zealand-based startup that produces premium gin and single malt whiskeys using its Reactory technology. This technology improves the maturation process by precisely controlling temperature and pressure within stainless steel reactors instead of traditional wooden barrels.

Additionally, the maturation process combines unaged spirits with high-quality oak to replicate the chemical interactions of conventional aging. This results in matured products within days rather than years. By avoiding barrels, the startup reduces wood usage, yielding more spirit per tree.

This also minimizes environmental impact by decreasing shipping requirements and lowering CO2 emissions. Moreover, all offerings are crafted without additives, colorants, or added sugars.

Titanic Distillers produces a Premium Irish Whiskey

UK-based startup Titanic Distillers manufactures premium Irish spirits by blending traditional craftsmanship with contemporary techniques. The startup blends Irish grain whiskey, triple-distilled malt, and peated spirit to create a balanced and versatile spirit with light vanilla notes, rich spice, and a hint of peat smoke.

It also offers a limited-edition premium blended Irish whiskey that pays tribute to Northern Ireland’s historic 1982 World Cup victory. Additionally, Titanic Distillers produces premium Irish vodka crafted from sugar beet and pure Irish spring water. It offers a clean, smooth profile with a zesty citrus tang and a peppercorn finish.

Further, Titanic Distillers offers immersive experiences through guided tours of its distillery and the historic Pumphouse. These tours provide insights into distilling heritage and include sensory tastings of its spirits.

2. AI-enhanced Brewing

Brewers leverage AI to analyze large datasets of ingredients, flavor compounds, and consumer preferences. This allows brewers to create new recipes rapidly. Atwater Brewery has an artificial intelligence IPA that uses ChatGPT to generate the recipe. This showcases AI’s role in modern brewing.

AI also enables brewers to fine-tune flavor profiles and maintain consistency. KU Leuven researchers are studying 250 beers and finding taste-enhancing compounds such as lactic acid and glycerol. By adjusting these components, they are improving beer flavor and consumer appreciation. For example, Sugar Creek Brewing Company uses AI and Internet of Things (IoT) devices to monitor beer quality parameters like temperature, fill level, and foam.

Moreover, AI offers personalized consumer interactions by analyzing preferences and providing tailored recommendations. Pernod Ricard uses AI to predict flavor trends and develop products like Buchanan’s pineapple-flavored Scotch.

Similarly, Ashland Brewing Company launched SomAI, a generative AI solution that provides real-time pairing suggestions for food, drinks, and cigars.

Additionally, alcoholic beverage retailers and manufacturers leverage generative AI to forecast demand and manage inventory efficiently. This innovation is improving inventory from a cost center to a competitive advantage.

Breweries also implement machine learning to monitor fermentation processes. This ensures optimal flavor development and consistency across batches. Deschutes Brewery implements a machine-learning system to increase fermentation capacity. This allows the brewery to delay infrastructure expansion plans.

Breweries are adopting AI for packaging design. The Whisky Exchange uses AI to design labels for a luxury collection of The Glenlivet 50-year-old single malt. Further, Turning Point Brew uses AI-generated imagery for the beer labels to offer distinctive and cost-effective branding.

Deep Liquid facilitates AI-powered Craft Beer Development

Australian startup Deep Liquid develops an AI-powered brewing platform that enables craft breweries to create personalized beers based on real-time consumer feedback.

The startup’s brewing platform integrates machine-learning models with direct input from brewers and consumers, collected via QR code-linked reviews. This allows the AI to analyze preferences, suggest recipe adjustments, and facilitate a collaborative product development process.

Further, Deep Liquid leverages data-driven insights to allow small and medium-sized breweries to improve product-market fit. It also streamlines research and development processes, enabling these breweries to maintain competitiveness in a challenging market.

AEDDIX Systems promotes Autopilot Brewing & AI-Driven Recipes

Austrian startup AEDDIX Systems offers an AI-enhanced brewing technology that integrates Internet of Things (IoT) hardware with intelligent software. The company uses this system to automate and monitor the beer fermentation process.

Moreover, the startup employs sensors and adaptive firmware to control variables, like temperature and yeast activity. This enables remote adjustments through a cloud platform and ensures real-time analytics and over-the-air updates.

