Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Key Takeaways

Among others, blockchain technology improves the following areas within the insurance industry:

- Claim Management – Reduces fraudulent claims and automates claim submission.

- Peer-to-Peer Insurance – Guarantees the payment from the investor to the customer in case an insurance demand event occurs.

- Reinsurance – Reduces operational costs of reinsurers and allows them to receive verified real-time data directly from insurers.

- Fraud Detection & Risk Prevention – Makes claims more reliable and less fraudulent. They also entitle policyholders to collect higher premiums for the service.

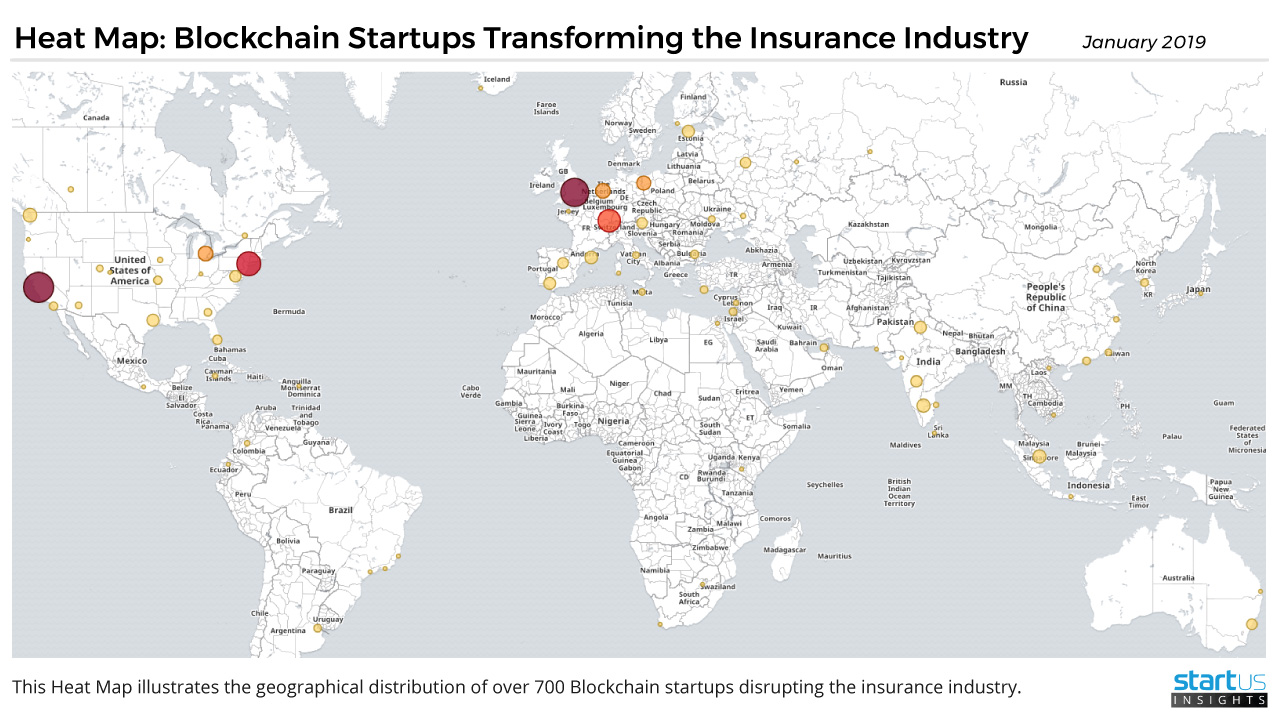

Heat Map: Blockchain Startups Disrupting The Insurance Industry

Our team has created the Heat Map below to highlight the hotspots of blockchain startups disrupting the insurance industry on a global level:

Click to enlarge

Global Distribution of Blockchain Startups in the Insurance Sector (c) StartUs Insights

8 Blockchain Startups Transforming the Insurance Industry:

- Black – A digital insurance company on the blockchain, opening the centralized insurance market for crowdfunding.

- B3i – A startup providing insurance solutions on a blockchain platform offering opportunities for efficiency, growth, and quality across the value chain.

- ChainThat – Delivering business efficiency by coordinating and streamlining operational processes across business networks.

- Inmediate – Make policies transparent and trustworthy by using smart contracts, powered by the Zilliqa blockchain solution.

- Lemonade – A startup that offers homeowners and renters insurance powered by artificial intelligence, blockchain, and behavioral economics.

- RiskBazaar – A peer-to-peer (P2P) risk contacts marketplace that lets consumers enter contracts with their friends within seconds.

- Teambrella – A P2P insurance service app powered by blockchain.

- Tierion – Turns the blockchain into a platform for verifying any data, files, or processes.

Blockchain-based solutions are already transforming the industry — helping insurers onboard clients more reliably, automating claims submission, easing reinsurance processes and designing smart insurance contracts, among other features.