Further, the solution maintains resilience against connectivity interruptions and facilitates consistent brewing outcomes.

3. Low Alcohol by Volume Drinks

Consumers seek healthier lifestyles, which prompts a shift towards low-ABV beverages. They are also choosing low-ABV drinks that offer both flavor and functional benefits. For instance, flavored alcoholic beverages make up 34% of low and no-alcohol product launches. Producers use botanical ingredients and functional additives like adaptogens and cannabidiol (CBD).

Moreover, social drinking habits are evolving as more consumers are adopting zebra striping, which is alternating between alcoholic and non-alcoholic drinks. Sales of low and no-alcohol beer in the UK rose by 20% in the last year. This indicates a broader acceptance of these beverages during festive occasions.

The low alcohol beverage market size is projected to grow from USD 1.41 billion in 2025 to USD 1.76 billion in 2029 at a CAGR of 5.5%.

Source: The Business Research Company

Producers utilize vacuum distillation and reverse osmosis to remove alcohol while preserving flavor. These methods prevent flavor degradation by operating at lower temperatures. AB InBev invested EUR 31 million to improve non-alcoholic brewing technologies in Belgium.

Additionally, beverage companies utilize adaptogens and botanicals to offer functional benefits. Katy Perry’s De Soi blends reishi mushroom, lion’s mane, and L-theanine to mimic the relaxing effects of wine.

Brewers also employ specialized yeast strains that produce less alcohol during fermentation. This allows the creation of low-ABV beers without post-fermentation alcohol removal. Craft breweries, like Athletic Brewing, use this method to produce flavorful low-alcohol beers.

Further, brands use digital platforms like The Zero Proof, which has an e-commerce platform to educate consumers about low-ABV options and gather feedback.

Wilda creates Bee-Friendly Natural Spritzers

Canadian startup Wilda produces low-alcohol beverages that blend honey and fresh-pressed juices to create natural spritzers and brews. It formulates drinks using minimal ingredients while avoiding artificial flavors and stevia and minimizing sugar and calorie content.

CALOW specializes in Light & Low-Calorie Spritzers

German startup CALOW produces low-alcohol, ready-to-drink wine spritzers. It blends wine with natural fruit flavors and carbonated water to create beverages containing 4% or 6% alcohol by volume. These spritzers are vegan, gluten-free, and contain no added sugar, in turn, resulting in less sugar and fewer calories.

Further, the company crafts flavors, like peach-mint-ginger and raspberry-elderberry-pomegranate, to provide a lighter alternative to traditional aperitifs.

4. Functional Alcoholic Beverages

Consumers demand drinks that support mental clarity, stress relief, or digestive health. Hence, brands are introducing functional alcoholic beverages to align with growing wellness trends. Odyssey Elixir recently launched mushroom-based hard tonics infused with Lion’s Mane and Cordyceps. The company claims these drinks offer cognitive and energy-boosting effects.

IWSR data shows that 13% of US drinkers consume both full-strength and no-alcohol products, up from 7%. Millennials lead with 22% participation, followed by Gen Z at 15% and Gen X at 11%.

Moreover, Gen Z and millennials are adopting moderation and purpose-driven consumption. They are seeking drinks that do more than intoxicate. 65% of Gen Z and 57% of millennials plan to reduce their alcohol intake in 2025. Also, 39% of Gen Z are intending to adopt a fully alcohol-free lifestyle throughout the year.

Nootropic-infused alcohol combines ingredients like L-theanine, GABA, and 5-HTP to promote mental clarity and reduce stress. Forbes reports an uptick in demand for alcohol with cognitive-enhancing ingredients among Gen Z.

Additionally, adaptogenic alcoholic drinks use herbs like ashwagandha and holy basil to allow the body to manage stress. Three Spirit utilizes functional botanicals and adaptogens in its Livener and Nightcap collections.

Electrolyte-fortified hard seltzers replenish hydration during social drinking and also reduce hangovers. Further, vitamin-enhanced cocktails that include vitamins B, C, and D support immunity and mood regulation. For example, Boisson Functional Spirits introduces cocktails fortified with immune-supporting nutrients.

Plant Botanical manufactures Sorghum Grass-based Vodka

US-based startup Plant Botanical produces vodka from sustainably grown sorghum grass. It also infuses vodka with botanicals like dandelion root, angelica root, ginseng, and goji berries. These ingredients contribute to the vodka’s special flavor profile and align with the startup’s focus on health-conscious consumption.

Additionally, the product line includes sorghum vodka and ready-to-drink vodka seltzers in flavors like passion fruit pear, pineapple lemonade, strawberry mint, and blood orange lime. All these products are made without added sugars or artificial additives.

Thrive offers Protein & Vitamin-enriched Beers

Belgian startup Thrive makes functional alcohol-free beers. It brews using traditional ingredients like water, barley malt, wheat malt, hops, and yeast. These ingredients enrich each variant with targeted nutrients.

Its product, Thrive Peak, incorporates whey protein to support muscle recovery post-exercise. Another product, Thrive Play, adds a blend of vitamins B, D, A, C, and E to promote energy metabolism and immune function.

Moreover, Thrive Unwind infuses magnesium for relaxation and to reduce stress. All products contain no added sugars, preservatives, or artificial flavors, and maintain a low-calorie profile.

5. Immersive Alcohol Experiences

Alcoholic beverage businesses use immersive events to strengthen emotional connections with consumers. These experiences allow consumers to interact directly with products, stories, and values.

Immersive content enabled by augmented reality (AR) and virtual reality (VR) allows brands to stand out in a crowded market. They combine entertainment, storytelling, and interactivity into tasting events, pop-ups, and digital experiences. This also includes the integration of cultural, historical, and artisanal elements into local experiences that attract tourists and locals.

The global whiskey tourism market is expected to reach USD 36.3 million by 2030. It is expected to grow at a CAGR of 9.6% by 2030.

Moreover, immersive experiences allow alcohol brands to deliver education through sensory journeys. These journeys explain ingredients, distillation, terroir, or heritage to improve customer engagement.

Companies are also integrating AR into packaging to deliver interactive experiences. For instance, Bombay Sapphire’s AR labels provide cocktail recipes and brand narratives upon scanning.

Additionally, VR immerses consumers in the alcohol production journey. The Macallan‘s Rare Journey VR experience takes alcohol beverage consumers from oak forests to Scottish distilleries.

Additionally, distilleries employ AR to improve on-site experiences. Beam Suntory‘s Hakushu distillery in Japan offers AR journeys through forest-grown ingredients.

Further, AI-powered mixologists offer personalized drink recommendations. Diageo‘s pilot in India features an AI bartender that adjusts recipes in real-time based on preferences.

Alcohol brands also create virtual replicas of their facilities. The Macallan‘s Gallery 12 uses Microsoft HoloLens to offer virtual tours of their whisky-making process.

littlewine.io delivers a Microlearning Platform for Winemakers

UK-based startup littlewine.io provides an immersive digital platform that connects wine professionals with winemakers’ stories, philosophies, and vineyards. It enables winemakers to share information about their wine tank, viticultural practices, and terroir through videos, images, and text.

Moreover, the platform features virtual vineyard mapping, EU-compliant e-labels, and structured wine data management. This facilitates accurate and engaging communication.

By centralizing authentic narratives and technical details, the company improves global understanding and appreciation of wines. Further, the platform enables informed connections between producers and their audiences.

Copper Compass Craft Distilling enhances Distillery Tours

US-based startup Copper Compass Craft Distilling produces small-batch rum and curates immersive spirits education experiences. Its platinum, coconut, whiskey barrel spiced, and lemon drop rums utilize traditional distillation techniques and natural ingredients.

Additionally, the startup offers guided distillery tours and tasting sessions that walk guests through the production process, from fermentation to bottling. It also hosts private mixology classes and rum distillation workshops to provide hands-on learning opportunities for enthusiasts.

6. Blockchain Authentication

Estimates suggest counterfeiters fake up to 20% of wine sold globally, making it a major issue in the alcohol industry. Blockchain provides a tamper-proof ledger that records every step of a bottle’s journey. This offers authenticity in the alcoholic beverage market and mitigates counterfeits.