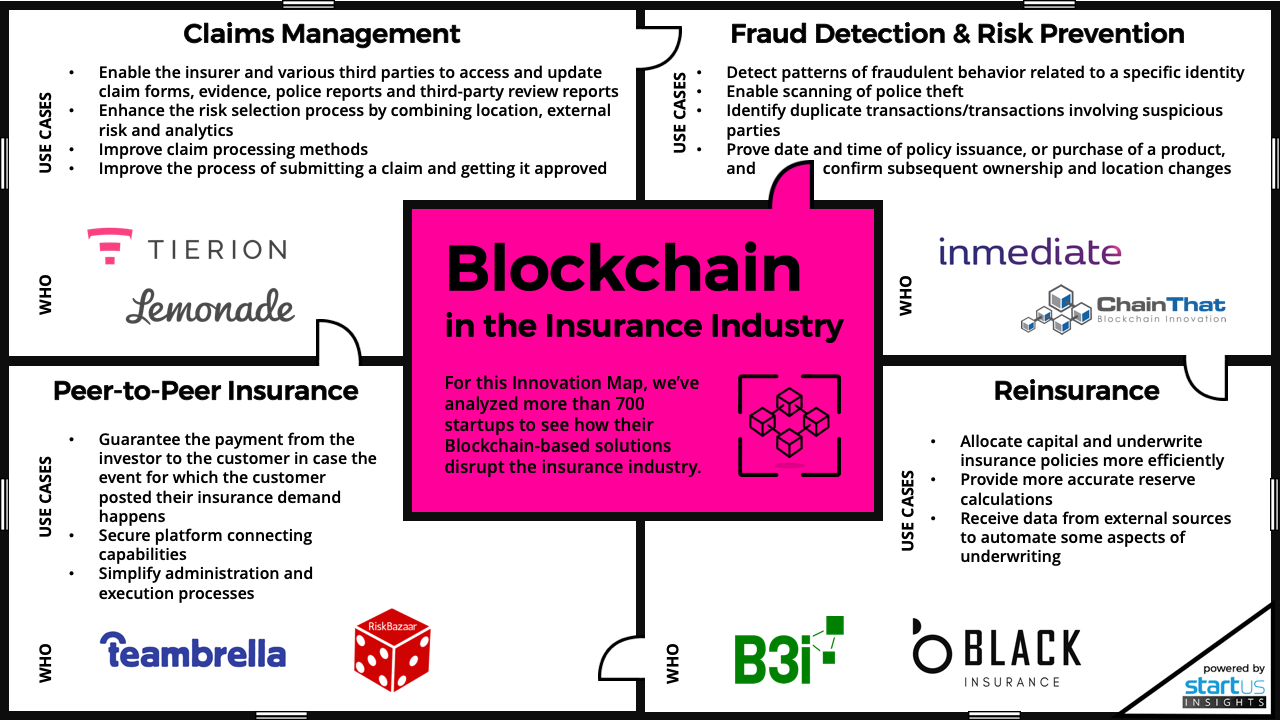

Innovation Map: How Blockchain Startups Transform The Insurance Sector

Our team of innovation analysts conducted thorough and extensive research on the potential of blockchain in the insurance industry, encompassing over 700 startups working in the field.

Below, you’ll find the Innovation Map highlighting the most promising application areas as well as a deep dive in each of the sections.

Claim Management

Ensuring submitting and processing claims is as consumer-friendly and as efficient as possible is instrumental for maintaining an edge over the competition. Using blockchain for such purposes includes combining numerous data points from various sources (i.e. location, analytics) to reduce the number of fraudulent claims.

A distributed blockchain ledger serves as a focal point for many streams of information and documents, including scene evidence, third-party reports, police comments etc.

Some steps of the claims submission can be automated. A car crash, for instance, triggers a new claim initiation, while contacting medical and/or mechanics support, all at the same time.

Commercial interest to blockchain is growing by the day, with companies like AXA Insurance using it to offer a claim-free flight insurance called Fizzy. They can automatically trigger a payment to the holder’s bank account in case of a 2+ hour flight delay.

Reinsurance

Processing and holding data on a distributed ledger allows reinsurers to receive verified real-time data directly from the primary source, without having to involve their counterparties — insurers in this case.

This also ensures faster capital allocation for satisfying upcoming claims. The advantages are even clearer when we take into account that insuring companies involves a multitude of reinsurers for the same contract, which inevitably requires the reinsurers to exchange the data readings between each other — complicating operations even more.

When using a shared ledger, there is no need to reconcile transactions regarding premiums and losses between the insurer and the reinsurers, as it will always be up to date.

Blockchain is capable of reducing operational costs of the reinsuring sector by $5-10 billion. Businesses are openly adopting blockchain innovations — Allianz, Swiss Re, AIG and Aegon are some of the biggest members that have formed a consortium called B3i for example.

Peer-to-Peer Insurance

Insurance companies design smart contracts that automatically facilitate applications for damage reimbursement in case bad weather conditions damage properties, for instance.

Such contracts are built around all sorts of measurements such as sensor data and weather readings — making such claims more reliable and less subjective or potentially fraudulent.

Not only that but smart contracts are also used by insurers to organize peer-to-peer insurance marketplaces. Such type of insurance entitles policyholders to collect higher premiums for the service than the traditional insurance contracts.

Fraud & Risk Prevention

The insurance industry benefits from blockchain’s functionality by using it to simplify and automate the user onboarding process. More specifically, blockchain allows the verification of various identity documents provided by a new customer.

It then gives specific access rights to the relevant people involved in the process, replacing centralized databases for managing data and documents. This makes KYC (know your customer) and due diligence procedures easier and faster for the client, and more reliable and simple for the insurer.

Conclusion

The operational inefficiencies of the insurance industry are many: Loads of paperwork worsening the customer experience; complicated claims management presenting an operational nightmare for insurers; risks of becoming a subject to fraud are tampering developments.

This is where blockchain steps in and provides all stakeholders with the tools to boost operational efficiency. It acts as a digital hub for all corporate data streams and transactions. Blockchain also makes claims management easier and more automated, ensuring the integrity of data and automating the process of claim submissions.

As blockchain gains traction in the industry with rising adoption rates, it is vital for industry players to closely follow the breakthroughs that the technology brings to the table — so as not to lag behind the digital transformation.