The blockchain technology enables real-time tracking of products, from vineyards to consumers. This offers transparency and quality control in the production process. WiV Technology, for example, collaborates with Georgian wine producers to create a blockchain-based trading platform. This improves traceability and reduces fraud.

Brands, like Crurated, assign each wine bottle a non-fungible token (NFT) and embed near field communication (NFC) tags in the seal. It creates a digital passport that tracks the bottle from production to consumption. This system increases authenticity and reduces the risk of counterfeiting.

Moreover, dVIN recently announced its digital cork NFT, a decentralized proof of ownership for luxury wine. This digital certificate provides a transparent chain of ownership and allows consumers to track the journey of a bottle from grape to glass.

Additionally, combining AI and blockchain allows brands to fight against wine fraud. AI algorithms analyze data for anomalies, while blockchain offers secure and transparent record-keeping.

Further, BlockCellar, in partnership with Bordeaux Index, tokenizes fine wines and spirits. This method maintains a secure record of provenance and opens new avenues for investment in the wine industry.

Native Digital specializes in a Product Authentication Solution

Swiss startup Native Digital develops Smart Dust DNA, a radio-frequency-based authentication technology. It embeds a digital fingerprint into physical products. The technology disperses micro radio-frequency identification (RFID) transponders within physical products. These transponders’ identifiers, energy signatures, and spatial relationships collectively generate a distinct electromagnetic pattern.

Each transponder stores an encrypted version of this pattern and forms a distributed memory. The startup links a physical item’s fingerprint to an NFT to create a secure digital match. This ensures the link remains tamper-proof and verifiable. Further, the technology improves authentication and traceability while connecting physical assets to decentralized systems.

Tracestory provides a Collaborative Traceability Platform

Argentinian startup Tracestory builds a blockchain-integrated traceability platform for beer production. It records and authenticates each stage, from barley cultivation to final packaging. The platform captures production events and stores them on a tamper-evident digital ledger. This enables stakeholders to access verified data through a user-friendly dashboard.

Tracestory assigns digital identities to production batches to offer data integrity and ownership. Further, businesses verify product origins by scanning a QR code on the packaging. The platform’s cloud-based architecture facilitates smooth integration without altering existing production processes.

7. Ready-to-Drink Cocktails

Modern consumers prioritize convenience in their beverage choices. RTD cocktails cater to this demand by offering ready-made, portable options that fit busy lifestyles.

The global RTD cocktails market is projected to grow at a CAGR of 15.4% from 2025 to 2030.

Moreover, RTD cocktails provide an accessible entry point to premium spirits without purchasing full-sized bottles. This affordability allows consumers to enjoy high-quality products while avoiding major financial commitments.

The rise of health consciousness also allows consumers to opt for beverages with lower calories and sugar content. RTD cocktails are offering options that align with these preferences. A noteworthy example is Onda tequila seltzer blood orange. It is a 100-calorie, zero-sugar RTD that appeals to health-conscious drinkers.

Additionally, alcohol manufacturers are adopting innovative canning and bottling techniques. These advances allow for the preservation of complex cocktail profiles without compromising taste.

RTD cocktails emulate the quality of bartender-made drinks. Collaborations with mixologists and the use of high-quality spirits are further improving the RTD experience. Tom Savano, in partnership with Virgin Atlantic Airlines, launched an RTD cocktail, the Virgin Redhead. This collaboration emphasizes the alcohol brand’s commitment to quality and innovation in the RTD space.

Further, e-commerce and direct-to-consumer (DTC) models are making RTD cocktails more accessible. Alcohol brands like Jim Beam Kentucky Coolers are using online platforms to reach a broader audience and facilitate convenient purchasing options.

Bold Drinks creates Ready-to-Drink Canned Cocktails

Spanish startup Bold Drinks produces ready-to-drink cocktails that blend premium spirits with distinctive flavors. They are packaged in recyclable cans for both convenience and sustainability.

The startup crafts beverages by combining ingredients like blackberry, lemongrass, cardamom, apple, and tarragon. These blends deliver bar-quality cocktails in a portable format.

MAISON COCKTAIL yields Ready-to-Drink Craft Cocktails

French startup MAISON COCKTAIL offers ready-to-drink craft cocktails. The startup combines selected spirits with fresh, natural ingredients. This allows for immediate consumption without additional mixing.

Moreover, the startp’s offerings include the Raspberry Daiquiri and several COCKORICO variants such as Moscow Mule, South Beach, and Sex on the Beach. Each maintains consistent alcohol content and flavor profiles.

8. Cannabis-Infused Drinks

Cannabis-infused beverages offer a low-calorie and hangover-free experience, making them appealing to consumers exploring moderation. CivicScience reports that 25% of Americans over 21 joined Dry January, and 19% replaced alcohol with cannabis products.

The global cannabis beverages market size is projected to grow from USD 3.09 billion in 2024 to USD 117.05 billion by 2032, at a CAGR of 57.50% during 2024-2032.

Source: Fortune Business Insights

Moreover, as cannabis legalization expands in nations like Germany and Ukraine, alcohol companies are capitalizing on emerging markets. Michigan’s Cannabis Regulatory Agency reported a 31% increase in customer spending on cannabis-infused beverages.

Innovations in emulsification and nanoemulsion technologies are also improving the onset time of cannabis-infused beverages.

Alcohol manufacturers employ nanoemulsion techniques to break down cannabinoids into nano-sized droplets. This results in faster onset times and more consistent effects. For instance, nano-emulsified tetrahydrocannabinol (THC) beverages deliver effects within 10 minutes – faster than the usual 30 minutes or more.

Additionally, ultrasonic homogenizers use high-frequency sound waves to create uniform emulsions. This provides consistent potency and stability in cannabis-infused drinks.

Microfluidization involves forcing liquid through microchannels at high pressure. This method increases the stability and clarity of cannabis beverages while improving their aesthetic appeal and shelf life.

Further, encapsulation involves enclosing cannabinoids within a carrier material. This technology allows for precise dosing and improves taste masking in cannabis-infused drinks. One notable example is Aurora Cannabis leveraging encapsulation technology in drinks like Neon Rush and Strawberry Pineapple Tropical Fizz.

Incognito makes Cannabis-Infused Cocktails

US-based startup Incognito produces cannabis-infused sparkling beverages that offer a non-alcoholic alternative to traditional cocktails. The startup offers four products, including cucumber mint lemonade and grapefruit rose lychee.

Each contains 5mg of tetrahydrocannabinol (THC) and 5mg of cannabidiol (CBD) per 12-ounce can. The company also provides a mixed pack featuring both flavors and a mixed spritz 4-pack with two cans.

Moreover, each beverage contains less than 0.3% THC, is low in calories, and is crafted by master mixologists to ensure consistent quality and taste. By providing a refined, alcohol-free option, Incognito ensures a flavorful and sociable drinking experience.

Nowadays manufactures Cannabis-Infused Spirits

US-based startup Nowadays develops cannabis-infused spirits that provide a controlled, alcohol-free alternative for social drinking. The startup crafts its beverages by blending precise doses of hemp-derived THC with natural fruit flavors.

Moreover, the product delivers effects within approximately 15 minutes of consumption. This rapid onset is achieved through nanoemulsification, and it improves the bioavailability of THC. Additionally, the drinks are designed to be mixed with other beverages or enjoyed over ice, offering flexibility in consumption.

9. Farm-to-Glass Brewing

Breweries that adopt farm-to-glass practices source ingredients directly from nearby farms. This reduces their carbon footprint by reducing transportation emissions and supporting local agriculture. Farm-to-glass brewing also aligns with the growing consumer demand for eco-friendly products.

Further, farm-to-glass practices enable breweries to control the cultivation and harvesting of ingredients. Breweries are able to ensure high quality and freshness, which leads to better taste profiles in beverages.

Consumers want products with clear origins and authentic stories. Farm-to-glass brewing offers sourcing transparency and connects them to the alcoholic beverage’s journey.

Additionally, breweries, like Hopkins Farm Brewery, are cultivating barley and hops on-site to offer freshness and reduce transportation emissions.

Establishing local malting facilities allows breweries to process grains nearby. This supports local agriculture and reduces supply chain complexities. Colorado Malting Company, for instance, malts barley and wheat from its fields and supplies craft brewers.

Further, advances in yeast technology, such as frozen liquid yeast, eliminate the need for traditional propagation and reduce energy consumption. Companies like Novonesis are leading in this area by offering sustainable solutions for fermentation.

Mahala Botanical creates Hand-sourced Botanical Spirits

UK-based startup Mahala Botanical produces alcohol-free, triple-distilled spirits through a farm-to-glass brewing process. This integrates foraging, infusion, and distillation in custom-built vacuum stills. The company sources nine botanicals that undergo vacuum infusion to extract natural flavors. The ingredients are then triple-distilled to achieve a complex, layered profile.

Moreover, each product is free of alcohol, sugar, gluten, artificial ingredients, and colorants. This aligns with vegan and health-conscious preferences.

Les Brassages du Meix specializes in Locally Grown Craft Brew

French startup Les Brassages du Meix offers a range of craft beers that utilize hops cultivated on its farm. The startup grows organic hop varieties like Brewer’s Gold, Fuggle, and Tardif Jaune, which are harvested and used directly in its brewing process. This allows the brewery to create diverse beer styles, including seasonal blondes, amber ales, and spiced winter brews.

Additionally, Les Brassages du Meix manages the entire production cycle from cultivation to brewing to ensure quality control and traceability. It offers businesses beers that reflect the local terroir and traditional brewing practices.

10. Experimental Flavors and Ingredients

Alcohol consumers seek novel and adventurous taste experiences. This is prompting alcohol brands to innovate with special flavor profiles. Bacardi reports that interest in savory and herbaceous flavors rose by 20%.

The rise of health-conscious consumers also enables the creation of beverages that offer functional benefits without compromising taste. Protein-infused cocktails and brothtails are gaining popularity as consumers seek nutritious yet indulgent options.

Additionally, globalization and cultural exchange are expanding consumers’ flavor horizons. This is encouraging alcohol brands to incorporate international ingredients.

Further, AI allows alcohol brands to analyze consumer data and predict successful flavor combinations. This leads to personalized and innovative beverages. Bacardi utilizes AI to personalize cocktails and to improve the drinking experience.

Botanicals and herbs, like elderflower, lavender, and exotic spices, add complex flavors to alcoholic beverages. They align with health-conscious trends and drive their popularity in craft spirits and low-alcohol drinks.

Umami and savory flavor integration create special taste profiles for alcohol enthusiasts. For example, Double Chicken Please offers the Red Gravy Eye cocktail. It is a combination of whiskey with coffee, butter corn, walnut, wild mushroom, and coppa ham.

Velixir offers Flavoured Fizzy Canned Cocktails

Singaporean startup Velixir makes handcrafted alcoholic beverages. It formulates drinks like Reminisce with house-made sour plum liqueur and Morning Stroll gin with honey and elderflower liqueurs.

Additionally, its offerings include zesty citrus combinations in My Sunshine. It also features a sugar-free hard seltzer lineup, Perhaps, Maybe, Somehow, and I Guess. They leverage stevia to create low-calorie blends like peach-mango and pineapple-strawberry.

Dokkaebier promotes Asian-inspired Craft Beers

US-based startup Dokkaebier crafts beers that fuse traditional brewing methods with experimental Asian ingredients to deliver distinctive flavor experiences. It combines gochugaru and ginger into Kimchi Sour – a tart, spicy profile rooted in Korea’s fermented dish.

It also brews Yuza Blonde Ale by pairing Belgian-style ale with yuza, a citrus fruit from East Asia. This results in a bright, zesty beer that balances tartness with floral notes.

Discover all Alcohol Trends, Technologies & Startups

Brewers and distillers will leverage smart fermentation, zero-waste methods, and personalized flavors going forward. Synthetic biology, capturing carbon in eco-distilleries, and digital twins will also be critical in the alcohol industry. As the climate and culture shift continues, these technologies will transform how drinks are made, delivered, and experienced.

The Alcoholic Beverage Industry Trends & Startups outlined in this report only scratch the surface of the trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.